2.5%

Expected GDP growth in 2026

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaJan Størup Nielsen

In a world of political uncertainty, the Danish economy is well positioned to handle future challenges. The foundation lies in the labour market, where record-high employment helps ensure robust public finances. This provides fiscal policy stability, allowing substantial resources to be allocated to strengthening the Armed Forces’ combat power. This year, increased household consumption is expected to drive a larger share of economic growth. At the same time, house prices are expected to continue rising – albeit at a slightly slower pace than before.

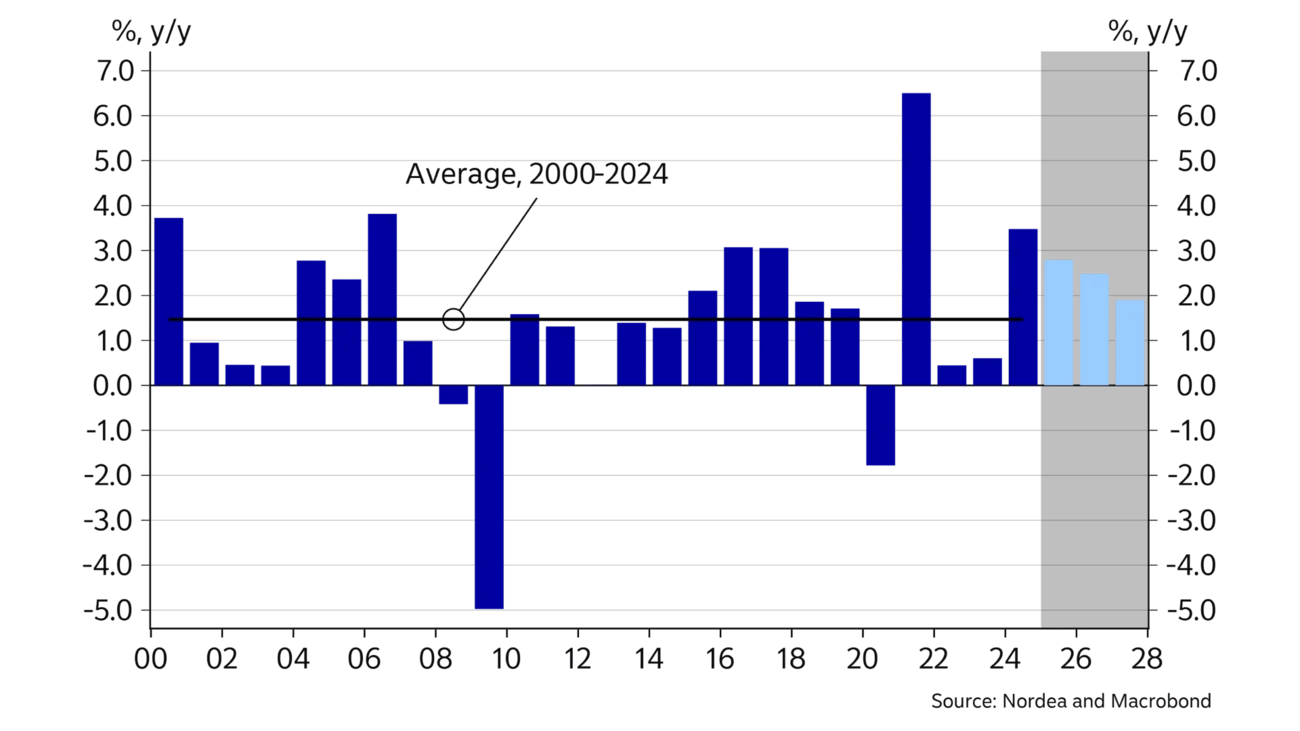

2025 was a turbulent year for the Danish economy. This was primarily due to the effects of Denmark’s large pharmaceutical industry – a major contributor to overall economic growth. Last year began with the biggest quarterly drop in GDP since 2023 and was followed by a drastic downward revision of the historical national account figures. Overall, this led to a somewhat more muted growth profile for the Danish economy than previously expected. Consequently, we had to make a relatively large downward revision to our growth expectations for the year in our latest Economic Outlook issued in September 2025.

Later, economic activity in Denmark rebounded strongly. Based on the current national account figures, we estimate that total activity grew by 2.8% in 2025. The increase is particularly noteworthy as it follows an even stronger increase in 2024. We expect the healthy growth to continue throughout the year, with total growth projected at 2.5%. This is slightly higher than the September forecast published last year. Finally, we reiterate our expectations about 1.9% growth for 2027.

The threat of a new tariff war with the US implies a greater downside risk to our growth outlook for the Danish economy. This reflects both the risk of lower goods exports directly to the US and the negative spillover effects on investment and consumer spending caused by heightened uncertainty.

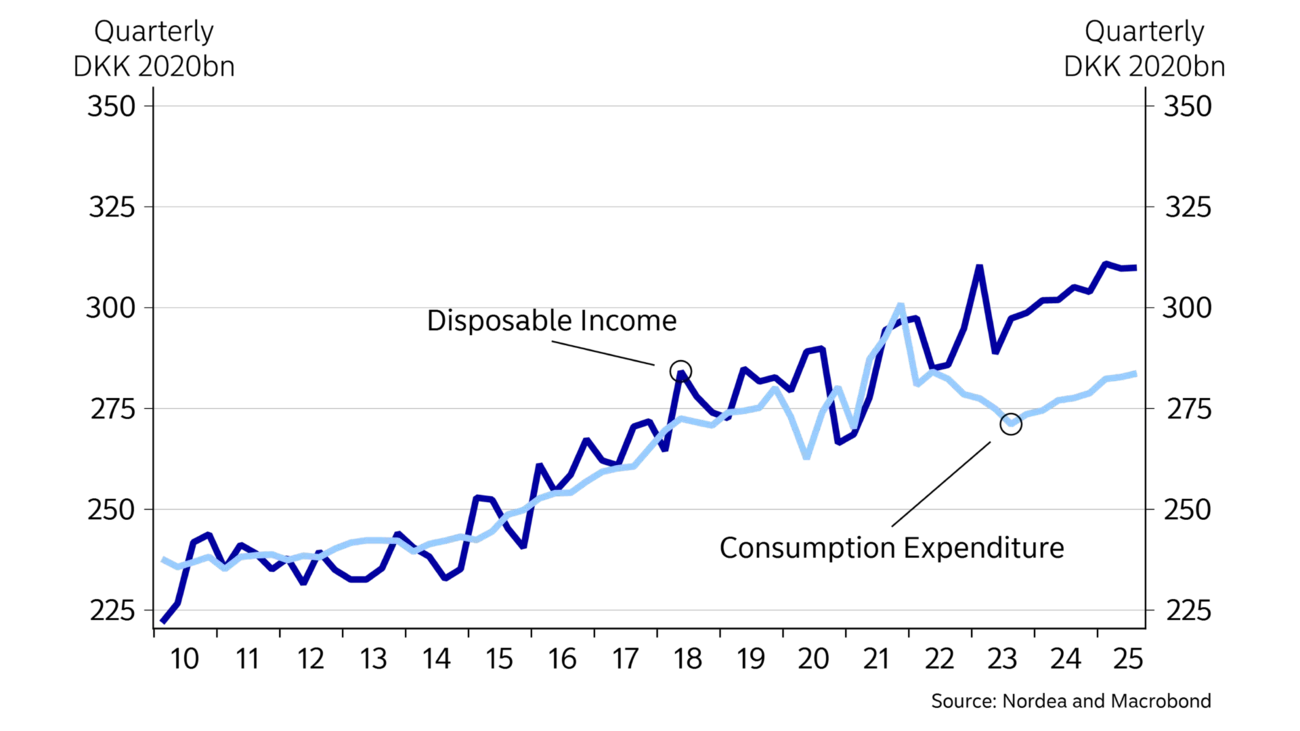

Despite strong economic growth in Denmark in recent years, household consumption has only grown modestly. Instead, savings have gone up, as households set aside more than 8% of their disposable income on average. The low propensity to spend is also reflected in consumer confidence readings, which are far below the historical average. In this context, it is especially households’ assessment of the current situation compared with a year ago that weighs heavily. This applies to their assessment of the family’s own situation as well as the assessment of the broader Danish economy. In addition, expectations for the future also remain relatively low.

2.5%

Expected GDP growth in 2026

~30%

Gross government debt level throughout the forecast horizon

-0.40

%-point, Spread between deposit rates – Danish central bank and ECB

A central theme for the negative perception of the economic situation is food prices, which reached an all-time high in mid-2025. However, food prices have since eased in line with downward pressure on global agriculture commodity prices. This trend is expected to continue throughout 2026 once the abolition of excise taxes on chocolate, confectionery and coffee – with effect from 1 July 2026 – should help to lower food prices in Danish stores.

But not only food prices are expected to fall. The Danish 2026 Finance Act includes a decision to reduce electricity tax to the EU minimum rate in 2026 and 2027. This is estimated to provide the average family an annual saving of up to around DKK 4,000.

| ‘24 | ‘25E | ‘26E | ‘27E | |

|---|---|---|---|---|

| Real GDP, % y/y | 3.5 | 2.8 | 2.5 | 1.9 |

| Consumer prices, % y/y | 1.4 | 1.9 | 1.3 | 2.1 |

| Unemployment rate, % | 2.9 | 2.9 | 2.9 | 3.0 |

| Current account balance, % of GDP | 12.2 | 12.3 | 12.2 | 11.4 |

| General gov. budget balance, % of GDP | 4.5 | 2.9 | 0.9 | 0.6 |

| General gov. gross debt, % of GDP | 29.3 | 29.2 | 28.7 | 28.0 |

| Monetary policy rate (end of period) | 2.60 | 1.60 | 1.60 | 2.10 |

| USD/DKK (end of period) | 7.17 | 6.37 | 6.01 | 5.92 |

Combined with cuts to labour income tax, this will likely provide a solid boost to household purchasing power.

Seen in this light, we expect private consumption to grow by 2.0-2.5% annually. If so, this would mark the highest growth since the spending boom during the Covid-19 pandemic in 2021, with consumption accounting for a larger share of total growth in the Danish economy over the forecast period.

Expectations of higher household consumption are supported by the prospect of wage growth of around 3% per year. Even though this is lower than in previous years, it will still increase purchasing power. Thus, the effect of the tax cuts should cause a temporary dip in inflation in 2026, with consumer prices rising by around 1.3% on average. In comparison, they rose 1.9% in 2025.

In the absence of new tax reductions, we expect inflation to rise above 2% again in 2027. However, political negotiations are ongoing, which could potentially result in an agreement to reduce VAT on all or selected food items. If this happens, it could extend the period of relatively low inflation.

For the past 10 consecutive years, Denmark has recorded a surplus in its public finances. Since 2019, the surplus has been the largest among EU countries when measured as a share of GDP. Thanks to strong public finances, public gross debt has been steadily declining and now accounts for less than 30% of GDP. Along with a large deposit on the government’s account with the Danish central bank, this has created substantial fiscal space, which has been used for the government’s purchase of the majority stake in Copenhagen Airports, the share issue in the partly state-owned company Ørsted and additional investments to enhance the Armed Forces’ combat power.

In 2026, the announced tax and duty reductions will likely contribute to eroding the government's income basis. At the same time, expenses are expected to rise, partly as a result of the political agreements on strengthening the Danish Armed Forces. Despite the expansionary fiscal policy and mounting pressure on expenses, we still expect public finances to remain in surplus in 2026 and 2027 – although significantly smaller than in previous years.

It is primarily the prospect of further employment growth and continued strong revenues from the pension yield tax that are expected to sustain the surplus in Denmark’s public finances. Together with the large balance on the government’s account with the Danish central bank, this looks set to ensure that public gross debt remains steadily below 30% of GDP in the coming years.

The Danish economy enters 2026 on a strong footing and is expected to keep growing.

Over the past six years, the number of wage earners in the Danish labour market has risen by around 10%. The strong increase has been driven by a steadily growing inflow of foreign labour and a series of reforms that have significantly boosted the employment rate, particularly among people over 60.

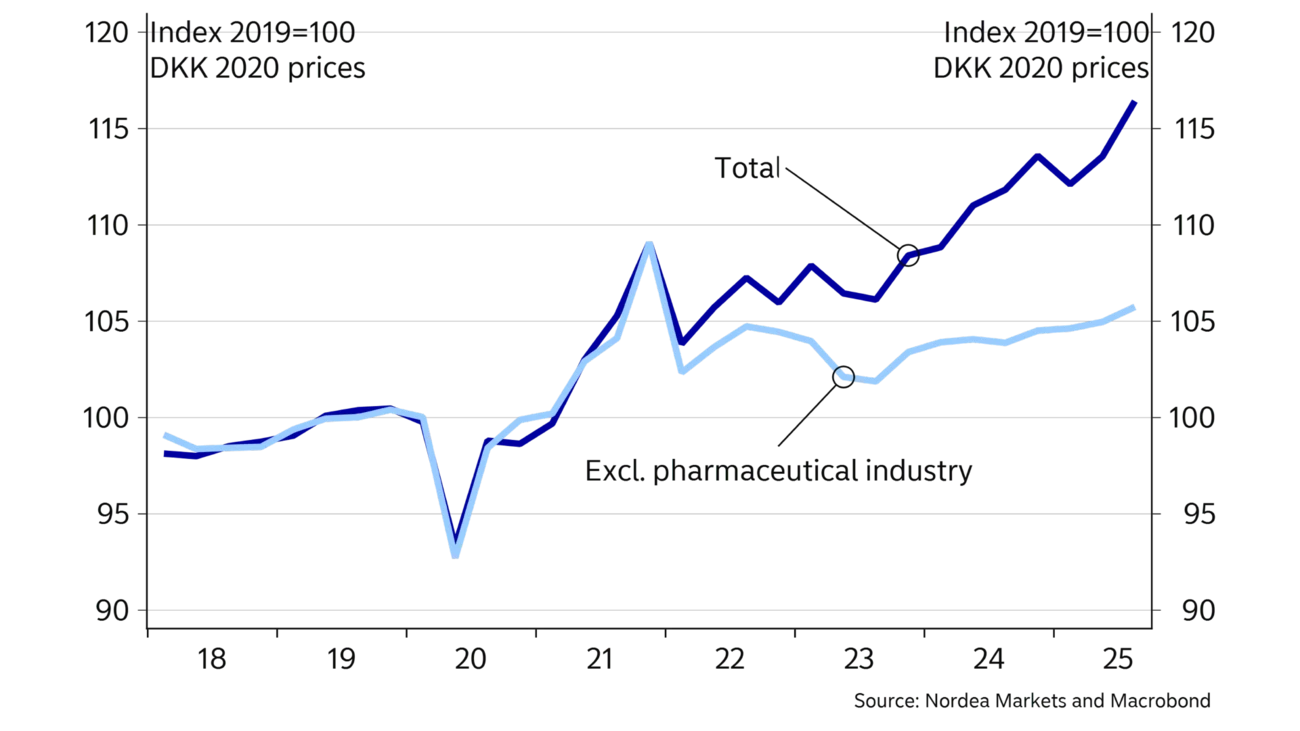

In the recent years, the surge in demand has been driven by the pharmaceutical industry in particular. As a result, the number of full-time wage earners in the Danish industrial sector has risen by nearly 40,000, corresponding to an increase of 14%.

Over the autumn, a very sharp increase was observed in the number of redundancy notices, likely partly due to developments in the pharmaceutical industry. As a knock-on effect of this, employment expectations in construction and retail have turned more cautious. Even so, the number of vacancies has moderately increased since mid-2025.

Overall, this suggests that recent years’ rapid increase in employment is starting to level off. However, this will not be enough to significantly impact unemployment, which is expected to remain stable at around 3.0% over the next few years.

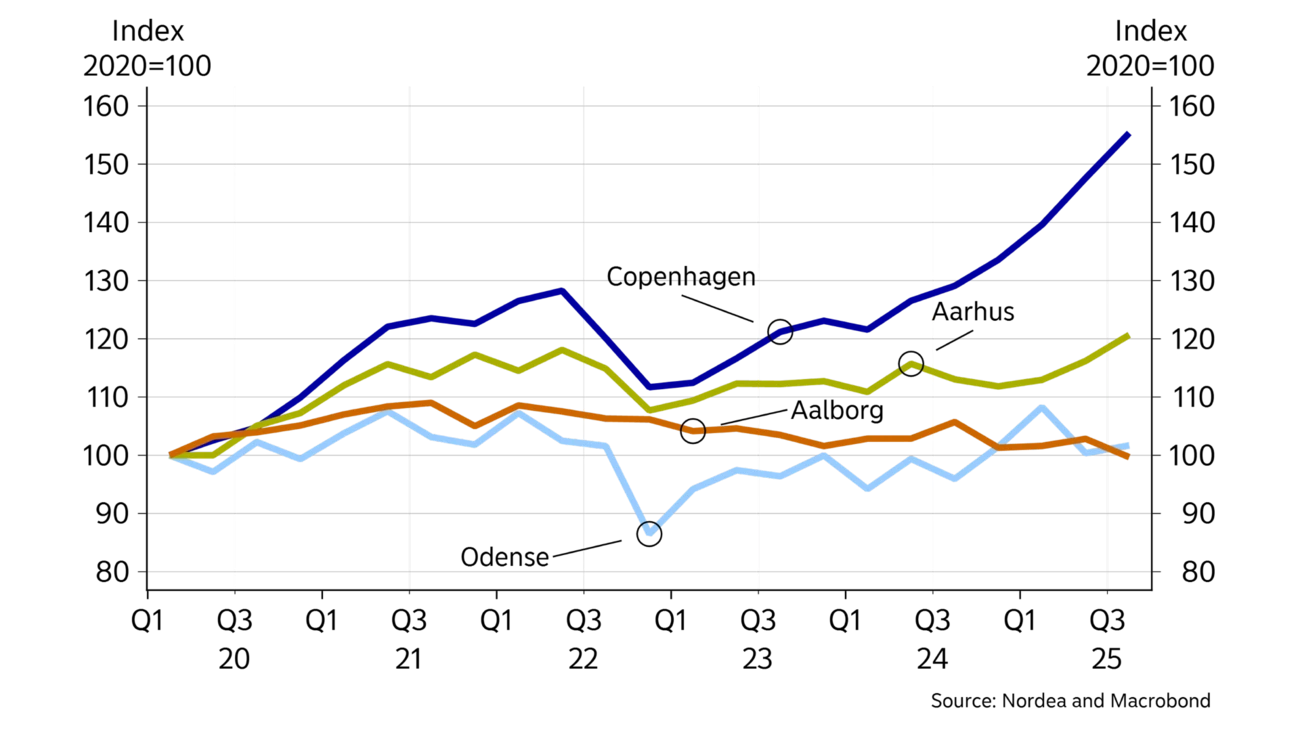

Since 2023 sale prices in the housing market have been steadily rising. This is mainly the result of growing employment, which, combined with a low number of homes for sale, has driven prices higher. At the same time, the supply of newly built homes has been low for a number of years, helping drive up prices on the existing housing stock – especially in the capital area, where prices have risen by around 10% in the past year. Along with rising prices, transaction activity has also increased. As a result, the number of homes sold is now close to the highest level since the years leading up to the financial crisis, excluding the Covid‑19 pandemic period.

In the forecast, we expect house prices in 2026 to increase by 5.3% on average, followed by a 3.6% increase in 2027. We also expect prices to continue climbing in the market for owner-occupied flats in the coming years. Rising house prices will likely be driven by both the continued improvement in the labour market and the increase in households’ purchasing power from tax cuts, duty reductions and higher real wages

Overall, the pace of house price increases is expected to gradually slow over the forecast period. This is partly due to the already high price levels near the largest cities. At the same time, towards the end of the period, a higher interest rate level may also dampen activity in the housing market.

Since early 2023, the policy rate in Denmark has been 0.4% point below the corresponding policy rate in the euro area. In this period, the Danish central bank did not need to intervene in the foreign exchange market.

However, in 2025, the DKK gradually weakened against the euro. This development reached a temporary peak in the first trading days of 2026, when the DKK traded above 7.47 against the euro. According to official data covering up to end-December 2025, the weakening has not yet been strong enough for the Danish central bank to intervene with support purchases in the foreign exchange market.

If the weakening of the DKK against the EUR continues, the Danish central bank will very likely begin supporting the currency by intervening in the foreign exchange market. The central bank would then start using the currency reserve, which stood at DKK 650bn (around 22% of GDP) in early 2026. If this intervention is not sufficient to stem the pressure for a weaker DKK, it may become necessary for the Danish central bank to implement an independent Danish rate hike. If that becomes relevant, we expect an initial rate hike of 0.15% point.

The longer Danish interest rates have risen and by end-2025 reached the highest level since 2023. We expect this trend to continue throughout the forecast period. However, the pace of the increases is expected to be slower. At the same time, short interest rates are expected to edge higher as the first rate hikes from the ECB and the Danish central bank are approaching.

This article first appeared in the Nordea Economic Outlook: Northern lights, published on 21 January 2026. Read more from the latest Nordea Economic Outlook .

Economic Outlook

The increase in household saving has kept private consumption subdued in recent years. We examine how alternative assumptions about the savings ratio in the forecast years will affect consumption, employment and economic growth.

Read more

Economic Outlook

The global economy was characterised by a high degree of resilience in a tumultuous 2025, with the prospect of renewed growth in 2026. However, there are significant risks are associated with the unpredictable geopolitical situation.

Read more

Economic Outlook

Finland’s economic growth has been slow to materialise. Weak consumer confidence and falling housing prices continue to hold back private consumption and construction investments. However, the fundamentals of the economy have improved, so the conditions for recovery are present. There are already signs of improvement in the manufacturing sector.

Read more