What is net-zero and why is it important?

Net-zero has gained immense traction on the global agenda, with COP26 in 2021 even being dubbed as the “net-zero COP”. The ambition represents the most comprehensive approach to limiting global warming to 1.5°C and overcoming one of the greatest challenges and priorities of the 21st century in order to prevent the triggering of critical climate events, irreversible biodiversity loss and the subsequent economic and social consequences.

To accomplish this, worldwide efforts are necessary, and national governments, corporations, and other organisations have been committing to embarking on the journey to net-zero. Leading the way is the European Union, which aims to become the first climate-neutral continent and achieve net-zero emissions by 2050. This objective is strongly supported by the European Green Deal, which encompasses a wide range of policy initiatives and investments aimed at establishing a sustainable economic model in the EU. In the Nordic context, countries have been closely following suit but with varying emissions reduction commitment scopes. Sweden is committed to achieve net-zero emissions with an end target of 2045. Others are aiming at carbon neutrality targets with Finland to become carbon neutral by 2035, followed by Iceland “before 2040”, and Denmark and Norway in 2050.

Carbon-neutral vs net-zero

|

|

Carbon neutrality

|

Net-zero

|

|

Boundary

|

Minimum requirement of covering Scope 1 and 2 emissions, while Scope 3 is encouraged

|

Must cover Scope 1, 2 and 3 emissions

|

|

Level of ambition

|

An organisation does not need to cut its emissions in line with a certain trajectory to be carbon neutral.

|

To be Net-zero, an organisation must reduce its emissions along a 1.5˚C trajectory across Scope 1, 2 and 3.

|

|

Approach to residual emissions

|

An organisation must purchase carbon offsets that either result in carbon reductions, efficiencies, or sinks to the sum of residual emissions after reductions have been made.

|

An organisation must purchase additional GHG removals that either remove or store carbon.

|

Source: Carbon Trust

With the full spectrum of national and local governments, public and private development frameworks and financial institutions setting net-zero targets, ambition will be passed on throughout value chains and partnerships. Organisations in all arenas will be subject to requirements originating from a net-zero pathway in some form.

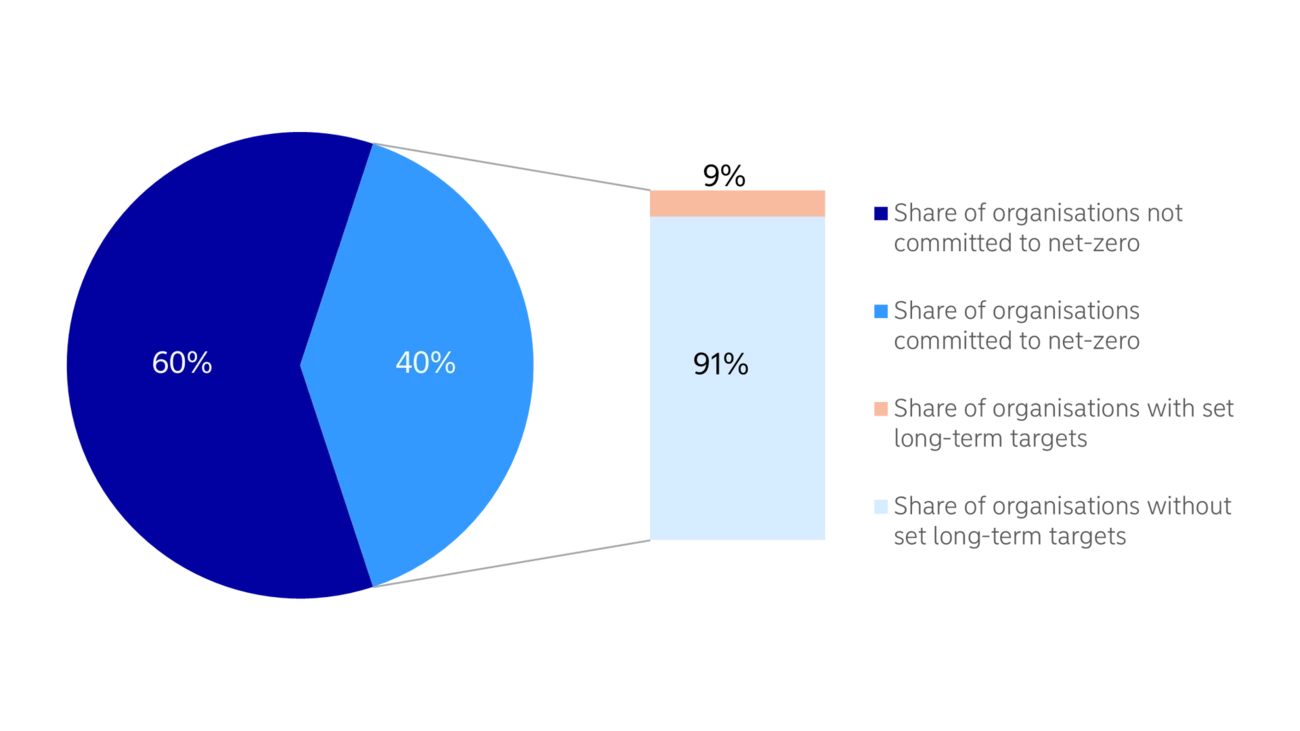

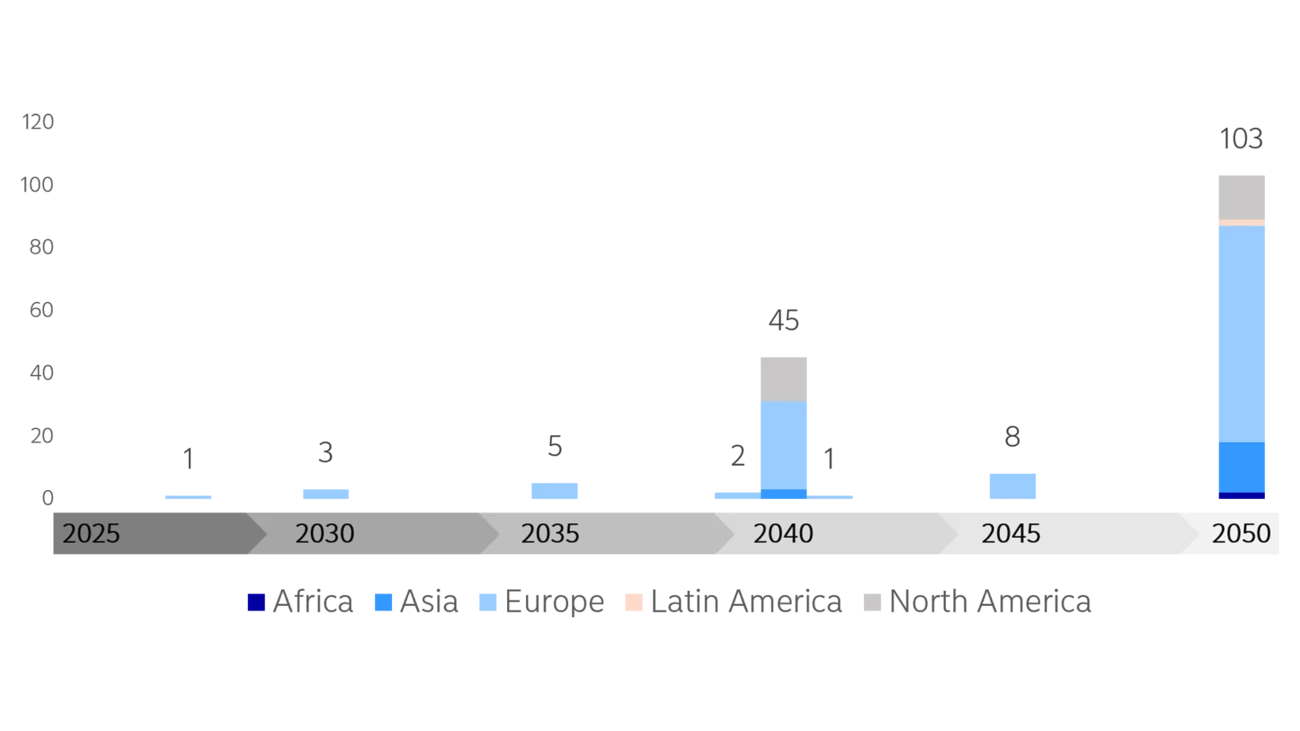

Net-zero target setting with SBTi: progress so far

Since the official launch of SBTi's Net-Zero Standard in 2021, over 1,842 organisations have committed to the standard, representing around 40% of the total organisations that have committed to or set short-term SBTs. Among those committed organisations, 89% are companies, 5.5% are financial institutions, and 5.3% are small or medium-sized enterprises. However, while the trend of commitment is increasing, only 9% of organisations have actually followed through with their net-zero commitments and established long-term science-based targets, including net-zero target years.