- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

Siden findes desværre ikke på dansk

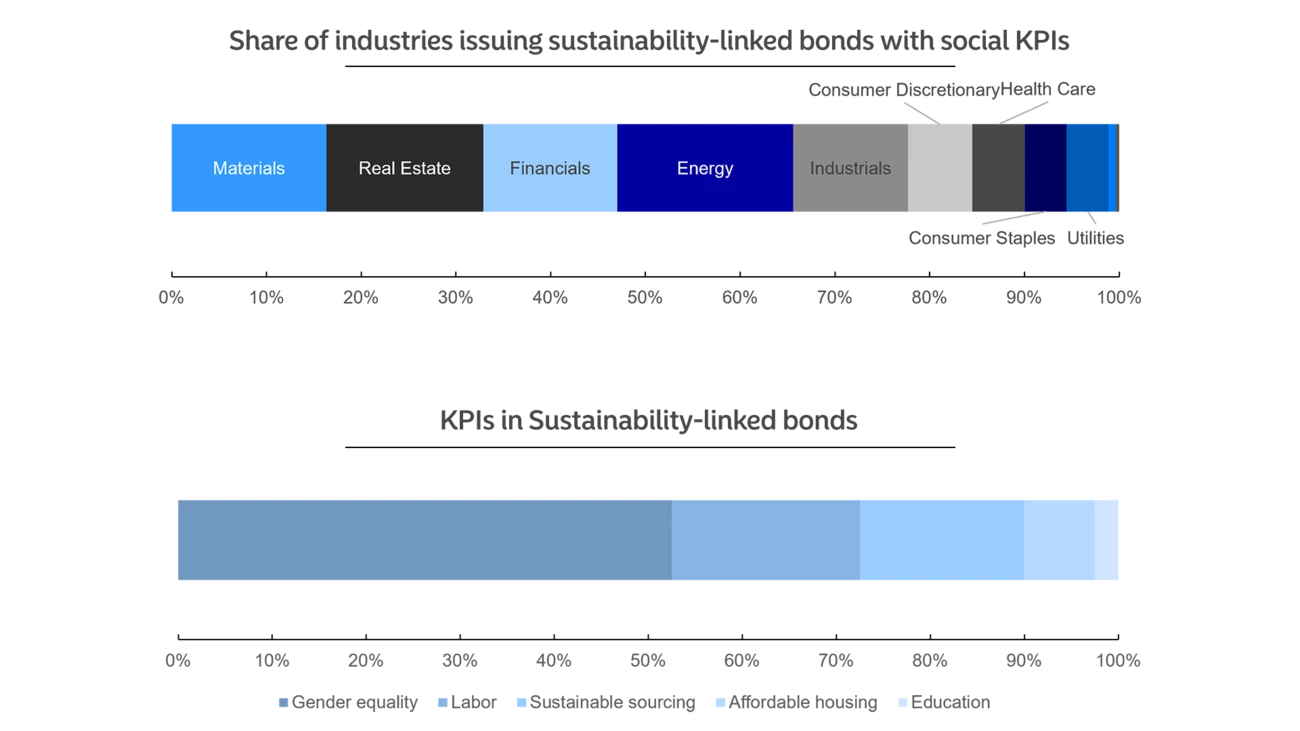

Bliv på siden | Fortsæt til en relateret side på danskWhen it comes to financing structures focused on social impact, the vast majority currently incorporate gender diversity targets as the social KPI, in part due to the availability of established and comparable data. Looking ahead, we expect a wider range of social targets to be reported on and included in sustainable financing where material.

After the surge in social bonds during the pandemic, investor focus is yet again shifting to social issues, this time with a broader view on companies’ operations and supply chains. At last week’s annual conference, the Principles for Responsible Investment (PRI), a UN-supported network of financial institutions, announced a new stewardship initiative for institutional investors. The initiative spurs investors to take action on social and human rights issues, just as the Climate Action 100+ initiative aims to drive climate action.

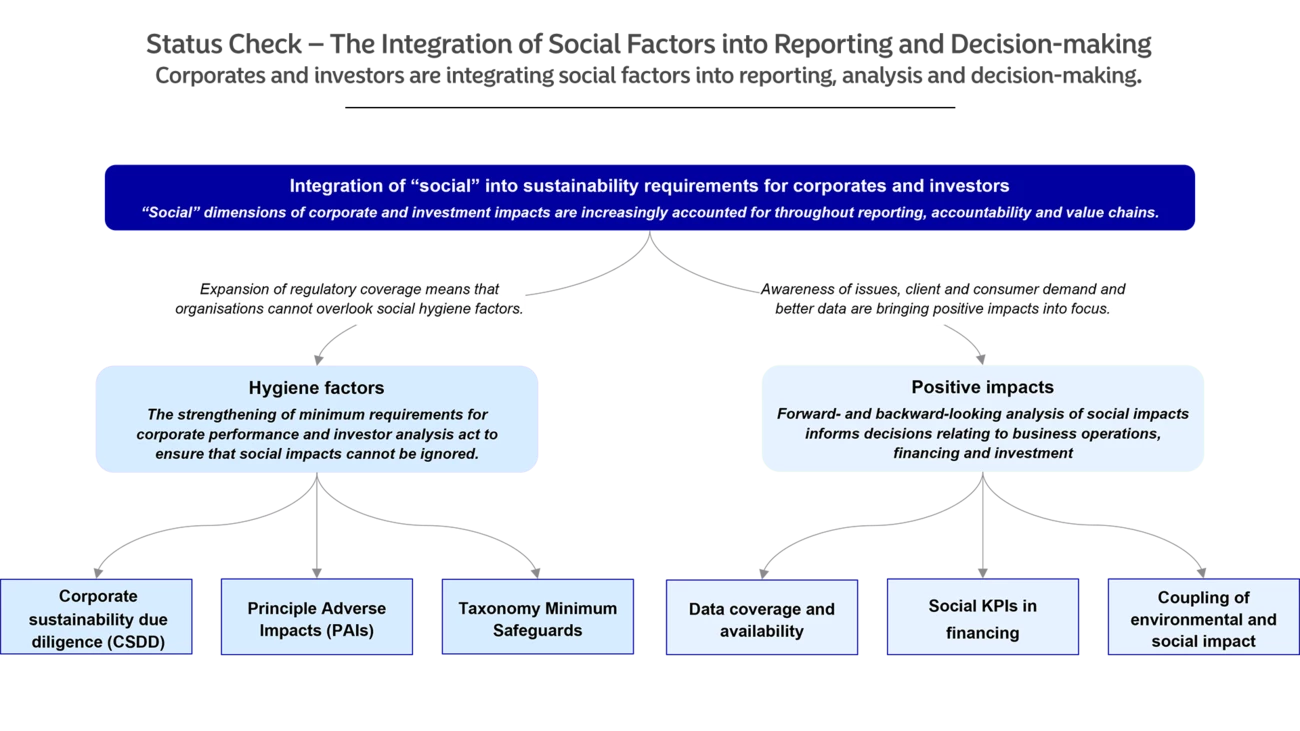

Beyond investor interest, regulation and reporting requirements published earlier this year also point to a stronger focus on social themes, with a broadening scope that encompasses global supply chains.

With reporting requirements increasing, companies have an incentive to get more visibility of their supply chains.

For many European companies, the most pressing social issues do not sit within their own operations, but rather in their supply chains, where there’s less visibility and control over factors such as working conditions and pay. Strengthening minimum social requirements has therefore become a core focus for European regulators this year.

The proposed Corporate Sustainability Due Diligence Directive (CSDD) will be a cornerstone of EU supply chain regulation, integrating more effective protection of human rights as well as environmental safeguards. The coming directive not only requires companies to provide workers with safe and healthy working conditions throughout their global value chains, investor and downstream partners are also expected to have performed their due diligence. What’s more, victims of breaches are now able to take legal action for damages in cases of non-compliance.

With reporting requirements increasing, companies have an incentive to get more visibility of their supply chains. Strict compliance with human rights should be seen as a hygiene factor for any type of corporation.

For companies seeking to align with the EU Taxonomy, these standards will be further reinforced with the establishment of Minimum Safeguards under the regulation. Even voluntary initiatives aimed at other areas are requesting disclosure on social factors. For example, the Taskforce on Nature-related Financial Disclosures, a disclosure framework for nature-related risks, includes people in its concept of nature.

In addition to hygiene factors, positive impacts also play an important role in understanding an organisation’s net effect on society. These positive impacts can be created either through exceptional social business conduct, or can be a direct result of the business model or product that delivers clear positive externalities for society.

In addition to helping investors interpret the social footprint of a company, well-understood social metrics can also be used as a window into company culture. This is arguably the most important driver of an organisation’s social sustainability over the long-term, affecting employees directly as well as the company’s supply chain and end customers. Sustainable thinking and value creation can only truly be embedded in companies if the culture to foster such an environment exists.

The best way to communicate such a culture, for employees and other stakeholders such as investors, is through the broader use of social metrics. These positive impacts, however, are often difficult to measure and isolate, making standardised metrics hard to come by and complex to interpret.

While social taxonomies could help, regulators tend to prioritise the environmentally-focused counterparts. Disclosure on social topics will nevertheless become more prevalent as the recently adopted CSRD incorporates these themes, driving greater data coverage and historical comparability, in addition to formalising the concept of double materiality. (Double materiality is the reporting approach that accounts for how sustainable factors affect the financial value of a company as well as how the company affects the environment and society.)

Only once a company has clearly identified its positive social impacts, and found a way to measure them, can it proceed to integrating social issues into financing solutions, such as sustainability-linked bonds or loans. Where a company has identified a shortfall on a material social issue and has committed to improving, a sustainability-linked structure with social key performance indicators (KPIs) can be a meaningful way to connect this commitment with financial incentives. These KPIs can range from access and affordability of essential services, such as health care, to reduced injury rates in high-risk industries, such as construction and manufacturing.

Looking at the sustainability-linked bond market, targets around workforce diversity, specifically gender equality, remain among the most widely used social KPI. This is often due to the ease of measurement and general market agreement over what constitutes an ambitious target, particularly in industries and companies with a highly imbalanced workforce. Other KPIs include affordable housing, often used by real estate companies, as well as sustainable procurement which can refer to a combination of environmental and social themes underlying procurement decisions. As always, materiality remains at the core of sustainability-linked bond and loan structures. The inclusion of these KPIs should only be considered if a social issue poses a core issue for the industry, or the company has highly ambitious existing social targets closely connected to the business strategy.

In the future, we expect to see increased focus on materiality requirements and pinpointing where the biggest social issues lie for a company, which then would result in a wider range of social targets used for financing products.

Many investors are already now requesting increased disclosure on social and governance themes and at least on the indicators (principle adverse impacts, or PAIs) mandated under the investor-focused Sustainable Finance Disclosure Regulation. These include violations of OECD guidelines and the UN Global Compact, gender pay gap, board gender diversity and exposure to controversial weapons. Looking ahead, companies are strongly encouraged to report on these metrics, as well as other material social issues where necessary. Companies which are not yet reporting on social metrics should be prepared to do so, at the latest with the onset of new sustainability reporting legislation CSRD.

We see the following as the main drivers of social disclosure over the coming years:

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more