- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

In a year that was unstable in many ways, the sustainable finance market demonstrated promising resilience. The Nordic sustainable bond market proved relatively more stable than the global market, experiencing 3% year-on-year growth compared to a contraction of 23% year-on-year globally. We outline the developments in some key charts below.

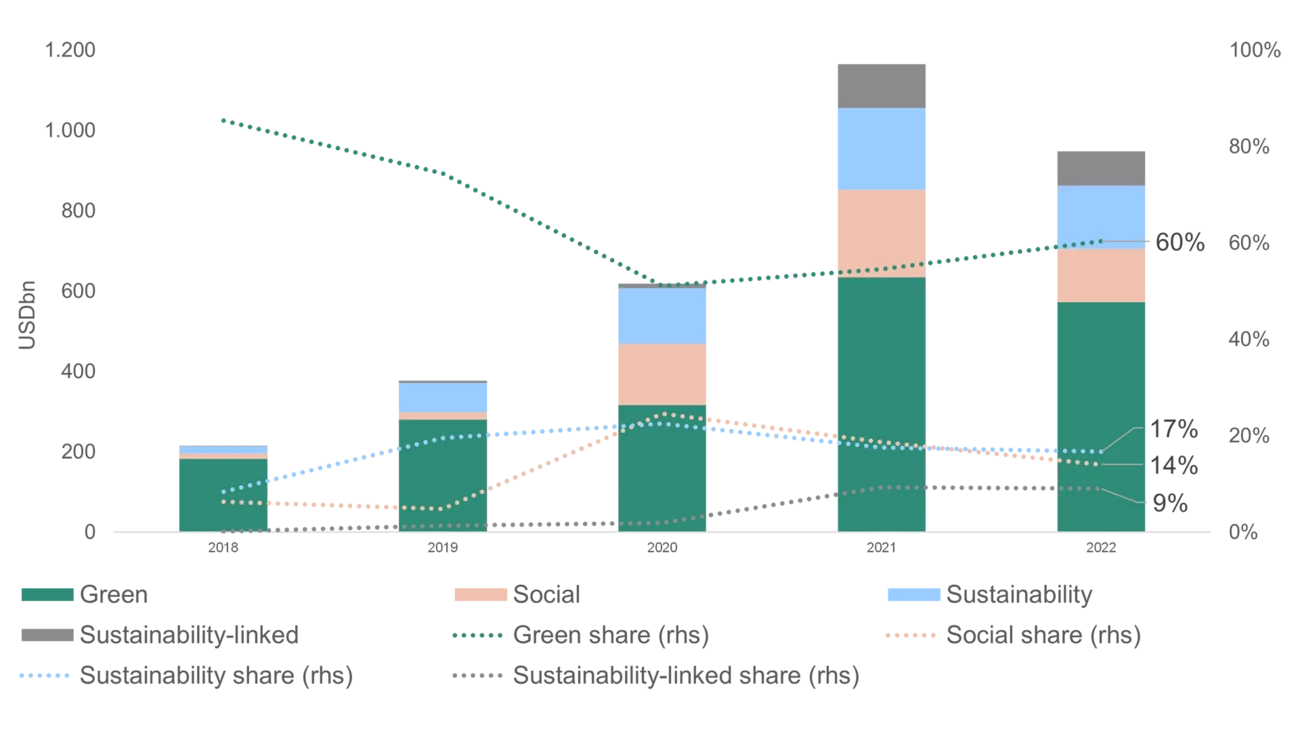

Historically the global sustainable bond market has consistently experienced year-on-year growth. This came to an end in 2022, with a 23% decline in GSSS (Green, Social, Sustainable, Sustainability-Linked) bond volume vs 2021. The first annual decline in sustainable bond volume can be largely attributed to the harsh macroeconomic environment that impacted global bond markets in 2022.

Sustainability-linked bonds (SLBs) failed to grow in share for the first time since the format’s introduction to the market, having taken approximately a 9% share in both 2021 and 2022. The format is finding its place between providing additional flexibility and attracting additional scrutiny. The first set of SLB penalties were triggered in 2022 as several companies missed targets. With more measurement dates to come in 2023, the format will face further challenges in the upcoming year.

Green bonds continue to lead the sustainable bond market with a 60% share in 2022, up from 54% in 2021, and the share of social bonds continued its decline from a 2020 high of 25%, now at 14%.

Source: BNEF

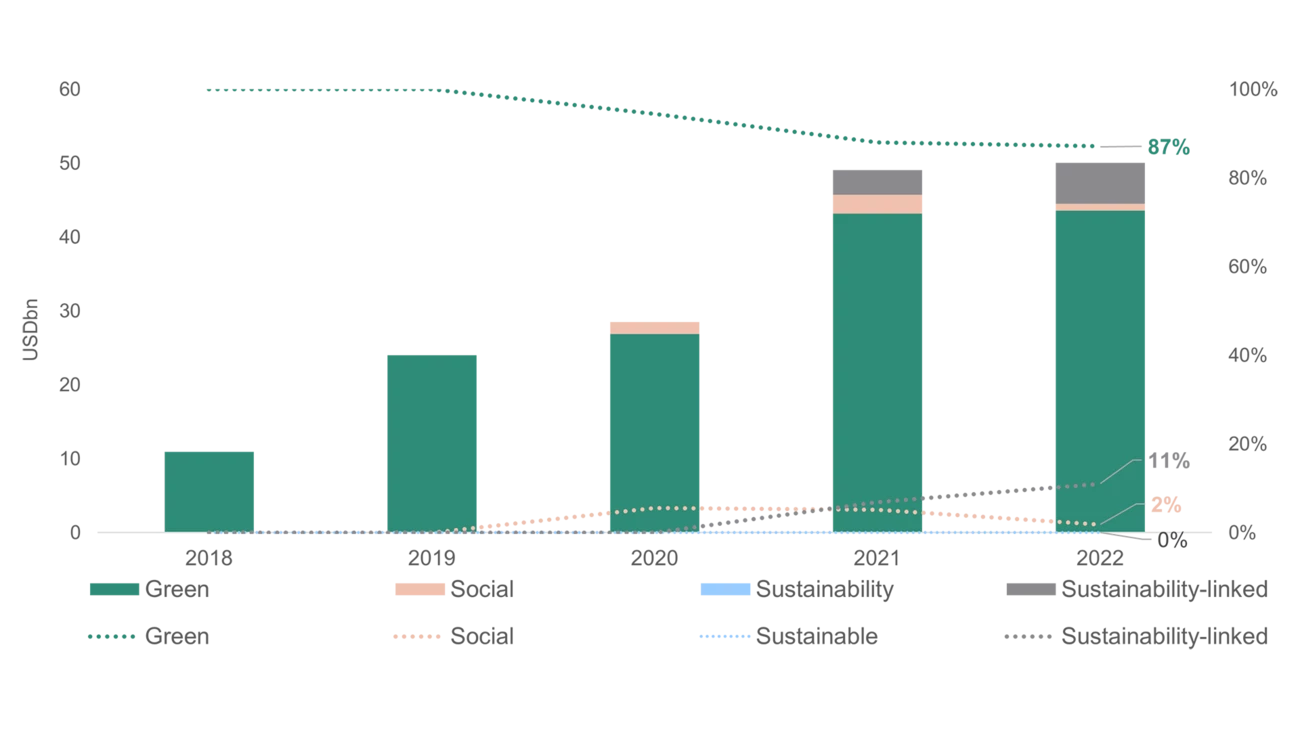

The Nordic sustainable bond market showed more resilience to macroeconomic conditions than global sustainable bond markets. The region’s 3% year-on-year growth bucked the global trend, providing reassurance to investors and corporates alike. The Nordic sustainable bond market also outpaces the global market in terms of overall share, with sustainable bonds taking a 12% share of all bonds in the Nordics vs just 2% globally. Over 2022 the average deal size in the Nordics grew by USD 14m year-on-year to USD 184m, supporting the strong performance seen in the region.

Green bonds continue to prop up the Nordic market, accounting for 87% of market share, remaining stable from 2021. While the global SLB share was flat year-on-year, it increased from 7% to 11% in the Nordics, making up for a drop in social issuances over the period and supporting growth in the region.

2022 saw sustainable bond supply begin to balance out in the Nordics, with Sweden’s previously dominant share dropping to 39%. Denmark’s share increased an impressive 11% to 23%, fuelled by the Kingdom of Denmark’s sovereign green bonds.

Source: BNEF

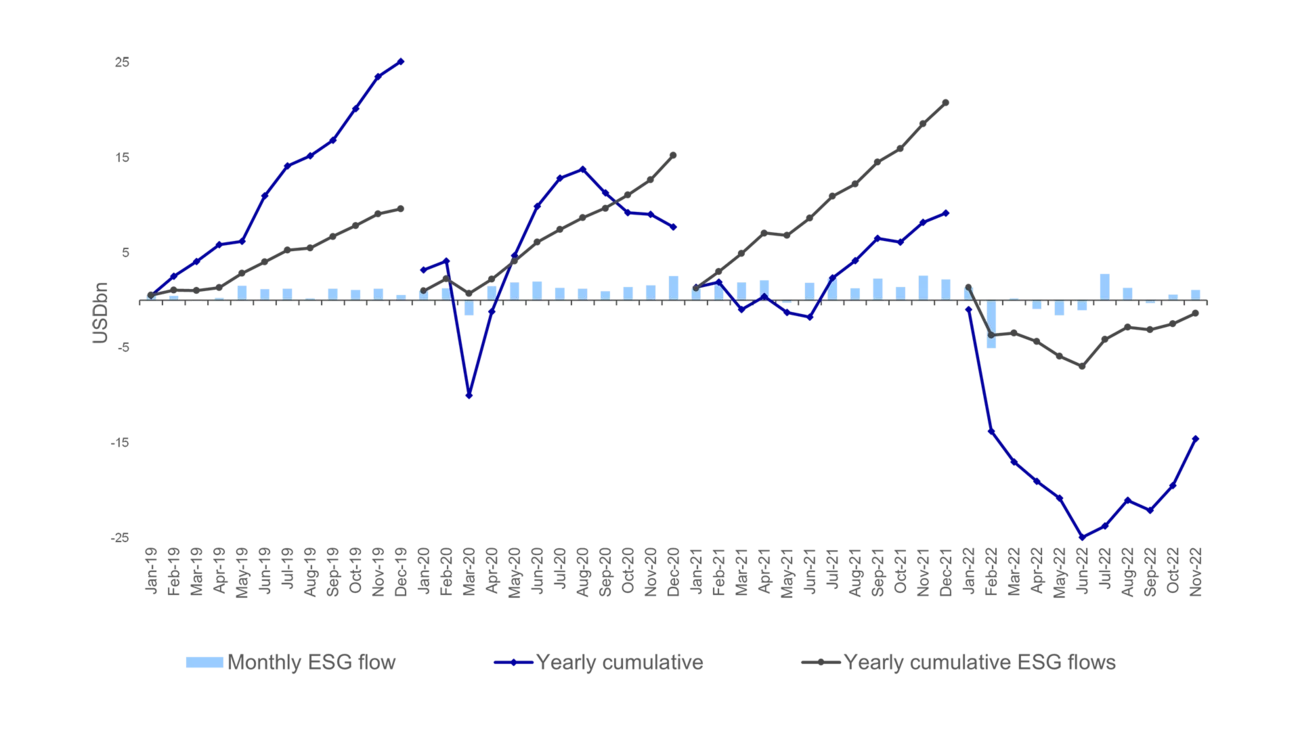

Fund outflows of roughly 15 billion USD were observed in the Euro Investment Grade (EUR IG) bond sector in 2022, while dedicated EUR IG ESG funds demonstrated more favorable performance with outflows of just 2 billion USD. This trend further supports the argument that ESG instruments are more resilient against unforeseen market conditions and are likely to remain attractive over the long-term.

Source: EPFR

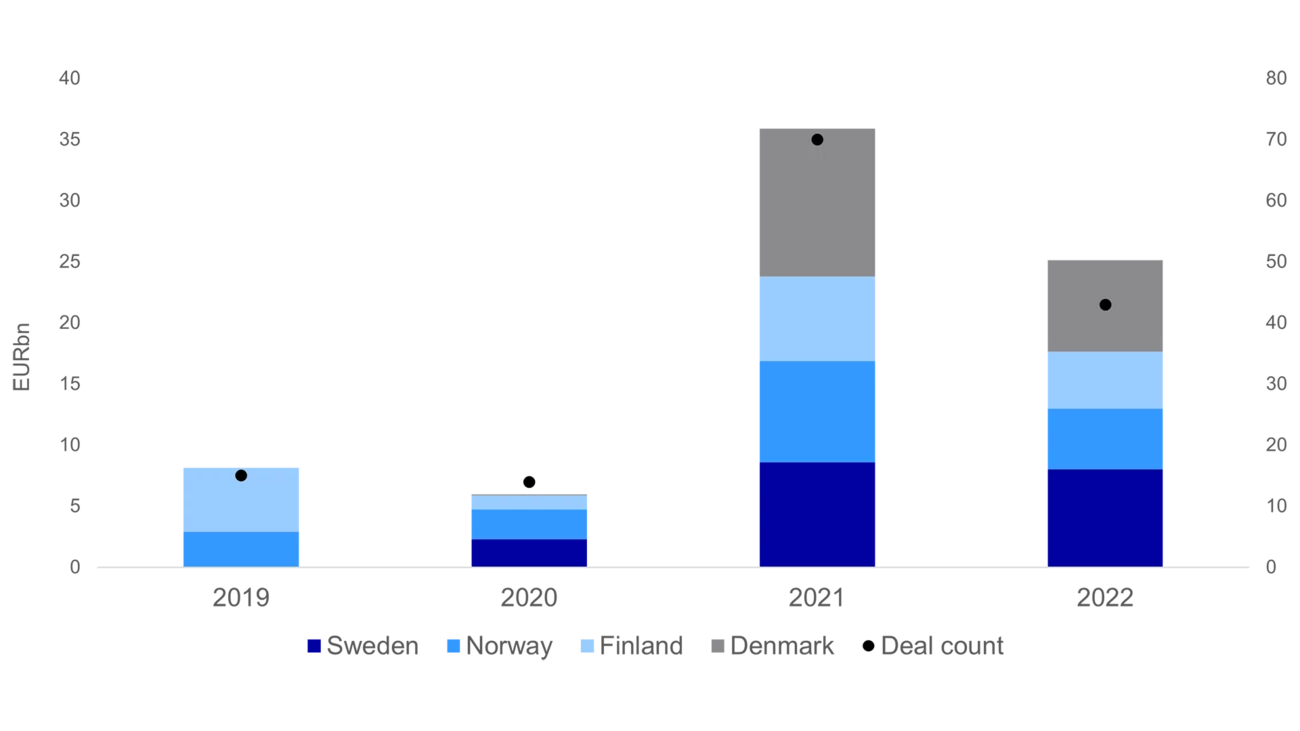

In 2021, the Nordic region experienced record growth in sustainable loan offerings, with year-on-year growth surpassing five times the previous year. However, the supply for 2022 saw a significant decrease, dropping by approximately a third from the previous year. Supply across the Nordics was relatively well-balanced with each country contributing around 20-30% to the total in 2022.

In 2022, green loans accounted for 4% of all sustainable loan financing. This aligns with the historical trend, with green loans typically maintaining under a 10% share while sustainability-linked loans (SLLs) dominate the rest of the market.

Source: Dealogic

The sectoral distribution of sustainable loan supply has remained inconsistent over the years, with utilities leading the market in 2020 (34% share), consumer health leading in 2021 (20% share), and materials now dominating in 2022 (36% share). Although climate-related KPIs continued to dominate the SLL market in 2022, we observed a significant increase in the number of diversity-related KPIs being incorporated within SLLs.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more