- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst

Jan Størup Nielsen

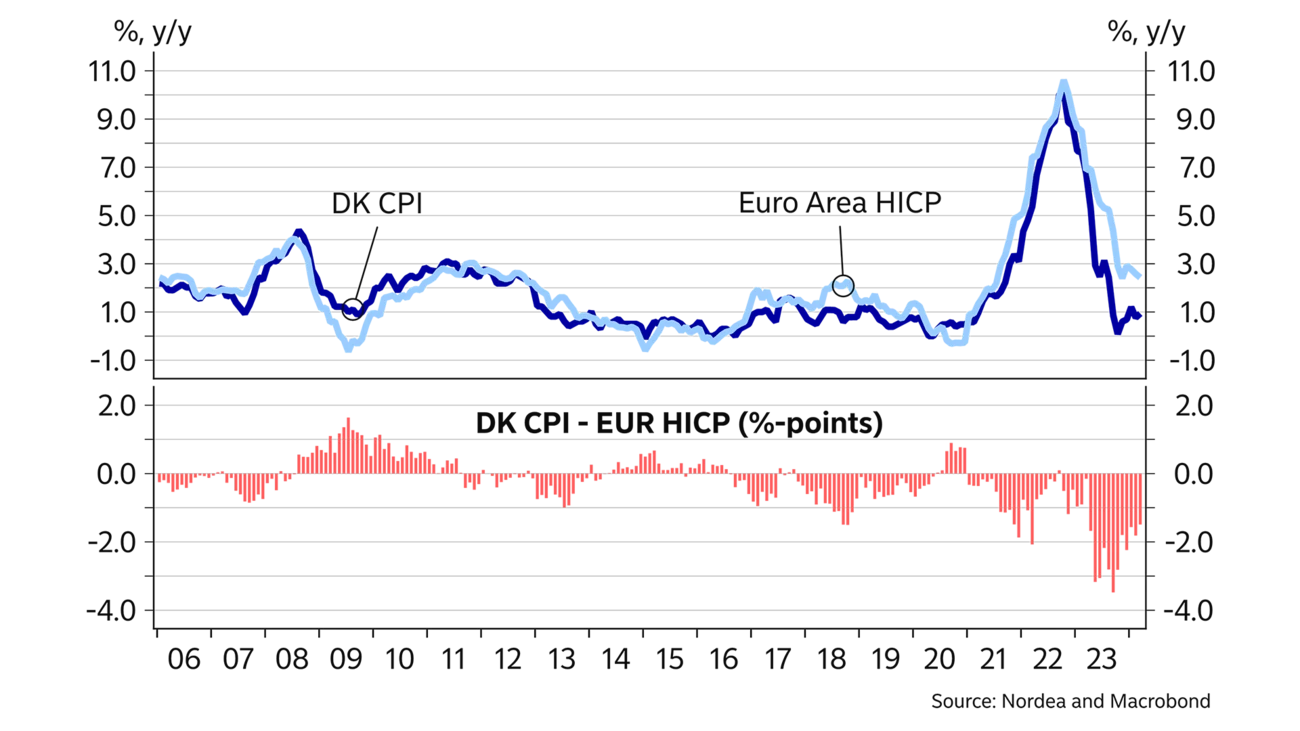

Historically, inflation in Denmark has been very similar to Euro-area inflation, primarily due to the long tradition of the fixed exchange rate regime which has created close monetary policy cohesion. But over the past year, the annual pace of inflation in Denmark has slowed much faster than in the Euro area. In 2024, this trend is expected to reverse, so that Danish consumer prices again will rise faster than in the Euro area.

Since October 2022, the annual rate of increase in the overall Danish consumer price index has consistently been lower than that in the HICP for the Euro area. This trend culminated in September last year when inflation in Denmark was a whopping 3.4% points below inflation in the Euro area. This is the largest difference measured since the euro was introduced in 1999. Also when focusing on the harmonised Danish consumer price index, which in contrast to the traditional index does not include expenses for owner-occupied housing, inflation in Denmark is now among the lowest in the EU.

There are several reasons for the unusually low Danish inflation. Firstly and most importantly are food prices, which have a weighting of 12% of the overall Danish index versus a weighting of more than 15% in the Euro area. In both Denmark and the Euro area, food prices soared in 2022 as a reaction to rising commodity prices and fear of new supply problems after Russia’s invasion of Ukraine. However, the soaring food prices in Denmark slowed down already at the beginning of 2023. Consequently, Danish food prices are now lower than a year ago. However, food prices in the Euro area are still more than 3% higher.

Part of the explanation of lower food prices is probably the fierce competition in the Danish market for groceries. At the same time, the European purchasing power survey showed that Danish food and non-alcoholic beverage prices were more than 20% above the EU average in 2022. This may imply that Danish food prices are more easily affected in the current situation with lower global prices.

Besides food prices, lower energy prices have also quickly found their way to Danish households compared to the Euro area. This is visible in, for example, electricity prices, which have declined much faster in Denmark than in the Euro area.

Also, inflation in Denmark has fallen rapidly compared to Norway and Sweden. Especially the strong trade-weighted Danish exchange rate has contributed to keeping Danish import prices down. This is in contrast to the other Scandinavian countries where a strong weakening of the exchange rates especially in 2023 prompted a sharp increase in prices of imported goods and services.

We expect that inflation in Denmark will gradually go higher in 2024, with the annual average increasing to just under 2%. This trend is expected to continue into 2025 with an average inflation of 2.4%. Expectations of moderately increasing inflation are especially driven by the fading effect of lower energy prices as well as continued high services inflation owing to strong nominal wage growth.

After the significant price increases in 2022, inflation in Denmark has decreased rapidly. However, the situation is different in the Euro area where inflation is still above 2%.

Conversely, in our Euro area forecast, we expect inflation to fall to slightly below 2% into 2025. Thus, the Euro area has been impacted by economic stagnation since mid-2022. This means that demand-side pressure is lower than in Denmark which in the same period has seen solid economic growth – although it has primarily been driven by the pharmaceutical industry. Therefore, over the coming years, the pace of wage growth in Denmark could be higher than in many other EU countries. This could especially lift the Danish services inflation relative to the Euro area.

In continuation of this, while lower global food prices are also expected to feed through more forcefully in the Euro area, Denmark may already have seen the largest effect of this. The negative contribution from food prices especially towards the end of 2024 is thus expected to be larger in the Euro area than in Denmark.

This article first appeared in the Nordea Economic Outlook: Falling into place, published on 24 April 2024. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more