1.7%

Estimated mainland GDP growth in 2025.

Kjetil Olsen

Economic growth in Norway is picking up, driven by increased consumer spending and housing construction. Household purchasing power rose sharply last year and will continue to rise this year, even without rate cuts. Strong income growth also supports the housing market. Activity in the oil industry remains high and fiscal policy is stimulative. The persistently weak NOK provides good profitability in the export sector. Moreover, the tariff war and the global situation will, on balance, have little impact on the Norwegian economy. Unemployment will thus stay at a very low level. High wage growth will also keep inflation well above the 2% target. Therefore, we do not expect Norges Bank to cut its policy rate this year or the next. The NOK will remain weak against the EUR but strengthen against the USD.

The new US administration has made the outlook for the US and the global economy more uncertain. Meanwhile, our most important trading partners in Europe are investing massively in defence and infrastructure. Interest rates have also been cut significantly. Growth impulses from our key trading partners are likely to increase going forward, although the tariff war is negative in itself. In addition, higher US tariffs have a minimal direct impact on the Norwegian economy. The global situation is thus unlikely to undermine the ongoing upturn in the Norwegian economy.

After two years of fairly low growth, capacity utilisation and growth are now on the rise. This is the clear message from the companies in Norges Bank’s regional network. Households take a brighter view on the future for good reason. In 2024, wages rose 5.6%, while prices “only” rose about 3%, resulting in historically high growth in real purchasing power. Pay talks this year will likely help boost purchasing power also in 2025, resulting in increased spending.

We are now also seeing clear signs that housing construction is picking up. Strong growth in prices of existing homes has led to a sharp upturn in the sales of new homes – in turn, resulting in in-creased housing starts. The current increase is admittedly from a low level, but this trend is significant for economic growth in Norway. We have seen a historic drop in housing investments. This, coupled with weak growth in consumer spending, has been the key reason for Norway’s relatively low economic growth. Now with positive trends in consumption and housing investment, overall economic growth in Norway will likely increase. Thus, the interest-sensitive sectors in Norway are now driving growth, even without rate cuts. This raises the question of whether the current interest rate level is far from normal and whether it was the rate hikes themselves – not the level – that had a tightening effect. With interest rates stable for 18 months, much of the negative impact seems to have worn off.

1.7%

Estimated mainland GDP growth in 2025.

2.0%

Estimated registered unemployment rate at end-2025

4.50%

Estimated policy rate at end-2025

Activity in the oil industry remains high but may dip next year. At the same time, housing construction is set to increase significantly. Overall, these two components will likely positively contribute to growth. A slightly lower oil fund value may limit increases in public spending next year; however, we find it difficult to see a contractionary budget for next year. Overall, economic growth in Norway is expected to be close to the trend, keeping unemployment low.

| 2023 | 2024 | 2025 | 2026 | |

| Real GDP (mainland), % y/y | 0.7 | 0.6 | 1.7 | 1.6 |

| Household consumption | -0.8 | 1.4 | 2.5 | 2.0 |

| Core inflation (CPI-ATE), % y/y | 6.2 | 3.7 | 3.2 | 2.9 |

| Annual wage growth | 5.3 | 5.6 | 4.5 | 4.0 |

| Unemployment rate (registered), % | 1.8 | 2.0 | 2.0 | 2.0 |

| Monetary policy rate (end of period) | 4.50 | 4.50 | 4.50 | 4.50 |

| EUR/NOK (end of period) | 11.20 | 11.79 | 11.75 | 11.50 |

Registered unemployment (% of labour force)

Consumer prices adjusted for energy and taxes (%)

House prices have risen by close to 7% so far this year. High wage growth and easier equity capital requirements have increased households’ borrowing capacity. House prices surged during the pandemic, when interest rates were at record lows, but remained relatively stable in 2022 and 2023 before rising again last year. House prices are now nearly 30% higher than in January 2020. Including this year’s pay talks, wages also grew by almost 30% in the same period. Fundamental factors are thus driving the increase in house prices.

Going forward, growth in house prices may moderate somewhat. House prices are not likely to receive a lot of help from rate cuts, which could underpin the extraordinary price growth. On the other hand, continued solid wage growth and a limited supply of new homes will likely drive further price increases, roughly in line with income growth.

Fundamentals are driving the rise in house prices.

So far this year, sales of existing homes have been record high. The sharply contracting supply of new homes has led to high activity in the market for existing homes. But the market for new housing is now advancing. Building permits in early 2025 show an upward trend in line with the uptick in new house sales. Strong growth in house prices has made more people favour new homes over existing homes. Construction projects increasingly reach the sales targets required to start building. Going forward, increased housing investment will make a solid contribution to the expected economic growth.

The construction sector has historically used much foreign labour. The weak NOK makes Norwegian wage levels less attractive in foreign currency. Labour shortages in the industry may quickly become a problem, potentially driving up wages to attract workers.

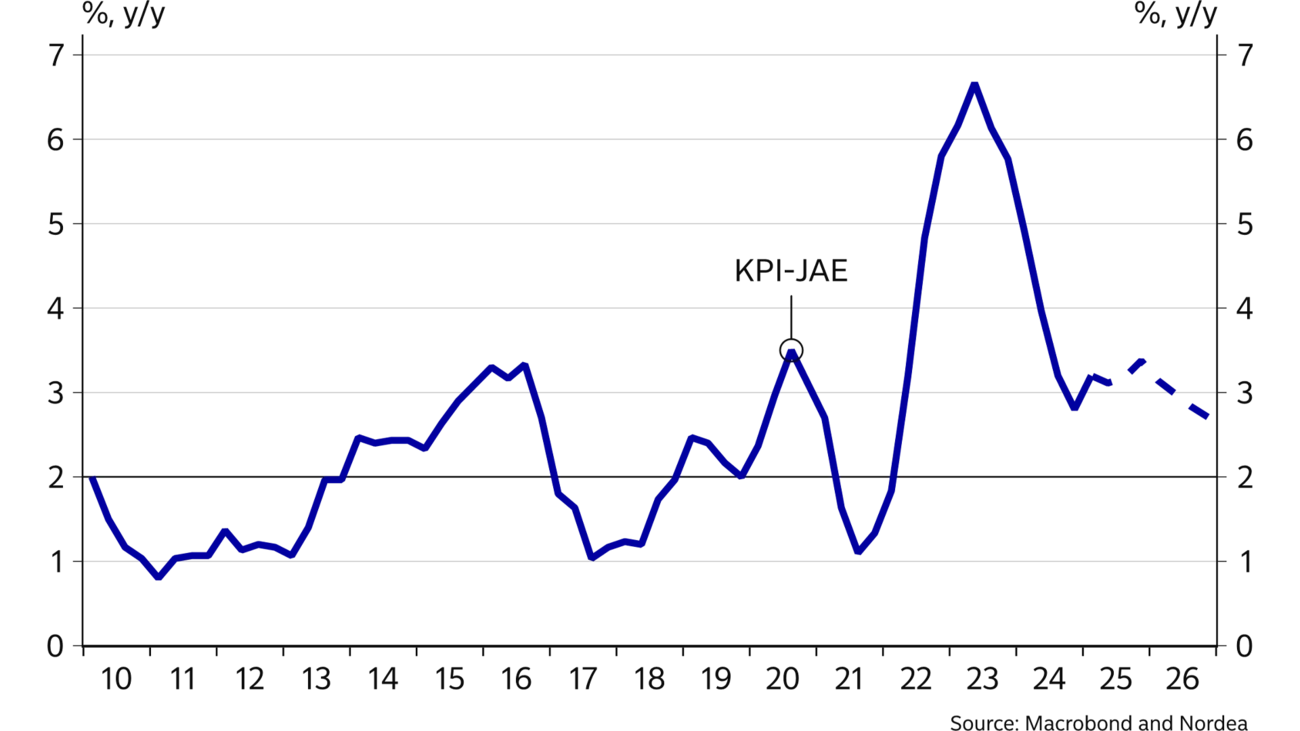

Underlying price growth, adjusted for energy prices and taxes, has remained at or above 3% recently, rebounding from late last year. After falling sharply since the summer of 2023, the decline in inflation has now stalled. We have long pointed out that the journey towards Norges Bank’s inflation target of about 2% would be a slow process and that the easy part of the inflation decline was behind us. Recent developments support this assessment.

Especially lower global price impulses have been a main contributor to the decline in inflation. Going forward, there is little to suggest that global factors will drive price growth much lower. Domestic conditions will likely keep price growth elevated.

In 2023 and 2024, Norwegian wages increased by about 11%, or 5.5% on average. With low productivity growth, it is therefore not surprising that domestic inflation has hovered around 4% recently. Also, lower administratively controlled prices of ferry tickets and kindergartens have contributed to lower domestic price growth than would otherwise have been the case. In the autumn, the effects of these factors will likely subside and, viewed in isolation, contribute to higher annual growth in consumer prices. Thus, domestic inflation will not necessarily decrease much, even though this year’s negotiated wage growth of around 4.5% is somewhat lower than in the past two years. At the same time, improved household purchasing power and thus higher demand may make it easier to pass on cost inflation to prices. Many companies, especially retailers, will likely try to increase their margins in line with the stronger demand. Overall, underlying inflation may thus remain around or only slightly below 3% until the end of 2026.

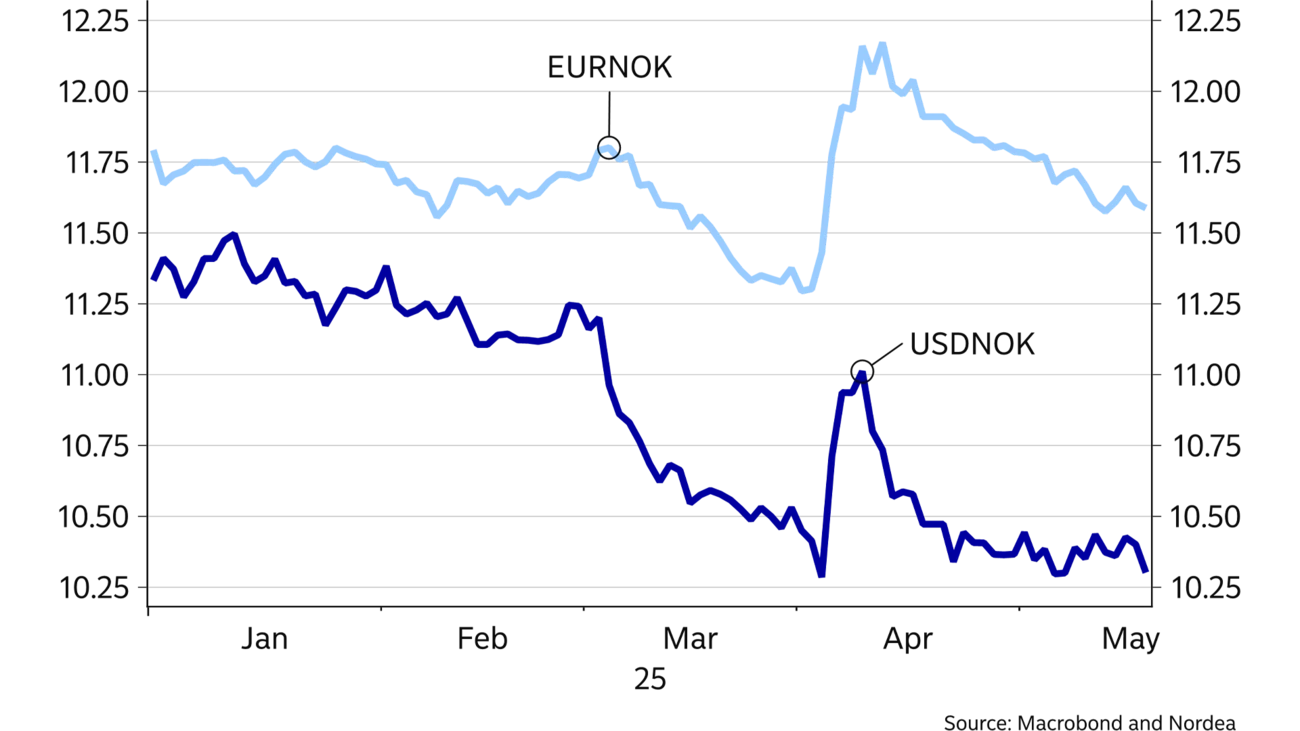

President Trump’s announcement of reciprocal tariffs on 2 April triggered a stock market plunge. Concurrently, OPEC announced it will increase oil production. In combination, the stock market drop and lower oil prices weakened the NOK markedly. This weakening was intensified by investors exiting speculative NOK positions built up in advance. The NOK has since recovered and is now around the same level or slightly stronger against the EUR than at the start of the year.

EURNOK and USDNOK

Nordea, interest rate forecasts, %

Measured against the USD, the NOK is clearly stronger due to the significant and broadly based USD weakening so far this year. Investors have reduced their holdings in US stocks since Trump took office. We see signs of growing distrust towards the US through higher risk premiums on US government bonds. There is considerable potential and risk of further significant USD weakening. Typically, there is a close negative correlation between the value of the trade-weighted USD and the trade-weighted NOK. Given our forecast for a further broad USD weakening and thus lower USDNOK, historical correlations could suggest that the NOK will strengthen considerably against other currencies as well. However, this correlation does not seem as strong now.

The risk premium on US government bonds may increase further going forward. We thus expect higher interest rates and lower values of US government bonds. Norwegian life and pension companies have currency-hedged most of their government bond holdings, which involves selling NOK when bond values fall to maintain their hedging ratios. Additionally, the geopolitical picture has widened the range of fluctuations in oil and gas prices going forward. This could make small commodity currencies, such as the NOK, less attractive.

Germany’s recently approved investment package for defence and infrastructure is massive. Along with a broad focus on defence across Europe, it could attract much international capital and support the EUR in the coming years. Ramped-up defence spending may also trigger larger capital flows to Sweden, with its broader defence industry, than to Norway. We thus expect limited downside risk for EURNOK and SEKNOK despite Norway’s significantly higher interest rates.

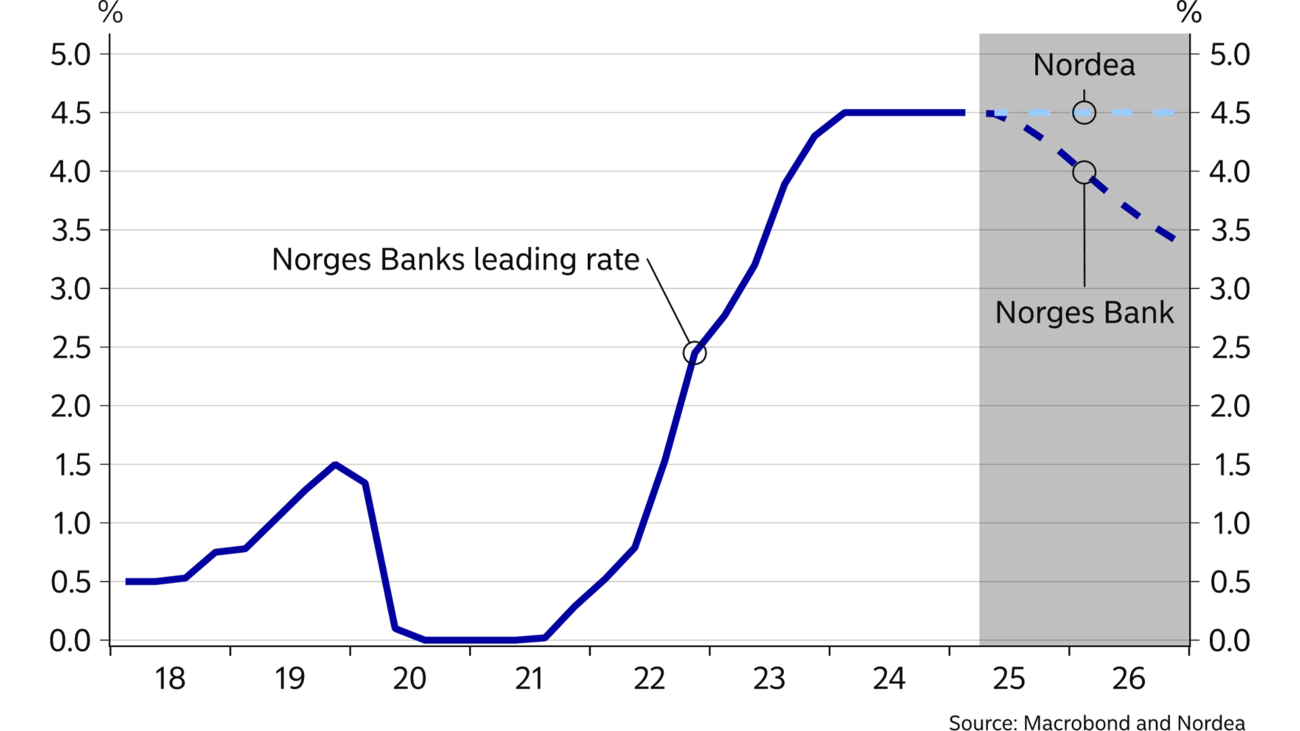

Inflation will likely remain around 3% in the forecast period throughout 2026, well above the 2% target. The inflation outlook does not give Norges Bank much reason to cut interest rates. Barring major inflation surprises, interest rates will, therefore, be driven by unemployment trends and economic prospects. If our forecast of rising growth and sustained low unemployment proves accurate, Norges Bank is unlikely to cut rates significantly. We do not expect any cuts this year or the next.

There is no basis for many rate cuts from Norges Bank.

Norges Bank delayed its planned March rate cut but has signalled that it will cut rates later this year, with a total of five cuts by the end of next year. Norges Bank thus maintains its long-held forecast of quite sizeable rate cuts. However, it has repeatedly pushed the rate cut forecast forward in time, given the persistently high inflation and lower-than-expected unemployment. Its interest rate forecast is based on the critical assumption that the current interest rate level is substantially above a normal or neutral level. In its forecasts, economic growth will, therefore, gradually weaken, resulting in rising unemployment if it does not cut rates quite aggressively. We disagree with Norges Bank on this point. The Norwegian economy appears to be doing well, with interest-sensitive sectors now improving, even without rate cuts.

However, we cannot rule out that Norges Bank will start to cut rates this autumn based on its expectation of higher unemployment next year. If so, in our view, this would stimulate the Norwegian economy, which could lead to lower, not higher, unemployment. We, therefore, anticipate very few – if any – rate cuts.

This article originally appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Get the latest Nordea Economic Outlook here.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more