Source: Nordea, Bloomberg and ECB

This simple measure gives an initial indication that the ECB approach to decarbonisation may have already begun to impact the climate credentials of its corporate bond portfolios. Further, it is worth noting that the backward-looking emissions sub-score, which we have crudely replicated here, is only one of three components of the total climate score.

The inclusion of the 43% of issuers with "above median/lagging” emissions hints at the ECB’s desire to provide support for steady decarbonisation across the whole economy. Indeed, the desire to “at least not initially” divest completely from companies with high climate impact was highlighted in Isabel Schnabel’s recent speech at the International Symposium on Central Bank Independence. She emphasised that reduction incentives should be in place for these companies as they will be key in achieving a green transition.

A potential new chapter ahead in ECB's bond portfolio decarbonization efforts

Starting in March 2023, the ECB will begin reducing its balance sheet by €15bn per month until June, which means that ECB will not be fully reinvesting the maturing debt in its portfolio. Reallocated proceeds will continue to be favoured towards issuers with higher climate scoring profiles.

Returning to Isabel Schnabel’s speech as an ECB Executive board member, she noted that current efforts are “insufficient” to meet ECB’s decarbonization targets in alignment with the Paris Agreement, as the decline of the balance sheet from March onwards will have a diminishing effect. As ECBs main steering tool to decarbonize the bond portfolio is their tilting parameter, the existing flow-based approach should be replaced with a new stock-based approach. In practice the proposed approach would include active reshuffling of the bond portfolio towards higher climate scorers. The stock-based approach may also be applied to other private asset classes in ECB's portfolio, such as covered bonds and asset-backed securities, as well as public sector holdings which account for half of the ECB’s balance sheet.

While it is uncertain how the ECB's new policy will affect the broader picture, it appears that the ECB must make additional changes to its approach towards decarbonisation. After all, ECB representatives have stated that “greening monetary policy requires structural changes to the monetary policy framework rather than adjustments to the reaction function.”

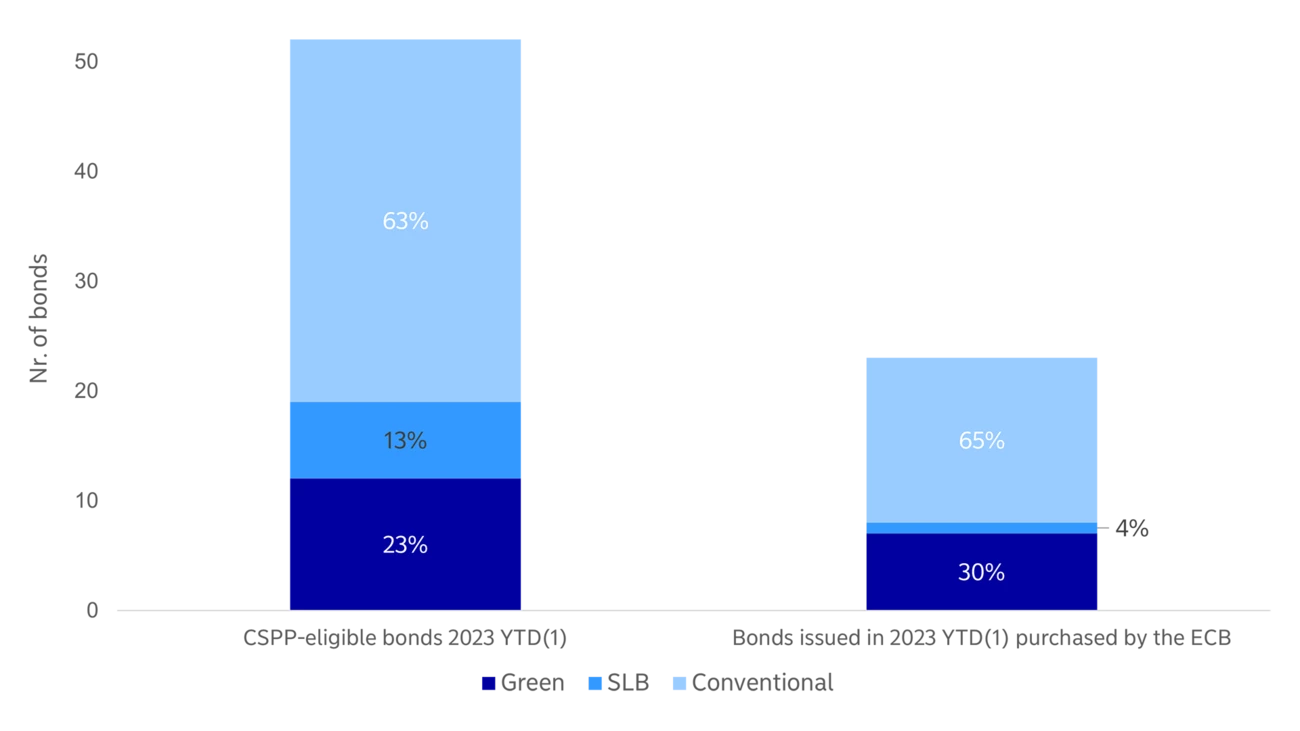

[1] Year-to-date: 21 February 2023

[2] A total of 3 issuers did not have a Bloomberg emission intensity score, and hence were excluded from the calculations.

[3] The scoring is based on data reported by issuers (metric tonnes of CO2 equivalent / $M of revenue) against industry peers (Bloomberg Industry Classification Standard Level 4). Leading/below median companies outperform peers' emission intensity performance.