- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst, Nordea

Jan Størup Nielsen

Denmark is characterised by being a small and open economy, offering numerous advantages in a global landscape marked by rapid changes. However, there are also drawbacks. One being that it can be challenging to present an accurate picture of total economic activity, as even minor changes may affect the overall picture significantly. This has recently led to a significant downward revision of Denmark’s economic growth profile in recent years.

Since the COVID-19 pandemic, the Danish economy has experienced a period of high economic growth – com-pared to the past and to other countries. However, the picture of strong economic growth has been modified after Statistics Denmark on 30 June published a major revision to the national accounts figures.

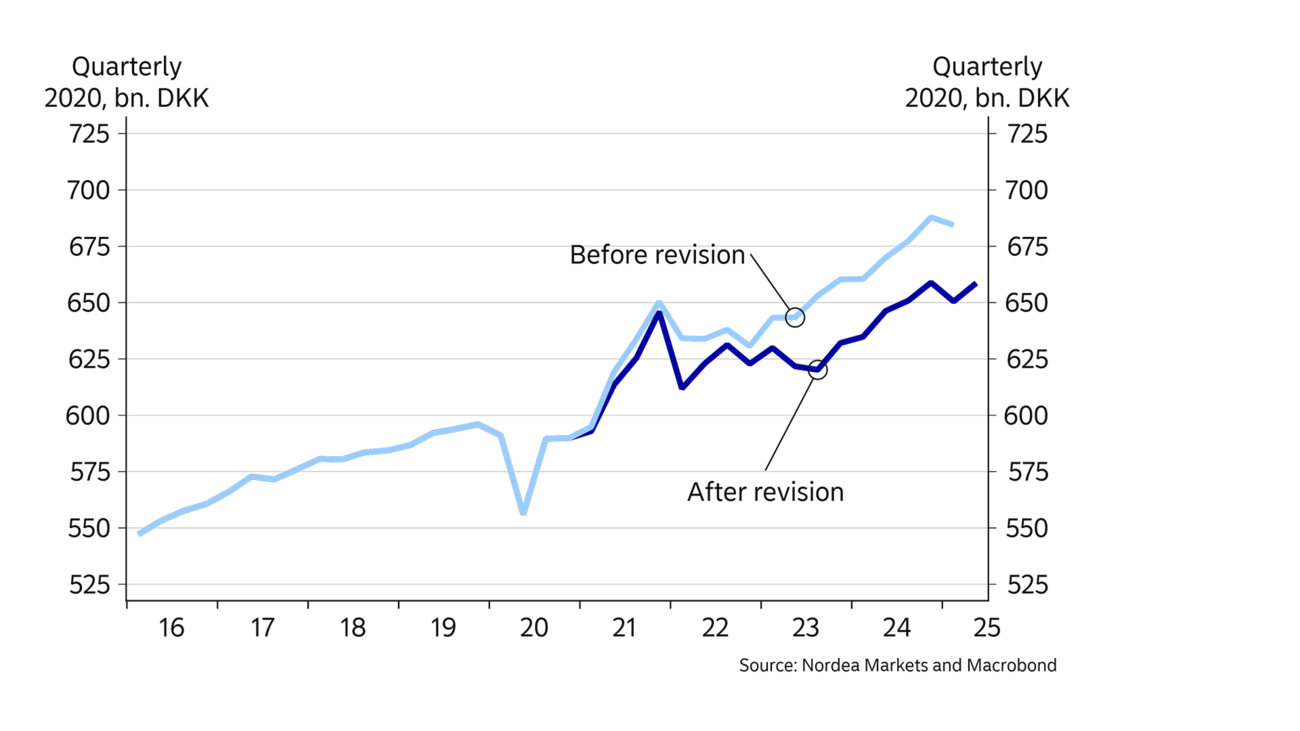

In the new statement, total GDP growth from 2021 to 2024 was revised down to 11.4% from 15.9%. According to Statistics Denmark’s own information, this is a larger revision than would normally be expected from the usual level of uncertainty. For 2022 and 2023, in particular, the new figures show noticeably more subdued developments, with GDP growth of around 0.5% in both years. If the pharmaceutical industry’s contribution is excluded, Denmark’s economy actually contracted in 2022 and 2023.

The publication of the revised national accounts figures in June was also a break with the historical pattern. Over the past ten years, the initial calculation has tended to underestimate quarterly GDP growth.

There are two main reasons why Statistics Denmark had to revise down the growth profile for the Danish economy.

The first one is primarily related to exports, which make up an increasingly large share of overall Danish economic activity. Here, relatively significant changes have occurred in the price indices used to calculate volume developments, for example to the service sector exports, in which shipping accounts for a significant share.

Here, the latest calculations show that prices, especially in 2023, accounted for a much larger share of the total value added than estimated previously. Yet this also means that the volumes constituted a smaller share, thus reducing real GDP growth.

The second major source for the revisions stems from a general downward adjustment in household consumption since 2021. Again, the revisions were mainly made because the indices used to adjust the figures for inflation have proven to be different than previously assumed. This is partly due to households making significant changes in their consumption patterns as a result of both the COVID-19 pandemic and the subsequent surge in inflation. Changed consumer patterns make it difficult for statistics agencies to produce preliminary GDP statements, as some of the information is based on estimates that rely on historical contexts.

The figures in the Danish national accounts have undergone a major revision. The new figures indicate more subdued growth than previously.

The GDP figure is crucial in understanding a country's economic activity – because it shows how activity develops over time and indicates the overall size of the economy. Precisely the size of the overall economy is used to calculate various ratios that are used in comparisons with other countries. This applies, for example, to key metrics, such as the public debt ratio, foreign assets and the current account trend.

In the calculation of these ratios, nominal GDP is used – not the GDP adjusted for inflation, which is typically used in measuring growth trends. The good news, however, is that, because the large revisions are mainly due to a redistribution between prices and volumes, the trend in nominal GDP is basically unchanged in the latest statement. Therefore, the revision has not significantly changed, for example, the assessment of Denmark as the EU country with the largest public budget surplus last year – or the current account statement of a 2024 surplus that reached a historically high level of more than 12% of GDP.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook .

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more