- Name:

- Juho Maalahti

- Title:

- Head of Sustainable Finance Advisory, Nordea

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskThe green transition is progressing in an unstable global situation. In Finland and more widely in Nordics, emissions are decreasing, but global emissions continue to rise. A contrast in transition pace has emerged between Europe and the United States, highlighting divergent political climates. Some international banks and investors have withdrawn from sustainability commitments, and the growth of corporate emission reduction pledges has slowed. However, sustainable finance continues but is changing form.

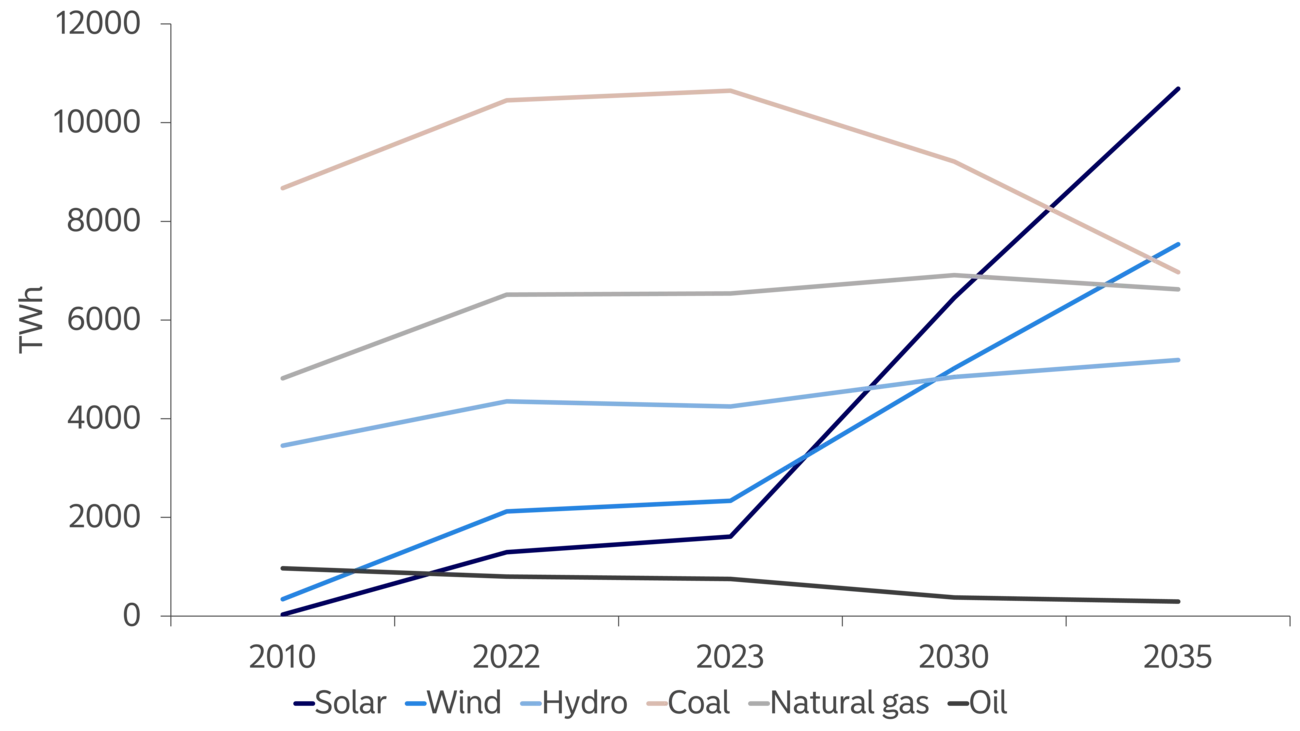

The green transition is progressing despite geopolitical uncertainty and climate policy fluctuations. Global investments aimed at reducing emissions hit record levels in 2024.

However, emissions are still rising globally, with no clear sign of the rapid decline needed to meet Paris Agreement goals. Last year, the Earth's average temperature exceeded 1.5°C above pre-industrial levels for the first time.

Europe and the United States are moving at different paces in this transition, reflecting their distinct political climates. Despite strong rhetoric, U.S. energy sector emissions are still projected to decrease by 2030. Meanwhile, technological competition with China is intensifying, causing the EU's political focus to shift towards domestic production and reducing dependencies.

Geopolitics now drives markets, and in the US especially, climate policy that changes dramatically with each election cycle creates significant short-term uncertainty. This makes decision-making challenging for companies and investors alike.

How then do these global trends and green transition drivers play out in the Nordic countries? Currently, these nations seem capable of following the emission reduction path required for the 1.5°C scenario. However, physical climate risks are progressing towards 2050 on a path well above 2°C of warming. This scenario demands significant investment in both emission reductions and adaptation. At the same time, risks of supply chain disruptions and cost increases, particularly through raw material prices, are growing.

In Finland, the green transition is advancing rapidly. Domestic greenhouse gas gross emissions have halved over the past 20 years. Energy production has seen the most significant progress, with fossil fuel use in both electricity and district heating production significantly reduced from previous levels.

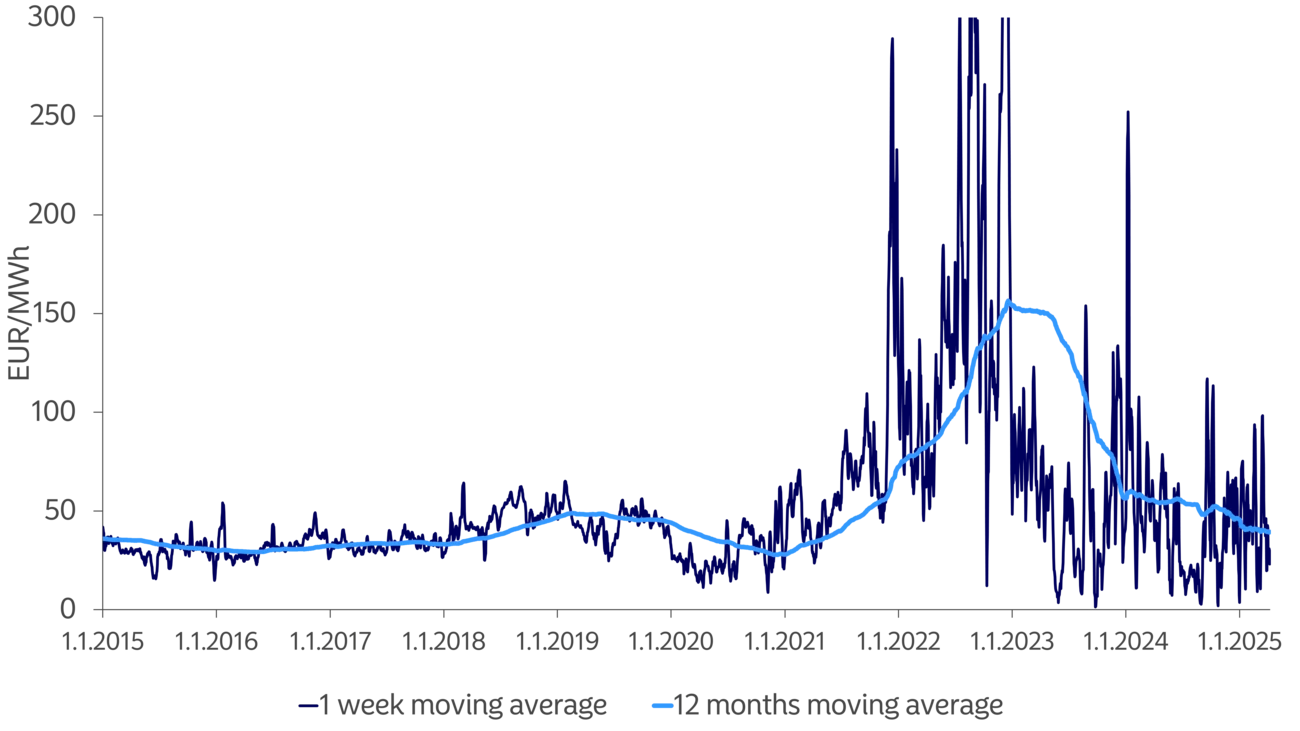

For electricity, the reduction in emissions has not brought higher prices, but price fluctuations have increased significantly.

For electricity, the reduction in emissions has not brought higher prices, but price fluctuations have increased significantly. The focus in the electricity system is now shifting to consumption flexibility and adjustable production capacity. Clean, affordable electricity is attracting energy-intensive investments to Finland, especially data centers. However, Finland should ensure that these investments bring more added value than just electricity sales. There’s a risk of Finland being relegated to a primary producer role in these high value-added services.

In transportation, the shift to electric vehicles has been hampered by a lack of affordable options and weak economic conditions. However, technological advancements and falling battery prices continue to reduce the production costs of electric vehicles, providing economic incentives for electrifying transport. The same applies to housing energy efficiency. Energy renovations that bring comfort and cost savings typically also lead to reduced emissions. Finland must ensure that future economic incentives for the green transition are properly set, enabling consumers, businesses and markets to drive progress.

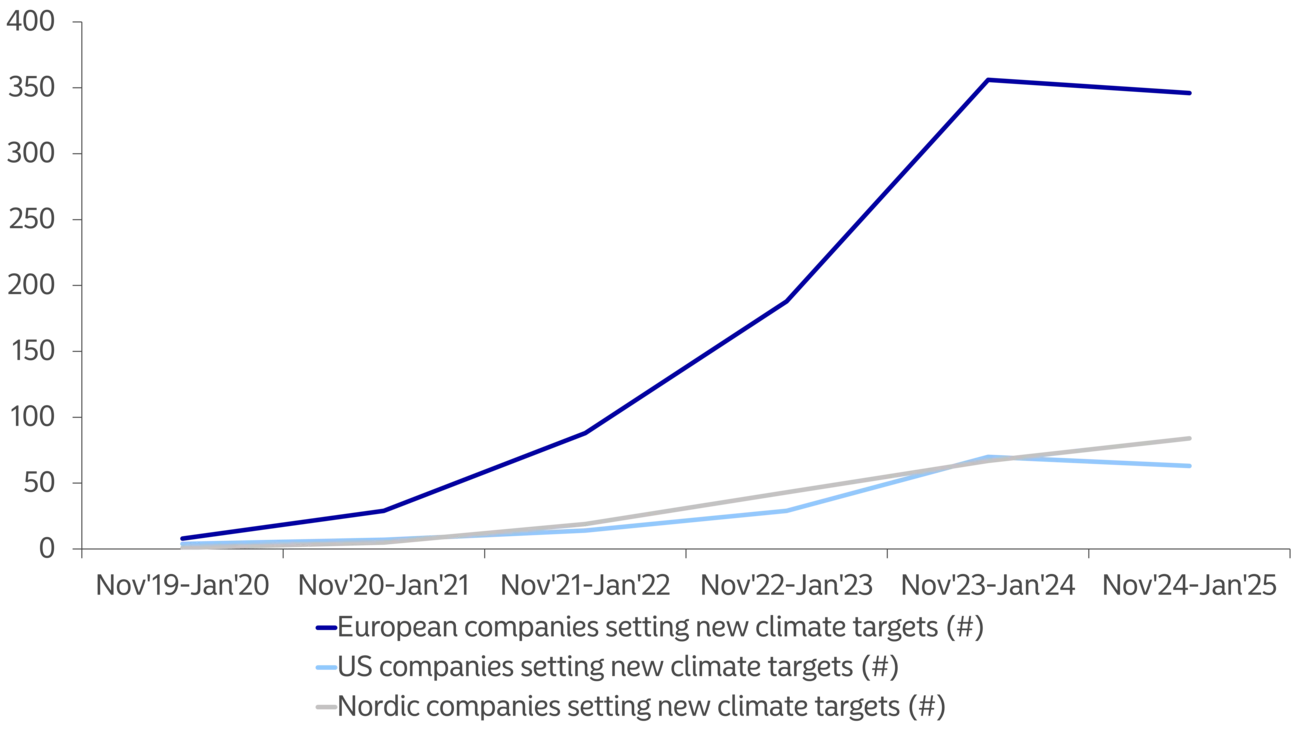

In Europe and particularly in the United States, new emission reduction targets set by companies are declining compared to a year ago, but Nordic companies remain committed to their emission reduction targets and continue to set new targets as in previous years.

Some international banks have withdrawn from various sustainability commitments, and several large players have stepped back from joint climate initiatives in financial markets. The impact on the green transition and sustainable development focus has been limited, especially in Europe.

While changing political atmospheres and tightened European regulation have added complexity, projects supporting the green transition remain attractive financing targets.

New corporate emission reduction targets are declining in Europe, and more notably in the United States, compared to last year. On the other hand, Nordic companies remain committed to their emission reduction targets and continue to set new targets, as in previous years. This is a concrete example of the difference in transition pace, particularly between the Nordic countries and the US, underscoring regional differences in climate action commitment.

This article first appeared in the Finnish Green Transition report published on 29 April 2025. Read the whole report here in Finnish.

Sustainable banking

Morningstar Sustainalytics has recently published a new report identifying companies that are taking steps to reduce emissions, set actionable targets and implement good governance practices. Nordea is highlighted for its significant progress in reducing emissions and its comprehensive climate targets.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more