- Name:

- Susanne Spector

- Title:

- Nordea Chief Analyst

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskHalf of all wage earners will get new wage deals in early 2023. The unions’ wage claim is 4.4%, while employers’ bid is 2.0% and a one-off amount of SEK 3,000.

At the end of March the labour market parties must decide a new industry benchmark that will affect 2.2 million people – nearly half of all wage earners. The norm around the industry benchmark is so strong that it often determines wage growth throughout the economy.

The industrial sector has made a wage claim of 4.4%, which is almost unanimously backed by the trade unions. However, there are tensions within some unions that consider the claim too low.

For the first time, employers have made a specific counter bid of 2.0% and a one-off payment of SEK 3,000. This bid equals wage growth of approximately 2.7% – higher than the average wage growth of 2.5% annually from 2013 to 2019.

Over the past 25 years the labour market parties have concluded three-year pay deals in seven out of ten pay rounds. Employers usually favour long deals but have this time suggested a one-year deal. Unions generally favour short deals so this time a one-year deal looks quite likely.

The sharply rising inflation has fuelled discussions about the risk of a wage-price spiral. For many, the correlation between wages and inflation is obvious. If wages increase more than productivity, businesses will have to raise their prices sooner or later.

However, it is not entirely easy to determine empirically whether wages drive inflation or vice versa. If the demand for products and services goes up, businesses need to hire new staff, which will result in lower unemployment and higher wage growth. If businesses raise their prices to compensate for higher wages, this means that wages drive inflation. But increased demand for goods and services could also lead directly to higher prices – and in turn to higher profits and higher wage claims. If so, inflation will be the driving force behind higher wages.

According to a new IMF study from autumn 2022, pure wage-price spirals are unusual. When the authors com-pare periods similar to today’s situation with accelerating inflation, rising nominal wages, falling real wages and low unemployment, they show that these are often followed by periods of falling inflation and faster nominal wage growth that allow real wages to recover. This implies that nominal wage growth should not necessarily be interpreted as the start of a wage-price spiral but could rather mean a return to historical profit and wage shares. That is why it would be reasonable to expect a period of slightly higher nominal wage growth than during the 2010s in the coming period.

Other studies suggest the same. A study by Hess and Schweitzer in 2000 entitled “Does Wage Inflation Cause Price Inflation?” concluded that wages are not a good indicator of future inflation and that the role of wages in monetary policy discussions is not justified. This is largely confirmed by more recent research.

Pure wage-price spirals are very unusual.

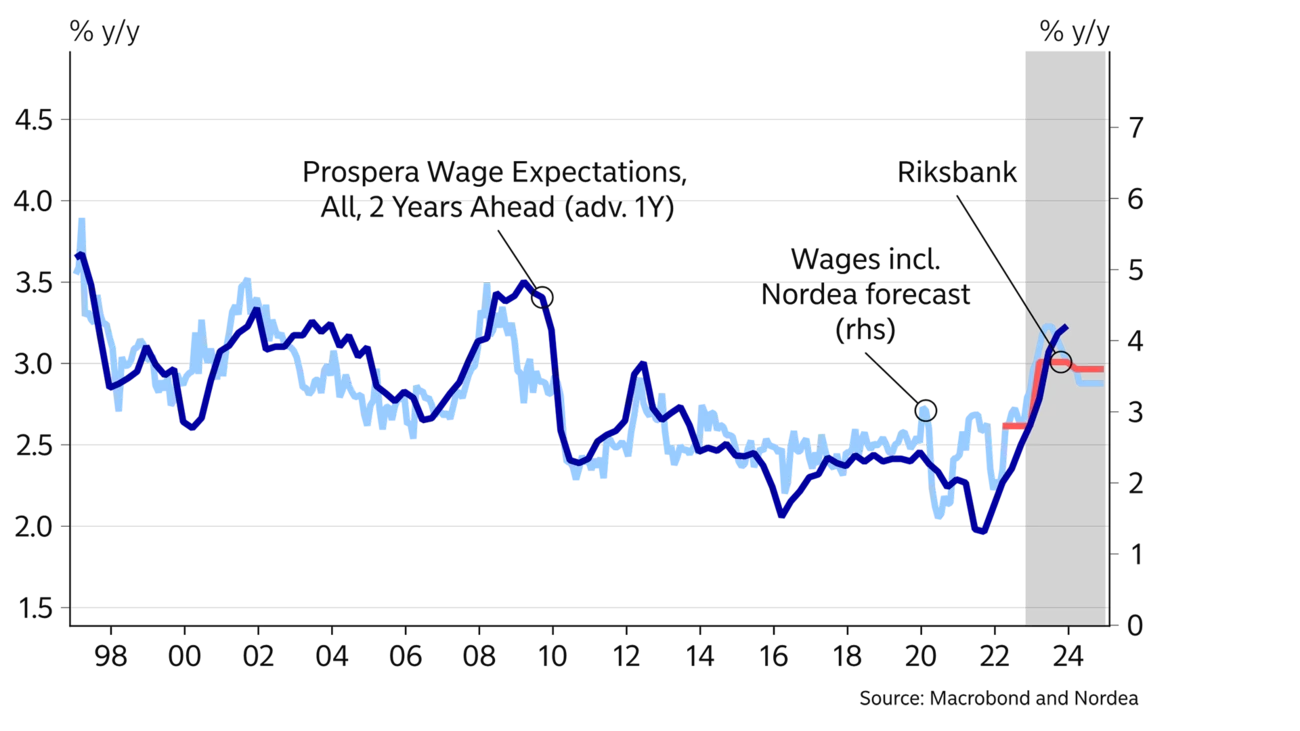

For Sweden it looks like the outcome of the upcoming pay talks will be in line with the inflation target, but at a higher level than in previous years. At the same time, the Riksbank is likely concerned that employers have deviated from their principle of not making specific wage bids, citing pressure for inflation compensation from wage earners as the reason. The cocktail of higher wage bids and prospects of a shorter deal puts pressure on the Riksbank to bring inflation back on target before the potential next pay round in 2024.

There are also other signs of a shift in wage formation in Sweden. Wage expectations are at the highest level since 2009, indicating a wage growth rate of about 4% next year. At the same time, a weaker labour market situation speaks against major increases in the near term. Nordea’s wage growth forecast is 4% in 2023 and 3.5% in 2024.

This article first appeared in the Nordea Economic Outlook: The Balancing Act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more