- Name:

- Ebba Ramel

- Title:

- Nordea Sustainable Finance Advisory

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskAs a first step in the implementation of the EU Taxonomy, companies covered by the Non-Financial Reporting Directive are required to report on eligibility for the first two EU environmental objectives. Nordea’s Sustainable Finance Advisory team takes an early look at how companies are approaching the task.

For the latest insights on companies' reporting under the EU Taxonomy, don't miss: A check-in on Nordic companies’ EU Taxonomy reporting and EU Taxonomy: The period of misalignment for sustainable finance.

The first two objectives of the EU Taxonomy – climate change mitigation and climate change adaptation – were confirmed in parliament last year and entered into force in January 2022. This means that companies within the scope of the Non-Financial Reporting Directive (NFRD) have to report on their share of taxonomy-eligible activities. Eligibility is defined as an activity which is covered by the EU Taxonomy under one of the two environmental objectives.

Eligibility reporting is just a first step to determine which activities will be able to report alignment to the taxonomy in 2023. For an eligible activity to be aligned with the EU Taxonomy, it further has to i) comply with the Technical Screening Criteria (TSC); ii) the Do No Significant Harm (DNSH) Criteria; and the company has to fulfil Minimum Social Safeguards throughout their global supply chain.

|

Eligibility |

Whether an activity is covered by the EU Taxonomy |

|

Alignment |

Whether an activity fulfils EU Taxonomy criteria: Technical Screening Criteria, Do No Significant Harm and Minimum Social Safeguards |

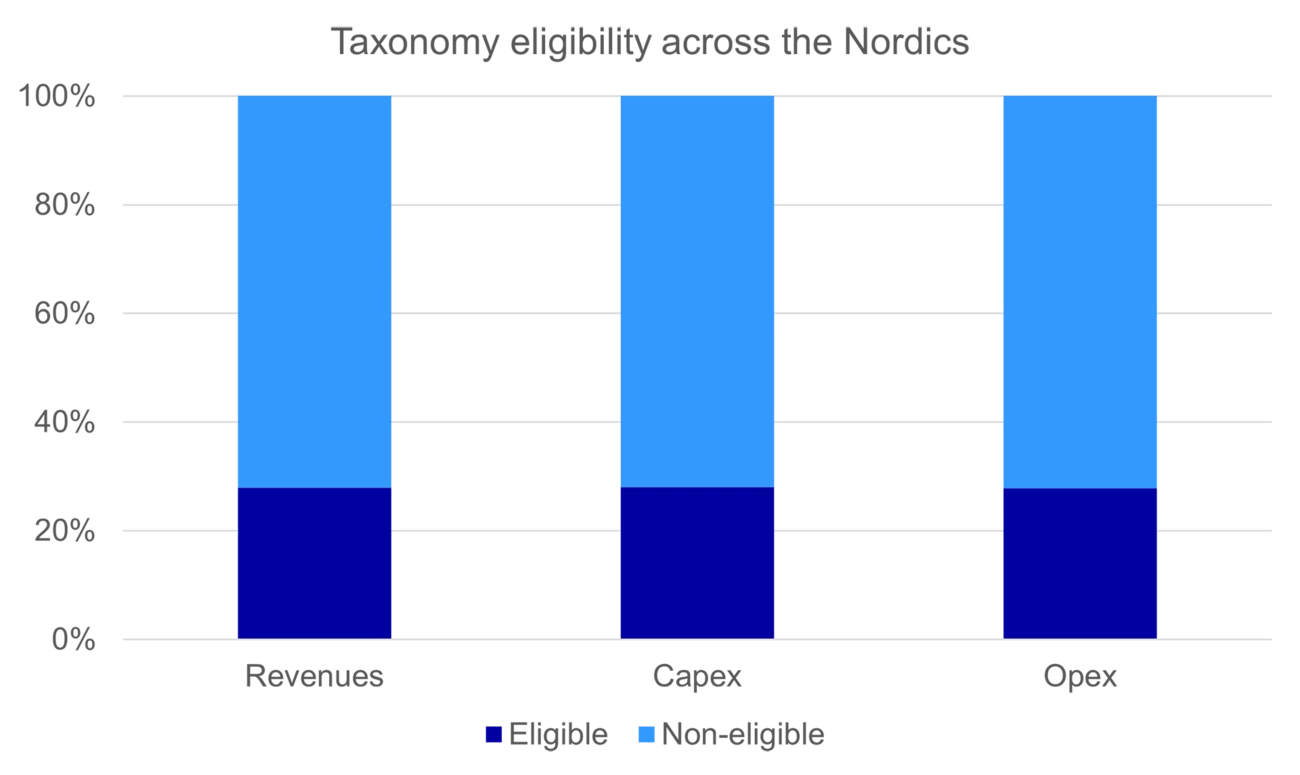

From our sample of 306 public companies in Nordea ESG Research’s coverage universe, the average eligibility across all three categories, Revenues, Capex and Opex, was just under 30%. This figure is somewhat lower than expected and suggests many companies have not clearly identified whether and how their activities fit into the Taxonomy framework. Generally, only few conclusions about a company’s sustainability profile can be drawn from its reporting on Taxonomy eligibility, as this is just a pre-step to the alignment reporting.

Nordea’s Taxonomy expert Matilda Persson notes that some aspects of eligibility reporting under the Taxonomy have caught companies off guard:

"As companies started to better understand the description of the activities in the climate delegated act, it was clear that many intermediate activities in the manufacturing value chain were not automatically eligible. This surprised many companies that see themselves as key players in a value chain of sustainable products,” she says.

As companies started to better understand the description of the activities in the climate delegated act, it was clear that many intermediate activities in the manufacturing value chain were not automatically eligible.

In our sample, 85% of companies required to report have already reported, with others expected to later this year. A further 27% of companies not covered by the NFRD reported voluntarily on eligibility. The majority of companies reporting voluntarily can be categorised into two groups: Nearly half are Norwegian corporates, which, while not part of the EU framework, follow the market standard. Another 34% consist of real estate companies. The sector has among the clearest eligible activity breakdowns and taxonomy criteria, and many companies are therefore fully covered by the Taxonomy. Some early movers, such as Atrium Ljungberg, even provided the first examples of reporting on alignment.

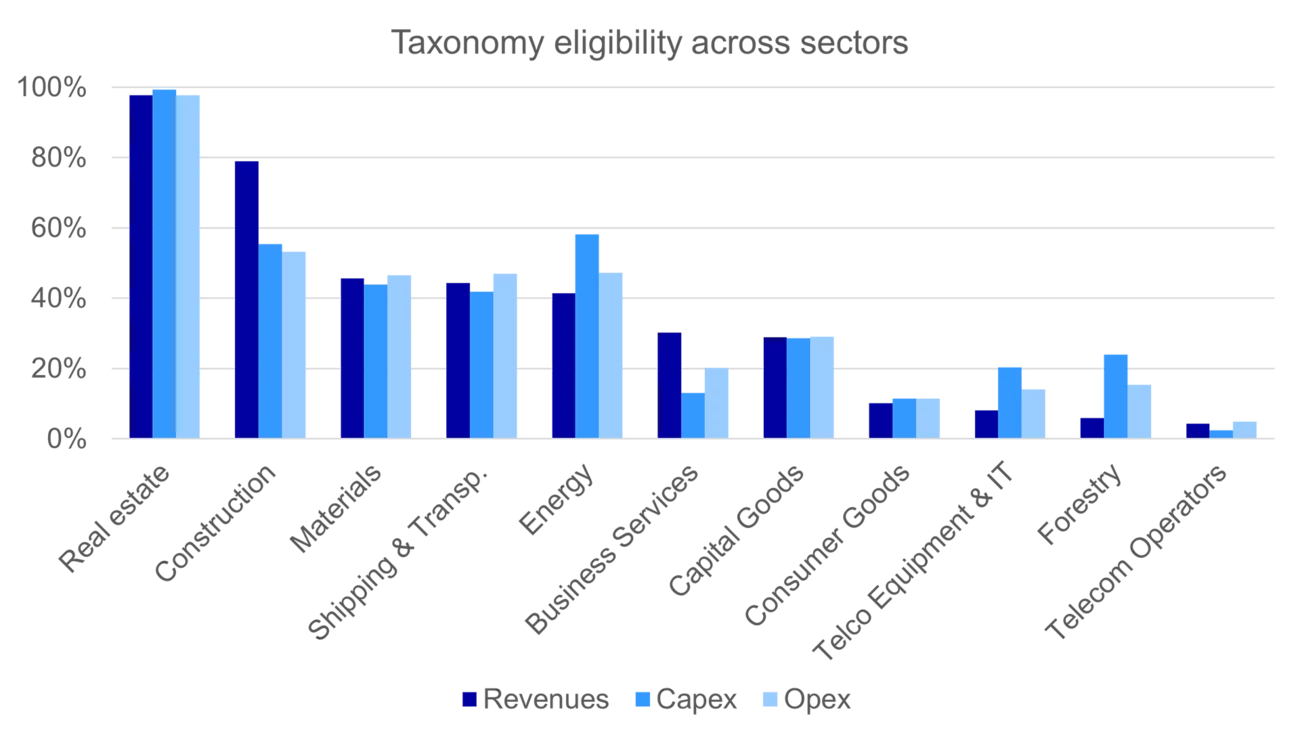

When comparing eligibility across sectors, real estate has the highest reported share of eligibility. This is most likely because the sector comprises a set activities that count as highly polluting. It is also less fragmented across activities than other sectors. Telecommunications and forestry are among sectors showing the lowest share of eligibility. Both sectors have been affected by changes of various related activities between the first Taxonomy draft in 2020 and the final version in 2021.

The largest variation in eligibility reporting can be seen in sectors that cover a wider range of activities, such as the capital goods and business services sectors.

As of yet, it is difficult to draw correlations between Taxonomy reporting and sustainable financing across industries. Nevertheless, as the current Taxonomy addresses some of the highest-emitting activities, we might see increased sustainable financing connected to transitioning these activities towards higher alignment in the future.

Since the beginning of the year, companies have to report on what share of their activities are eligible for the EU Taxonomy. However, precise information and templates on how to report on Taxonomy remain vague, leading to uncertainty in the market. Two significant issues remain: the scope of activities covered as well as the definition of an exact measure for Capex and Opex, which leaves much up to interpretation for the reporting company. Overall we expect to see clearer market standards emerging in the coming reporting cycles.

One cautionary remark about eligibility: On its face, it is not possible to infer any information about taxonomy alignment. From January 2023, companies in scope will have to report on their taxonomy alignment. Many companies with a high eligibility (a high share of activities covered in the Taxonomy), will report significantly lower alignment of activities that actually meet all requirements.

Lastly, in April the EU Platform on Sustainable Finance published its report on the remaining four environmental objectives (water, circular economy, pollution prevention and biodiversity). There will be a feedback period during the coming months. Should the EU Commission and the EU Parliament confirm the final version in 2022, companies may also have to report on eligibility for the remaining four objectives.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more