1.6%

Forecast for mainland GDP growth in 2026

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaKjetil Olsen

The Norwegian economy has picked up but has recently been slightly weaker than estimated. While many areas of the economy are doing well, others are more challenging. Overall, we still see growth broadly in line with trend growth in the Norwegian economy. Registered unemployment will thus remain at the current low level. Inflation will ease gradually but stay above Norges Bank’s 2% target in the next few years. The scope for further rate cuts is thus quite limited. However, a stronger NOK in the near term could still lead to one more rate cut before summer.

After a couple of years of very modest growth and rising unemployment, growth picked up last year, nearing the Norwegian economy’s trend level. As a result, registered unemployment has stabilised at a low level and is now likely close to normal. The economy’s starting point is good, with normal growth and unemployment.

Despite overall stability, some sectors thrive while others face challenges.

Private consumption is now growing strongly, and the outlook for consumption is also positive. Solid wage settlements over several years have reduced the real debt burden for many households. Wages have risen well above prices over the past two years, boosting purchasing power. Rate cuts, higher electricity subsidies and cheaper childcare have further increased disposable income. With prospects for continued strong real wage growth and a slight further drop in interest rates, purchasing power is set to rise substantially. Higher private consumption has been – and will remain over the coming years – by far the largest positive growth driver in the Norwegian economy.

At the same time, mainland exports are performing well despite uncertainty and higher tariffs. Growth among our closest and most important European trading partners is clearly increasing. In Norway, higher defence spending and major investments in power supply will create positive ripple effects for many. Overall, mainland companies are signalling increased investment. Public demand is also expected to rise somewhat more than usual in the coming years, even though many municipalities face tight finances. Large parts of the Norwegian economy are thus doing well, and the outlook remains positive.

The supplier industry for the petroleum sector has enjoyed strong years, thanks to a sharp rise in oil investments. Tax incentives introduced during the pandemic accelerated several investment projects. Looking ahead, few large new projects are in the pipeline. Oil investments will therefore decline over the next few years, and early reports of staff reductions in the supplier industry have already begun to emerge.

Activity in the construction sector remains very low, and parts of the industry report fewer contracts. Sales of new homes have been weaker than expected, and the construction sector turned more pessimistic towards the end of last year. The decline in residential construction has halted, but recovery is slow to materialise. We still expect residential construction to gradually pick up, though from very low levels.

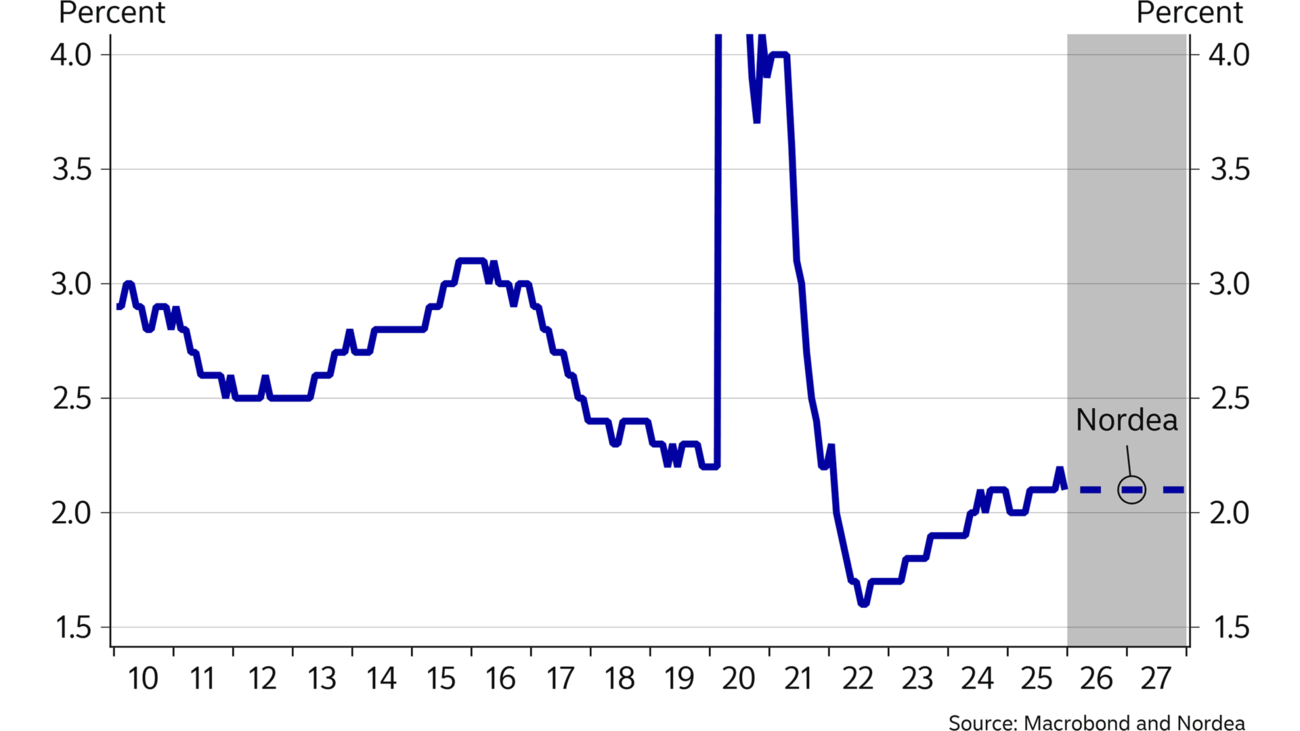

Overall, we anticipate growth to stay close to trend in the Norwegian economy at 1½–1¾% over the next couple of years. Headwinds in some areas of the Norwegian economy are offset by tailwinds in others. Registered unemployment has hovered just above 2% since the summer of 2024. With normal growth in the Norwegian economy going forward, unemployment will likely remain at this level.

| ‘24E | ‘25E | ‘26E | ‘27E | |

|---|---|---|---|---|

| Real GDP (mainland), % y/y | 0.6 | 1.6 | 1.6 | 1.6 |

| Household consumption | 1.5 | 3.2 | 2.3 | 2.2 |

| Core inflation (CPI-ATE), % y/y | 3.7 | 3.1 | 2.7 | 2.4 |

| Annual wage growth | 5.6 | 4.9 | 4.4 | 4.0 |

| Unemployment rate (registered), % | 2.0 | 2.1 | 2.1 | 2.1 |

| Monetary policy rate (end of period) | 4.5 | 4.0 | 3.75 | 3.75 |

| EUR/NOK (end of period) | 11.78 | 11.84 | 11.25 | 11.25 |

Forecast for mainland GDP growth in 2026

Estimated registered unemployment rate at end-2027

Estimated policy rate at year-end 2027

Residential construction stabilised at a low level last year after falling ~30% over the past two years. After a slight rise in new home sales in H1 2025, sales flattened in H2 2025 and came in lower than expected. Construction costs rose sharply during the pandemic – more than prices of existing homes. Given normal profitability requirements, developers cannot price newbuilds in a way buyers find attractive. With new home sales at a low level, new housing starts remain subdued.

Unless construction costs fall or developers write down land costs, prices of existing homes will likely need to rise faster than construction costs for a period to revive new home sales – and thus residential construction. We believe this will happen and thus expect residential construction to rise slightly from H2 2026.

Historically, lower interest rates have strongly boosted housing prices. Empirical evidence shows that a 1% point drop in interest rates, in isolation, raises housing prices by 10-12% beyond income growth. Last year, house prices rose by 5% nationwide, roughly in line with income growth. Therefore, we have probably not yet seen the full effect of past rate cuts on house prices. Many rental properties have been put up for sale in major cities. This temporary increase in the supply of existing homes has helped dampen house prices.

With one more rate cut this year, the policy rate will have fallen by a total of ¾ % point from its peak. Combined with expected income growth and the fact that housing supply is low due to limited construction in recent years, prices of existing homes could rise by ~15% over the next two years. This will most likely help narrow the price gap to new homes and lead to increased sales of new homes and new housing starts.

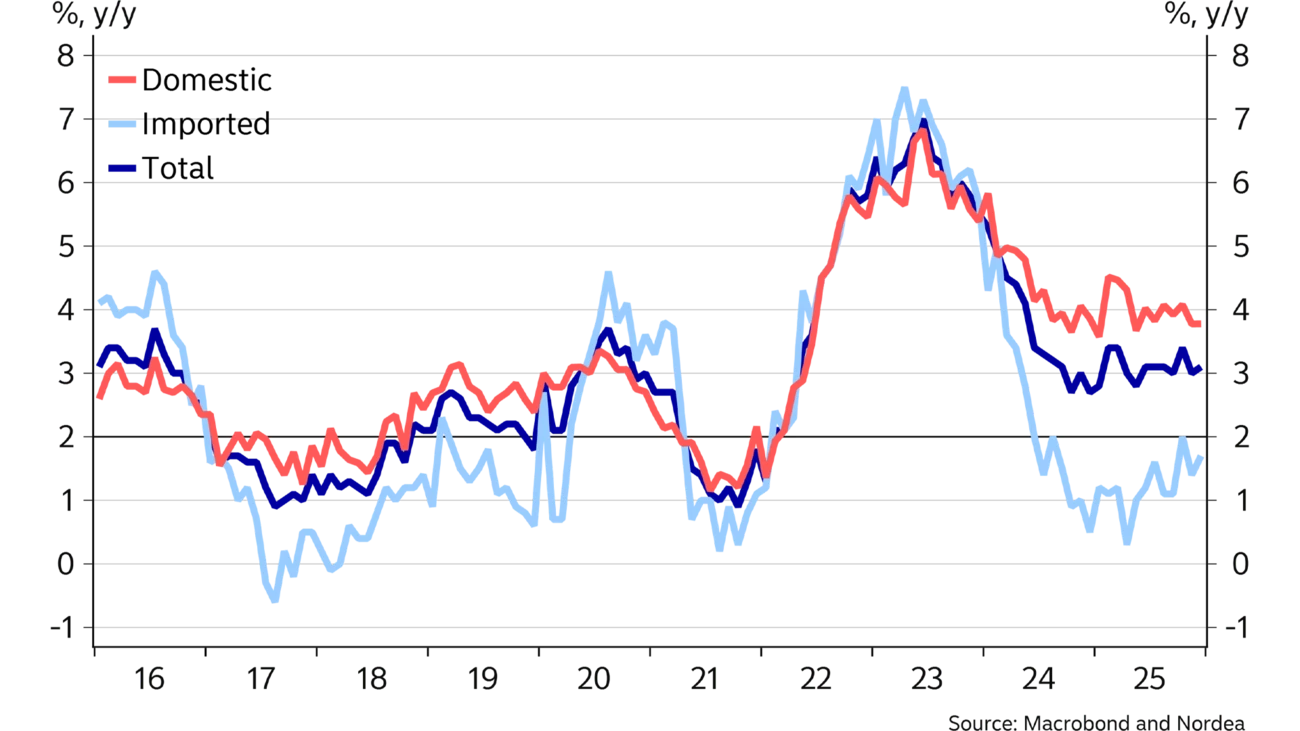

Underlying price growth – adjusted for energy prices and taxes – has remained fairly stable at ~3% over the past 18 months (see chart B). The decline in inflation has, therefore, come to a halt. Price growth is being sustained by domestic price increases of ~4%. It is reasonable to assume that the high domestic growth – accounting for about two-thirds of overall price growth – stems from recent years’ strong wage growth. High wage growth raises business costs, which are eventually passed on to consumer prices.

So far, there is little evidence of any improvement in productivity growth that could have helped offset costs at the current wage growth. For inflation to fall further, wage growth will likely need to come down. Over time, wage growth can hardly stay much above 3% if overall inflation is to remain at 2%.

After rising by ~5½% in both 2023 and 2024, wages appear to have increased by just under 5% last year. Expectations point to a further decline this year. Meanwhile, profitability in the industries exposed to competition remains very strong. Despite high wage growth in recent years, workers’ share of profits has fallen. The wage share in the “front-line” sectors that set the benchmark in wage talks – covering ~50% of the manufacturing industry – is historically low and far below the average of recent decades. The employee side will likely use this to argue for fairly generous wage increases going forward. In addition, registered unemployment is low. Wage growth will probably decline somewhat this year and the next but not enough to reduce inflation to the 2% target.

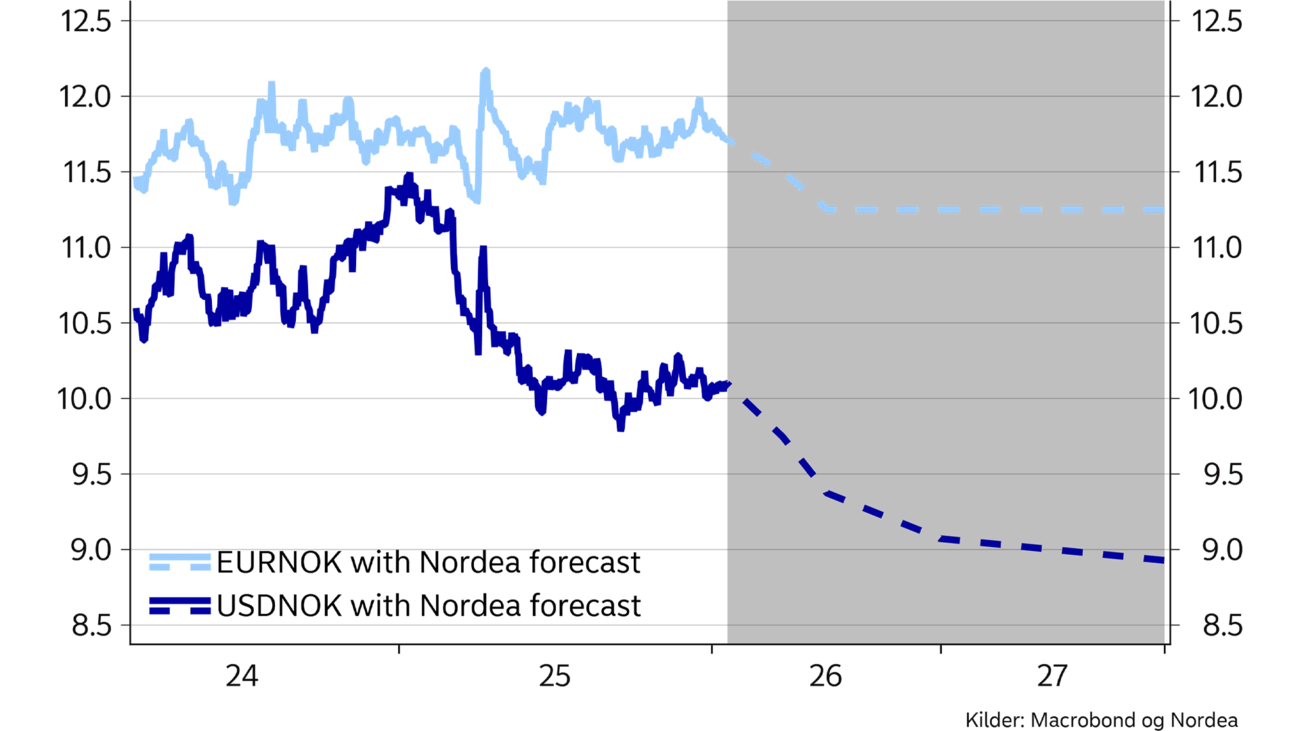

During H2 2025, lower oil prices contributed to the NOK weakening. Owing to market oversupply, oil prices are expected to stay near the current levels over the next six months. Futures for oil and gas suggest that Norwegian state revenues from petroleum tax this year will be lower than the estimated oil-adjusted budget deficit. As a result, Norges Bank, on behalf of the state, will need to transfer more funds from the Government Pension Fund Global to the state’s account with Norges Bank – requiring larger NOK purchases. These factors could push the NOK somewhat stronger – towards 11.25 against the EUR by summer.

Against the USD, the NOK may strengthen even further. Last year, the USD weakened by ~10% across the board, and there is a clear risk it could weaken even more in the coming years. Read more about the USD outlook in the Global Overview.

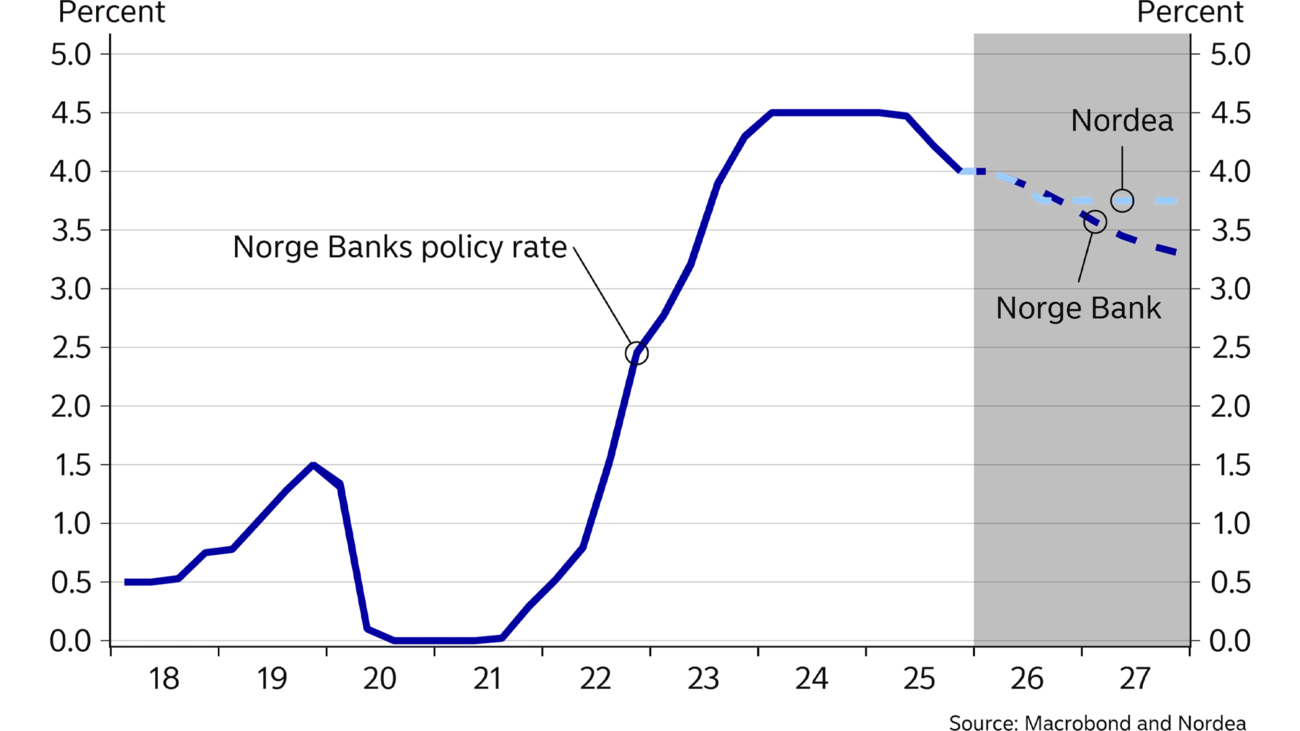

Last year, Norges Bank cut its policy rate twice, from 4.5% to 4.0%. We have long maintained that Norges Bank would settle for these two rate cuts, with no further cuts this year or the next. However, our view of a somewhat stronger NOK could still open the door to one more rate cut. In addition, Norges Bank has announced a programme for central bank certificates, which will likely widen the gap between the money market rate and the policy rate by ~0.1% point. To offset the impact on the economy, Norges Bank will need to cut its policy rate accordingly. We expect Norges Bank to lower its policy rate to 3.75% before summer and keep it there.

A stronger NOK could pave the way for one more rate cut from Norges Bank.

Norges Bank has an objective of low and stable inflation close to 2% over time. At the same time, monetary policy should support high and stable output and employment. Inflation remains too high and, by all indications, will stay above the 2% target for the next two years. Capacity utilisation and unemployment are now close to normal levels. Overall, economic growth in Norway is expected to be close to trend going forward. This will help maintain a normal situation in the Norwegian economy, even without multiple rate cuts.

With persistently high inflation and an economy in balance, a clear weakening with rising unemployment will likely be needed before more cuts than the one we project become relevant. On the contrary, we believe multiple rate cuts would spur stronger growth and, over time, lower unemployment. That would, in turn, make it even harder to reach the inflation target. That is why we also believe the scope for further rate cuts remains very limited.

This article first appeared in the Nordea Economic Outlook: Northern Lights, published on 21 January 2026.

Read more from the latest report

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Economic Outlook

Join us for the release of the Nordea Economic Outlook on 21 January. Register for our webinar featuring Nordea’s Group Chief Economist Helge J. Pedersen, who will provide an in-depth look at Nordea’s latest economic forecasts.

Read more

Economy

The global economy proved to be more resilient to President Trump's aggressive trade policy than many feared. This provides the basis for a tempered – but real – optimism as we enter the new year.

Read more

Sustainable finance

The European Commission has unveiled its long-awaited revision to the Sustainable Finance Disclosure Regulation (SFDR), with new categories, thresholds and a focus on measurable indicators.

Read more