- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaWhile the global sustainable bond market made a definite, if somewhat muted, return to growth in Q1 2023, the Nordic market stood out once again, showing strength despite some concerns carried over from 2022. With record sustainable volumes in Q1 and notable traction in the corporate Eurobond market, sustainable financing has found a successful home in the Nordics.

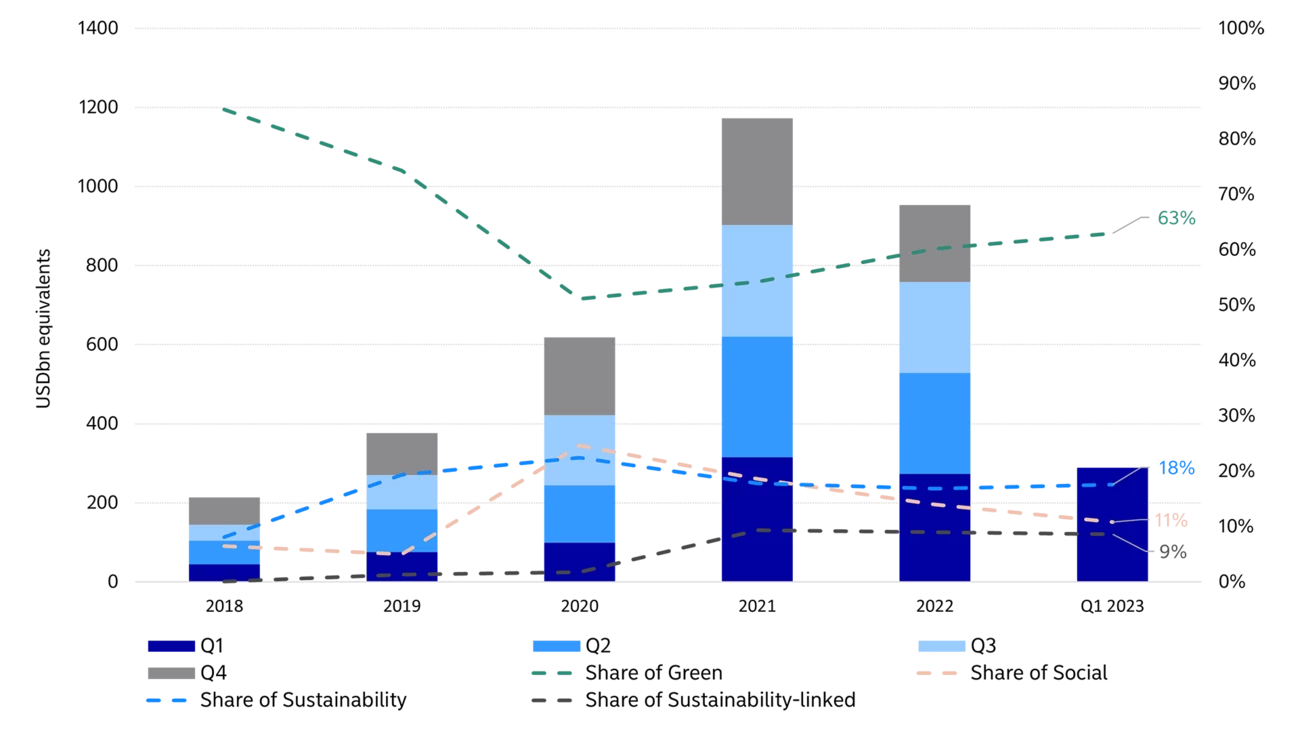

The global sustainable bond market is showing signs of recovery in 2023, with Q1 volume up by 5% compared to the same period last year. Despite the positive year-on-year trend, the Q1 volume failed to reach new highs in 2023, falling 9% short of the record Q1 sustainable bond volumes observed in 2021. This initial, yet dampened, recovery can be attributed to the macroeconomic challenges of 2022, such as rising interest rates, poor market liquidity and geopolitical uncertainty, carrying over into early 2023.

Source: Bloomberg, Nordea

Green bonds continue to lead the global market, with the format’s relative share increasing to 63% in 2023 from 2022’s full year figure of 60% and Q1 figure of 54%. This continued dominance has been supported by investors’ preference for tried-and-tested formats during times of economic uncertainty, as well as the clear link to impact that the use-of-proceeds format is able to provide.

The sustainability-linked bond format continues to hold the 9% share of sustainable bond volume from 2021. With fears of greenwashing and integrity lingering in the market, concerns about the limited impact of some sustainability-linked bonds have contributed to the stagnation in share of issuance seen globally. However, SLBs’ maintenance of share despite this criticism may indicate that it is poised for growth as the format matures.

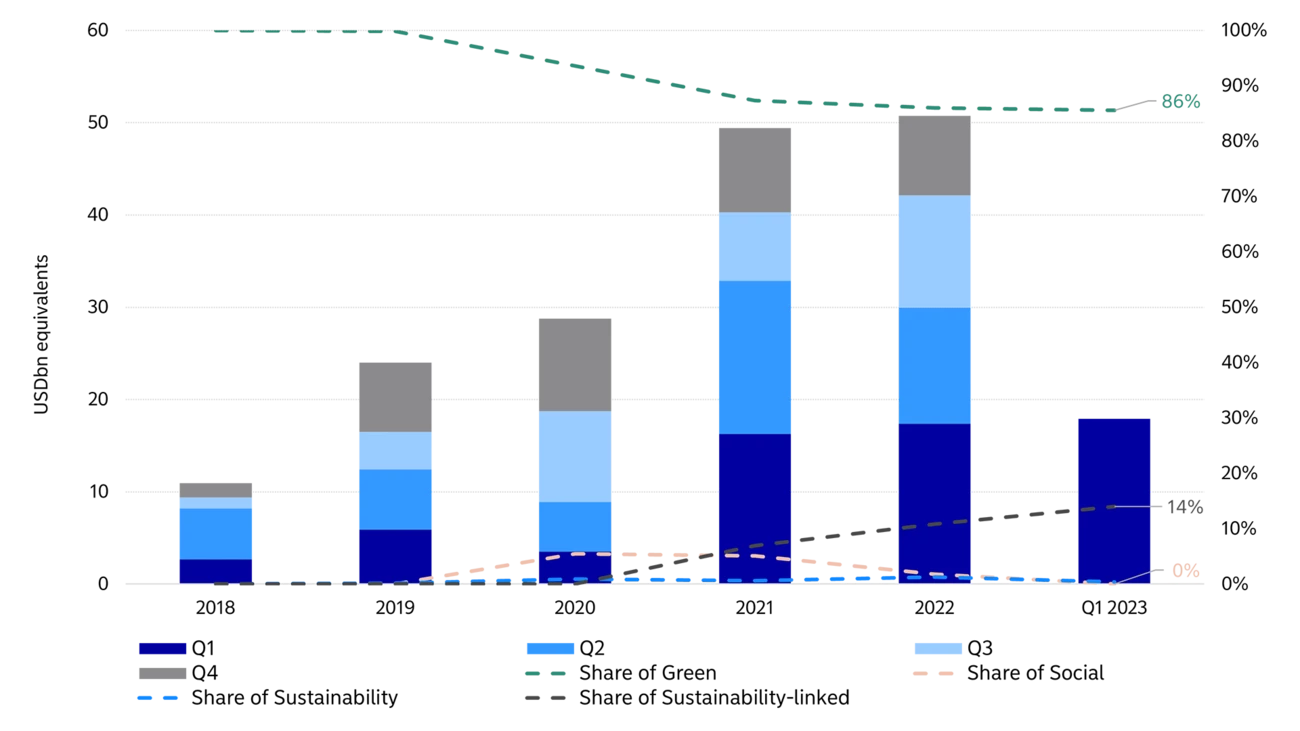

The Nordics saw an increase in Q1 sustainable bond volumes for the third consecutive year, bucking the global trend for the last two. The region’s record Q1 2023 volume was up 3% relative to the first quarter of 2022. Although this represents a slight slowdown from last year’s year-on-year growth of 7%, this relative stability and maintained growth demonstrate the strength of the region’s market as Nordic investors and issuers further embrace sustainability.

Source: Bloomberg, Nordea

Green bonds continue to dominate in the region, taking an 86% share of volume in Q1, maintaining their share from 2022. The remaining 14% of volume is comprised of sustainability-linked bonds, with social and sustainable formats not yet having been issued in the Nordics during 2023.

Although it is too early in the year to draw absolute conclusions, the first quarter issuance of sustainability-linked bonds, alongside the growth in share over the two previous years (volume shares of 7% and 11% in 2021 and 2022, respectively), indicates that the format is gaining a genuine foothold in the region. The history of corporate sustainability in the Nordics may be a factor in the region’s seemingly greater acceptance of the fledgling format. Established trust in companies’ sustainability efforts, high levels of transparency and well-established frameworks and regulations in the Nordics may help abate concerns over the format’s robustness seen on the global scale.

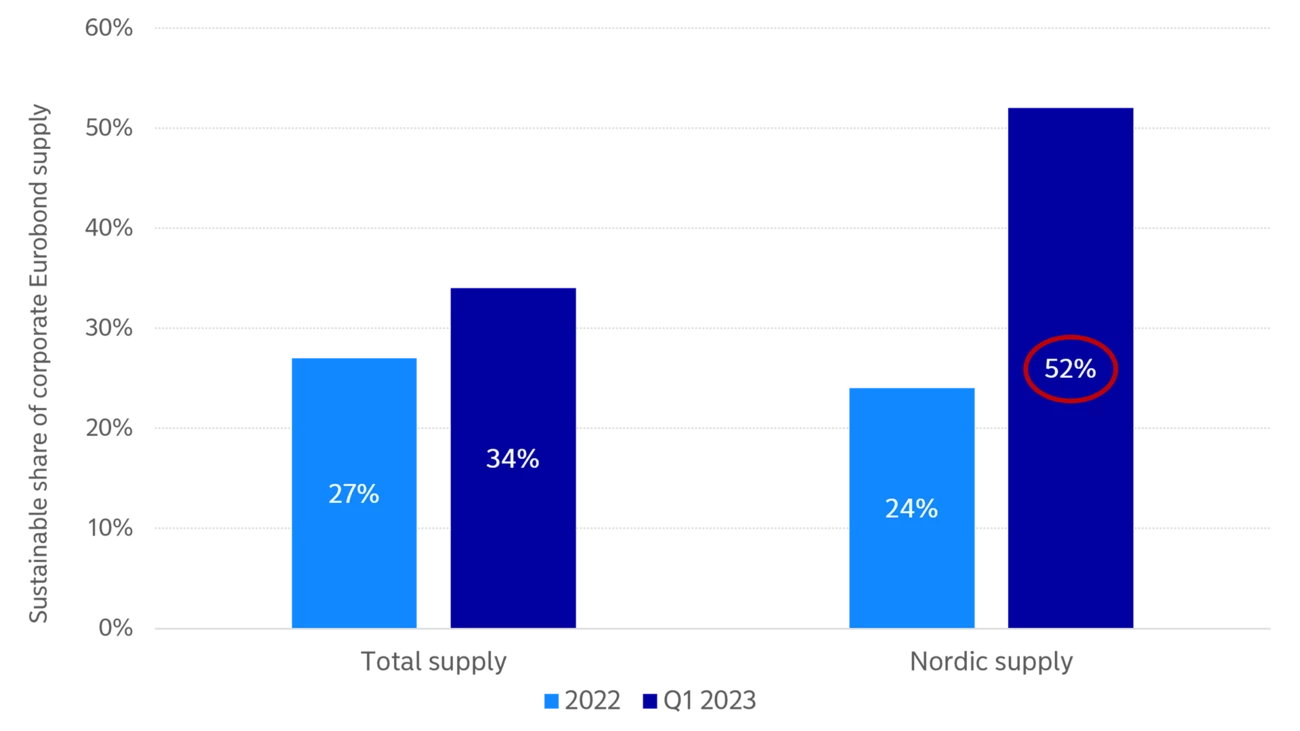

A surge in the share of sustainable bonds within the Nordic corporate Eurobond market brought the sustainability formats well and truly into the mainstream in 2023, surpassing the majority threshold for the first time. Now representing a 52% share of Nordic corporate Eurobonds in Q1 2023, up from 24% in 2022, the sustainable bond formats may soon be considered the norm if this trend continues.

The share of sustainable bonds also grew in the corporate Eurobond market as a whole, up to 34% from 27% in 2022. With the share of sustainable bonds still growing across the market as a whole, and not far behind the now leading Nordic corporate Eurobond market, it is clear that sustainable formats are here to stay.

Source: Bloomberg, Nordea

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more