- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

High interest rates have sent the Finnish economy into a recession. Mortgage holders and the public sector are adapting their spending to respond to higher interest rates, which has weakened demand but will lead to more balanced finances. However, as purchasing power improves and global demand picks up, the economy will start to grow again next year.

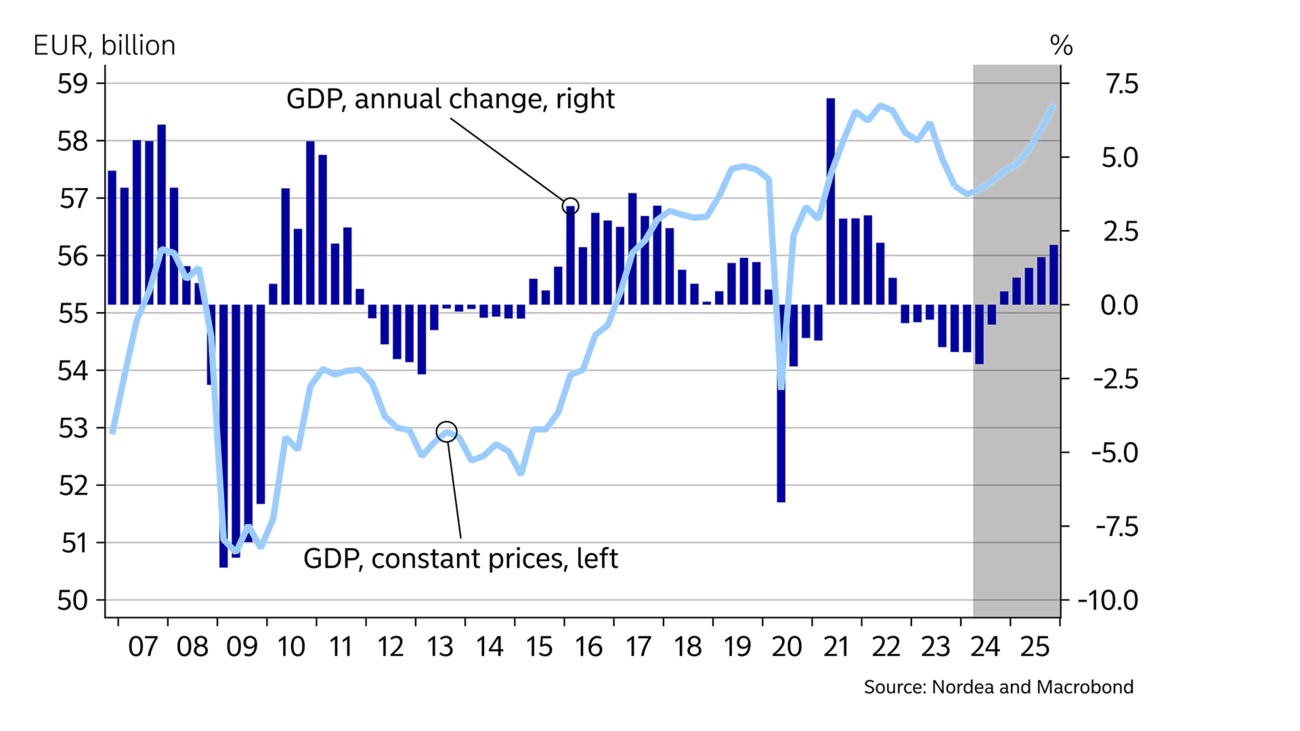

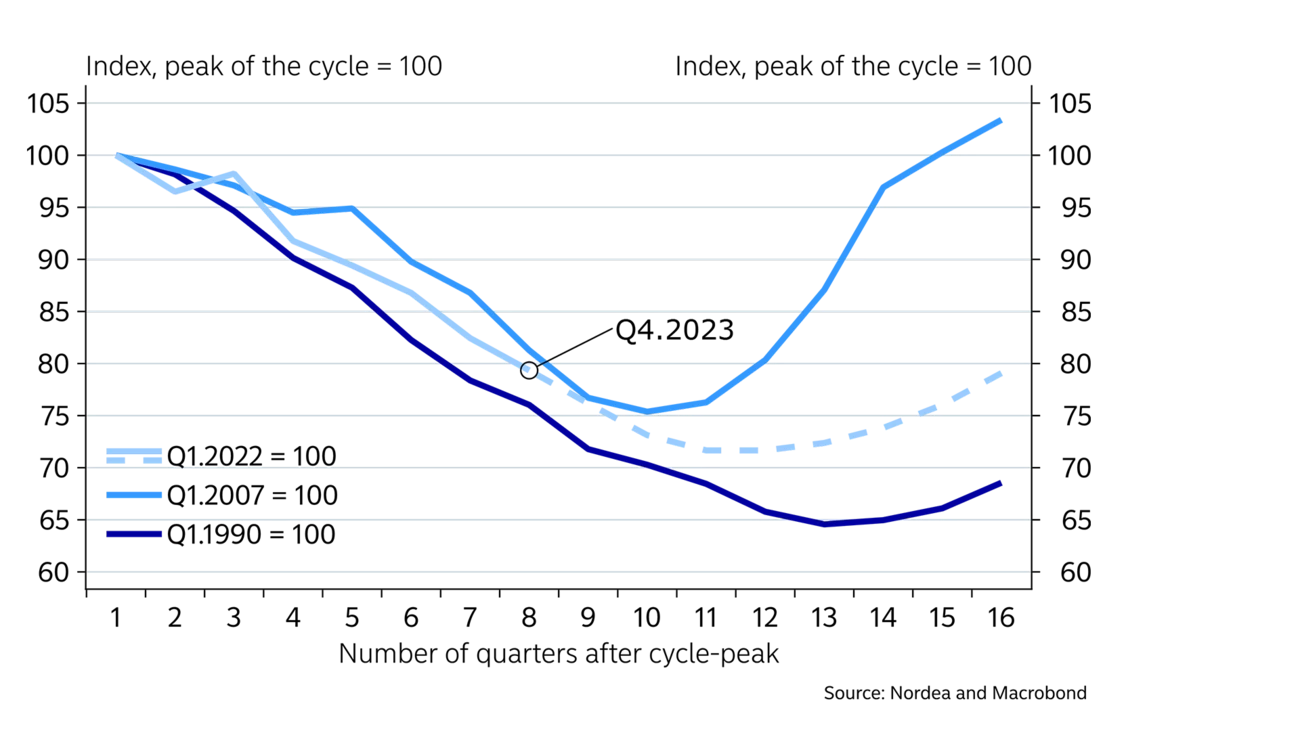

The Finnish economy was one of the poorest performers in Europe in 2023, as GDP contracted by 1% year-on-year. Finland is now suffering a lot more than other countries from the rise in interest rates because most households have mortgages with a variable rate. The era of extremely low interest rates led to an excessive construction boom in Finland, after which construction has since declined significantly and house prices have fallen in the new environment. This leads to a pertinent question: should Finns continue to tie their mortgage rates differently from borrowers in the large eurozone countries whose economies and inflation rates mostly determine the eurozone interest rate level?

Despite the contraction in global trade, Finland’s goods exports continued to grow mildly last year. The strong performance of service exports, which has continued for many years, came to a halt last year when exports of ICT services, in particular, declined significantly.

However, the economy is expected to start growing again by the end of this year. Consumer confidence and real incomes are still weak, but the latter will gradually improve on the back of lower inflation, wage increases and falling interest rates. Moreover, a pick-up in global manufacturing has improved the outlook for the export sector, and the decline in construction is expected to finally end next year.

We forecast Finland’s economic growth to be -1% this year. We expect the economy to begin growing again during the latter half of this year. We have downgraded GDP growth in 2025 to 1.5% as the Finnish government has announced major additional fiscal adjustment measures for next year, which will for their part slow down the recovery in consumer purchasing power. However, the adjustment measures are necessary for halting growth in government debt, which has continued for years.

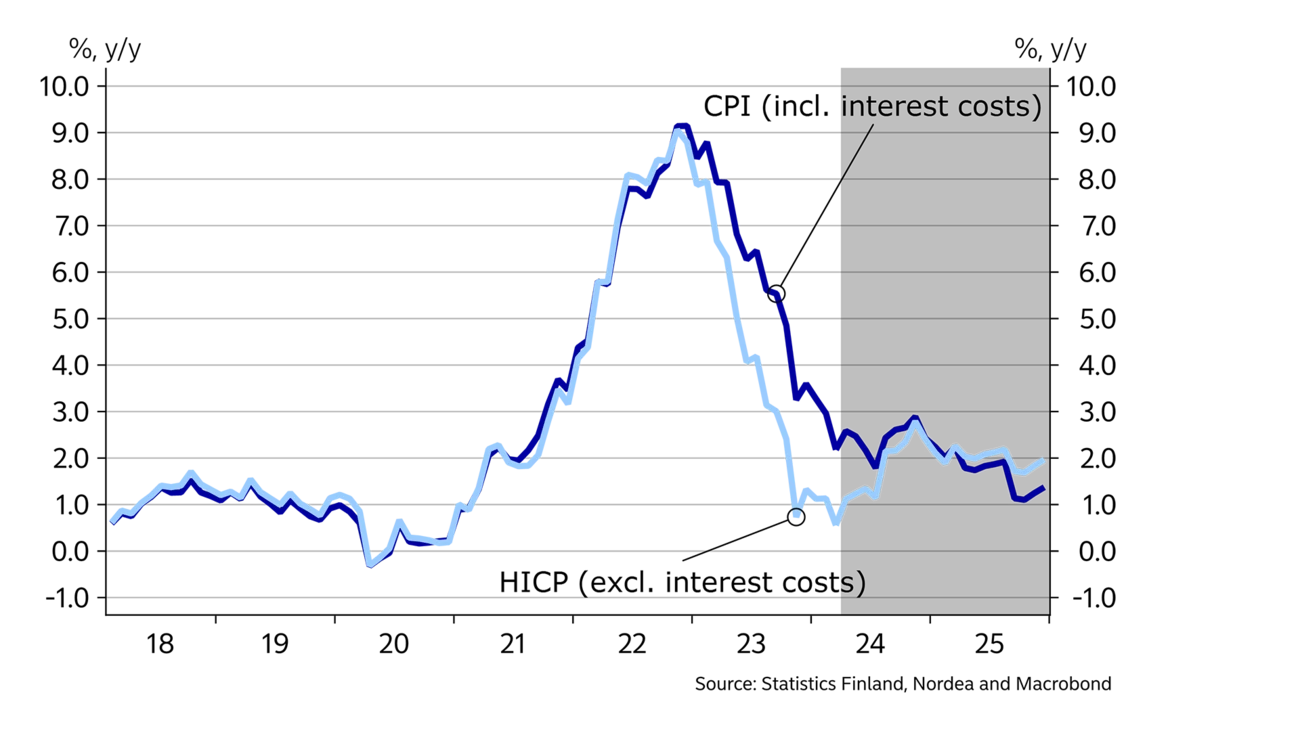

The rise in consumer prices slowed down across the board. Consumer price inflation (CPI) was only 2.2% in March, compared to an average of 6.2% last year. The EU’s harmonised index of consumer prices (HICP) fell by 0.5% in March. The HICP does not include the effect of loan interest.

Energy and food prices are already lower than last year, and the annual change in the prices of goods has fallen to near zero. Inflation is only kept up by an increase of about 3% in the prices of services year-on-year, which is due to the fact that last year’s wage rises are now reflected in these prices. Interest rates will keep consumer price inflation in Finland high for the first half of this year, but in the latter half their impact on the consumer price index will most likely be negative.

We will see a slight jump in inflation in August-September, when the year-ago figures will no longer include a calculation error in electricity prices. Also, an increase in the general value added tax rate from 24% to 25.5% will raise most consumer prices. But on the whole, inflationary pressures are expected to be weak throughout the forecast period.

| 2022 | 2023 | 2024E | 2025E | |

| Real GDP, % y/y | 1.3 | -1.0 | -1.0 | 1.5 |

| Consumer prices, % y/y | 7.1 | 6.3 | 2.5 | 1.7 |

| Unemployment rate, % | 6.8 | 7.3 | 8.0 | 7.6 |

| Hourly earnings, % y/y | 2.4 | 4.2 | 3.3 | 2.9 |

| General gov. budget balance, % of GDP | -0.8 | -2.7 | -3.2 | -2.0 |

| General gov. gross debt, % of GDP | 73.5 | 75.8 | 78.6 | 78.2 |

| Monetary policy rate (end of period) | 2.00 | 4.00 | 3.25 | 2.25 |

Private consumption has continued to be lackluster because wage earners’ purchasing power is still weak, despite lower inflation and higher wages. The high interest rate level has resulted in increased costs for families with children, in particular, as they typically have a lot of debt. The purchasing power of pensioners, in real terms, has not decreased much in recent years since pensions have increased in line with consumer prices. Pensioners also have less debt than financial assets, so the higher interest rates have had a positive impact on pensioners’ purchasing power.

The purchasing power outlook for next year is mixed. Inflation and interest rates are expected to continue to fall, but on the other hand, the government’s actions to balance public finances will slow down the recovery in purchasing power. On the whole though, purchasing power is expected to improve this year and next.

Private consumption is expected to grow much more rapidly in 2025 than this year. The weak situation in retail and services is expected to begin to ease once purchasing power recovers. An increase in real wages will most likely also improve consumer confidence.

Employment has held up reasonably well despite the weak economy. The employment rate trend has remained around 73%, while the unemployment rate has also stayed below 8%. However, the labour shortage experienced in recent years has eased in most sectors and the number of job vacancies has decreased significantly.

Growth in public sector employment has helped support the labour market. In February, the number of people employed by the private sector had fallen by more than 60,000 year-on-year, but at the same time the public sector workforce had grown by more than 70,000. We expect the employment situation to deteriorate somewhat this year. The continued decline in activity in the construction sector, in particular, will further increase unemployment.

However, the unemployment situation is expected to rebound again next year as economic growth picks up. The government’s efforts to stimulate employment will increase incentives to work and will likely boost employment next year, once the economy improves.

The improvement in purchasing power will be halted temporarily by tax increases.

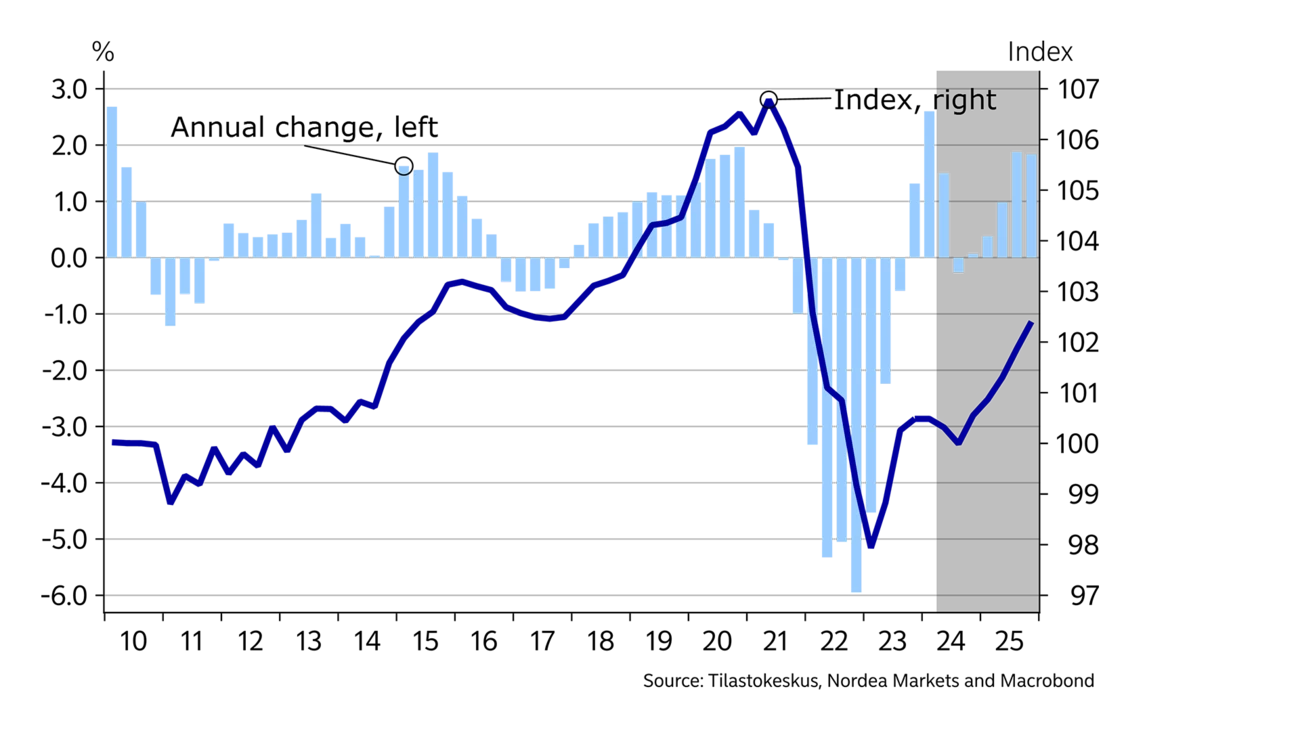

Housing sales have continued to be sluggish in the first months of this year, and house prices are still falling. In February, they were 5.5% lower than the year before.

The decline in market interest rates since last autumn and expectations of the central bank’s interest rate cuts have not yet cheered up the housing market. The household debt ratio has begun to fall, as very few mortgages are being taken out and borrowers are repaying their mortgages early whenever they can. Households with a mortgage and property investors are going through an adjustment in order to manage higher interest rates. Although interest rates are forecast to fall from their current level, they are not expected to go all the way down to zero. As a result, the costs of owning a home have increased for the foreseeable future, and the amount of debt is now being adjusted to cope with the higher interest rate level. Similarly, property investors are losing most of their profits through interest expenses if they hold a lot of debt. All of these factors are resulting in lower demand and falling prices on the housing market.

The construction boom of the past few years has increased supply significantly, which partially explains the poorer trend in house prices and rents in Finland compared to many other European countries.

The volume of construction will continue to fall. Over the past year, the volume of started construction projects was less than six million square meters. The last time the volume was this low was in the mid-1990s. The biggest drop has occurred in housing construction starts, but new commercial and office premises have also suffered, falling by almost half from the level seen a couple of years ago. Housing production is plagued by the oversupply created in recent years and weak demand, as well as increased costs. Office construction also faces the problem of oversupply, as the proliferation of remote working has decreased demand for offices, leaving many premises vacant. Weak purchasing power and growth in online trade are hurting the retail sector, curbing enthusiasm for building commercial premises. In industrial and warehouse construction and land and water construction, on the other hand, the situation has remained relatively good.

Investments in machinery and equipment have held up better than construction, and higher interest rates and weak demand have not caused companies to completely shelve their plans to invest. In the longer term, the investment environment in Finland will be attractive due to, for example, clean and inexpensive electricity.

But construction accounts for more than half of all investment and will therefore drag total investment into negative territory this year as well.

The long period of growth in Finnish service exports turned into a decline last year. The value of IT service exports contracted by 15% year-on-year, with gaming companies, among others, experiencing a sharp drop in revenue last year. Service imports, however, have remained high, leading the annual foreign balance of trade in services to fall to nearly EUR -10bn.

The situation has been more stable in goods exports, and the improved outlook for global industrial production and the turnaround in the inventory cycle are expected to improve Finland’s goods exports already this year. Like elsewhere, manufacturing output forecasts have been revised up since the start of the year, even though industrial production continues to decrease and many companies were affected by labour strikes last month.

Adjustments to public finances will prevent the government debt-to-GDP ratio from growing further.

Public finances in Finland deteriorated considerably last year, as the budget deficit increased to 2.7% and the government debt-to-GDP ratio grew to 75.8%. Government expenditure continued to grow rapidly, driven by high index increases in social benefits and in public sector employment and wages, and higher interest expenses. Higher inflation and the resulting rises in wages and interest rates are now being reflected as an increase in public expenditure, since growth in tax revenue has already slowed down significantly. Tax revenues are also lost through subsidies for the green transition, including a lower tax on electric vehicles.

Growth in public expenditure is expected to become more moderate this year, as the increase in both wages and in indexed and interest expenses will be milder than last year. Additionally, the government’s spending cuts will also begin to curb growth in expenditure.

The government’s large additional fiscal adjustments of about EUR 3bn (1% of GDP) for next year consist of tax raises and spending cuts.. The value added tax rate will be raised from 24% to 25.5% as of 1 September 2024 and income taxes on pensions and high-income individuals will be increased as of the beginning of 2025. On the expense side, cuts will be introduced in many areas. The savings measures planned for next year will dampen economic growth because, in many ways, they directly weaken consumer purchasing power or demand in the economy without having any major positive effects on consumer behaviour. However, these fiscal adjustments were called for in order to break the Finnish government’s debt cycle. In our estimate, these savings will allow Finland’s debt-to-GDP ratio to start to decline moderately as of next year.

This article first appeared in the Nordea Economic Outlook: Falling into place, published on 24 April 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more