3.3%

Expected global GDP growth in 2026.

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaTuuli Koivu, Philip Maldia Madsen, Jan von Gerich

The global economic outlook has continued to be rather stable, despite geopolitical uncertainty. However, the level of uncertainty continues to be high, and the confidence among corporates and households is repeatedly tested. We expect the central banks in all large economies to stand still in 2026, but volatility could be high both in the bond and FX markets.

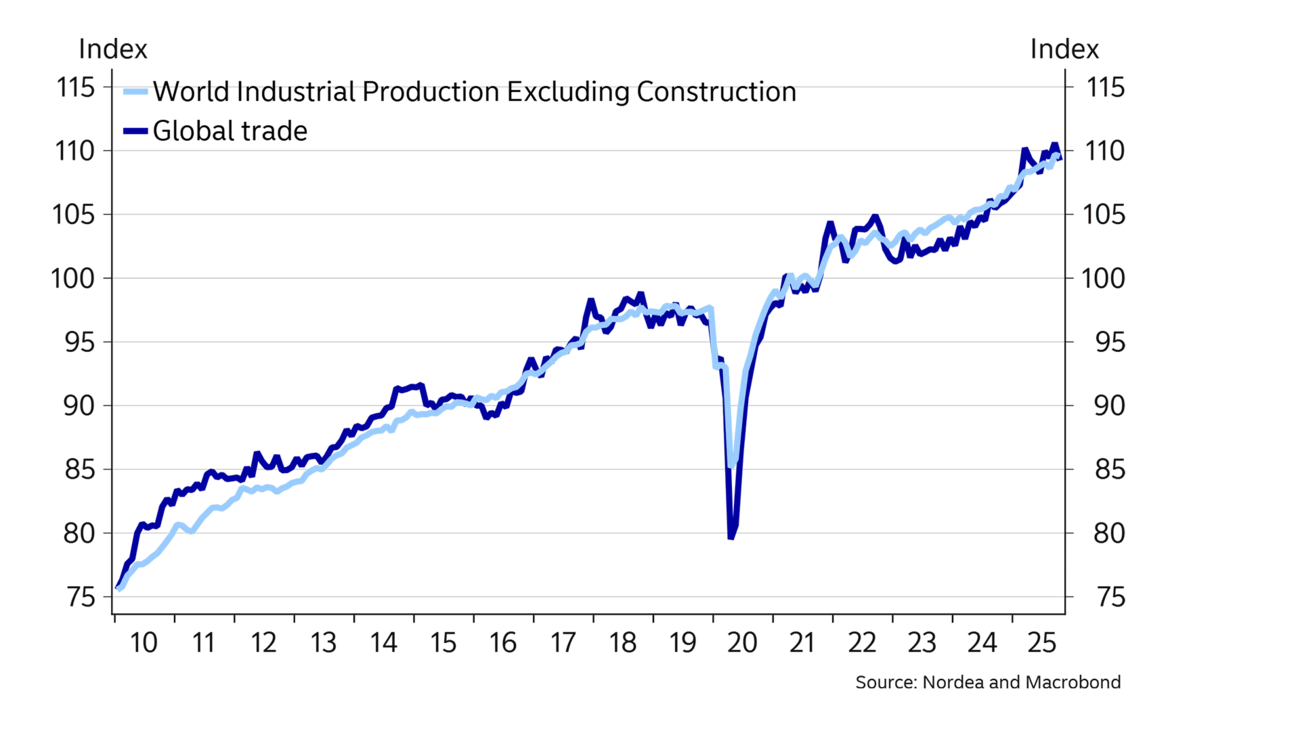

The global economy turned out to be resilient in 2025, despite the high level of geopolitical and political uncertainty. For 2026, we expect another year of relatively stable global growth, supported by loose fiscal policies, favourable financial conditions and rapid technological development.

At the same time, the global environment continues to be very uncertain, and the level of confidence especially among households is tested all the time. In the euro area, consumer confidence could finally improve and savings rates decline if the geopolitical environment turns out to be more stable than we now foresee. However, at the moment we do not see any signals of this type of positive development. In the US, by contrast, the savings rate is already low and weak consumer confidence implies that there is more room for negative surprises. In China, it remains to be seen whether the leaders will boost consumption via more fiscal stimulus than what we currently pencil in.

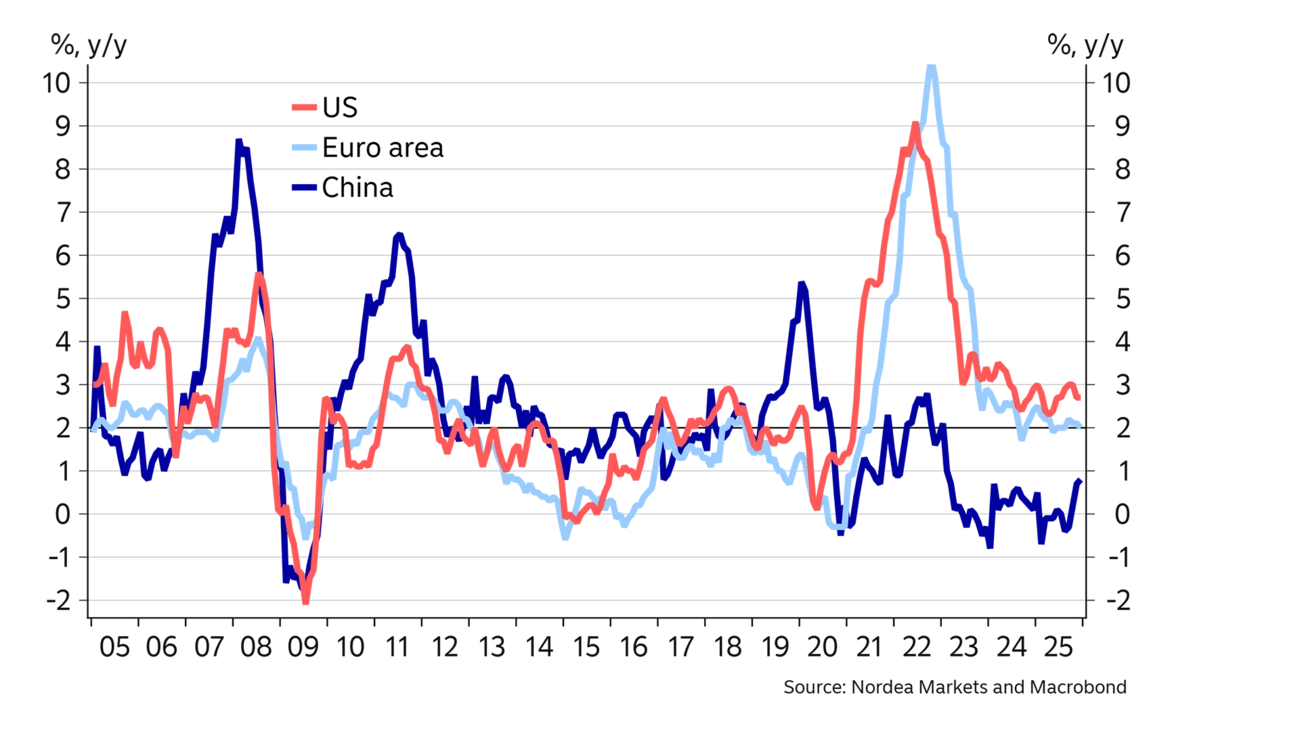

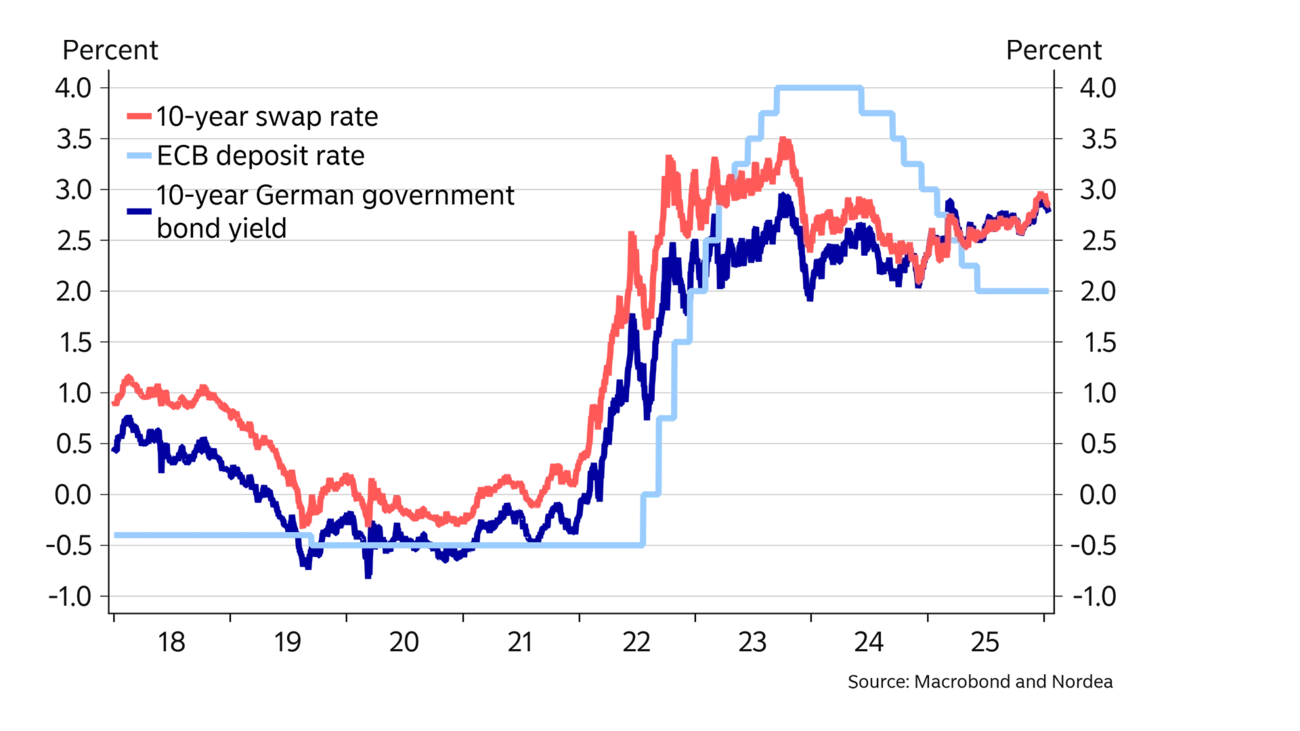

We expect all large central banks to stand still in 2026. In the euro area, the inflation outlook is stable. There are no signs that overly low inflation numbers will return, but on the other hand, slower wage increases and only marginally higher growth rates should also keep the upside risks related to inflation under control. Thus, the ECB can be confident with its current monetary policy stance. The outlook for the Fed is more challenging, given the scarce and somewhat contradicting data releases and the continuously higher-than-targeted inflation numbers. On top of low oil prices, one of the factors limiting global price pressures in the near term continues to be China’s overcapacity, which has caused tough price competition in many sectors.

3.3%

Expected global GDP growth in 2026.

3.3%

Expected German 10-year yield at the end of 2027.

62 USD

Expected oil price at the end of 2026.

In the US, the visibility around economic performance is still blurred by the government shutdown, which cancelled and delayed many data publications, but it seems that the overall tone of the economy continues to be strong. Productivity growth was robust last year, and the strongest part of the US economy continues to be the dynamic corporate sector, supported by rapid technological development, favourable financial conditions and deregulation. Households have continued to consume most of their income, but, given the low confidence, that may turn around. On the other hand, the approaching mid-term elections may encourage President Donald Trump to further boost the economy by e.g. offsetting the tariff increases for consumers, on top of the already loose fiscal stance.

Most analysts estimate that China’s growth in 2025 was slower than the 5% official number suggests. Domestic demand suffered from Chinese consumers remaining cautious, the ongoing downward trend in the housing market and the leaders’ aim to limit the problem of overcapacity by discouraging fixed investments in infrastructure and manufacturing. The bright spot of the economy has been the export sector, which benefits from extremely strong competitiveness, thanks to the weak CNY, negative domestic price pressure and rapid technological developments. The next five-year plan will be published in March, and it is already clear that the importance of self-sufficiency and high-tech remains high. The looming question is whether there will finally be more stimulus to boost consumption.

Euro area growth was more resilient than many expected last year, partly thanks to countries such as Ireland and Spain. The investment boost from Berlin should start to augment demand and boost growth also in the largest euro area economy in 2026. One of the major challenges in the euro area has been weak productivity growth since the pandemic. We expect Europe to slowly follow the development in the US and China and start benefiting from new technologies. In the best case, higher growth rates could materialise without widespread price pressure, if productivity accelerates. In our baseline scenario, the war in Ukraine continues. One upside risk for the euro area is that a peace agreement in Ukraine could strengthen confidence in the economic zone, reducing the currently high saving rates and boosting consumption and growth more than expected.

The environment remains highly uncertain, and the confidence of businesses and households is constantly being tested.

Our baseline forecasts of no ECB or Fed rate moves in 2026 could be taken as suggesting smooth sailing for the financial markets, but this is not even close to what is likely to play out. However, we believe that the threshold for the ECB to adjust rates this year remains relatively high, and we contend that the next move will be a hike, though not until 2027. Even another ECB cut is possible, though, if another increase in geopolitical tensions really hurts economic development.

The path for the Fed looks more uncertain this year, too, and we could easily see more rate cuts, if the US economy were to surprise to the downside. The most recent Fed meeting suggests that the Committee is quite divided on the monetary policy outlook and whether further rate cuts are needed.

Economic data distortions resulting from the federal government shutdown are a further complicating factor in trying to analyse the true state of the US economy.

Even if we are right about the central banks, longer bond yields could see considerable moves. In particular, longer US bond yields are drawn in different directions by downside economic growth risks and even more unsustainable fiscal policies, which should support higher term premia. Potential concerns about the Fed’s independence and questions around the status of the US as a safe haven could create additional uncertainty. We think the term premia argument will drive bond yields higher this year, but if the US economy starts to show signs of more significant weakness, then the cycle will also determine the direction of longer yields.

We furthermore expect euro-area bond yields to continue to rise on the back of an improving economic outlook and a bond market having to digest huge amounts of issuances at a time when the central bank is reducing its bond holdings.

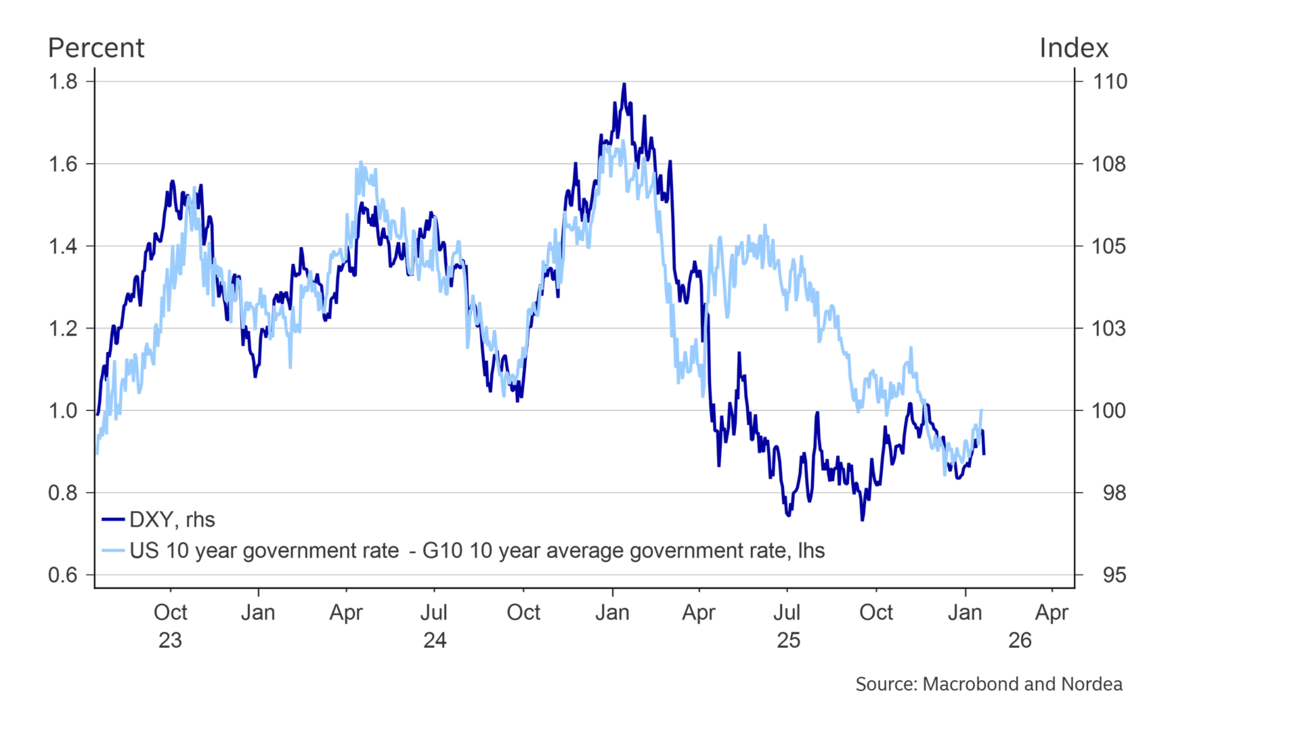

The dollar had a very difficult year in 2025. It weakened by 9% on a trade-weighted basis and 13% versus the euro. There was a sharp drop that took place in the first half of the year, followed by consolidation in the second half. This raised questions about the direction going forward, with some speculating whether the greenback will stage a comeback. Yet, we think the consolidation rather paves the way for further dollar weakness this year.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

|---|---|---|---|---|---|---|---|---|

| 2024 | 3.3 | 3.3 | 2.8 | 2.8 | 0.7 | 0.7 | 5.0 | 5.0 |

| 2025E | 3.3 | 3.1 | 2.2 | 1.9 | 1.5 | 1.2 | 5.0 | 5.0 |

| 2026E | 3.3 | 3.2 | 2.3 | 2.0 | 1.5 | 1.5 | 4.5 | 4.5 |

| 2027E | 3.2 | 3.2 | 2.0 | 2.0 | 2.0 | 2.0 | 4.0 | 4.0 |

| Year | EUR/USD | EUR/GBP | EUR/NOK | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

|---|---|---|---|---|---|---|---|---|

| 2024 | 1.04 | 0.83 | 11.24 | 11.48 | 3.00 | 4.50 | 4.58 | 2.36 |

| 2025 | 1.17 | 0.87 | 11.83 | 10.82 | 2.00 | 3.75 | 4.15 | 2.85 |

| 2026E | 1.24 | 0.88 | 11.25 | 10.50 | 2.00 | 3.75 | 4.50 | 3.15 |

| 2027E | 1.26 | 0.88 | 11.25 | 10.40 | 2.50 | 3.75 | 5.00 | 3.30 |

The US economy has proven remarkably resilient and fared much better than feared. Restrictive immigration policies and tariffs have clearly slowed down the economy, but surging investments in artificial intelligence have offset some of that drag and provided a new source of strength. Even so, it is evident that the days of exceptional growth are behind us, both in absolute and relative terms. Economic growth has clearly picked up steam in the rest of the world. Growth in Europe and especially Germany will likely accelerate even further this year, as fiscal policy is poised to deliver strong tailwinds.

As a result, we expect the economic gap between the US and the rest of the world to continue to narrow in the coming years, which would weaken the dollar further. The changing growth trajectory is also apparent in our central bank forecasts. The ECB will likely gradually shift towards a tightening bias before it begins to hike rates next year, while the Fed is likely to maintain an easing stance, but remain sidelined. We do not expect the Fed to lower its policy rate twice this year, as the market is currently anticipating. Higher interest rates could support the dollar, but with the bond market only pricing in two rate cuts, the effect would be limited. In addition, we do agree with the bond market that the balance of risks points towards a weaker economy and rate cuts, and not the other way around.

Beyond the macroeconomic backdrop, several flashpoints have the potential to trigger significant dollar moves just like last year. Institutional risks range from President Trump’s focus on influencing the Fed to the Supreme Court’s ruling on the legality of the reciprocal tariff programme. Either could erode confidence and raise the risk premium investors demand to hold the dollar, similar to what we experienced last year around Liberation Day, when the dollar weakened far more than interest rate differentials would suggest. That relationship has closed again, but could quickly reemerge if investors become nervous. A ceasefire between Russia and Ukraine is another important geopolitical risk, which could strengthen the euro and other regional currencies against the dollar.

Overall, we maintain our view that the dollar will weaken further over the next years, but expect more modest and gradual depreciation compared to last year. Several flashpoints could create larger fluctuations and result in an even weaker dollar.

This article first appeared in the Nordea Economic Outlook: Northern Lights, published on 21 January 2026.

Read more from the latest report

Economic Outlook

The increase in household saving has kept private consumption subdued in recent years. We examine how alternative assumptions about the savings ratio in the forecast years will affect consumption, employment and economic growth.

Read more

Economic Outlook

The global economy was characterised by a high degree of resilience in a tumultuous 2025, with the prospect of renewed growth in 2026. However, there are significant risks are associated with the unpredictable geopolitical situation.

Read more

Economic Outlook

In a world of political uncertainty, the Danish economy is well positioned to handle future challenges. The foundation lies in the labour market, where record-high employment helps ensure robust public finances.

Read more