- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

Sivua ei ole saatavilla suomeksi

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleThe world economy is stressed for many reasons. Overheating in the US, the tight COVID stance and real estate sector slowdown in China, the energy market crisis in Europe and geopolitical risks are all denting growth prospects. At the same time, inflationary pressures are strong and will continue to be central banks’ main headache in the coming months.

We revise down our forecasts for all major economies and note that recession risks have mounted. High inflation, rising interest rates, a deepening energy crisis in Europe and the fact that China still does not have an exit plan from its tight COVID policies imply that growth will be weak or even negative in the coming quarters. Recession risks are highest in the Euro area, where the energy sector is chaotic and energy rationing seems likely, at least in some European countries, during the winter.

Oil prices have come down during the second quarter due to a weaker economic outlook and China’s lockdowns. However, the physical oil market remains tight, and we expect Brent oil prices to hover around USD 110 per barrel. Stretched OPEC spare capacity and robust demand should keep oil prices high. However, European gas prices are through the roof, trading as high as USD 500 per barrel oil equivalent in late August. We expect elevated prices ahead as well, in particular because Russia has few incentives to increase gas exports. Thus, electricity prices in the Euro area will remain at very high levels. The industrial sector will bear the heavy burden from high energy prices while European households will be partly shielded due to government interventions.

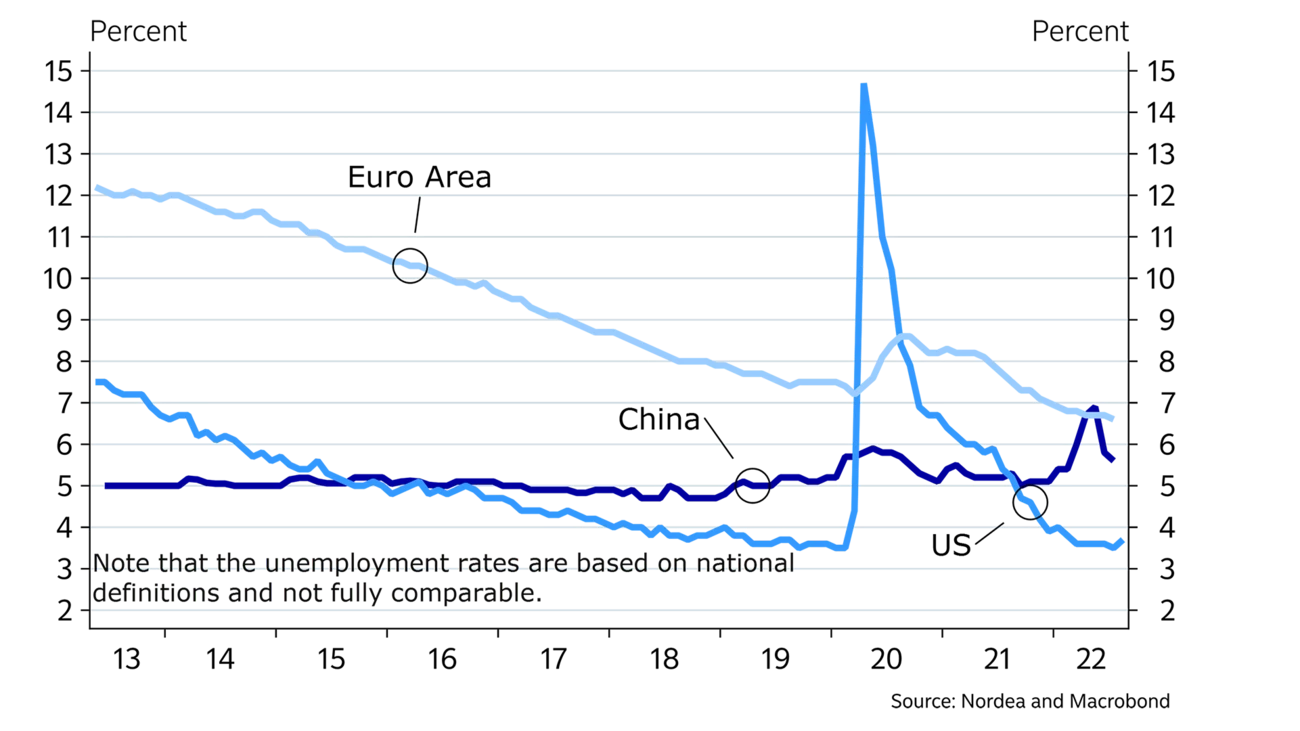

We do not think the US economy is in a recession at the moment, although GDP growth numbers were negative in the first half of 2022. The reasons behind the decline were mainly technical: strong import growth hurt net exports and companies started to downgrade their inventories due to expected slower growth. In any case, growth prospects in the US are of course limited due to the fact that there is not much spare capacity left in the economy. In addition, the tightening of financial conditions is naturally hurting the housing sector and housing starts are declining. Strong labour market trends, accumulation of household wealth during the pandemic, rapid wage increases and most recently the decline in oil prices have supported households’ position despite high inflation. However, consumption growth has already slowed down and is expected to remain sluggish. The approaching mid-term elections will obviously be one of the things to follow in the autumn.

The direction of Chinese politics has worried many investors and corporates for most of President Xi’s second term in power. Increasing control from Beijing as well as unpredictable and harsh regulations have raised questions about China’s long-term plans. In 2022, confidence has been hurt by China’s decision to continue with tight COVID lockdowns. We assume that China’s COVID stance will continue to hurt the economic outlook and especially consumer confidence. At the same time, the provided stimulus will remain limited, which implies that the ongoing downside correction in the real estate sector will continue and activity levels in that sector will remain permanently lower. That removes one important growth engine not only for the Chinese but also for the global economy and we revise China’s growth forecast permanently lower. A positive risk would be to see the policy line becoming more liberal again after the autumn’s Party Meeting but so far there are very few signs of that.

We pencil in a temporary decline in Euro-area GDP during the winter months.

Energy is the number one topic in Europe. If one is not extremely optimistic and assumes either a dramatic change in Putin’s line or an especially mild winter, it is likely that energy prices will remain very high and some European countries will need to resort to energy rationing during the winter months. The estimates about the scale of rationing or its economic impact differ very much depending on assumptions on, for example, weather conditions, ability to replace Russian gas with other types of energy, possibilities to increase energy efficiency and political decisions. Rationing among households is politically challenging, but hurts the economy less than rationing among businesses. We pencil in a temporary decline in Euro-area GDP during the winter months due to the limited energy supply, but expect a rapid recovery to normal activity levels in the spring. However, the chaos in the energy sector may cause a negative confidence shock that could take Europe into a much more severe downward spiral. Much will depend on governments’ ability to shield the most vulnerable households from the worst effects.

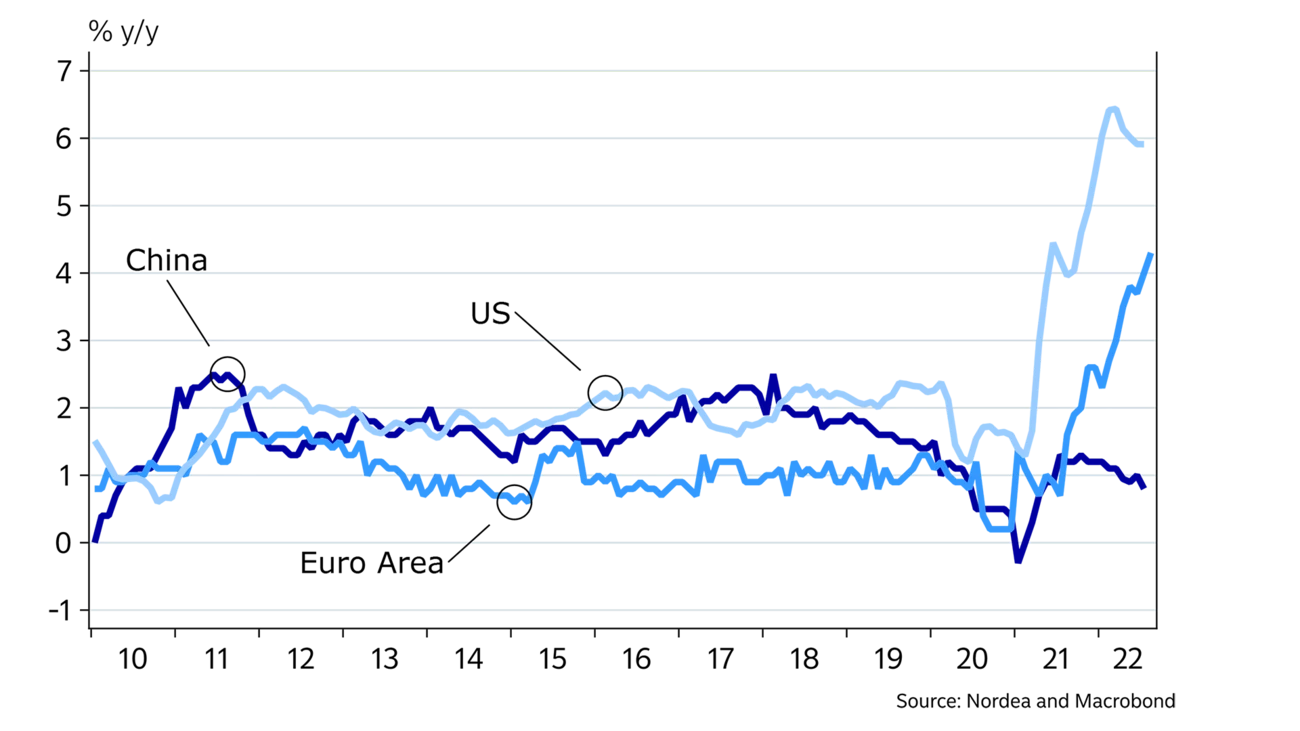

Inflation has continued to break records in many countries. Energy and food are still the most important drivers of inflation but increases in production costs also continue to feed into higher goods prices and the end of COVID lockdowns has boosted companies’ pricing power in many service sectors. Although the weak global outlook has recently driven the prices of many raw materials and oil lower and we expect monthly changes in consumer goods prices to calm down by the end of the year thanks to eased supply constraints and lower transport prices, the self-sustaining wage-price spiral is still strong in the US. In the Euro area, the pass-through of high gas and electricity prices to consumers has only just started. Thus, without a sudden turnaround in the energy sector, inflation will be high also in 2023. In this regard, China is a clear outlier as inflationary pressures in the country remain limited. This is partly due to limits on consumers’ energy prices but also the COVID lockdowns, which hurt consumption and especially the service sector.

|

Year |

World New |

World Old |

US New |

US Old |

Euro area New |

Euro area Old |

China New |

China Old |

|

2021 |

6.0 |

5.9 |

5.7 |

5.5 |

5.3 |

5.0 |

8.1 |

8.1 |

|

2022E |

3.1 |

3.3 |

2.0 |

3.2 |

3.0 |

3.0 |

3.0 |

4.0 |

|

2023E |

2.3 |

3.2 |

1.0 |

2.1 |

0.0 |

1.5 |

4.0 |

5.0 |

|

2024E |

2.6 |

- |

1.5 |

- |

1.0 |

- |

4.0 |

- |

|

Year |

EUR/USD |

EUR/GBP |

USD/JPY |

EUR/SEK |

ECB: Deposit rate |

Fed: Fed funds target rate |

US: 10Y benchmark yield |

Germany: 10Y benchmark yield |

|

2021 |

1.13 |

0.84 |

115.10 |

10.29 |

-0.50 |

0.25 |

1.52 |

-0.18 |

|

2022E |

0.95 |

0.90 |

145.00 |

10.90 |

2.00 |

3.75 |

3.65 |

1.90 |

|

2023E |

1.05 |

0.86 |

120.00 |

10.50 |

2.25 |

4.50 |

4.00 |

2.15 |

|

2024E |

1.10 |

0.84 |

115.00 |

10.40 |

1.75 |

4.00 |

4.00 |

2.00 |

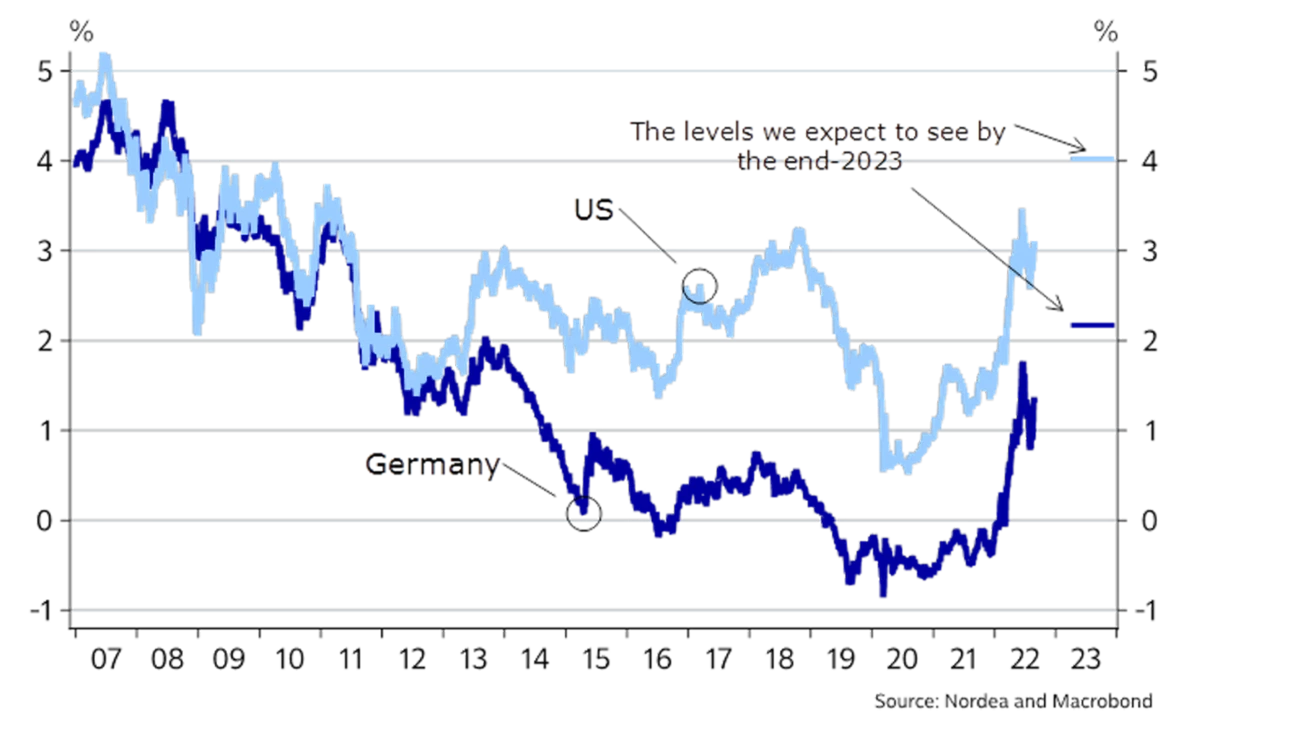

Financial markets have toyed with the idea that the weaker growth outlook could quickly persuade central banks to reverse course and start to cut rates next year. We think central banks have plenty more work to do and expect the Fed to raise its benchmark rate to above 4% next year and the ECB to 2.25%. Inflation pressures are the highest they have been in decades, and central banks may very well need to go even higher than this; even at the cost of pushing the economy in a recession.

Given the high inflation uncertainty, central banks cannot rely on their ability to forecast where inflation will be in a few years’ time, but have to put more emphasis on current inflation dynamics. This means that they will most likely need to hike rates at least until they are convinced that inflation has peaked and is clearly on its way towards the target. Even the ECB is set to accelerate the pace of its tightening.

We see more upside potential for long yields, not least because we think the US economy has plenty more growth left and central banks will raise their short rates noticeably further. Furthermore, the Fed’s quantitative tightening should have an increasing impact on longer yields, while discussions on how and when the ECB will shrink its huge bond holdings will likely also start later this year. In addition, the rising short rates make US Treasuries less appealing in the eyes of international investors. In the Euro area, the weaker economic outlook should limit the upside potential for longer yields, especially this year, but yields could rise further next year if the economic pain proves short-lived. Volatility it set to remain elevated.

There are downside risks to this view, if economic weakness proves more persistent and wage pressures come down faster in the US and remain contained in the Euro area.

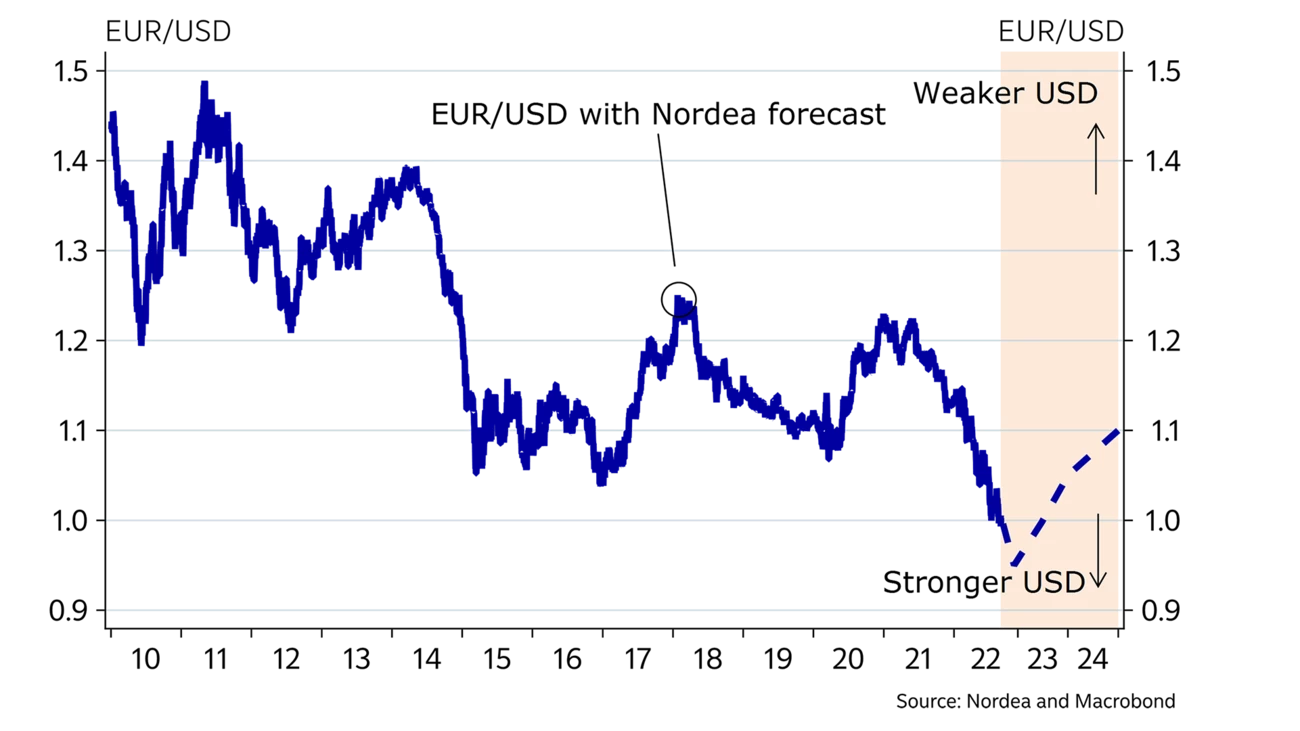

We believe the US dollar will continue to power on strengthening against most other G10 currencies, well supported by a diverging economic outlook and energy security situation, higher rate differentials and the USD’s safe haven status. From a dollar smile perspective, the USD strengthens either when the US economy outperforms the rest of the world, when the US economy is in a recession or when we have a synchronized global slowdown on the cards. While the debate is rife if or when the US eventually will enter into a recession, we see the US economy doing better than most other major economies ahead. It has become clear that Europe and Asia will pay a hefty price to keep the lights and heat on this winter, while the US will benefit from its energy independence. From a purely energy safety view of the world, the US economy is the one to bet on. Even if you do not agree and instead expect the US economy to crash soon, the USD should do well because of its status as the ultimate safe haven.

Eventually, the tide should turn. The question is what it will take for the USD to weaken again. The USD could weaken under a clear Fed pivot to dovish policy compared to other central banks. Alternatively, the USD could weaken under a global synchronized growth scenario, whereby most economies experience healthy growth at a pace that outperforms the US economy. However, it is unlikely that we will see such a scenario this year or next, in our view.

This article first appeared in the Nordea Economic Outlook: Feeling the Squeeze, published on 7 September 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more