- Name:

- Marco Kisic

- Title:

- Head of ESG Research, Nordea Equities

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskMarco Kisic

Our analysis of the main public infrastructure programmes in Europe points to a substantial step-up in investment due in 2026, which contrasts with the capital drain we’re seeing for US cleantech. This is driving investors’ sentiment for infrastructure, which, for the first time in years in Q2 2025, was higher in Europe than in the US, topped by the Nordics. We expect this trend to continue to support European and Nordic cleantech companies, which should continue to close the valuation spread compared to US ones.

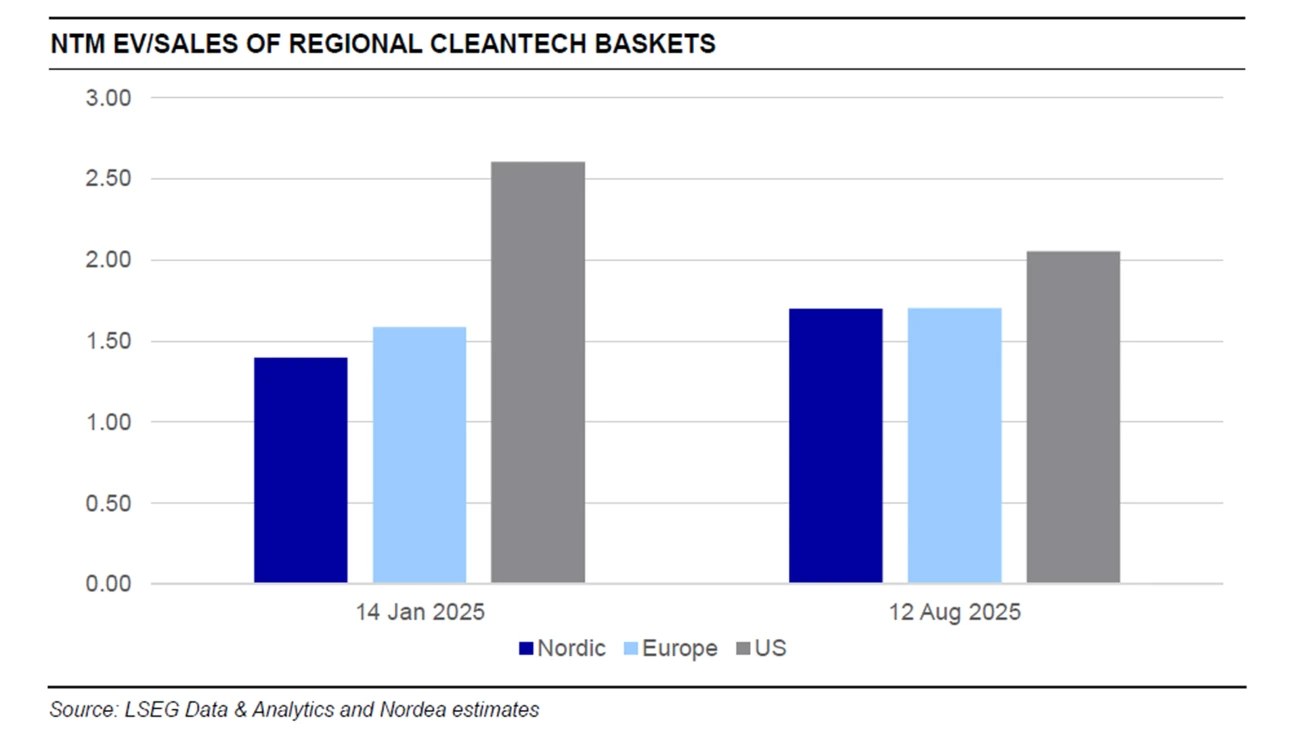

The valuation spread between European and US cleantech companies has narrowed since January. We expect it to contract further in the coming months. Our analysis of the main public cleantech and infrastructure programmes suggests 2026 will be a particularly strong year for European investments, in contrast to the US.

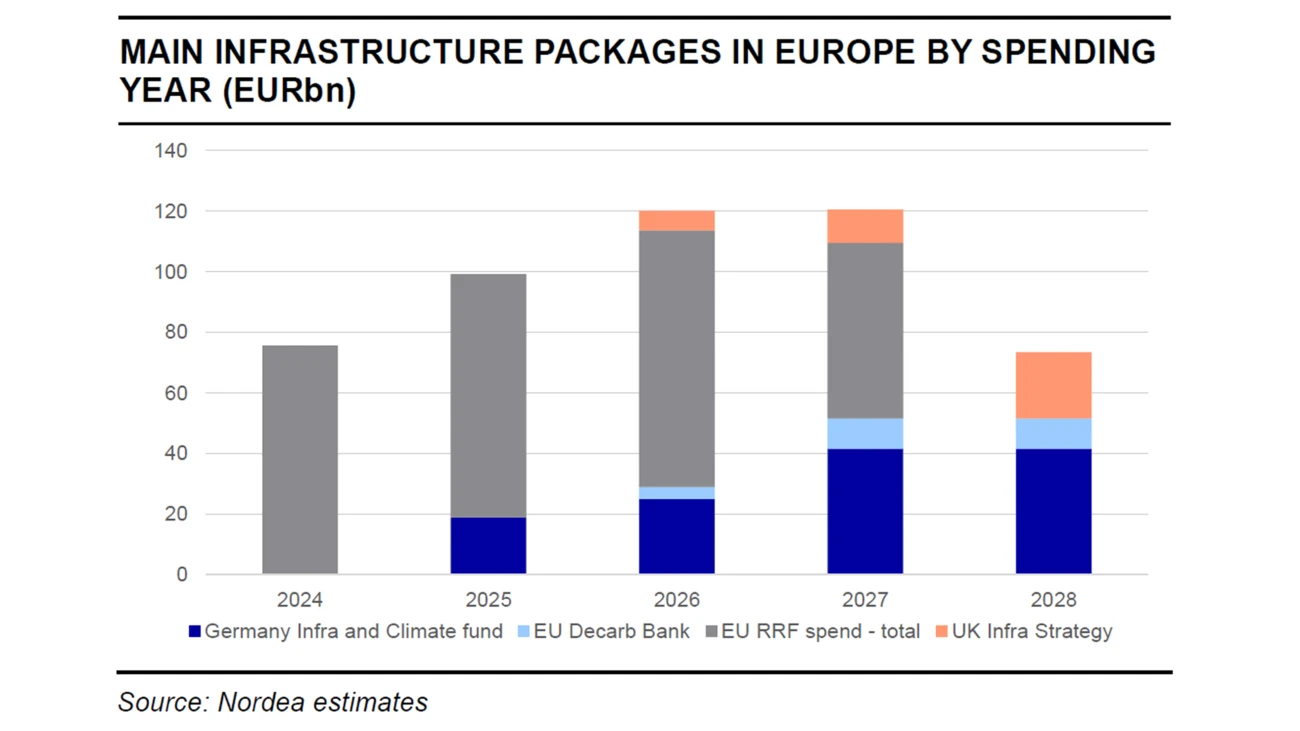

In Europe, we expect countries will rush to spend the COVID-19 recovery fund, which expires in August 2026, coinciding with the launch of the German infrastructure package and the implementation of the new UK ten-year infrastructure strategy. We estimate these combined schemes could drive an increase in public investment flows of some EUR 40bn year-over-year.

Conversely, in the United States, the Trump administration has frozen around USD 20bn in funds under the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA). The phase-out of cleantech subsidies is projected to drain tens of billions of USD yearly from the cleantech segment. In addition, higher tariffs are likely to hit US clean technologies.

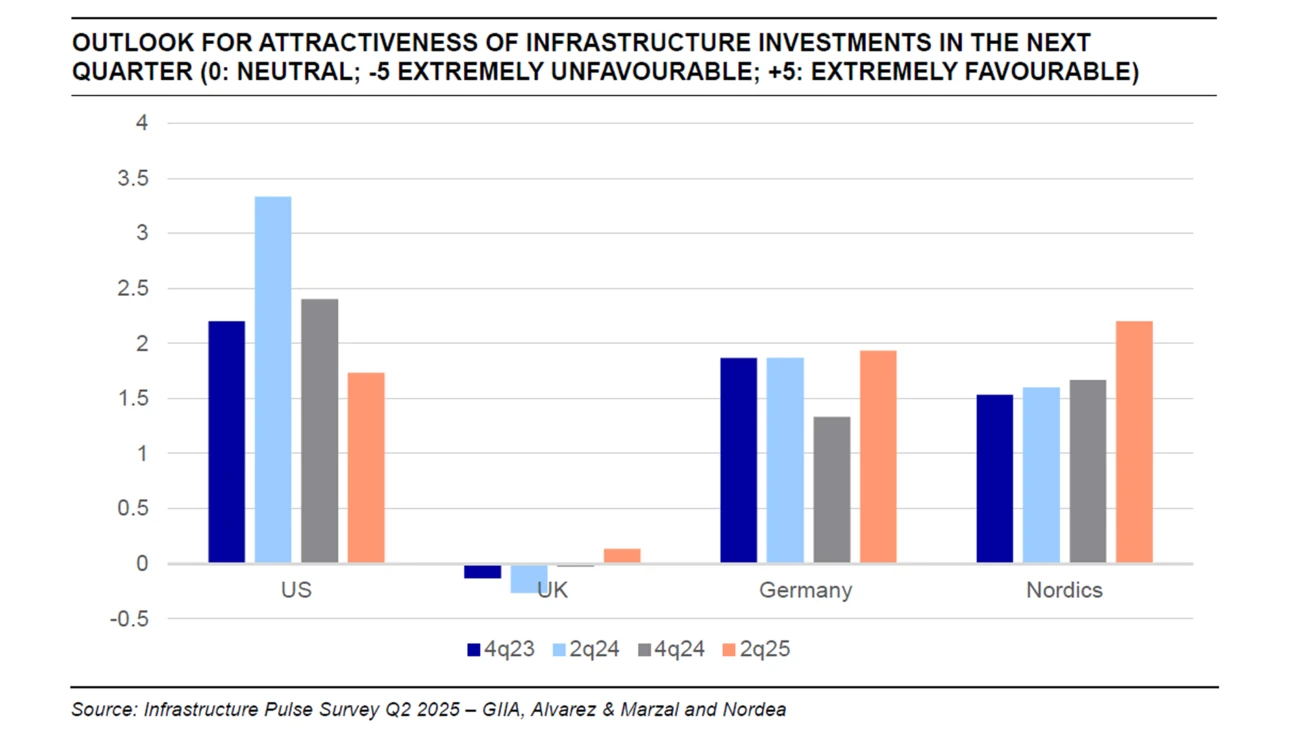

This regional flip is reflected in the recent improvement in investor sentiment towards infrastructure in Europe. For the first time in years, investors now see bigger opportunities in Europe than in the US, according to the GIIA infrastructure survey – with the Nordics topping the list, an opportunity we believe should partly filter through to clean technologies.

For the first time in years, investors now see bigger infrastructure opportunities in Europe than in the US - with the Nordics topping the list, an opportunity we believe should partly filter through to clean technologies.

We reviewed the GIIA infrastructure survey for clues on the sectors in which appetite is highest within the infrastructure space. Data centres are viewed as the most appealing infrastructure opportunity in Europe (and the US). This is followed by towers, traditional renewables and batteries, while regulated gas and electricity and regulated water are the least attractive.

These regional dynamics and shifting preferences also have an impact on market valuations. The valuation of US cleantech stocks has retracted compared to the beginning of the year (2.1x NTM EV/sales currently versus 2.6x in January 2025) but remains higher compared to Nordic and European stocks (at 1.7x). We anticipate further compression of the US/Europe cleantech valuation spread.

While individual equity cases have recently weighed on Nordic performance, we see the gap between large and small caps stabilising for the first time in three years. A partial normalisation of the macro environment, such as a Ukraine peace agreement, could prove positive for small-cap cleantech stocks.

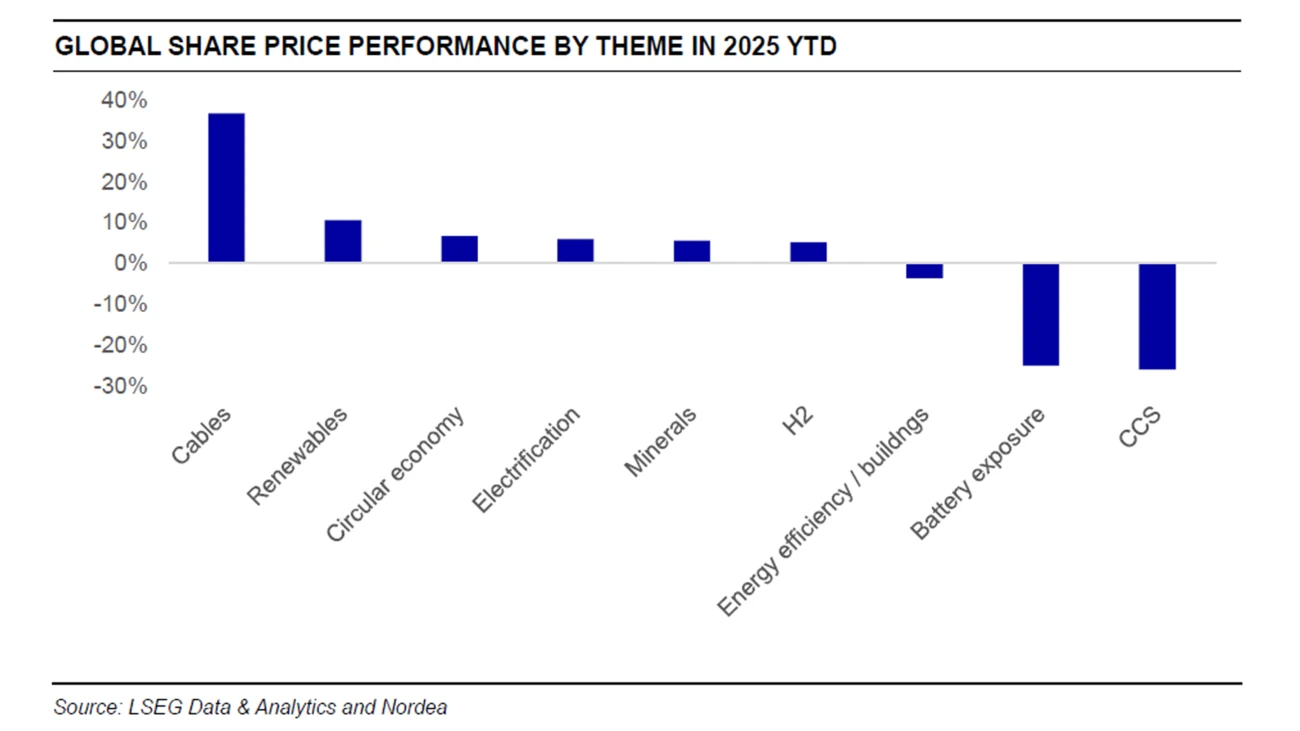

Mature themes, such as cables and renewables, have continued to perform better than emerging themes, such as batteries and CCS (carbon capture and storage). We expect this to remain the case in the months ahead.

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more