- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

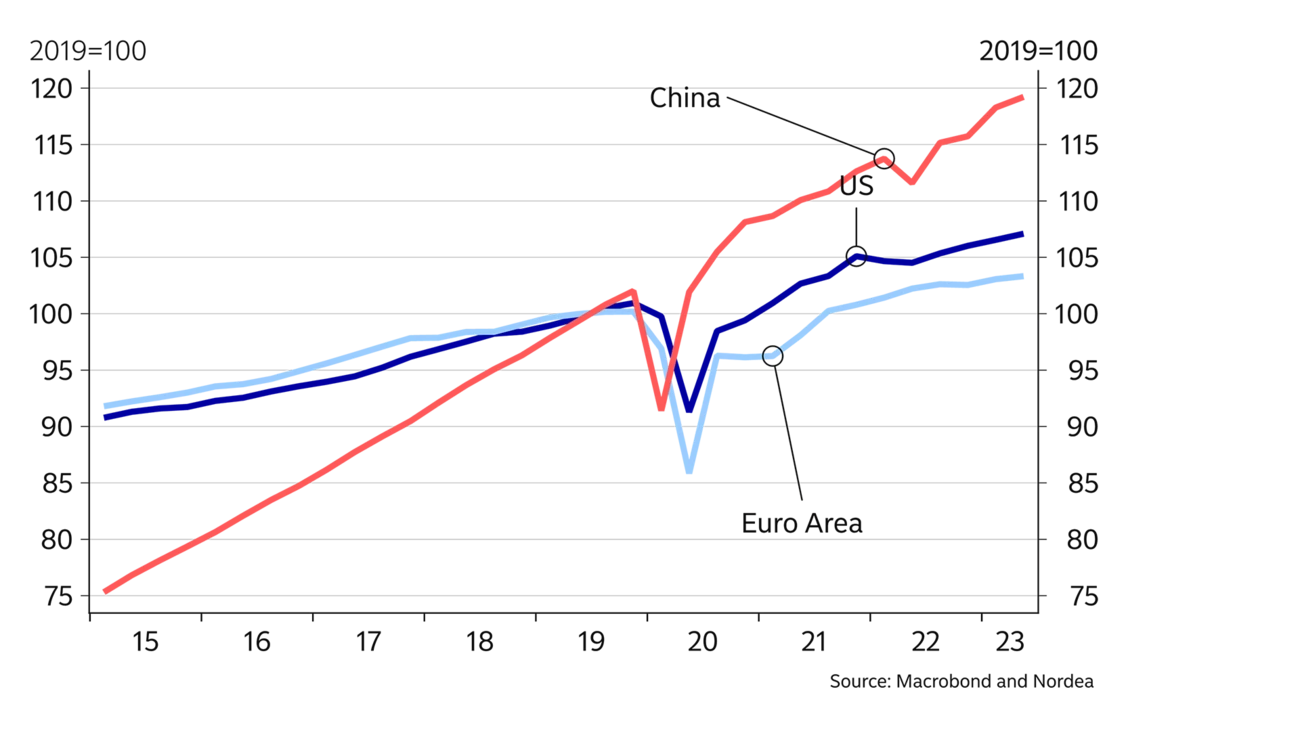

Central banks are still concerned about inflation, which is slowing down, but is still above the target level. Consequently, it will take time before monetary policy will be eased, and the global outlook continues to be weak. In China, restarting the economy has turned out to be more challenging than expected, and leaders are facing challenges in trying to restore confidence among households and companies. Interest rates may be close to peaking, but rate cuts are not around the corner.

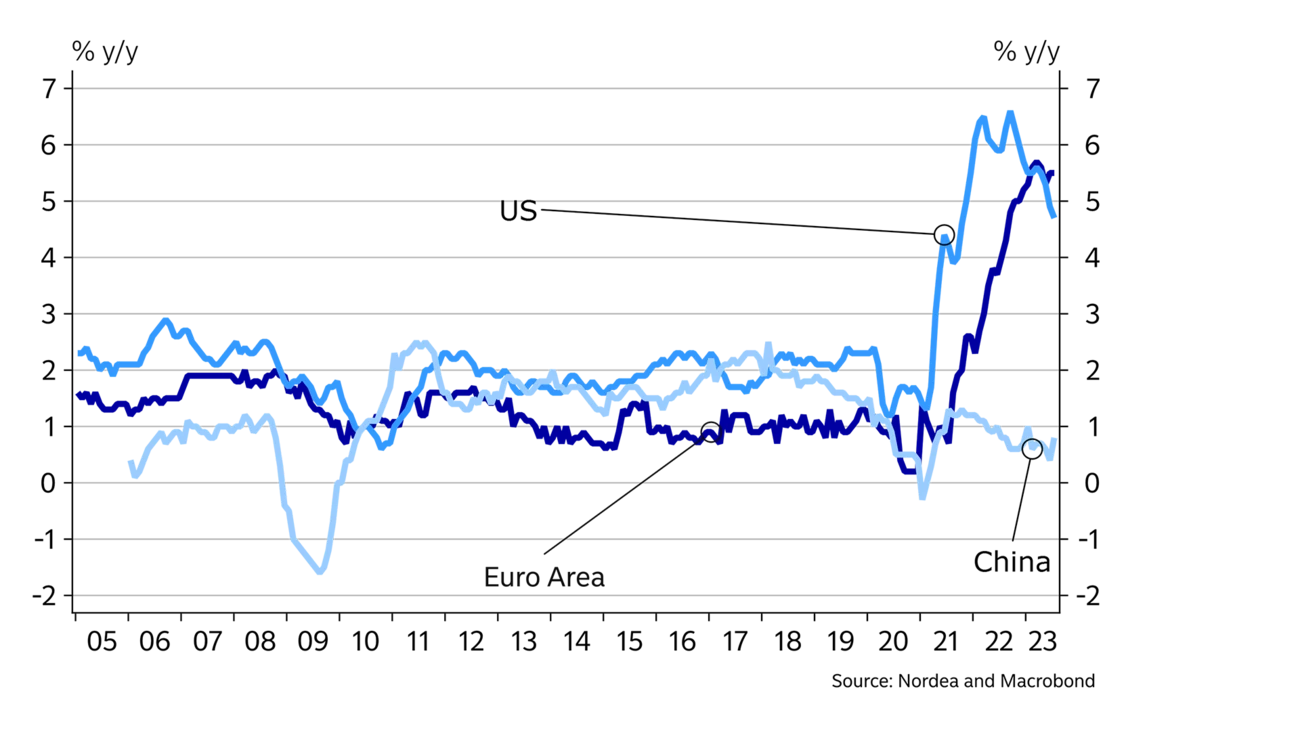

High inflation has been the main theme of the global economy for more than two years now. Although it is now slowing down, it remains uncertain whether inflation rates will remain above the central banks’ targets for longer. These worries stem mainly from the fact that even though monetary policy tightening has significantly weakened economic growth, labour markets have remained surprisingly strong. If this continues, wage and price pressures could remain strong also going forward. Thus, expectations of monetary policy easing have been delayed further, and it may turn out to be necessary to tighten monetary policy even more in many countries in order to restore price stability. This implies that the global growth outlook will remain weak and the risk of a recession still exists.

In China, economic growth has been weaker than expected. Although the service sector has continued to recover from the zero-COVID policy, it seems that uncertainty about the country’s future economic policy and geopolitical tensions have hurt confidence among households and private companies. As a result, economic activity, especially in the housing sector, continues to be weak, hurting both consumption and fixed investments.

Headline inflation has continued to decline sharply in basically all western countries. However, this has mainly been due to a decline in energy prices and the stabilisation of food prices. At the same time, the decline in core inflation has been much more gradual, and is still clearly above central banks’ targets in many countries.

Looking forward, we expect headline inflation to continue to go down. One explanation for the decline continues to be energy. We build our forecasts around the oil future curve and do not assume the oil price to contribute significantly to inflation numbers in the near term. Even if there are certain supply side limitations that could cause upward pressure on the oil price, we expect the weak global outlook to balance the situation. Furthermore, should volatility in natural gas prices have increased when winter approaches and keeps Europe on its toes, the full gas storages and the long-term weather forecasts expecting a mild winter speak for rather stable energy price expectations.

Another factor limiting inflation is weak global demand, which, together with stable energy prices, have implied that producer price pressures have been and will remain moderate. Thus, goods price inflation is likely to remain stable in the coming quarters.

Labour markets and wage increases will obviously be an important factor driving future inflation. Given that the US labour market only shows rather moderate signs of cooling off and since Euro-area wage agreements with historically high increases have been negotiated in many countries to cover at least the whole of 2024, it seems that wages will boost especially service price inflation significantly also in the future. However, as we expect demand to continue to be weak, we also assume that not all companies can pass on all rising wage costs to their final prices, and we expect that the recent rise in companies’ profit margins will be reversed. This would allow inflation to return to central banks’ targets, despite relatively strong wage increases.

The US economy has continued to grow, even though monetary policy tightening has persisted for more than a year and a half now. It seems that the economy is more resilient to higher rates than expected, partly due to the high share of fixed mortgage rates and the fact that many large companies issued long-term bonds during the period of very low rates. As a result of robust economic activity, the labour market continues to be strong and shows only moderate signs of cooling off. Thus, even if a number of sectors’ price developments are weak, we assume that the Fed needs to continue to tighten monetary policy in order to get inflation sustainably back on target.

China’s economic growth has been weaker than expected, and the future looks gloomy as well.

China’s economic growth has been weaker than expected, and the future looks gloomy as well. Growth has slowed down more than expected, and the development, especially in the real estate sector, raises concerns. Housing sales have dropped again and construction activity continues to decline. At least a slight downward correction in housing prices is going on, and many companies are facing problems in financing their activities. Overall, it seems that its leaders have not been able to restore confidence in the economy after the end of the zero-COVID policy. At the same time, development in exports is sluggish due to weak global demand, heightening worries over China’s growth outlook. So far, the scale of policy stimulus has remained limited, and without a significant change in China’s political stance, the growth outlook is likely to remain weaker than what we have previously pencilled in for China.

Euro-area GDP has remained almost constant for the past year. Despite the challenges tighter monetary policy is posing to manufacturing and retail sales, for example, the labour market has so far continued to be strong as economic activity has increased in the service sector. However, the most recent PMIs indicate that growth is now also losing momentum in the service sector, which could open the door for lower wage increases and lower inflation. However, that process will be slow due to the centralised wage negotiation system and will require patience from the ECB to not tighten monetary policy too much when tackling stubbornly high inflation.

|

Year |

World New |

World Old |

US New |

US Old |

Euro area New |

Euro area Old |

China New |

China Old |

|

2022 |

3.5 |

3.5 |

2.1 |

2.1 |

3.4 |

3.5 |

3.0 |

3.0 |

|

2023E |

2.9 |

3.0 |

2.0 |

1.2 |

0.5 |

1.0 |

5.0 |

6.0 |

|

2024E |

2.5 |

2.7 |

0.9 |

1.0 |

1.0 |

1.0 |

3.0 |

4.0 |

|

2025E |

2.7 |

- |

1.9 |

- |

1.0 |

- |

3.0 |

- |

|

Year |

EUR/USD |

EUR/GBP |

USD/JPY |

EUR/SEK |

ECB: Deposit rate |

Fed: Fed funds target rate |

US: 10Y benchmark yield |

Germany: 10Y benchmark yield |

|

2022 |

1.07 |

0.89 |

131.94 |

11.12 |

2.00 |

4.50 |

3.88 |

2.56 |

|

2023E |

1.07 |

0.87 |

148.00 |

12.00 |

3.75 |

5.75 |

4.40 |

2.60 |

|

2024E |

1.12 |

0.92 |

135.00 |

11.20 |

3.00 |

5.00 |

4.00 |

2.40 |

|

2025E |

1.15 |

0.95 |

130.00 |

10.70 |

2.00 |

4.00 |

4.00 |

2.20 |

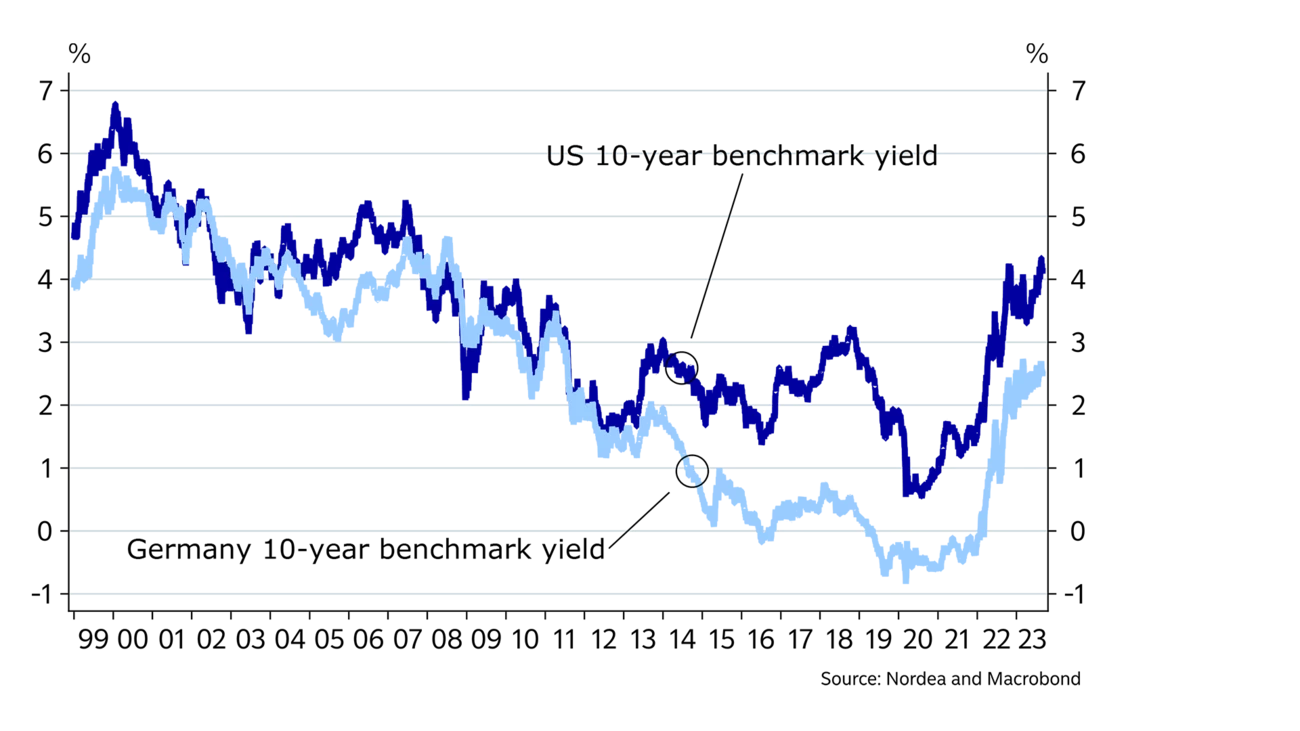

Major central banks have finally moved into a genuine data-dependent mode, meaning that the pattern of signaling the outcome of policy meetings well in advance is finally over. While peak rates are at least likely to be close, further hikes certainly cannot be excluded. Only rate cuts are excluded for now.

In our baseline forecasts, the Fed will hike rates once more by 25 bp during the autumn, while we do not see any further increases from the ECB. Risks remain tilted towards further tightening, though. While inflation pressures have clearly receded from their highs, the road towards the 2% target could yet prove long and bumpy, which is why we do not expect to see rate cuts until well into 2024 at the earliest.

Also, financial markets have lately started to contemplate the idea of higher interest rates for longer, which has been illustrated by longer yields heading higher and US yields even making fresh 16-year highs. It is naturally not only the central banks’ outlook that guides long yields. Both the Fed and the ECB are allowing their bond holdings to fall, while public deficits remain sizable, which means private investors need to buy a lot more bonds than has been the case for a long time. Growth expectations have also boosted bond yields, especially as the risk of a US recession is now considered less likely than before. Especially in the US, bond yields may stay above 4% for several years, while a return to the rock-bottom levels that prevailed in the Euro area for a long time is not in sight either.

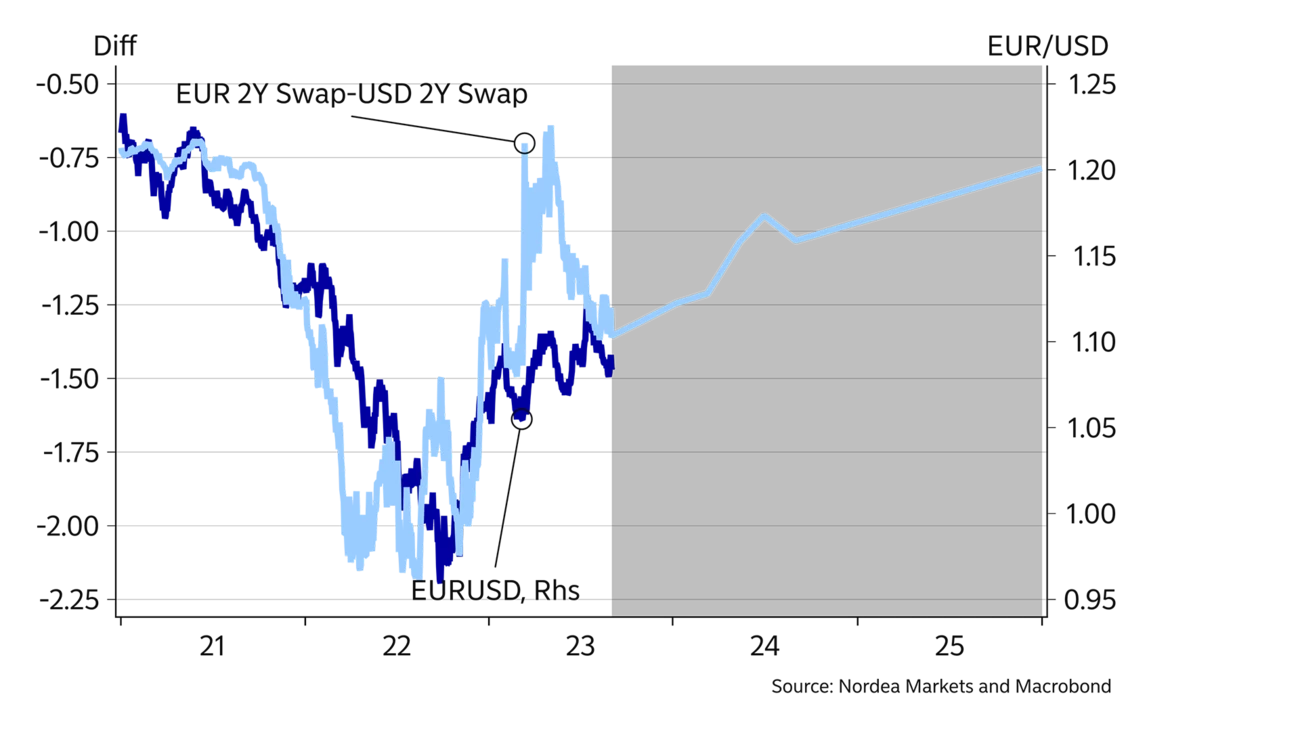

After a strong footing last year, 2023 has been mixed for the USD. Our view of a resilient US economy and higher US rates for longer than markets currently expect should support the USD going forward. Markets could get wrongfooted as positioning has been well against the USD since Q4 2022. Thus, the risk is for a lower EUR/USD in the short to medium term. Eventually, global growth should pick up when global inflation and rates come down. This will lead to a weaker USD over the longer term.

The risk-sensitive G10 currencies (CAD, AUD, NZD, NOK and SEK) will not be in favour until central banks start cutting rates. However, eventually cyclical currencies should start to perform once global growth is allowed to pick up steam and inflation becomes less of a concern.

The JPY has been a disappointment, with Bank of Japan (BoJ) falling behind other G10 central banks. We still believe that a normalisation of monetary policy is on the cards. However, the BoJ is unlikely to move substantially in time to mend the wounds inflicted on the JPY. More likely, the JPY will recover somewhat once other G10 central banks cut rates, and that will take some time.

This article first appeared in the Nordea Economic Outlook: Not there yet, published on 6 September 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more