- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

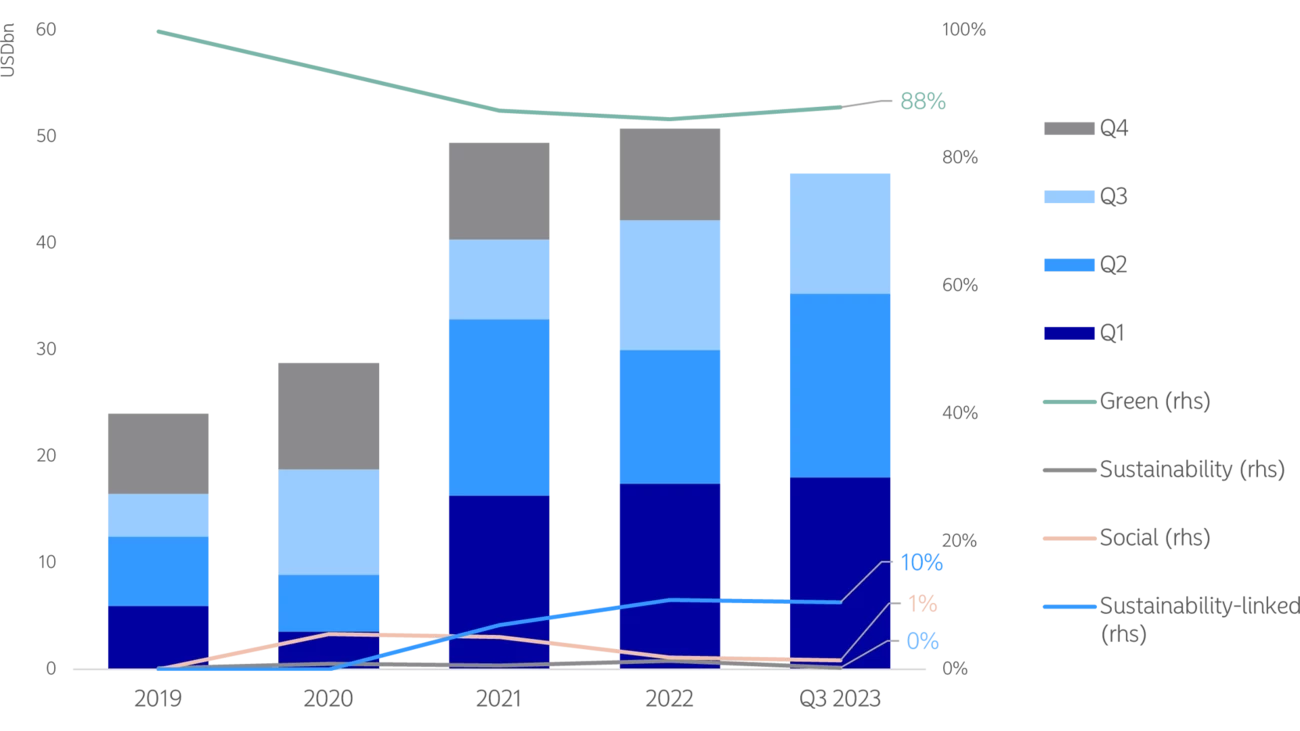

With the latest quarterly data now in, the Nordic bond market looks set to continue its unbroken trend of sustainable volume growth for another year. Supported by record H1 sustainable volume, the slightly reduced Q3 figures were enough to take Nordic sustainable bond supply to a new year-to-Q3 high. While Nordic sustainable loan volumes continued to fall in Q3, we can point to macro factors for the drop in performance, as almost a third of Nordic loan market volume carried a sustainable label during the quarter, representing the greatest penetration of sustainable formats since Q2 2021.

The Nordic sustainable bond market saw a relatively muted start to H2, following record H1 volumes in the region. The intra-year drop in volume, with Q3 volume down 38% on Q1 and 35% on Q2, was expected as we saw the market conditions of late 2022 push some bond supply into this year. Q3 volume may reveal the true state of the sustainable bond market more clearly, with quarterly sustainable volume down 8% year-on-year in Q3 2023. Nonetheless, the Nordic sustainable bond market reached a record year-to-quarter volume of approximately USD 46.5bn of sustainable bond issuance during the first 9 months of 2023.

Source: BNEF, Nordea

While we are broadly seeing sustainable bond volume growth in absolute terms, it is also important to understand what this means in the context of the Nordic bond market as a whole. We have therefore examined how the share of total Nordic bond volume issued with a sustainable label has changed over time. The latest data, up to Q3 2023, reveals a clear long-term trend, showing the market becoming proportionally more sustainable year-on-year. Over the past 5 years, the proportion of Nordic bond volume issued with a sustainable label – green, social, sustainability or sustainability-linked – each year has steadily increased from 5% in 2015 to 13% over the first 9 months of 2023.

While we arguably observed some wavering in the resilience of sustainable formats during the broader market uncertainty of H2 2022, with the sustainable share of Nordic issuance dropping just below 10% across Q3 and Q4, we have seen this bounce back during 2023. In fact, Q3 2023 marks the fourth consecutive quarter of growth in sustainable bond issuance as a proportion of the total Nordic market. This recent growth trend has also set a new high-water mark, with 14% of total Nordic issuance in Q3 2023 carrying a sustainable label.

Source: Bloomberg, Nordea

This trend adds to evidence that the sustainable bond market is approaching a phase of maturation, as we covered previously.

The Finnish sustainable bond market continued to impress during Q3 2023, following record H1 sustainable volume with further record-breaking sustainable volume in the third quarter. Finnish Q3 sustainable supply was up over 520% on last year’s Q3 figure and up over 150% on Finland’s previous Q3 high observed during 2020. As a result, Finland beat its previous full-year sustainable bond volume record already in the first nine months of 2023. 2022’s record full-year figure has been topped by around 3%, as 2023 Finnish sustainable volume totaled approximately USD 6.7bn at the end of Q3.

Source: BNEF, Nordea

As in previous years, green bonds represented the majority of the Finnish sustainable bond market during 2023, making up 83% of sustainable volume issued by the end of Q3. The bulk of Finnish green issuances in 2023 came from the financial sector. SSA has taken second place in Finnish green bond issuance so far, following record SSA green bond issuance during Q1, with the materials sector following closely behind. Sustainability-linked bonds have made up 11% of Finnish sustainable bond volume so far in 2023, down from 15% in 2022, with issuances from the technology, healthcare and consumer discretionary sectors.

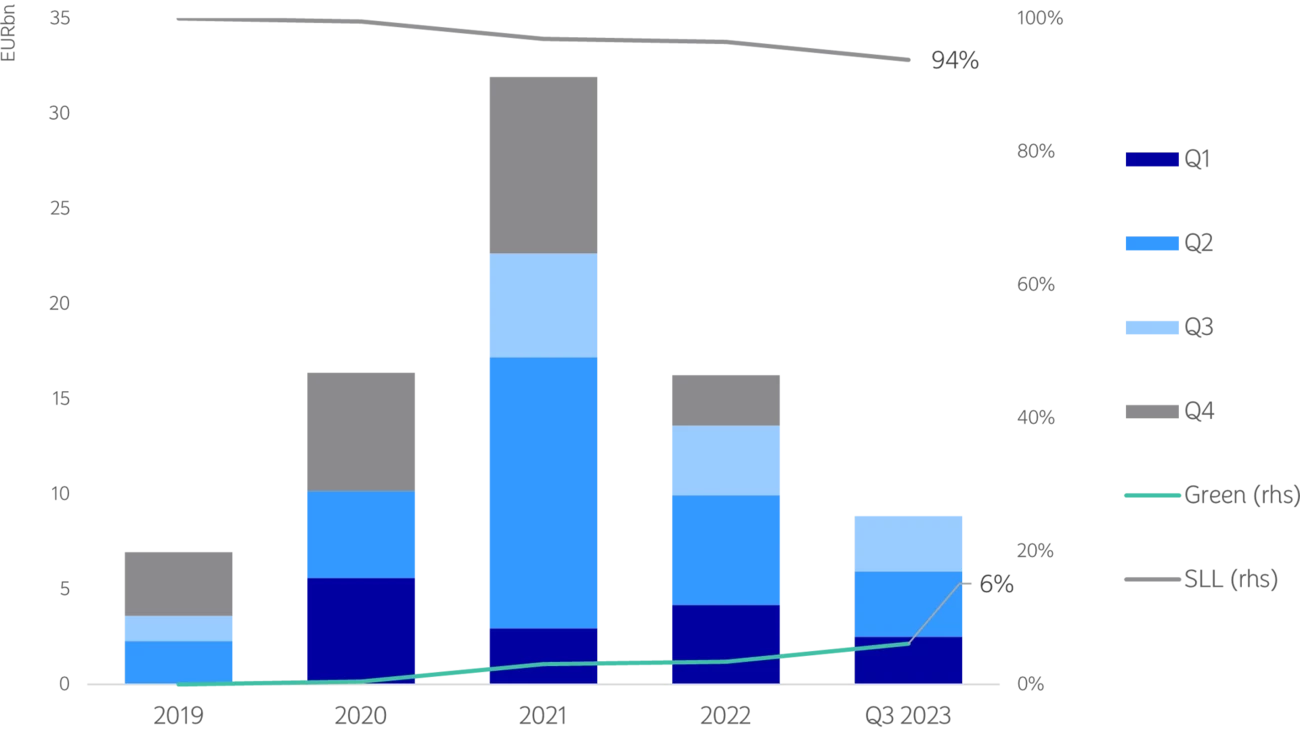

Sustainable loan supply continues to struggle in 2023, as we see conversations around sustainable financing continue their slight tilt towards the bond side. Nordic Q3 sustainable loan volume was down 16% quarter-on-quarter and 21% year-on-year, with interest rate conditions still not favouring the characteristics of sustainable loan formats. As discussed in our H1 update, the shorter financing terms often seen in higher interest rate environments do not always align well with the application of sustainability linkages. The yearly perspective shows a similar story, with volume at 2023 Q3 falling short of 2022 and 2021 figures by 21% and 47%, respectively.

Source: Dealogic, Nordea

The Danish market leads the volume rankings for the first 9 months of 2023, taking 41% of total Nordic supply to the end of Q3. Sweden has taken an unusually small share so far during 2023, dropping to the smallest contributor to Nordic volume at 13% after being the leading contributor at 42% in 2022. The Norwegian share remained relatively stable at 31% of the Nordic market, with Finland taking the remaining 15%. While Finland represents a minor share of the market at the end of Q3 2023, sustainable formats have the greatest penetration there, with green and sustainability-linked loans making up over 45% of the total loan market in the country during the period.

Stay on top of the latest developments in the fast-moving world of sustainable finance. Receive a curated monthly digest and occasional flash updates with the latest news, insights and data from our Sustainable Finance Advisory team.

Register here

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more