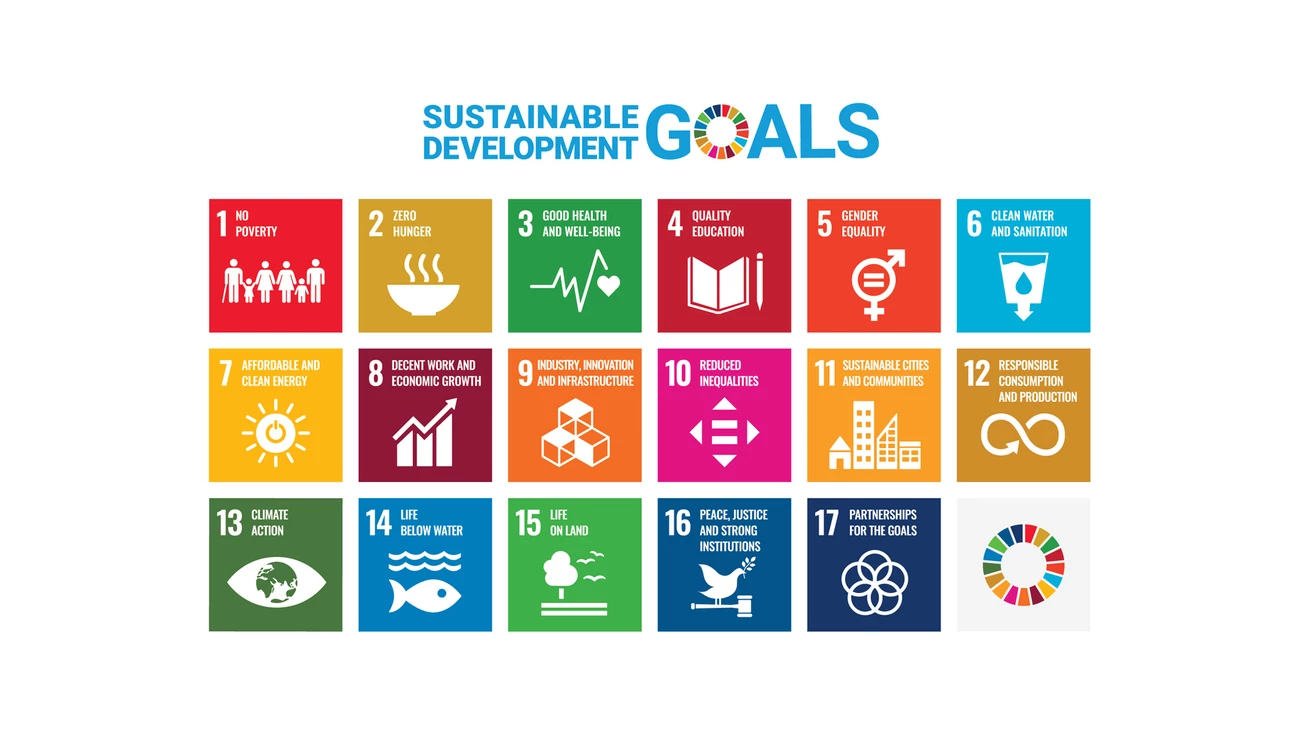

Sustainability at the core

At the global level, the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement set the general sustainability agenda as well as the more specific climate agenda. We have a key role to play in reaching society’s goals through redirecting investments and financing towards more sustainable technologies and businesses, and contributing to the creation of a low-carbon, climate-resilient and circular economy.