- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

Kjetil Olsen

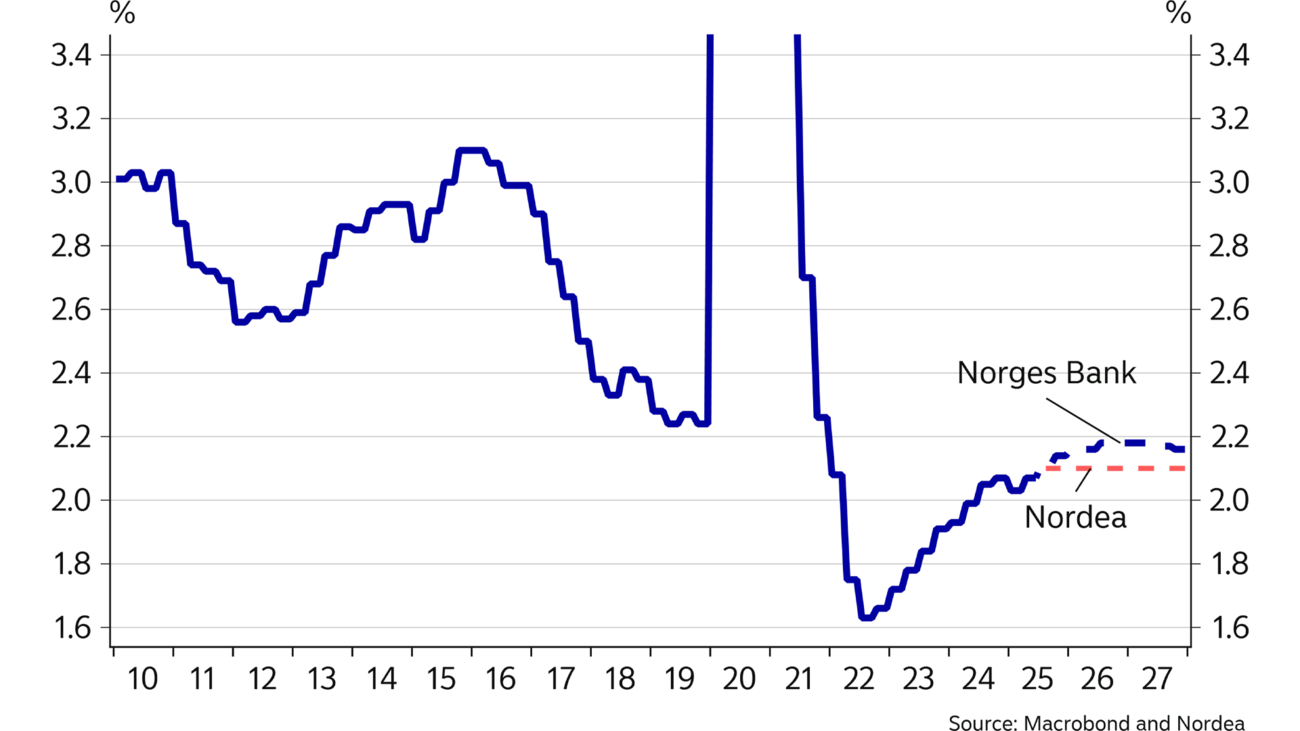

Economic growth in Norway has picked up significantly, and the outlook is good despite global turmoil. Rising household purchasing power is the main reason for the current economic upturn. In the coming years, growth will be in line with or somewhat above trend growth and contribute to keeping unemployment at a low level. Together with strong profitability in the industries particularly exposed to international competition, this will ensure continued high wage growth, contributing to keeping inflation above Norges Bank’s 2% inflation target. The room for further rate cuts is thus limited.

Economic growth in Norway has rebounded strongly after a couple of modest years. Growth already picked up in H2 2024 and has continued to accelerate so far this year. Excluding power production and traditional fishing, which fluctuate with weather conditions and quotas, growth reached nearly 4% on an annualised basis in both Q1 and Q2. While we long forecast economic growth to pick up, the recovery is stronger than anticipated.

Several factors are contributing to the current up-turn. The main reason is stronger household purchasing power and thus higher personal spending. Last year’s (2024) pay talks delivered historically high real wage growth, while this year’s (2025) pay talks will help boost purchasing power substantially also in 2025. Rates have already been cut once and an additional cut is likely before year-end.

This will strengthen the current consumption growth. With tight labour market conditions and high profitability in the industries particularly ex-posed to international competition, which set the tone for Norway’s wage growth, real wage growth looks set to remain strong in the coming years.

Meanwhile, housing construction has stabilised and shows early signs of recovery, which is also aiding the economic pick-up. Rate cuts will benefit the sector going forward – but how much remains to be seen. Strong oil investment growth has cushioned the economy from recent years’ sharp housing investment declines. Investment activity in the petroleum industry has been record-high so far this year, but is expected to moderate in the coming years. The roles may therefore be reversed going forward.

Mainland exports are still generally at good levels despite global uncertainty about tariffs. Industry investments have risen since last summer. Very good profitability over many years may fuel the desire to increase capacity. Additionally, major infrastructure projects in power and roads are sending clear signals of increased demand to construction companies.

In addition, highly stimulative fiscal policy measures have helped sustain economic activity in Norway in recent years and will likely continue driving growth going forward. Recent years have seen a clear pattern of spending increases beyond the initial budget proposal through political negotiations and supplementary grants. While the 2025 budget proposal indicated a budget impulse of 0.5% of mainland GDP, the budget impulse is now estimated at 1.3% if excluding the extra allocations to Ukraine. Looking ahead, there is still significant room to increase spending while staying within the fiscal spending rule. We have thus good rea-son to believe that budgetary policy will continue to provide significant stimulus to the Norwegian economy in the coming years, regardless of the election outcome this autumn.

In conclusion, the growth outlook for the Norwegian economy is good, even without many rate cuts. Growth will likely remain at or somewhat above trend growth, helping to maintain registered unemployment at low levels.

| 2024 | 2025E | 2026E | 2027E | |

|---|---|---|---|---|

| Real GDP (mainland), % y/y | 0.6 | 2.0 | 1.8 | 1.7 |

| Household consumption | 1.4 | 3.0 | 2.3 | 2.0 |

| Core inflation (CPI-ATE), % y/y | 3.7 | 3.0 | 2.7 | 2.5 |

| Annual wage growth | 5.6 | 4.9 | 4.4 | 4.0 |

| Unemployment rate (registered), % | 2.0 | 2.1 | 2.1 | 2.1 |

| Monetary policy rate (end of period) | 4.50 | 4.00 | 4.00 | 4.00 |

| EUR/NOK (end of period) | 11.78 | 11.75 | 11.50 | 11.50 |

The housing market showed strong momentum early in the year, but moderated as summer approached. Nevertheless, housing prices in Norway have increased by 5.5% over the past year, roughly in line with income growth. The easing of equity capital requirements has enabled more people to borrow larger amounts. This likely contributed to the strong rise in housing prices early in the year. Many rental properties have also been put up for sale, especially in the big cities. This temporary uptick in the supply of homes may have dampened housing prices.

By year-end, the policy rate will likely be 0.5 percent-age point lower than at the start of the year. Historically, lower interest rates have had a strong positive effect on housing prices. Empirical evidence suggests that a 1 percentage point lower interest rate leads to a 10-12% increase in housing prices when viewed in isolation. Combining the impact of a 0.5 percentage point interest rate reduction with the projected income growth could drive housing prices up by approximately 20% between 2025 and 2027. If Norges Bank’s forecast of five interest rate cuts in total is realised, housing price growth could surpass 30% during this period – the most robust housing market expansion since the pre-financial crisis era.

Housing investments have tumbled in the past three years. This has contributed strongly to the modest economic growth in Norway until recently. In H1, housing investments rose very modestly from a very low level. Sales of new homes, typically a leading indicator for construction activity, had a strong start to the year but softened somewhat in Q2. We have observed the same trend in the number of building permits.

There is reason to believe the housing market will strengthen this autumn. Rising prices of existing homes could boost sales of new homes as well as housing starts. This would further increase housing investments and contribute to economic growth in Norway.

We may see an increase in housing prices of about 20% over the three years from 2025 to 2027.

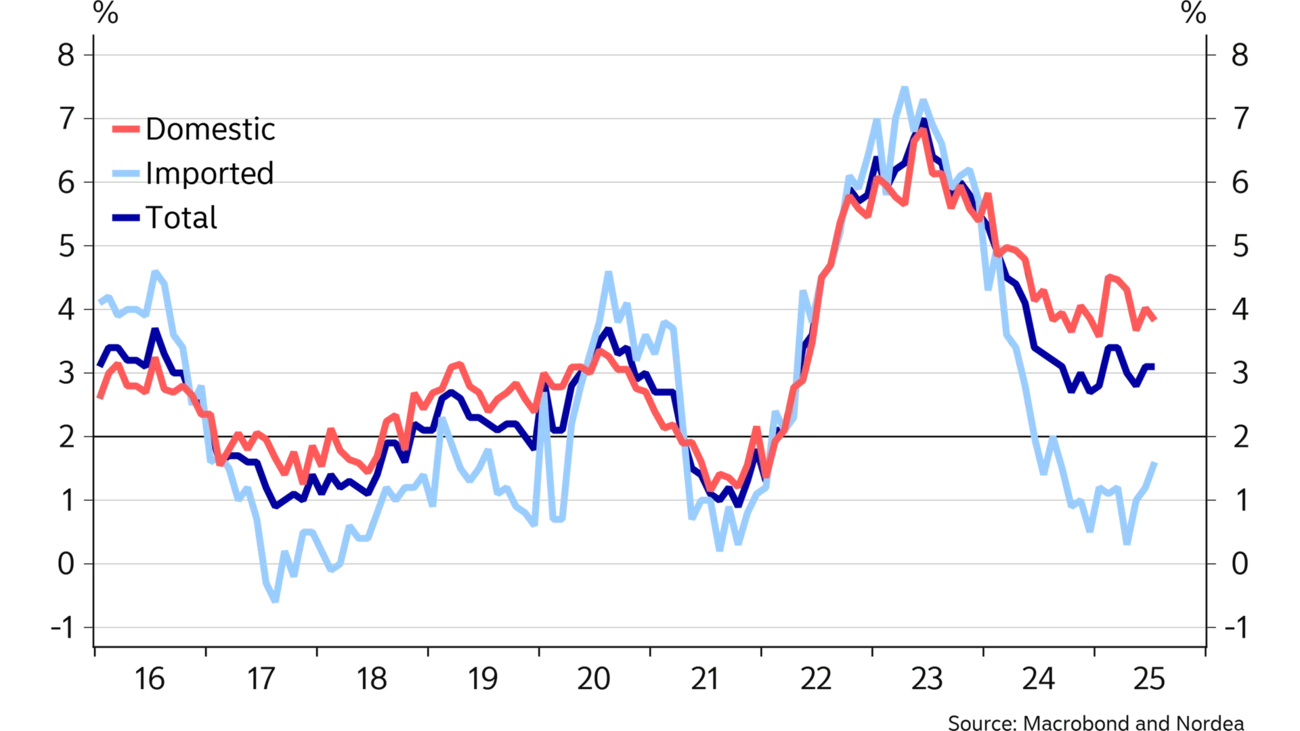

Inflation has fallen sharply from its 2023 peak, but now seems to have stalled. Underlying price growth – adjusted for energy prices and taxes – remained fairly stable at around 3% the last year. We have been emphasising for some time that the straightforward phase of lower inflation is now behind us. While higher im-port prices drove inflation up after the pandemic, strong domestic price growth is now keeping it elevated.

Several years of strong wage growth has increased costs, which have over time been passed on to consumers – the main reason why inflation remains too high. Over the past two years, wages have risen by about 5.5% annually on average. It is therefore no sur-prise that domestic inflation is high. This year’s pay talks point to somewhat lower wage growth, with the wage-leading sectors agreeing on 4.4%, which has set the tone for other pay talks. However, actual wage growth in recent years has often exceeded the agreed framework.

Average monthly wages for H1 2025 rose by 5.8% compared to the same period last year. These figures have traditionally been a good indicator of actual annual wage growth as measured in the national accounts. It is thus uncertain whether wage growth will end up much below 5% when the final figures for 2025 are released. In addition, higher wages will improve household purchasing power and thus mean higher demand, making it easier to pass on cost inflation to prices. Many companies, especially retailers, which have struggled until recently, will likely try to increase their margins in line with the stronger demand.

Future wage developments will depend on labour market conditions and the outlook, inflation expectations and, not least, profitability in the industries particularly exposed to international competition. The wage share in the manufacturing sector is historically low and well below the average of recent decades. The Norwegian “frontfag” pay talk model is based on the principle that wage-earners should, over time, receive their fair share of profits.

The low wage share makes it challenging to reduce the agreed wage growth significantly, see the theme article. Domestic factors will thus keep price growth elevated in the coming years. Meanwhile, there are few indications that global economic conditions will con-tribute to any further substantial reduction in imported inflation. We therefore expect inflation to remain well above 2% in the years ahead.

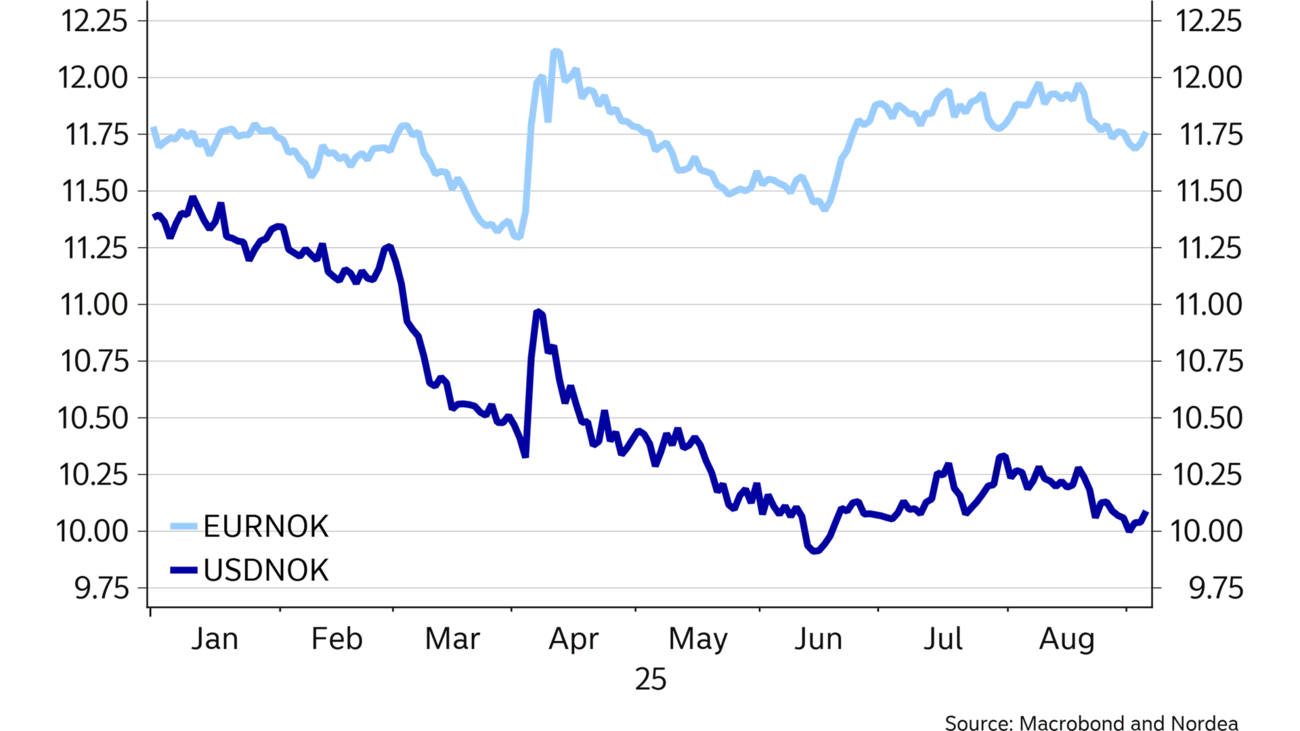

Over the summer, lower oil prices contributed to a weakening of the NOK. However, we expect fewer rate cuts in Norway than the market is pricing in. This could gradually help strengthen the NOK. Increased use of oil revenues through the state budget pulls in the same direction. Tax revenues from oil and gas companies are also expected to decrease starting next year. Consequently, Norges Bank, on behalf of the state, will need to transfer more funds from the Government Pension Fund Global to the state’s account with Norges Bank. This entails larger NOK purchases from Norges Bank. These factors could strengthen the NOK somewhat, but likely only to about 11.50 against the EUR. Against the USD, the NOK may appreciate more – not due to a stronger NOK, but a weaker USD. So far this year, the USD has fallen by about 10% across the board, and there is a clear risk of a much sharper decline in the coming years, see Global Overview for more on the USD outlook.

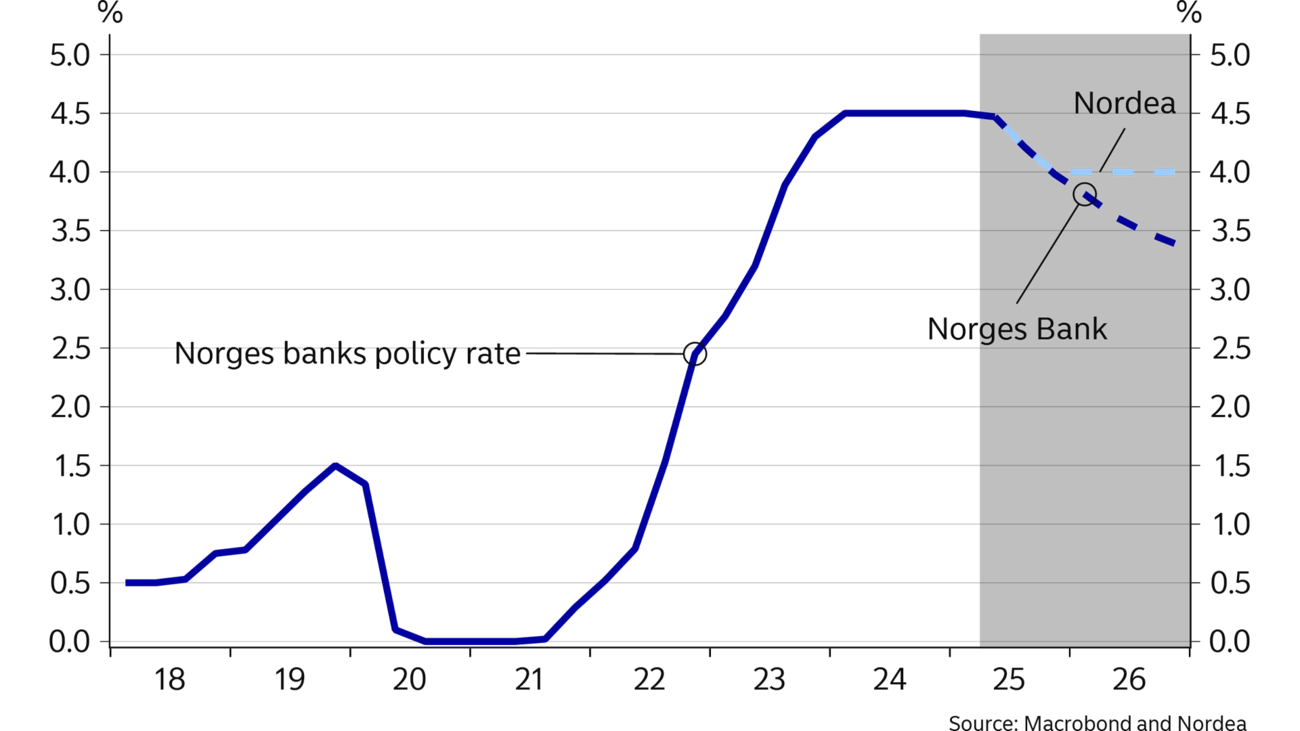

Inflation has fallen sharply from its peak, but has stabilised well above the 2% target over the past year. Registered unemployment has remained low, close to what Norges Bank considers a normal level. At the same time, economic growth in Norway has surged to well above trend growth in H1 – that is, the pace needed to keep unemployment stable over time. It is thus far from clear that the policy rate should be cut in such a situation. Nevertheless, Norges Bank cut the policy rate for the first time in June from 4.5% to 4.25% and has long signalled a gradual further reduction. This economic projection assumes that monetary policy is restraining economic activity, and that today's interest rate level will sufficiently slow growth to gradually increase unemployment, which in turn should moderate wage and price inflation. To avoid slowing the economy too much, Norges Bank plans to gradually lower the rate towards what it sees as a more normal level – one that neither restrains nor stimulates growth.

The room for rate cuts is smaller than many expect.

However, what constitutes a normal or neutral rate is highly uncertain. Norges Bank has revised up its forecast of this level several times in recent years, and the end point of its rate paths has been adjusted upwards accordingly. However, it remains an open question whether the current rate is actually restraining the economy – and, therefore, whether rates should fall much further. Looking at the broader picture, it is far from clear that today’s rate level is high by this measure. Economic growth in Norway has picked up, driven mainly by stronger household purchasing power and spending – a segment that ranks among the most sensitive to interest rate changes in the economy. Debt growth is accelerating, and house prices are climbing. With fiscal policy also providing structural stimulus to the economy, it is questionable whether the current interest rate is significantly above the neutral level. At the same time, inflation is almost certain to remain well above the 2% target for a long time. The scope for rate cuts is therefore more limited than widely anticipated. We expect that Norges Bank will deliver just one of its signalled rate cuts this year, with no further cuts coming after that.

This article first appeared in the Nordea Economic Outlook, "Steady path," published on 3 September 2025. Find out more about the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more