- Name:

- Juho Kostiainen

- Title:

- Nordea Chief Analyst

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskJuho Kostiainen

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

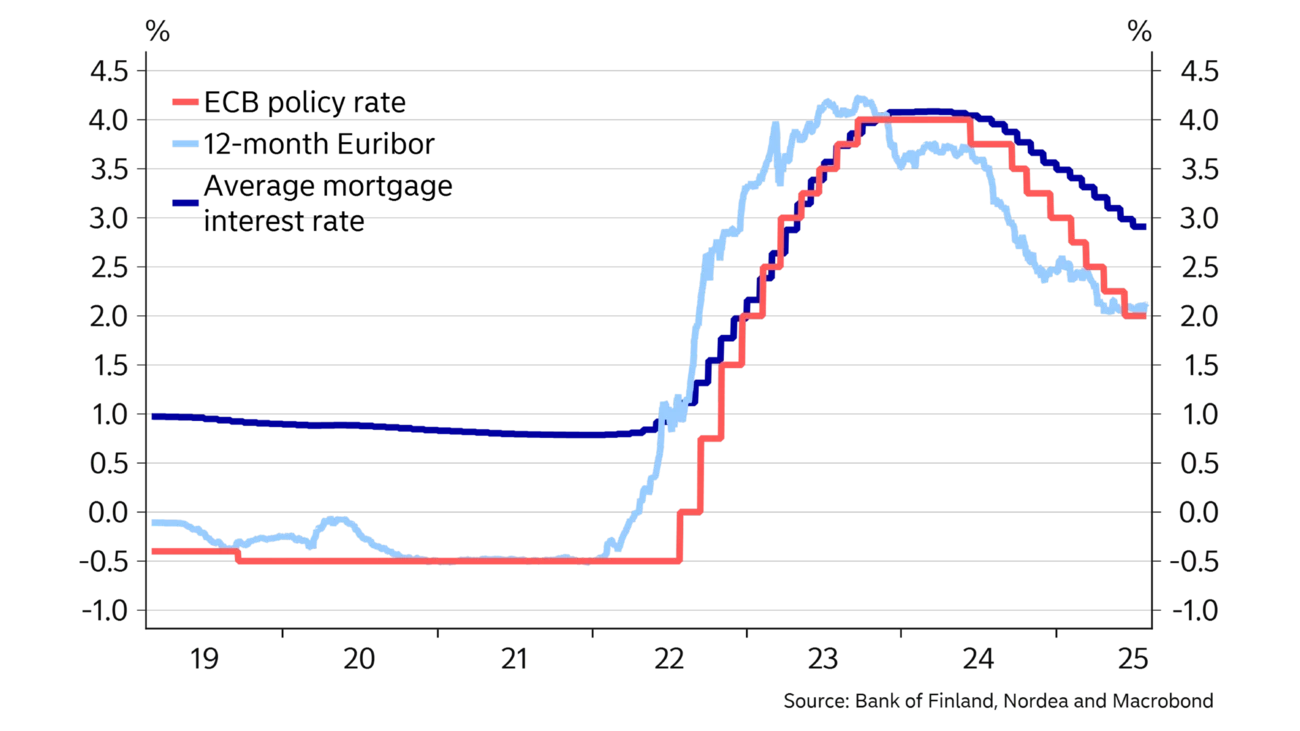

The ECB’s policy rate has fallen from 4% to 2% in a year, and the Euribor interest rates have followed a similar trajectory. Since the interest rates on loans taken by Finnish businesses and households are usually fixed for a short period, the looser monetary policy has decreased their interest expenses at a quicker pace than the average for the eurozone. Indeed, the average interest rate has fallen by one percentage point on the entire mortgage stock and by as much as 1.4 percentage points on the entire corporate loan stock since the peak seen a year ago. The effects of changes in monetary policy on interest expenses are yet to be fully realised, and barring any surprises, the average mortgage interest rate will fall further by approximately 0.5 percentage points by next April because the most common reference rate on Finnish mortgages is the 12-month Euribor, which reached its current level of about 2% in April this year.

However, the lower interest rates have not resulted in positive economic development yet. GDP declined in the first half of the year, while unemployment continued to rise and inflation is very low. Why is it taking looser monetary policy so long to translate into stimulus?

First of all, consumer confidence has been low since the spring of 2022, when Russia invaded Ukraine. In addition to the war, consumer sentiment has also been depressed by a weak labour market and, lately, the trade war with the US. Even though the drop in interest rates has improved the situation for households with debt, the uncertainty has increased the household savings ratio, keeping private consumption weak.

Uncertainty over trade policy may have also decreased corporate investment this year. However, the amount of new corporate debt has begun to increase in recent months, even though the corporate loan stock still fell year-on-year in June.

Weak confidence and an oversupply in housing are slowing down the effects of looser monetary policy.

Another reason for the slow impact of monetary policy is the oversupply in the Finnish housing market, which saw lots of construction during the years of low interest rates. The interest rate on new mortgages in Finland is already the fourth lowest in the eurozone, but the current oversupply in housing and weak consumer confidence have so far kept home prices sliding. As a result, monetary policy has not yet had a positive effect through an increase in households’ real estate assets. Elsewhere in the eurozone, home prices have already begun to rise, which means that the effect of monetary policy on wealth is starting to work in the right direction.

Monetary policy often provides economic stimulus through the construction sector, as the rise in asset values and growth in housing demand accelerate building. However, the oversupply in the housing market is limiting new housing starts in Finland, keeping this channel of monetary policy relief blocked for the time being.

The stock of household debt continues to contract, even though transactions in previously owned properties have clearly picked up over the past year. Wage earners’ purchasing power is still recovering, interest rates are still higher than in past years despite the drop that has occurred and the purchasing power of households with mortgages is still 4% lower on average than in 2019. In the current uncertain labour market, households have continued to focus on repaying their debt even though interest rates peaked last year.

As a result, looser monetary policy has not yet provided stimulus to the Finnish economy to the desired extent. However, lower interest rates are expected to boost economic growth this year and next, and this impact will become more amplified as confidence in the economy is restored and the oversupply in the housing market is unwound.

This article originally appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The previously high-flying Danish economy has had its wings clipped as historical growth figures have been revised lower and industrial production has declined, particularly in the pharmaceutical sector. Despite reduced altitude, the Danish economy is still very strong.

Read more