- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaThe economic outlook is more uncertain than it has been for a long time. High price growth and rising interest rates will make these tough times for Norwegian households. The impact on consumer spending will be mitigated by lower savings and more people in paid work. Unemployment could rise somewhat but will likely stay very low.

Consumer prices are rising and at a faster pace than we have seen for decades. Particularly electricity, fuel and food prices have increased, but prices of many other goods and services are higher than we have seen in a long time as well. Higher prices erode households’ purchasing power and even with the electricity subsidy scheme for households, consumer prices will rise almost 6% this year compared to 2021. That is far above the wage growth of 3.7% that was agreed between the labour market parties in the spring. Although wages look set to grow more this year due to wage drift in the corporate sector, higher price growth will lead to tighter household finances across the board. In addition, Norges Bank is hiking its policy rate quickly. This makes further inroads into household finances for everybody with debt. Norwegian households have increased their debt-to-income ratios over a long period and are thus particularly vulnerable to higher interest rates.

In our scenarios article we illustrate the impact on three families with the same income but different debt-to-income ratios. For a family with a debt-to-income ratio of 5, disposable real income could fall by more than 8% during 2022. Expectation surveys show that households have never been more pessimistic about their own financial situation over the coming year.

But the erosion of purchasing power that many feel now or will experience should be put into perspective. For families with debt, the decline in purchasing power this year will just be marginally larger than the boost those same families enjoyed when the policy rate was cut to zero during the pandemic and remained at that level for an extended period. At the same time, lockdowns and travel restrictions caused most people to spend far less than before and as a result, many experienced improved financial leeway. For many households, it may seem challenging to go back to their pre-pandemic financial situation.

Savings rose sharply during the pandemic and are now decreasing, which helps keep overall consumption at a healthier level than the dwindling purchasing power would imply. At the same time, the number of people in paid work has risen sharply compared to a year ago. This boosts income for households as an overall group. Higher wage growth than agreed in the central settlement pulls in the same direction. Nonetheless, we see a clear downturn in consumption growth going forward. This will in turn dampen growth in the Norwegian economy.

1 / NORWAY: MACROECONOMIC INDICATORS

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP (mainland), % y/y |

-2.3 |

4.1 |

3.2 |

1.0 |

1.3 |

|

Household consumption |

-6.6 |

4.9 |

6.6 |

1.0 |

1.0 |

|

Core consumer prices, % y/y |

3.0 |

1.7 |

3.8 |

4.0 |

3.0 |

|

Annual wage growth |

3.1 |

3.5 |

4.5 |

5.0 |

4.0 |

|

Unemployment rate (registered), % |

5.0 |

3.1 |

1.8 |

1.8 |

2.1 |

|

Monetary policy rate, deposit (end of period) |

0.00 |

0.50 |

2.75 |

3.25 |

3.25 |

|

EUR/NOK (end of period) |

10.47 |

10.03 |

10.50 |

9.60 |

9.30 |

Times are also tougher for businesses, which in addition to capacity constraints, higher input prices, supply problems and labour shortages also now have high electricity costs to worry about. Sharply increasing costs create uncertainty and may lead to project delays.

With lower growth in both domestic and global demand ahead, profitability could also come under more pressure. Both factors could weaken the investment outlook among mainland businesses.

At the same time, the challenges in energy markets in Norway and globally will likely speed up the development of Norway’s power supply and renewable energy. A sharp uptick in oil investments will also be a key growth driver for Norway in the coming years. Higher energy and oil investments will be key growth drivers for the industry and overall economy in Norway in the coming years and is unlikely to be greatly affected by interest rate changes, global growth or the prevailing economic uncertainties.

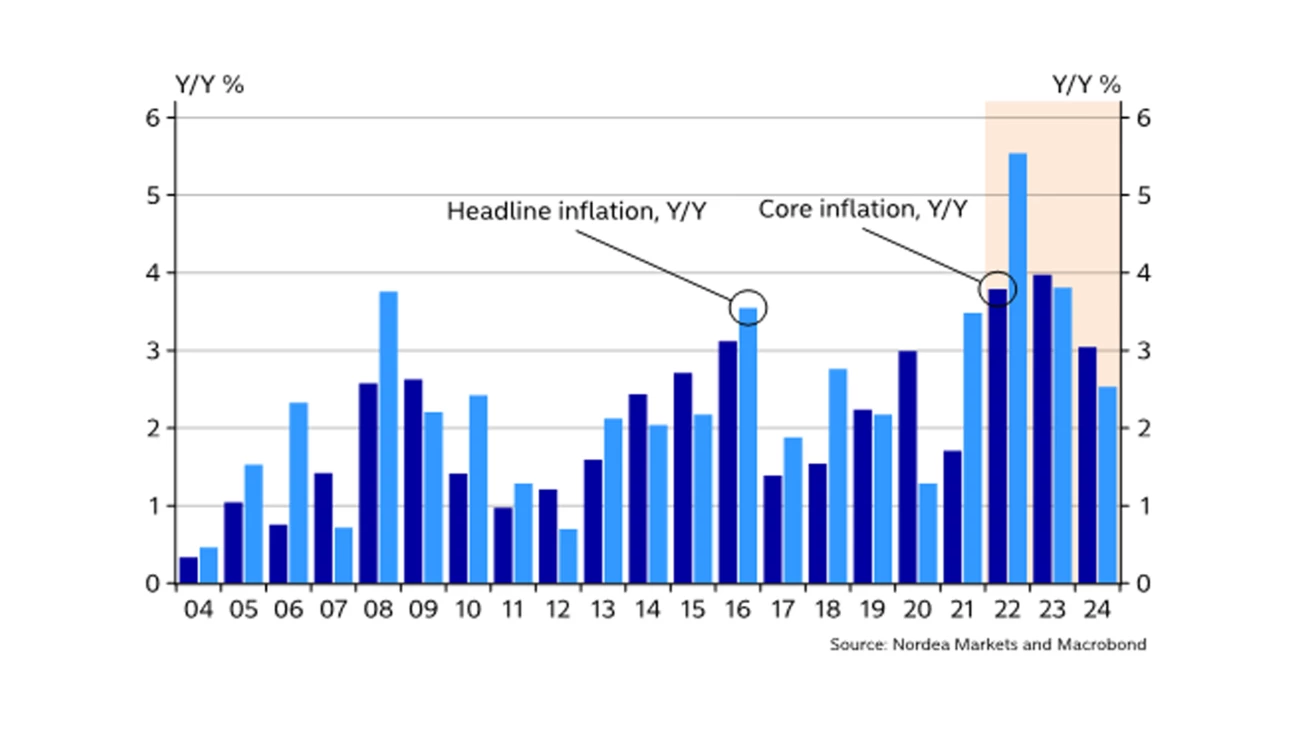

A / Higher core inflation

CPI and CPI-ATE, Y/Y %

We expect higher core inflation ahead driven by higher wage growth. Headline inflation will move lower due to base effects.

B / Higher rates ahead

Norges Bank and Nordea, key rate, %

Norges Bank will hike policy rate to 3.25% next year.

Registered unemployment is at a low since 2008, with close to two vacant positions for each registered unemployed. Labour is still in strong demand and we see several indications that wage drift has increased more than previously assumed. We still believe that average annual wage growth in 2022 will end up at about 4.5%, clearly above the central settlement (3.7%).

Next year’s pay talks will be very demanding. Wage earners have had much poorer real wage growth this year than assumed in the central settlement due to sharply higher price growth than expected. Next year, compensation will be demanded for this year's real wage decline. Also, the CPI forecast for 2023 will likely be around 3.5-4%. This means a higher starting position for the pay talks than in a long time. Moreover, wage growth among Norway's trading partners is rising, which will add to the upward wage pressure as well. We think Norway’s economy will be far from hitting the wall before next year's pay talks. Labour shortages will continue. Last time unemployment was this low, wage growth rose to about 6%. In our view, it could easily reach 5% next year, and if so, real wages will increase and help underpin consumption despite the interest rate increases.

Headline inflation (including energy prices) ran at 6.8% y/y in July. Excluding the government’s electricity subsidy scheme, inflation would have been almost 9%. The effect of the high energy prices on 12-month price growth will fade towards year-end and into next year due to base effects. We assume that the subsidy scheme will continue as long as electricity prices are record high, which may be the case for a long time.

Adjusted for energy prices and VAT changes, inflation rose to 4.5% y/y in July. This is the highest inflation reading since Statistics Norway started calculating these statistics in 2001. We expect core inflation to keep climbing over the coming months and predict that it will exceed an annual growth rate of 5% before the end of the year. The high demand in the Norwegian economy has made it easy for businesses to pass on higher costs to prices. Although many drivers are external, we now see price increases of most Norwegian goods and services. Purely domestic factors, such as higher wage costs and rents, also push underlying price growth higher. If our wage forecasts prove accurate, core inflation will stay well above Norges Bank’s 2% target for some time to come.

Next year’s pay talks will be very demanding.

Norges Bank has sped up its policy rate hikes lately. For a long time, the central bank’s mantra was a gradual pace as it was uncertain about the effects of higher rates. But this approach has been overshadowed by surging price growth and strong concern that the high and rising inflation will trigger a price/wage spiral that could keep inflation at too high a level. Given the current pressure in the Norwegian economy and labour market, we consider such fears to be justified. It will take time and much higher interest rates than today to bring core inflation in line with the 2% target.

We look for a policy rate of 2.75% by end-2022 and 3.25% in 2023. This is compatible with a mortgage rate of about 4% by end-2022 and about 4.5% in 2023. We consider the risk related to the estimated interest rate peak to be balanced. If the labour market remains tight and wages and prices rise more than expected, Norges Bank may be forced to hike rates further. Conversely, the economy may slow down faster than we project and price pressures could ease sooner. If so, interest rates could peak at lower than at 3.25%.

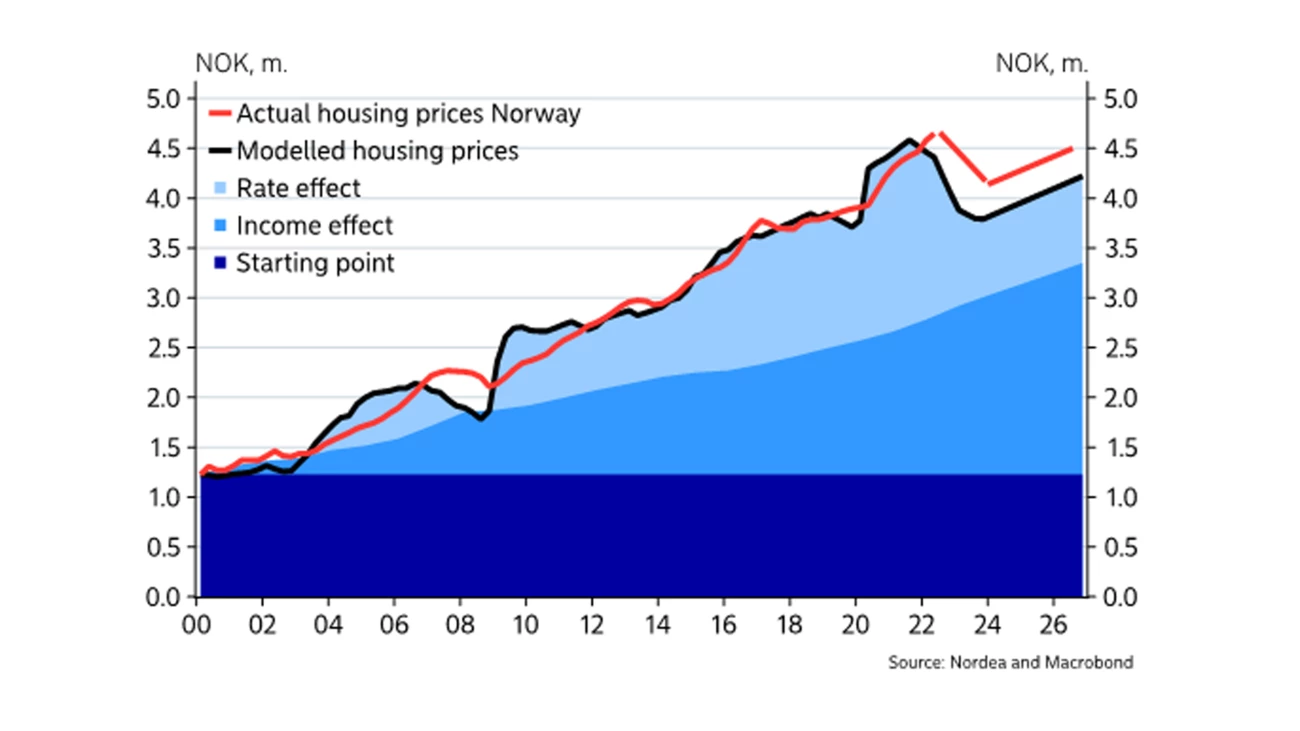

C / Purchasing power for housing will decline

Nordea’s housing price model, NOK

Higher interest rates will erode purchasing power in the housing market and dampen prices slightly.

D / New export records

Oil and gas exports, NOKbn per year

Sharp increase in oil and gas exports due to high energy prices.

Housing prices have surged this year even though interest rates have risen from record-low levels. It takes time before higher interest rates affect housing prices. A lower supply than usual due to a new act on the sale of real estate has also lifted housing prices. But we now see that the number of homes being put on the market has risen above last year’s level. At the same time, rapidly rising interest rates will quickly curb the purchasing power in the housing market. This will contribute to cooling down the housing market going forward. A drop in housing prices of 5-10% from today’s levels until the end of 2023 seems likely to us. But we do not think the housing market will come to a complete standstill. Although unemployment could rise somewhat, it will remain at a low level. At the same time, wages will rise in nominal terms. The decline in housing prices will also be dampened by higher construction costs due to higher prices of materials as well as a slowdown in the housing supply.

Norway’s oil exports reached about NOK 830bn in 2021, roughly a doubling from recent years. So far this year, Norway has exported oil and gas for close to NOK 910bn up until end-July. Given the extreme European energy prices, we estimate that Norway's oil exports in 2022 will be around NOK 2,000bn. We project oil exports of about NOK 2,100bn in 2023 and NOK 1,400bn in 2024.

A drop in Norwegian housing prices of 5-10% seems reasonable.

The perfect energy market storm will result in massive government revenues. In 2022, petroleum revenues could end up at about NOK 1,400bn versus the government’s latest forecast of NOK 960bn. In 2023, revenues could move sideways around NOK 1,500bn before receding to about NOK 1,000bn in 2024. By comparison, the value of the Norwegian Oil Fund is estimated at NOK 12,000bn. 2022 petroleum revenues could thus equal 11.5% of this value.

The NOK has recovered over the summer thanks to favourable financial market conditions and higher energy prices. We expect a weaker NOK towards the end of the year . We think the major central banks’ sale of bonds (QT) and the higher interest rates, notably in the US, could result in a choppier stock market during the autumn. In addition, Norges Bank will probably have to sell more NOK during the autumn to balance the NOK flows from the large tax receipts from oil companies. This also suggests a slightly weaker NOK towards year-end.

The future development in oil and gas prices, and in turn the NOK, is very uncertain. If energy prices remain elevated for some time, as we think they will, the NOK could strengthen further. Also, Norwegian oil investment looks set to increase sharply ahead, and this will force the oil and gas companies to buy more NOK to pay their Norwegian suppliers and employees. This also points to a stronger NOK over time.

This article originally appeared in the Nordea Economic Outlook: Feeling the squeeze, published on 7 September 2022. Read more in the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more