- Name:

- Anna Westlund

- Title:

- Nordea Senior Analyst

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskSweden is facing a demographic shift. As population growth slows significantly, labour supply is holding back long-term economic growth in Sweden.

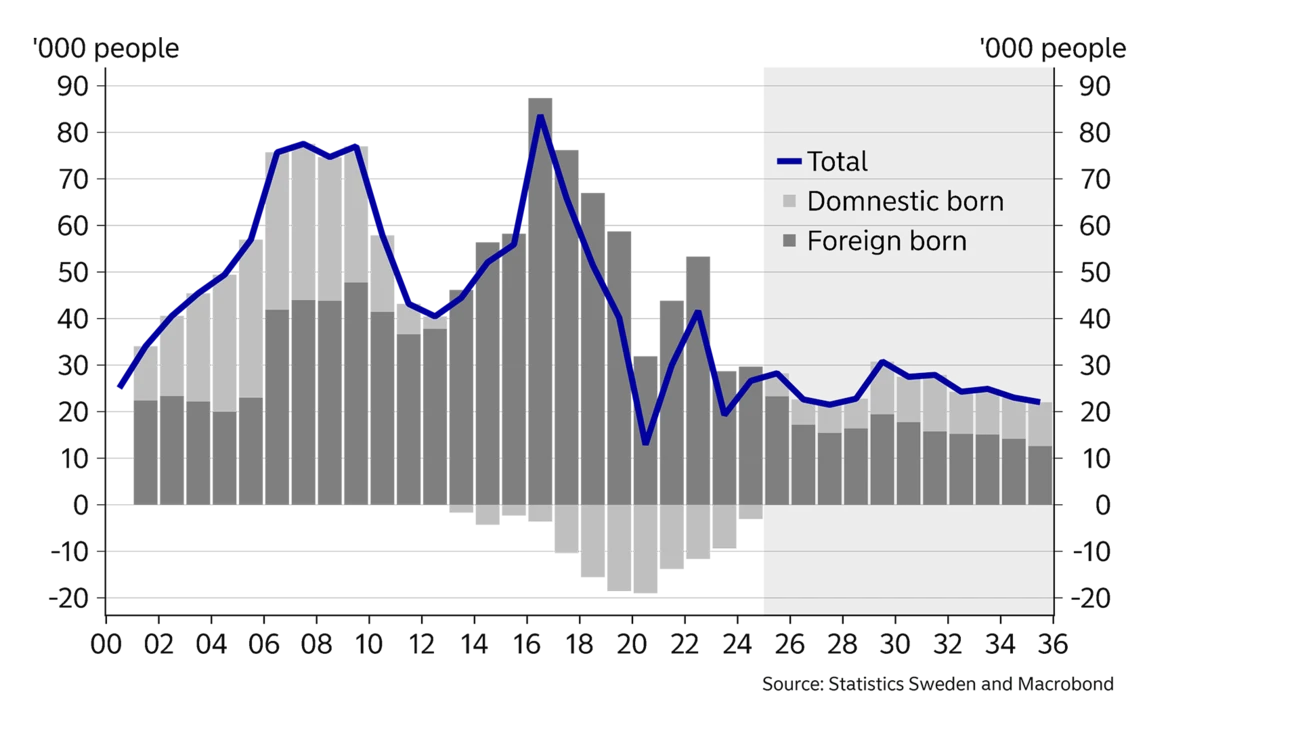

From 2000 to 2019, Sweden’s population grew by about 75,000 people per year on average. This is strong growth, both historically and compared to many other European countries. The increase in Sweden’s working-age population (15-74 years) has mainly been driven by immigration. The increase in the foreign-born population has thus offset the decline in the native-born population that has persisted for several years; see chart below. Immigration has now decreased, and the birth rate has fallen to a historical low. In combination, these factors have significantly slowed population growth.

Sweden is experiencing a demographic shift. Lower birth rates and an ageing population are a global phenomenon, and Sweden is not the only country experiencing slow labour supply growth. In some countries, it is even declining.

According to Statistics Sweden’s forecast, population growth will be low going forward. The population in Sweden is set to grow by a total of about 250,000 people over the next decade, or 0.2% on average per year, compared to close to a million, or 1% per year, during the 2010s. The explanation is still a low birth rate and low net migration. At the same time, life expectancy has increased. Consequently, an increasing proportion of the population consists of people who have left the labour market, and the dependency burden is growing for those who work. The working-age population will grow by about 25,000 people, or 0.3%, per year on average over the next decade, according to Statistics Sweden.

In the long term, economic growth is in part determined by the labour supply (labour force and hours) and how much is produced per hour worked (productivity). The foundation for economic growth is thus increasing labour supply or productivity growth. Productivity growth can vary greatly over time. In Sweden, productivity growth has averaged 1.5% per year over the past 40 years, thanks to technological advancements and higher education levels. However, since the financial crisis, productivity growth has been much weaker – just under 1% per year. Lower productivity growth is a global trend with no clear-cut explanation. Future developments are thus uncertain.

Lower population growth will hold back long-term economic growth in Sweden.

The labour supply is determined by population size, the proportion of the population that works and working hours. The labour participation rate in Sweden is generally high. Although there is room for higher participation within certain groups, the possibilities for further expanding participation are limited. Moreover, some groups work part-time and there is an ongoing debate in Sweden about reducing working hours, which, all else equal, would dampen the labour supply. In the long run, population growth is the main driver of the labour supply.

In Sweden, GDP growth averaged 2.2% between 2000 and 2019. During this period, the population grew relatively strongly, but a higher employment rate also contributed to growth. The long-term outlook for GDP growth is highly uncertain. But, given slowing population growth and limited room to further increase labour force participation, long-term GDP growth will decelerate. Productivity growth recovering to the historical average (1.5%) implies long-term GDP growth of about 1.8%, compared to the average of 2.2%. If productivity growth does not recover but remains at the average since 2000, growth is likely to slow further to about 1.3%. If the labour supply restrains growth, then productivity development accounts for a larger share of the overall growth.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more