Did you know?

In 2021 we won the Swedish award ‘best digital coach 2021’ for our efforts to guide our customers.

Digital banking is when banking customers use financial apps or websites to carry out financial transactions or activities online. Some examples of digital banking activities are:

Digital banking is about making people’s everyday lives easier and enabling them to be much more in control of their finances. You can trade stocks easily. You can check your savings and accounts easily. You can transfer money from one account to another easily. You don’t need to call somebody, or visit a branch office, to ask for help – you are in charge. Today’s digital banking solutions will often also get smarter as you use them and can connect with other banks and service providers which gives you an exact overview of your financial situation.

A lot of people truly appreciate this financial empowerment:

In 2021 we won the Swedish award ‘best digital coach 2021’ for our efforts to guide our customers.

For us at Nordea, digital also means personal. It’s always up to you as the customer to decide how you want to interact with us, whether it’s by getting help online from a robo-adviser, getting personal advice at a branch office or by having an online meeting with an adviser in the convenient comfort of your home.

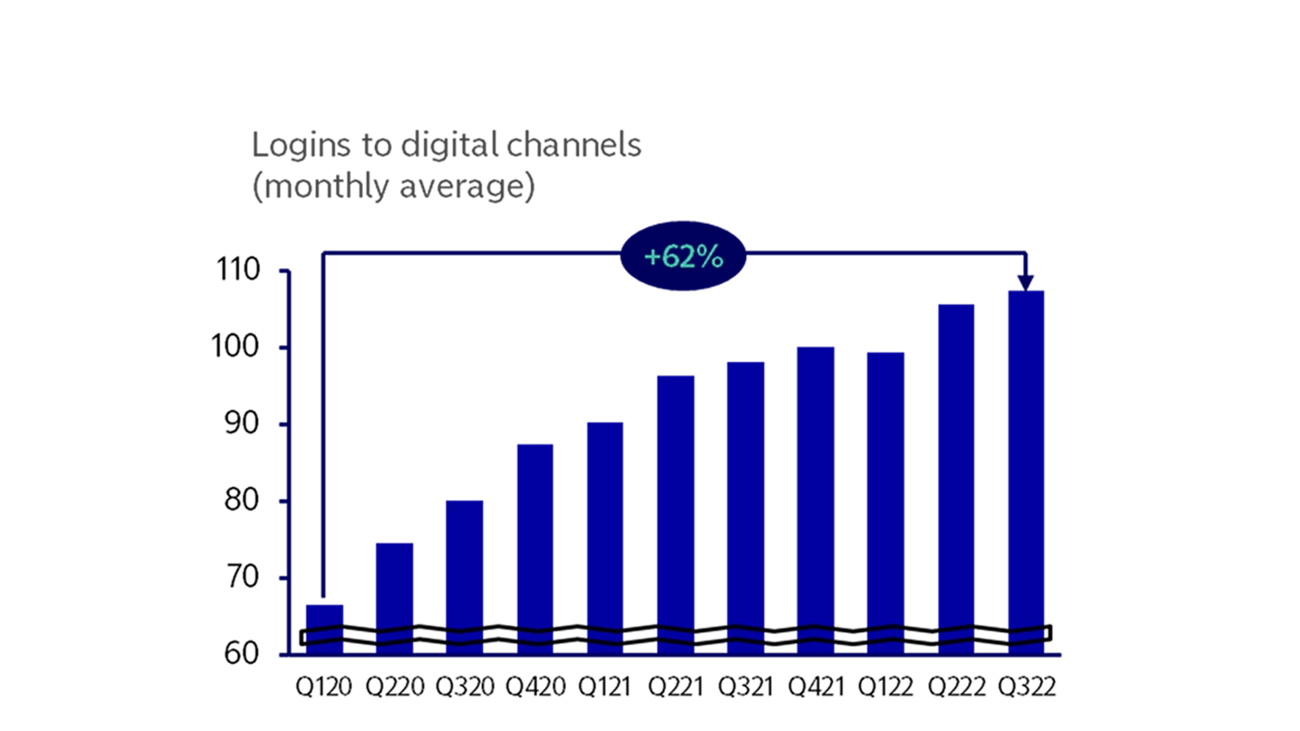

We can see digital banking has become immensely popular with our customers – and this trend continues:

We have more than 1 billion digital engagements per year and around 4 million digitally active customers in the Nordics.

We had 22% more monthly logins to our digital services in 2021 compared with 2020.

The Nordea mobile banking app now has more than one billion logins annually.

You cannot be empowered by digital banking if you don’t know how to use it – or simply feel insecure. That’s why we at Nordea not only create digital solutions – we also help our customers use the digital solutions. Our efforts are targeted customers of all ages and include:

Nordea has a wide range of digital banking solutions accessible to personal customers such as

Nordea has won numerous awards for our digital banking. In 2022 we were rated as Sweden’s best digital bank by the independent European rating bureau D-rating. The assessment was based on nearly 400 indicators related to customer journeys, contact paths, mobile apps and web features, and our customers' ability to access value-creating banking offerings. In Denmark, a Voxmeter survey has also shown high customer satisfaction with our digital banking solutions. And the research company Autonomous ranked Nordea as one of the six banks being a true digital leader globally (second quarter of 2022.)

We are also very proud of the fact that our mobile banking app was rated more than 4 out of 5 stars in the Apple and Google Play app stores in all the four Nordic countries in 2021.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more