- Name:

- Tuuli Koivu

- Title:

- Nordea Chief Economist, Finland

Central banks will be reversing their monetary policies and start cutting rates in the coming months. The weak economic outlook and resultant declining price pressure trend are the biggest reasons for the turnaround. In addition, geopolitical tensions and the approaching elections will get a lot of attention this year. While the US elections in November will receive the most attention, it is also worthwhile to follow the results of the European elections and formation of the new EU Commission.

In many countries, the economic trend could change in 2024. The short-term economic outlook is still weak due to the tight monetary policy, but now that inflationary pressures are easing we expect central banks to start cutting rates in the coming months and economic growth to start accelerating towards the year-end.

However, there are still many substantial downside risks to the global economic outlook. In China, political risks are elevated, and the trend of the Party’s increasing control over the economy has a negative impact on the country’s potential growth rate and can cause immense sectoral differences. Furthermore, the geopolitical risks are high. The war in Ukraine is likely to continue hindering the reconstruction of the country; at the same time, the risks surrounding the Middle East and the Red Sea are also elevated. Materialising these risks could again cause challenges and disruptions in global supply chains, as well as to the disinflationary process.

This year is also interesting in terms of approaching elections, which may increase political uncertainty. The results of the US election are far from certain; in the EU, the future trends in developing a functional internal market, for example, may depend on the results of the June elections and the new EU Commission. Overall, the role of politics has increased in the global economy in recent years due to the pandemic, the green transition and increasing geopolitical tensions, which all encourage a more active role for governments. Thus, elections and political developments are one of the hot spots for the global economy and financial markets in 2024.

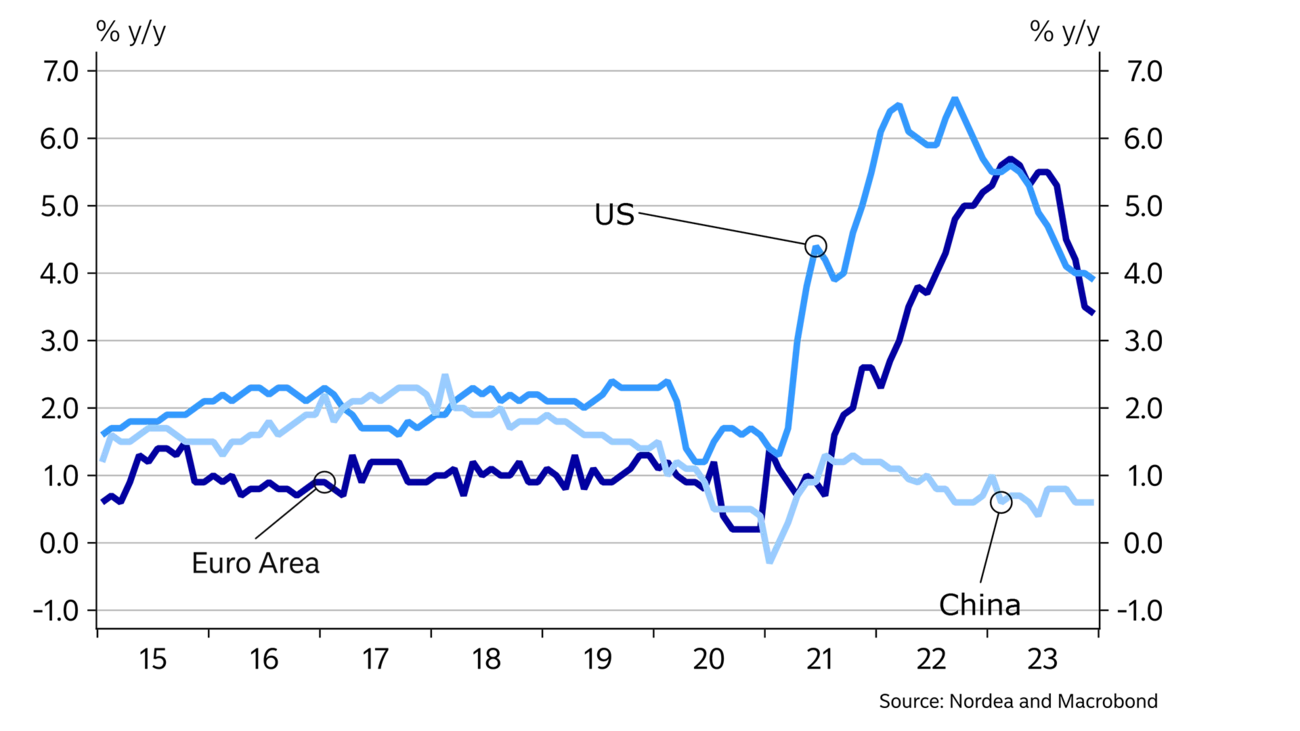

Price pressures have fallen faster than was expected in our previous forecast, and headline inflation is already close to the targeted levels in many countries. Inflation both in energy and food prices has eased and contributed to disinflation. We expect this trend to continue and foresee the oil price, for example, continuing to hover around USD 80 per barrel. Weak demand contributes to stable energy prices and has probably been the main reason why the rise in the oil price has been very moderate, despite serious geopolitical tensions in the Middle East.

Also, core inflation has slowed down substantially in all major economies. Weak global economic development has contributed to negative raw material and producer price developments as well as decreased corporates’ pricing power. We expect the process of disinflation to continue in the coming quarters as the currently weak economic trend should keep price pressures weak. In the Euro area, for example, we expect headline inflation to hit the ECB target as early as in the coming months.

On the top of the recent supply chain worries in the Red Sea, the main challenge for the disinflationary trend stems from the tight labour market and resulting strong wage increases. In the US, robust economic growth has supported the labour market development, while in the Euro area, labour market development has continued to be surprisingly strong even though the GDP has not increased for more than a year. This combination of weak GDP growth and robust employment growth has of course implied negative productivity growth and rising unit labour costs. The ECB seems to be worried that this could lead to more permanent cost and price pressures, but it is also possible that corporates are not able to pass through higher labour costs to the final prices due to weak demand.

US growth is set to slow down this year, as the lagged impact of the previous monetary tightening bites, but no recession is in sight. The pandemic-era household excess savings are running out, but real purchasing power is again developing positively, which should support consumption growth going forward. Inflationary pressures have fallen significantly, but we see risks that the Fed’s rate cuts will give the economy an unnecessary boost at a time of still low unemployment, which could lift wages and inflation again. There are downside risks, though, not least due to important elections in November, with the two presidential election candidates – President Biden and former President Trump – having starkly contrasting views on nearly everything.

In China, leaders have increased the support to the economy but the long-term challenges continue to exist.

Since our previous forecast, China’s economic outlook has stabilised as the leaders have increased support to the economy. In our baseline scenario, China will publish another ambitious growth target in March and the official GDP numbers will continue to be around 5% in 2024. Towards the year-end, external demand should also start to improve, and the downward correction in the real estate sector should come to an end. However, the long-term challenges in the Chinese economy persist as the Party’s control continues to increase, causing confidence problems in the private sector and among consumers. This makes it even more challenging for the country to fix its growth model, where unproductive fixed investments should give room for consumption. The main downward risk continues to be the possibility of a major downward correction in housing prices, which could send households and thus the whole economy into a downward spiral.

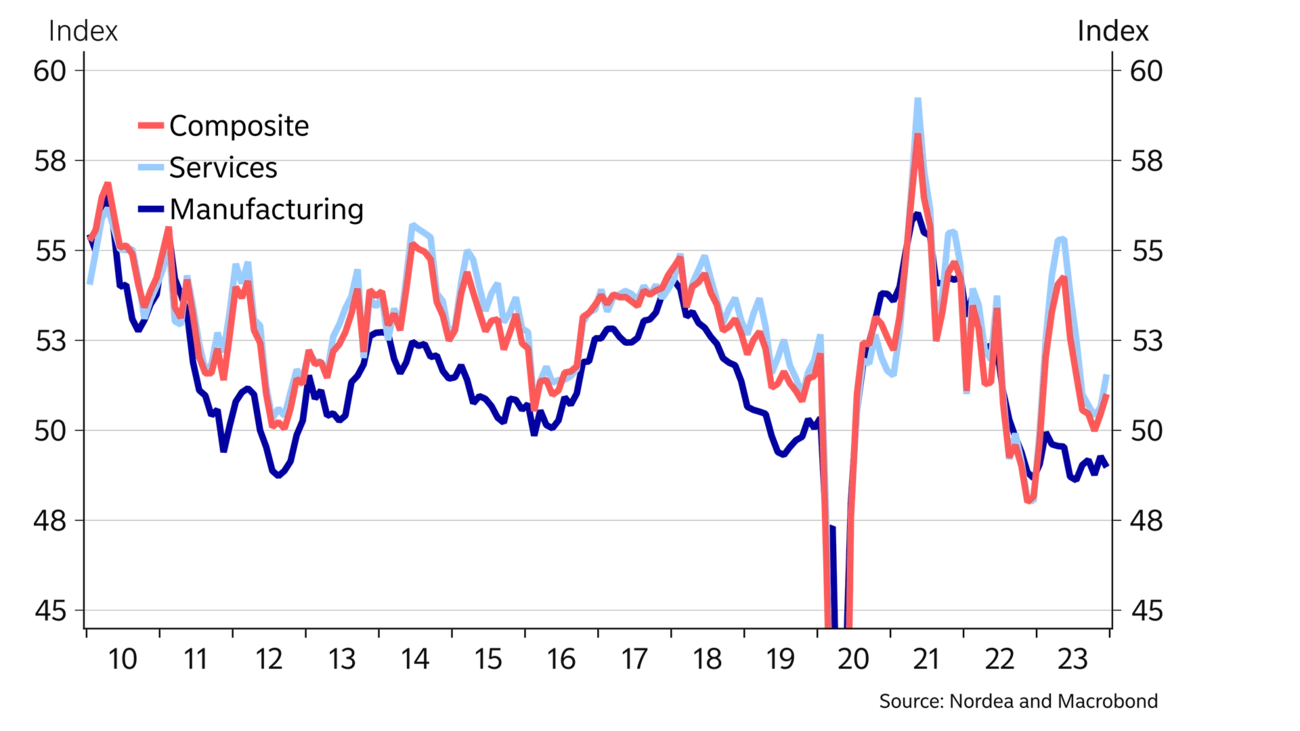

Euro-area GDP most likely declined slightly in the second half of 2023 due to the sluggish development of consumers’ purchasing power, monetary policy tightening and weak external demand. The short-term growth outlook is weak, and the PMIs continued to be clearly in contractionary territory in December. Weak real economy development is expected to further reduce inflationary pressures via a decline in corporates’ pricing power and weaker labour market development. This would allow the ECB to start cutting rates, which should boost growth gradually towards the end of 2024.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

| 2022 | 3.6 | 3.5 | 2.1 | 2.1 | 3.4 | 3.4 | 3.0 | 3.0 |

| 2023E | 2.9 | 2.9 | 2.1 | 2.0 | 0.5 | 0.5 | 5.2 | 5.0 |

| 2024E | 2.5 | 2.5 | 1.5 | 0.9 | 0.0 | 0.0 | 3.0 | 3.0 |

| 2025E | 3.0 | 2.7 | 1.8 | 1.9 | 1.5 | 1.0 | 4.0 | 3.0 |

| Year | EUR/USD | EUR/GBP | USD/JPY | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

| 2022 | 1.07 | 0.89 | 131.94 | 11.12 | 2.00 | 4.50 | 3.88 | 2.56 |

| 2023E | 1.10 | 0.86 | 141.02 | 11.10 | 4.00 | 5.50 | 3.88 | 2.02 |

| 2024E | 1.15 | 0.84 | 130.00 | 10.80 | 3.25 | 4.50 | 4.20 | 2.10 |

| 2025E | 1.15 | 0.84 | 128.00 | 10.70 | 2.25 | 4.50 | 4.20 | 2.00 |

Monetary tightening is behind us, and all focus is already on looming rate cuts from major central banks. Financial markets seem convinced that rate cuts will start rather early in the year. The central banks themselves are less certain.

The Fed now seems increasingly willing to ensure a soft landing to the economy and has already taken the first steps towards the first rate cut. While the timing looks uncertain, the Fed could start cutting already during the spring. We see a total of 100bp of cuts from the Fed this year. However, the US labour market remains relatively tight and the economy is doing fine, and while inflationary pressures have eased, we are not so sure if the US economy needs lower rates. Instead, we think the Fed’s rate cuts risk giving the economy an unnecessary boost, which could push wage growth and inflation higher again and stop the cutting cycle short. We also see longer Treasury yields remaining at around 4% in the coming years.

We think the economic environment is more supportive of rate cuts in the Euro area, but the ECB disagrees, focusing on the remaining inflation risks and refusing to even discuss the prospect of rate cuts. Against that backdrop, we think rate cuts will start only in June, and see gradual cuts throughout the rest of our forecast horizon towards a neutral policy stance at around 2%. Risks are tilted towards an earlier start and steeper cuts if the economy falls into a deeper recession and inflation recedes more clearly below the ECB’s 2% target. The 2% level is also a reasonable anchor for longer EUR benchmark bond yields.

Over the past two years we have seen that the major G10 currencies (except the JPY) have enjoyed the limelight at the cost of smaller currencies. Looking ahead, we favour the JPY and more risk-sensitive currencies such as the NOK.

According to the dollar smile theory, the USD tends to strengthen both when the US economy is very strong and also when it is extremely weak (during recessions or during intense risk aversion). Moreover, according to this theory, the USD performs worse when the economic outlook for the rest of the world is better than for the US economy. This theory captures well the experiences over the past two years. Looking ahead, we believe that lower rates globally will continue to support economic activity and risk sentiment, lowering the appeal of the USD from a safe-haven standpoint. Moreover, our expectations of more near-term rate cuts in the US relative to the Euro area and others such as Japan, the UK and Norway point towards a weaker USD in the years to come. This does not mean that we see a massive USD weakening ahead. We expect the US economy to continue to do well on a global perspective. Furthermore, geopolitical challenges and the outcome of the US presidential election could see the USD surprising positively ahead. If Trump is elected again, the USD should benefit from its safe-haven status. However, twin deficit worries (the US is running both high fiscal and trade deficits) are more likely to appear under Trump, which could weaken the USD. Both the outcome of key events and how markets perceive the outcomes are challenging to predict, which will continue to contribute to volatility.

Eventually, cyclical currencies should start to perform once global growth is allowed to pick up steam and inflation becomes less of a concern. The JPY has been a huge disappointment over the last two years. We expect the normalisation of monetary policy in Japan to begin this year. Higher rates in Japan bundled with cuts elsewhere should give a stronger JPY ahead.

This article first appeared in the Nordea Economic Outlook: Past the peak, published on 24 January 2024. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more