For more information

On sustainable loans, contact Ebba Ramel.

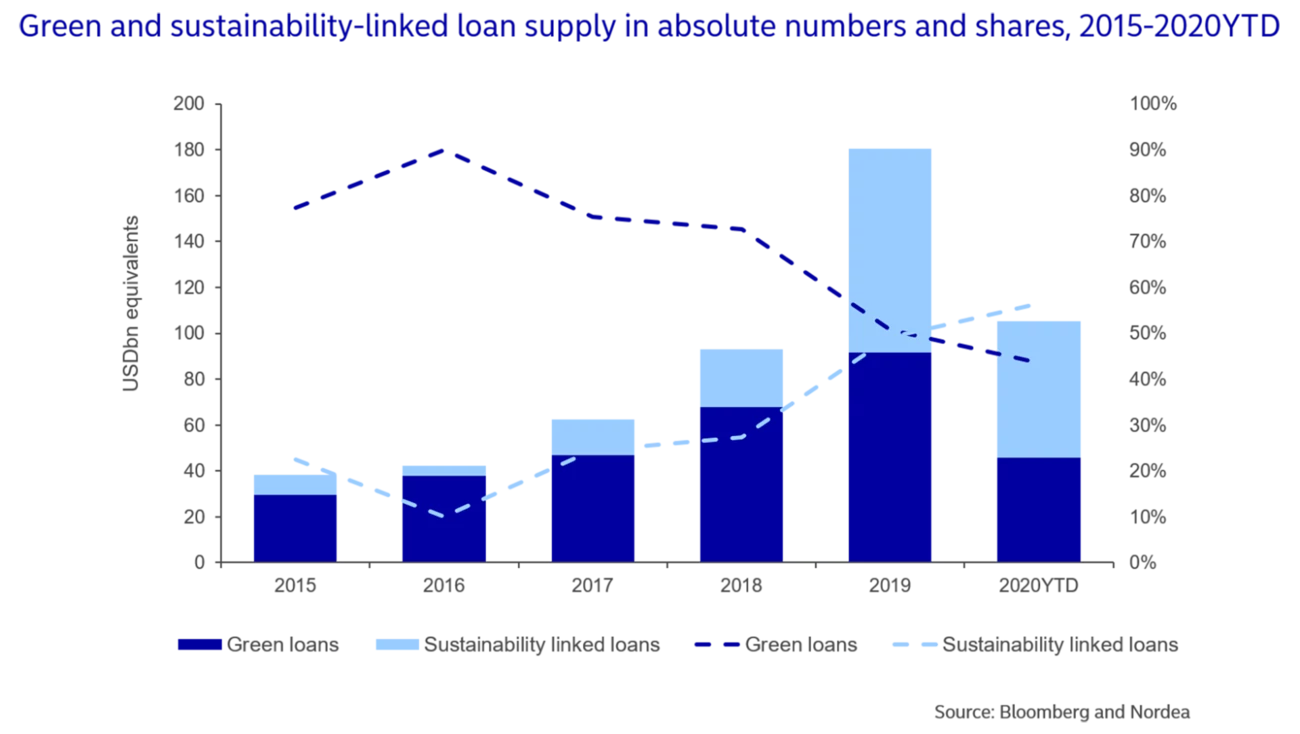

EmailSince the publication of the Sustainability-Linked Loan Principles in 2019, global sustainability-linked loan volumes have shot past green loan levels. Sustainability-linked loans provide a good complement to green loans for companies pushing a broader sustainability strategy and are a relevant alternative for entities within sectors that are not green by nature.

The sustainable loan market is a relatively young market. The two types of approaches used for structuring sustainable loans are green loans, which have to be used to finance pre-defined green assets and projects, and sustainability-linked loans, which allow the proceeds to be allocated to general purposes but give the borrower an incentive to fulfill pre-defined sustainability targets.

Prior to 2018, financial institutions used the Equator Principles to manage environmental, social and governance (ESG) risks within project finance, but there were no recognised market standards governing the wider sustainable loan market. In 2014, the International Capital Market Association (ICMA) published the Green Bond Principles (GBPs), indicating the direction taken by capital markets with regard to sustainable finance. In 2018 the Green Loan Principles (GBPs) were published by the Loan Market Association (LMA), the Asia Pacific Loan Market Association and (later) the Loan Syndications and Trading Association (LSTA), followed by Sustainability-Linked Loan Principles (SLLPs) in 2019.

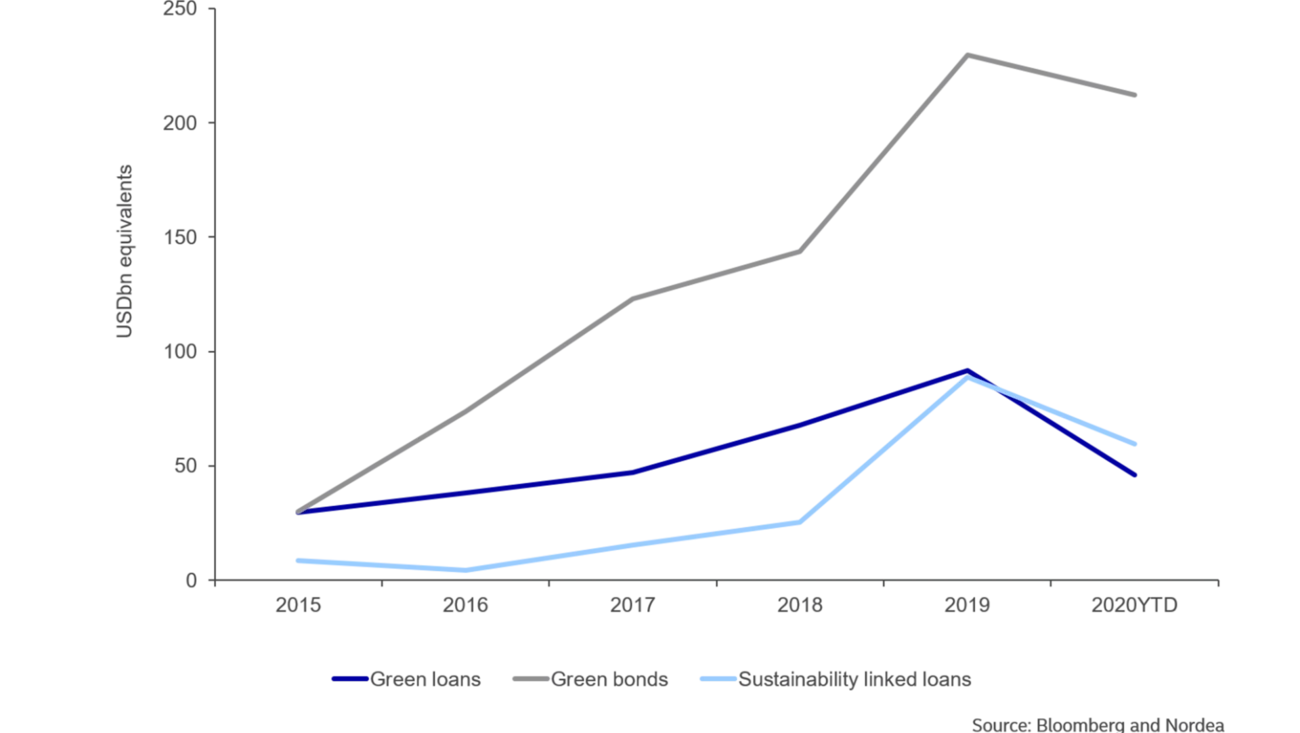

Green loans have been the preferred format in the sustainable loan market, mainly thanks to the early establishment of rules of play in the capital markets, which has provided guidance to the loan market. However, since 2018 and especially following the publication of the SLLPs in 2019, the sustainability-linked loan market has picked up at an impressive pace, surpassing green loan volumes in 2019.

The publication of the SLLPs certainly gave legitimacy to the market and credibility to the format, encouraging lenders and borrowers to set up these types of facilities. However, the recent increase in popularity of sustainability-linked loans can be traced to the surge in the green bond market over the last couple of years. The nature of green loans and bonds means that the formats compete over green assets and projects to be financed by green debt. If an asset or project is financed by a green bond, the same asset or project cannot be financed by a green loan. Because green bonds are public instruments, most entities prefer to use their limited amount of green assets and projects for issuing green bonds, with the communication and branding opportunities they bring. They can then complement the bond with a sustainability-linked loan facility to further push the entity’s overall sustainability strategy.

Comparing the top five sectors using the respective sustainable debt formats reveals some interesting findings. Close to 90% of green loans are raised by only five sectors, while that number is around 40% for the top five sectors raising debt through sustainability-linked loans.

|

Sustainability-linked loans |

|

Green loans |

|

|

Utilities |

14% |

Renewable Energy |

47% |

|

Transportation & Logistics |

9% |

Power Generation |

23% |

|

Chemicals |

7% |

Utilities |

8% |

|

Industrial Other |

6% |

Real Estate |

6% |

|

Food & Beverage |

5% |

Financial Services |

3% |

Source: Bloomberg and Nordea

Given that banks use green loans as a basis for their own green borrowing, the eligibility of assets and projects included in a green loan will depend on the lender’s definition of eligibility for its green borrowing. Green borrowers are therefore limited by the eligible categories in the GLPs as well as the lender’s own terms. The green loan format is evidently suitable for sectors with assets and projects that are green by nature, such as renewable energy, and sectors with established and broadly accepted methods for defining green, such as real estate.

The sectors raising sustainability-linked loans are more dispersed when it comes to sector type and share size. The format does not require a definition of green assets and projects to be financed but instead allows all types of entities to commit to sustainability targets that are linked to the terms of the debt. Any entity can improve within sustainability, given its broad meaning and application.

Sustainability-linked loans provide an alternative for borrowers in sectors that lack clear definitions of green, such as the food and beverage industry or companies within sectors that may not have green assets and projects but can decrease their environmental footprint, such as transportation and logistics. The format is also an alternative for entities pushing an overall sustainability strategy by combining raised green debt with a sustainability-linked loan, for example utilities investing in renewable energy solutions (green) and targeting a reduced carbon footprint (sustainability-linked).

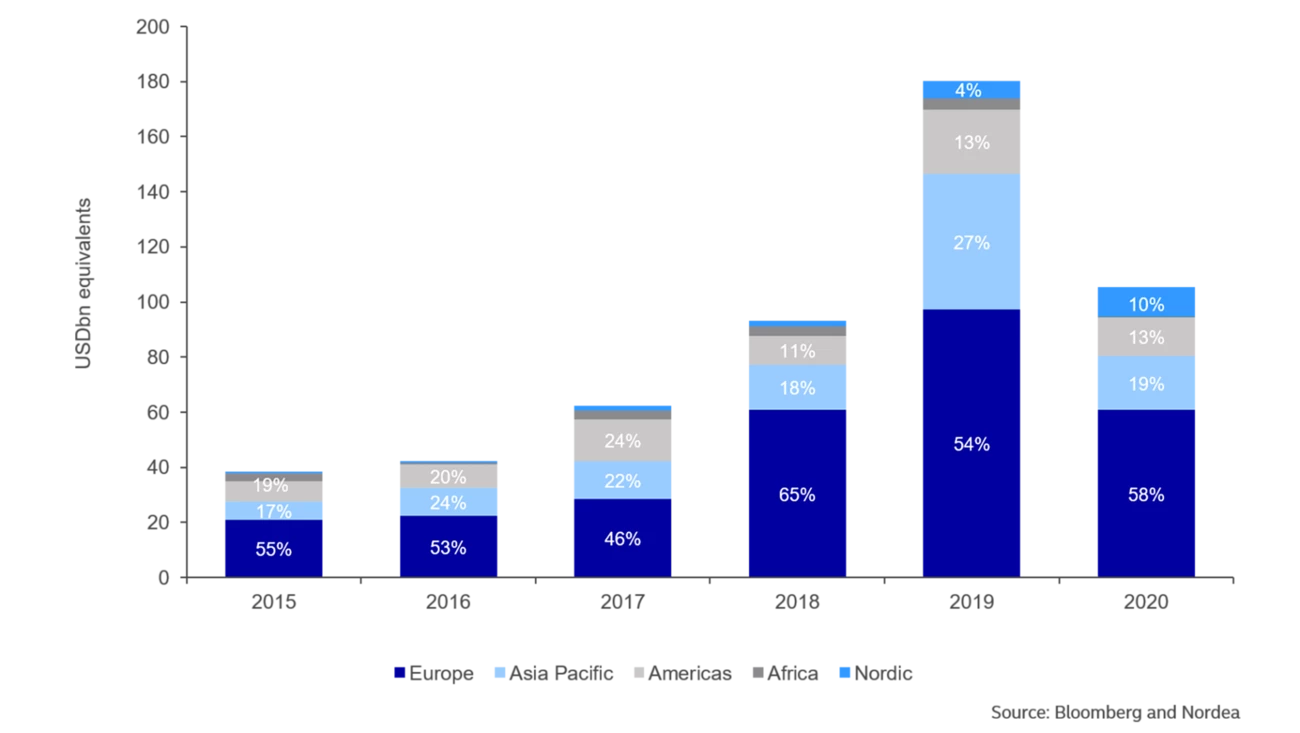

Sustainable loans are raised most actively in the European market, constituting about half of the market since 2015. Asia is the second largest market, and together the two regions make up 80% of the sustainable loan market in 2020.

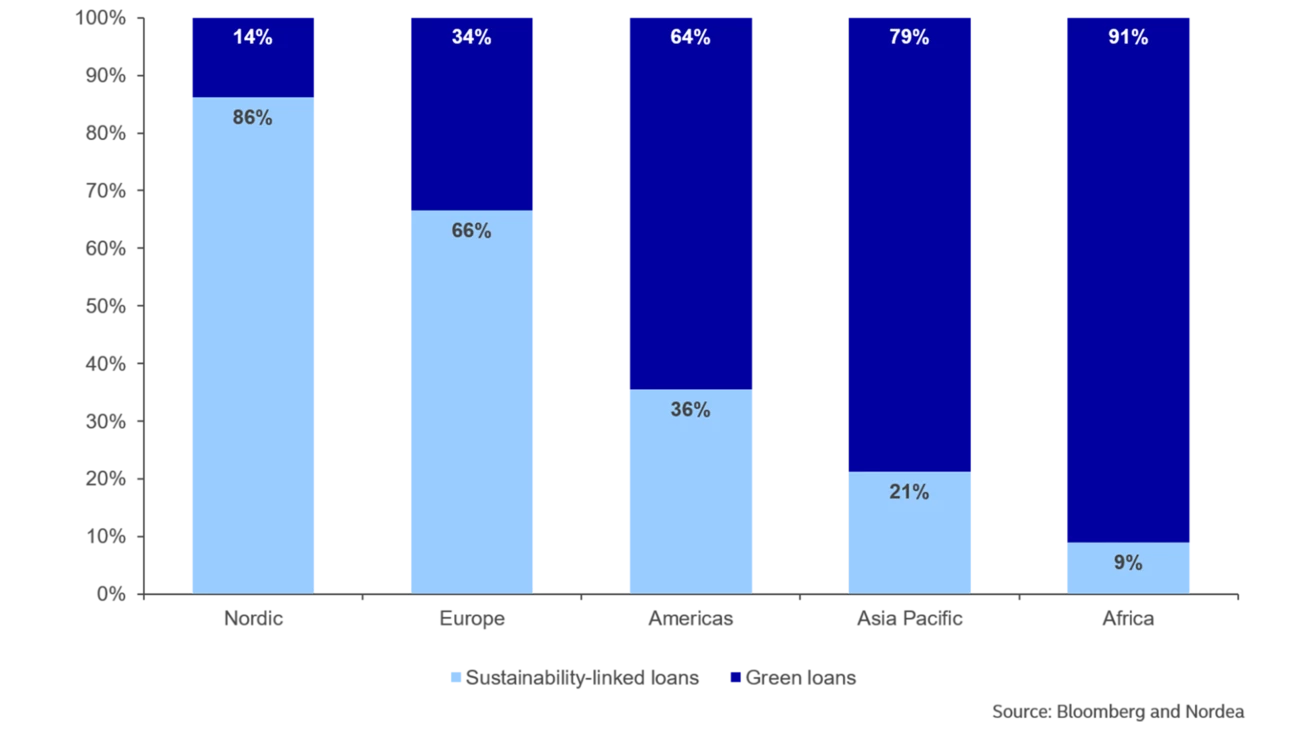

Digging into the characteristics of the respective regions’ sustainable loan market in 2019 and 2020, an interesting insight is that sustainability-linked loans are most popular in the Nordic and European regions, while the majority of sustainable loans raised in Americas, Asia Pacific and Asia are green loans. The majority of loans raised by the green lending regions are raised to finance renewable energy and power generation projects, while the European and Nordic sustainable borrowers come from a larger set of sectors, including not only renewable energy and power generation but also chemicals, telecom and pulp and paper, among others.

Since 2018, there has been a strong sustainability push from the EU, with initiatives such as the EU Action Plan on Sustainable Finance and the EU Green Deal, which aim to increase awareness of sustainability issues and shift capital towards sustainable investments. The larger share of sustainability-linked loans from a broader set of sectors in the European region during 2019 and 2020 signals that the transition towards sustainable investments has already begun.

Ebba Ramel is an analyst in Nordea’s Sustainable Bonds team.

Jacob Michaelsen is Head of Sustainable Finance Advisory at Nordea.

On sustainable loans, contact Ebba Ramel.

Email

Sustainable banking

Morningstar Sustainalytics has recently published a new report identifying companies that are taking steps to reduce emissions, set actionable targets and implement good governance practices. Nordea is highlighted for its significant progress in reducing emissions and its comprehensive climate targets.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more