Physical risks in production and transmission

In the Nordic power sector, physical risks manifest across both production and transmission systems.

In production, hydropower faces increased variability due to changing snowmelt and rainfall patterns. Thermal power plants may struggle with cooling efficiency during heatwaves. Wind and solar resources are also affected by shifting weather regimes, potentially reducing predictability and reliability.

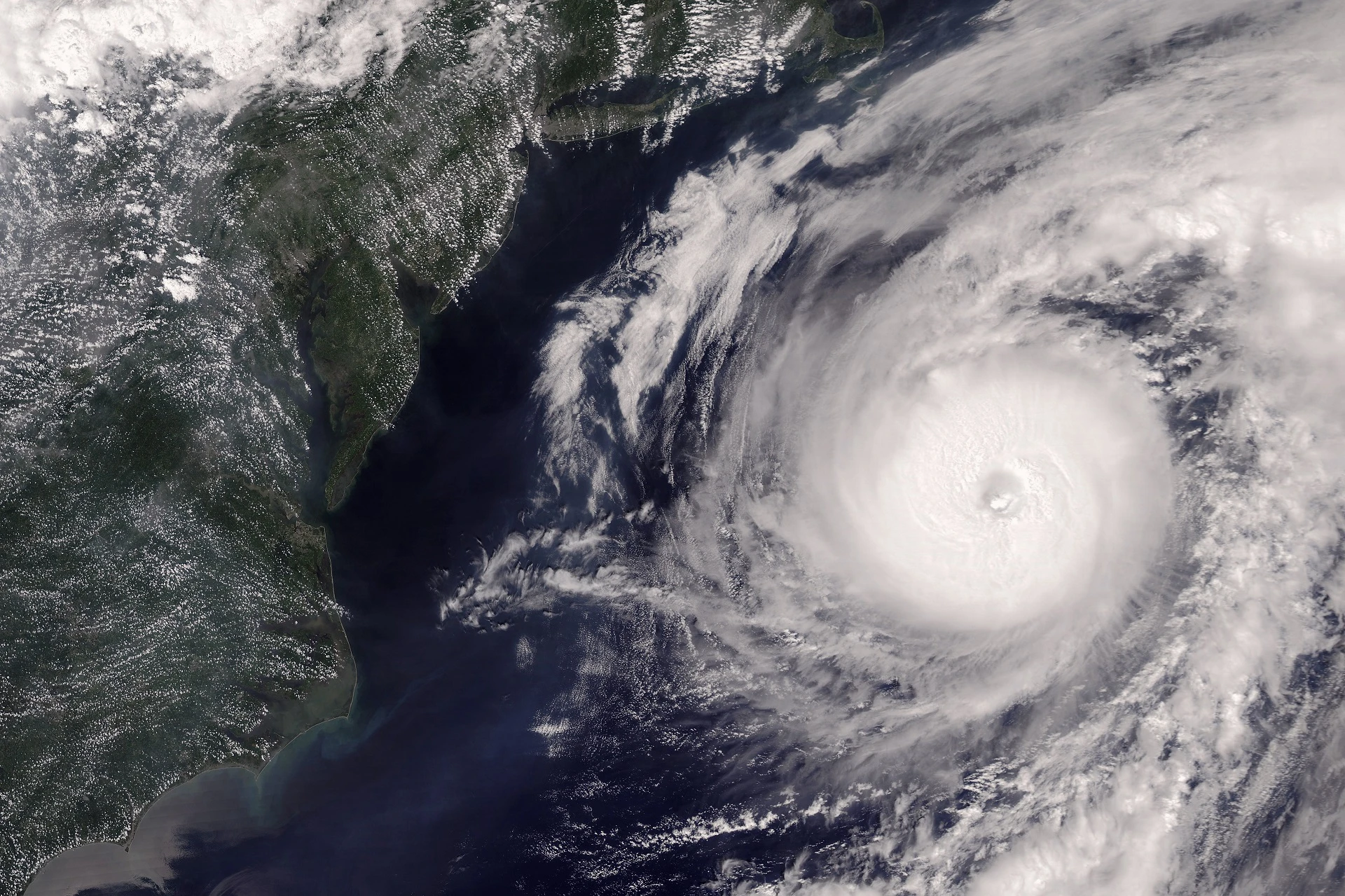

In transmission, the grid infrastructure is exposed to storms, flooding and coastal erosion. Substations and overhead lines are vulnerable to damage, leading to service interruptions and increased maintenance costs. The interconnected nature of Nordic grids means that disruptions in one area can cascade across borders, amplifying risk.

Integrating physical risk into internal risk oversight

Internal risk oversight frameworks must evolve to reflect the dual nature of climate risk. Traditionally focused on transition risk, these frameworks now need to incorporate physical risk as a core component.

From an impact, risk and opportunity (IRO) perspective, this means assessing:

I) how physical risks affect asset performance, financial stability and societal obligations,

R) the probability and severity of climate-related disruptions, including regulatory and reputational dimensions, and

O) the potential for innovation, resilience and competitive advantage through proactive adaptation.

Companies should conduct scenario analyses that include 2°C and higher warming pathways. These analyses must be localised, reflecting regional climate projections and asset-specific vulnerabilities. Governance structures should ensure that physical risk is addressed at the board level, with cross-functional input from operations, finance and sustainability teams.

Short- to medium-term actions

To mitigate physical risks, Nordic power companies must act decisively in the short to medium term.

Infrastructure resilience is paramount and may include elevating substations, reinforcing transmission corridors and investing in distributed energy systems that reduce reliance on vulnerable nodes. Digital monitoring and predictive maintenance can enhance operational readiness.

Strategic planning must integrate climate adaptation into investment decisions. This involves using climate-adjusted cost-benefit analyses and embedding resilience criteria into procurement and project design.

Organisational capacity is also critical. Companies need to build internal expertise on climate science, risk modelling and adaptation strategies. Collaboration with research institutions and public agencies can accelerate learning and innovation.