- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskChina is now one of the bright spots in the global economy thanks to its post-COVID rebound. Developed economies, however, continue to fight against inflation, which is still too high. As central banks tighten their monetary policy it remains to be seen whether they will be able to deliver a soft landing or if many economies will slide into a recession. There are still factors favouring higher bond yields, while the best days for the USD are likely behind us for now.

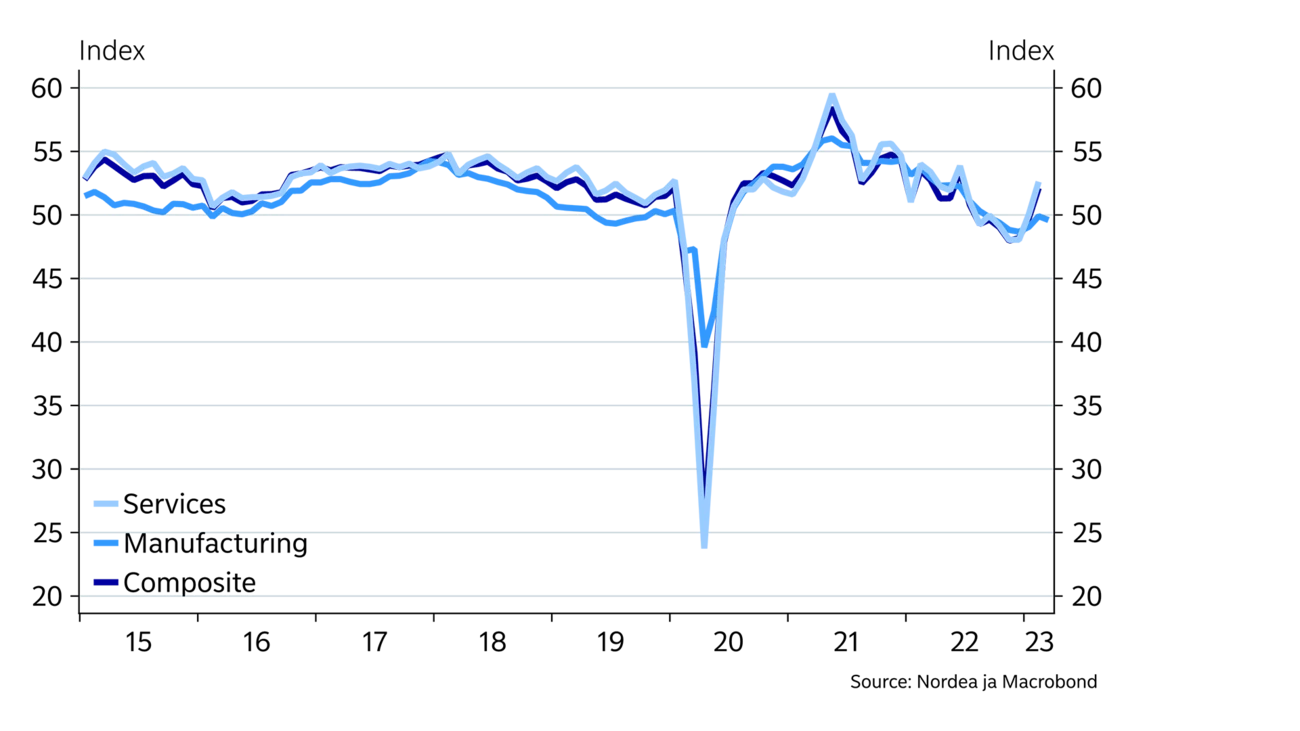

The global economic outlook is dominated by the same theme as in our winter forecast. Inflation continues to be rising too fast in the developed economies and the question remains whether the central banks will be able to bring inflation down without causing a deep recession and high unemployment. In our view, inflationary pressures are still strong and central banks are not yet done with their policy tightening; which means that growth prospects continue to be sluggish in the developed economies. The tightening may cause further worries in the banking sector and it hurts sectors like manufacturing and construction, while at the same time the short-term outlook is much stronger in services where the post-COVID rebound continues.

In China the post-COVID rebound has been strong, and our 6% growth forecast for 2023 is still valid. However, as growth is currently concentrated in the service sector, the positive spillover to the global economy is limited.

European energy prices have come down from their 2022 heights and are now back in more normal price ranges. In April, oil prices traded around USD 80/barrel, while European gas prices have traded around USD 70/barrel when measured in oil barrel equivalents. The energy situation in Europe now looks much better than a year ago, with ample gas storage levels going into the summer refilling season. While energy price spikes cannot be ruled out, we expect European energy prices to be lower in 2023 than last year. As for oil prices, we expect a level of around USD 90/barrel towards the year-end due to the continued reopening of China’s economy and OPEC’s desire for higher oil prices.

Core inflation has continued to be higher than we expected in our winter forecast in most western economies. The decline in headline inflation has been almost entirely due to low energy prices, and the broader price pressures are still strong. Especially in the Euro area, monthly changes have continued to be robust in both service and non-energy industrial goods prices, which has boosted annual core inflation numbers to record-high levels.

Looking ahead, the declining global price pressures in e.g. logistics, energy and raw materials are expected to finally slow down goods price inflation also in the Euro area – a development already seen in the US where the price of many goods rose rapidly during the pandemic but has since calmed down. At the same time, however, service price inflation is likely to continue to be strong in both economic zones due to high wage increases. As a particular headache for the ECB, the system of centralised wage negotiations in many Euro-area countries implies that the rapid increase in wage costs will be a sticky phenomenon now that it has started.

Adding to central banks’ challenges, inflation forecasts continue to be highly uncertain. One source of uncertainty stems from companies’ pricing power. At the aggregate level, it seems that companies have been able to increase their profit margins but this trend may quickly reverse if demand weakens. Thus, even if the inflation picture looks strong right now, there are also downside risks to our baseline.

The banking worries that surfaced in March will no doubt lead to some further tightening in financing conditions, but such worries are unlikely to do all the work for the Fed. Financial conditions remain looser than last autumn, for example, and core inflation is not coming down as fast as the Fed would like. The labour market remains tight, which will keep wage growth elevated even if peak growth rates are likely behind us. Growth momentum is set to slow further ahead, but this is because that is needed to bring inflation down, not because the economy lacks growth potential.

China’s data for January-March support our optimistic 6% growth forecast for 2023.

China’s data for January-March support our optimistic 6% growth forecast for 2023. The post-COVID rebound has been particularly strong in the service sector and we expect that to continue in the coming months. Even the real estate sector shows signs of stabilising after a downward trend since 2021. Looking further ahead, China’s big challenge is to shift the emphasis of the economy from fixed investment to consumption. This may not be an easy task due to rather weak income growth, increased geopolitical risks and the uncertainty around the housing sector. All those factors have probably increased risk awareness among Chinese households. Thus, we expect China’s growth to slow down to 4% in 2024 and gradually decline further in the coming years.

Euro area GDP growth slowed down to 0.1% q/q in Q1 2023. The PMI numbers show that growth momentum has recently gained pace in the service sector, but the tighter monetary policy and the decline in household purchasing power have negatively affected the development in construction, manufacturing and retail trade.

The positive development in the service sector will likely boost the labour market, which is already very tight. The unemployment rate is a record-low at 6.6%, and companies continue to see shortage of labour as the biggest growth obstacle. Labour market tightness coupled with high inflation has led to significantly higher wage increases than the Euro area is used to. On top of boosting households’ purchasing power, the wage increases also imply that especially service price inflation is likely to remain elevated, further challenging the ECB’s inflation target.

|

Year |

World New |

World Old |

US New |

US Old |

Euro area New |

Euro area Old |

China New |

China Old |

|

2021 |

6.1 |

6.0 |

5.9 |

5.7 |

5.3 |

5.3 |

8.1 |

8.1 |

|

2022E |

3.5 |

3.4 |

2.1 |

1.9 |

3.5 |

3.3 |

3.0 |

3.0 |

|

2023E |

3.0 |

3.2 |

1.2 |

0.8 |

1.0 |

1.0 |

6.0 |

6.0 |

|

2024E |

2.7 |

2.7 |

1.0 |

1.3 |

1.0 |

1.0 |

4.0 |

4.0 |

|

Year |

EUR/USD |

EUR/GBP |

USD/JPY |

EUR/SEK |

ECB: Deposit rate |

Fed: Fed funds target rate |

US: 10Y benchmark yield |

Germany: 10Y benchmark yield |

|

2021 |

1.13 |

0.84 |

115.10 |

10.29 |

-0.50 |

0.25 |

1.52 |

-0.18 |

|

2022E |

1.07 |

0.89 |

131.93 |

11.11 |

2.00 |

4.50 |

3.93 |

2.54 |

|

2023E |

1.15 |

0.91 |

127.50 |

11.30 |

3.75 |

5.50 |

4.20 |

2.60 |

|

2024E |

1.15 |

0.93 |

120.00 |

10.80 |

3.00 |

4.50 |

4.00 |

2.50 |

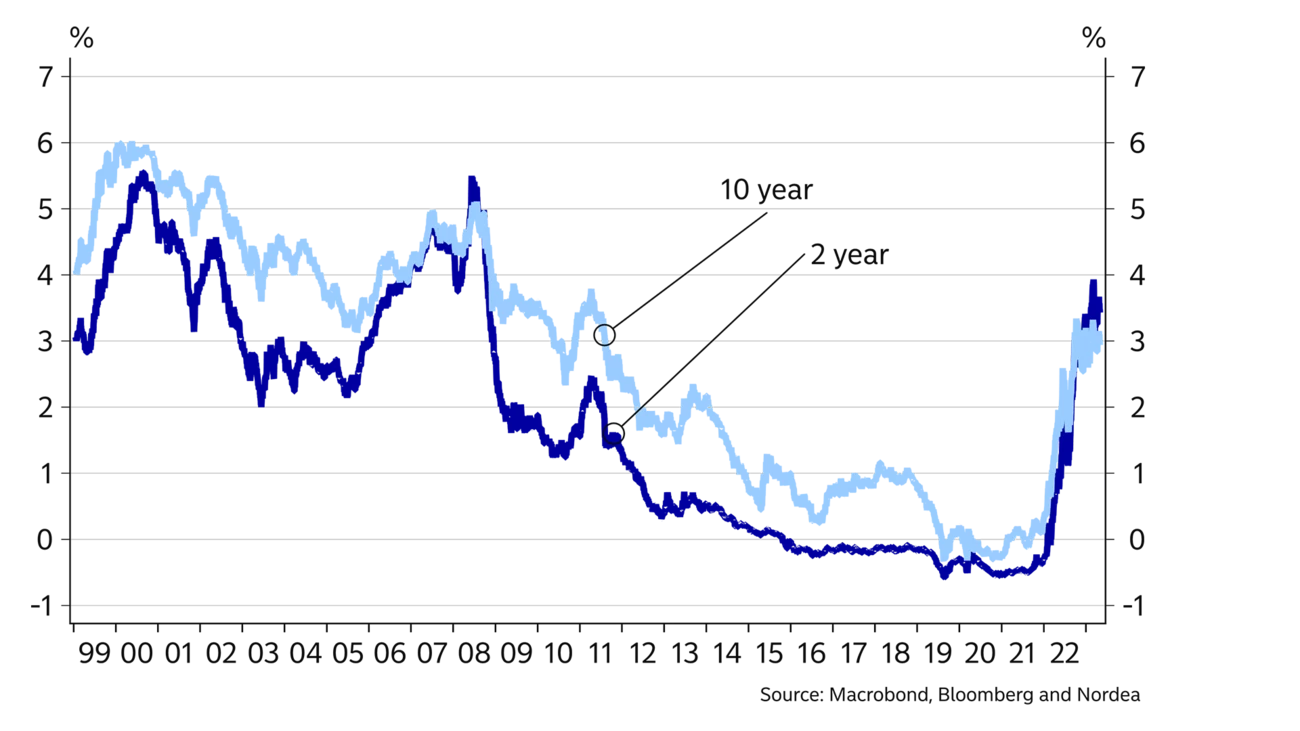

Many central bankers have started to emphasise that the majority of rate hikes are behind us and that rates will soon peak. Nevertheless, the fact remains that central banks are driven by incoming data, and their proven inability to forecast inflation in the current uncertain environment will keep a strong focus on realised data as opposed to heavy reliance on forecasts. While such a reaction function increases the risk of overtightening, it sets the bar for stopping rate cuts at a rather high level and the bar for cutting rates even higher.

We think the Fed will raise rates to around 5.5% and the ECB to just short of 4%, but those baseline forecasts are by no means the upper end of where rates could go. We disagree with especially the market pricing of US rates, where sizeable rate cuts are priced in for the coming 12 months. We think that after rates have peaked, central banks will need to keep rates at such restrictive levels for some time before they can be certain that inflation will reach the target. Rate cuts are thus unlikely to be on the table until well into 2024.

Short rate expectations are not all that matter for longer bond yields, though they have been the most important driver lately. With central banks reducing their bond holdings, one could easily argue that the risk premium in longer bond yields should gradually return after central banks have depressed it with their large bond purchases in the past few years. Also, the ECB is set to accelerate that process by likely ending reinvestments in its Asset Purchase Programme (APP) altogether in the second half of the year. That said, the market is unlikely to price out rate cut expectations any time soon, which together with rising short rates will keep yield curves clearly inverted for now.

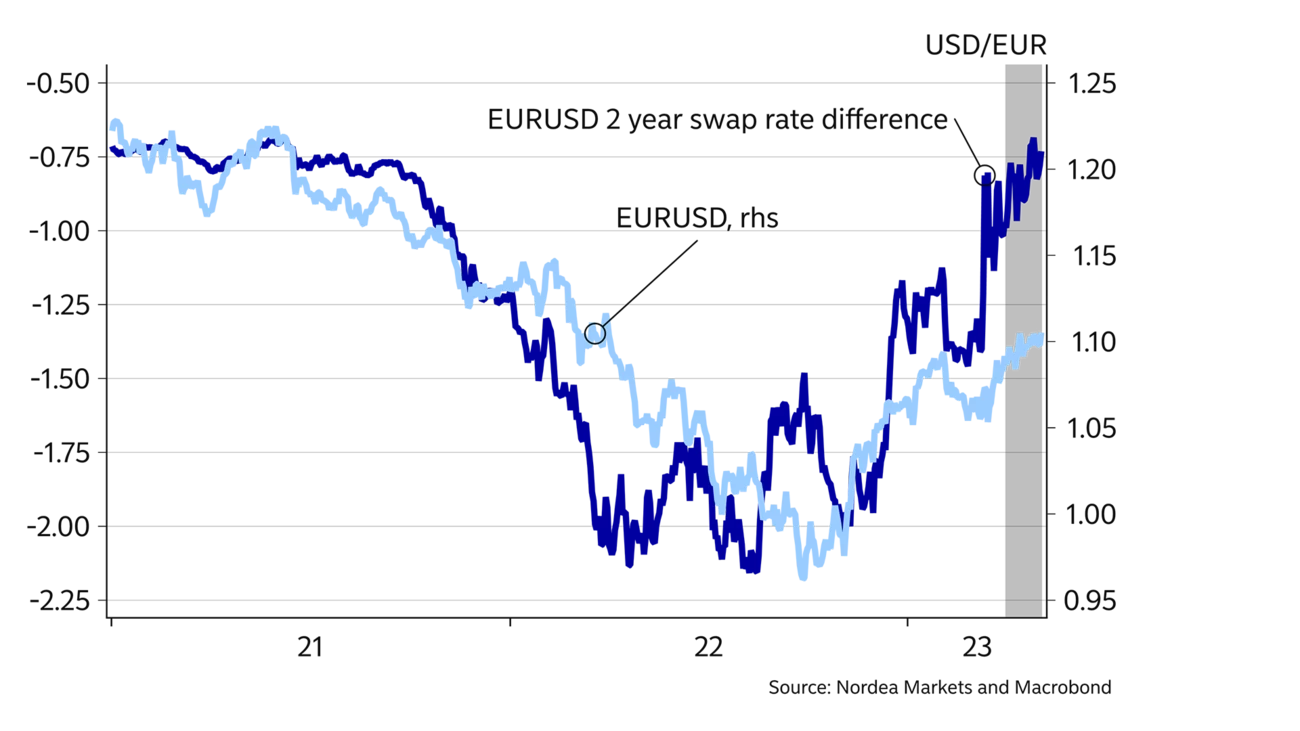

After a strong footing last year, the USD has developed poorly so far this year. Looking ahead, we still expect to see a weaker USD. The global economy is doing fairly well, with the reopening of China helping along the way. Risk sentiment took a turn for the worse during March due to banking-related stress. While risk-off episodes are usually a positive for the USD, this time was different as US banks were among the more exposed sectors. Moreover, a lower rate differential between the USD and other currencies is on the cards. The Fed is close to pausing, while the ECB has to do more. All of the above factors point to a weaker USD. The wild card for the USD remains the higher-than-usual likelihood of a global recession over the next couple of years, which could be in favour of the USD.

The EUR is among the bright stars in the G10 universe, supported by improved economic sentiment and higher rates. This will likely continue towards the end of the year, as the Euro area lags behind the US when it comes to the inflation and rates cycle. Looking at the other G10 currencies, the NOK is particularly exposed due to lower rate differentials, energy prices and government NOK transfers. The NOK is unlikely to strengthen before the summer, but it could recover later on. One of the other currencies that could be in focus in H2 2023 is the JPY. With a new governor at the helm of the Bank of Japan and higher inflation, a historical normalisation of monetary policy could be on the cards. That could set the stage for more JPY strengthening. Besides the JPY, safe-haven currencies such as the CHF could benefit from a more uncertain macro environment towards the end of 2023 and going into 2024.

This article first appeared in the Nordea Economic Outlook: The Inflation Standoff, published on 9 May 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more