- Name:

- Jacob Michaelsen

- Title:

- Nordea Sustainable Finance Advisory

Transition finance is one of the most hotly debated topics within sustainable finance. Nordea's Sustainable Finance Advisory team shares its view on the current state of transition finance and where it's headed.

Amid the flood of sustainability-related terminology, much of the recent debate has revolved around transition, referring to the shift to a green economy. Transitioning in the global economy also requires transition within the financial market in order to achieve the ambitious climate goals set forth in the Paris Agreement. Transition finance is industry inclusive (spanning green to brown) and aims to offer especially high-emitting companies financing for the shift towards a climate-neutral, or even positive, status quo.

The International Capital Market Association (ICMA), Climate Bonds Initiative and the EU have provided further guidance for navigating the transition finance market. These resources include the Transition Finance Handbook (ICMA), the Transition Finance Report (EU) and Financing Credible Transitions (Climate Bonds Initiative), the former two of which are expected to be supplemented with updated guidance later this year[1].

The Transition Finance Handbook by ICMA provides guidance on transition finance as a whole, in contrast to focusing on one asset class such as “transition bonds.” The Handbook is intended to guide capital markets practitioners on their climate transition pathways, with the utilisation of use-of-proceeds instruments and general corporate purpose instruments aligned to the Sustainability-Linked Bond Principles.

The EU Transition Finance Report, on the other hand, is an advisory report on how the Taxonomy supports the EU’s 2030 and 2050 climate goals and clarifies how companies can voluntarily disclose their level of compliance with the forthcoming EU Green Bond Standard. Lastly, Financing Credible Transitions presents a labelling framework that aims to identify credible transitions aligned with the Paris Agreement.

The need for transition finance in order to reach global climate goals is indisputable. However, there isn’t a shared consensus around the terminology and instruments needed within the capital markets to reach those goals.

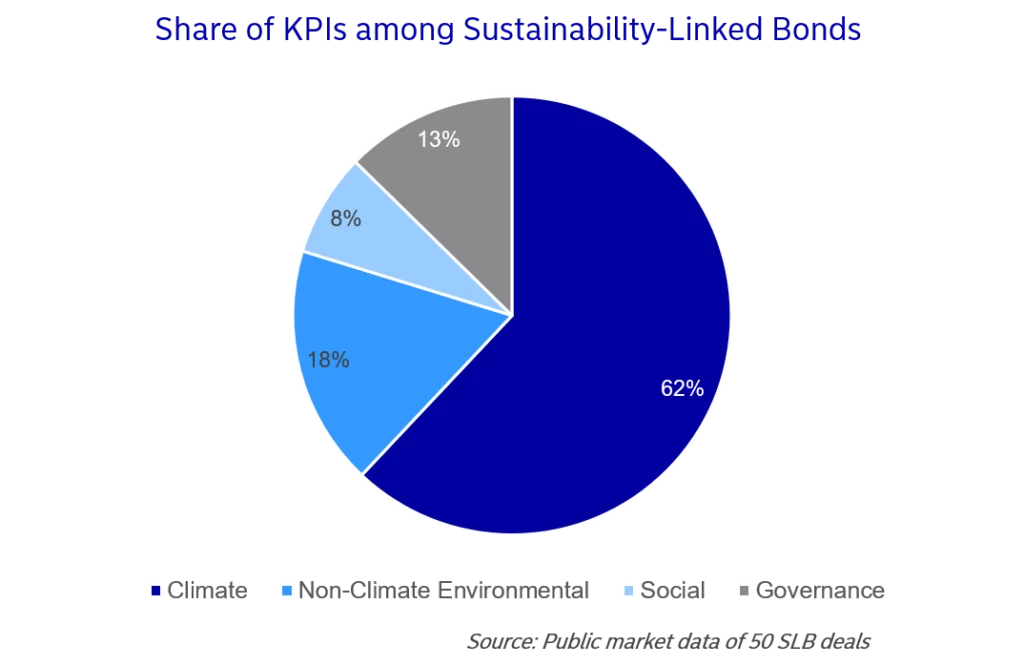

Transition bonds continue to be characterised as confusing and short-lived in the years to come. In contrast, sustainability-linked bonds (SLBs)[2], despite being a relative newcomer to the market, have continued to gain popularity, especially among companies with set climate targets. Notably, 62% of issued SLBs have had greenhouse gas emission reduction targets in place, highlighting the maturity of and heightened focus on climate-related topics under the “sustainability umbrella.”[3]

While transition finance is crucial, the nascent market is still awaiting harmonized and standardized market practises in order to tackle concerns such as “transition washing.” SLBs are expected to supersede transition bonds, while conventional use-of-proceeds bonds, such as green bonds, continue to offer transition possibilities.

We see SLBs as the superior instrument in the transition finance space. They allow companies to not only communicate their transition ambitions to stakeholders but to convey their sustainability agendas more broadly to society as a whole.

[1] The ICMA annual conference in June 2021 is expected to include further guidance on cross-referencing in connection to the Green Bond Principles (GBPs) and Sustainability-Linked Bond Principles (SLBPs).

[2] Sustainability-linked instruments allow issuers to tie sustainability-related targets on a broader level (encompassing the whole sustainability agenda including several targeted themes) to focused areas (such as climate action or social issues such as gender diversity) that they want to communicate to stakeholders.

[3] Climate targets are more often externally set, verified and annually reported, compared to other sustainability KPIs.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more