- Name:

- Marco Kisic

- Title:

- Head of ESG Research, Nordea Equities

Marco Kisic

Nordea Equity Research’s annual ESG ratings for approximately 300 companies reveal ongoing progress, but with noticeable impacts from challenging macroeconomic conditions.

Nordea Equity Research annually publishes ESG ratings for the 300 companies in our universe, ranging from AAA to CCC, based on a proprietary model. This year’s ratings, drawing from full-year 2024 reported data, indicate continued ESG progress, albeit with complications arising from economic headwinds and the introduction of the Corporate Sustainability Reporting Directive (CSRD).

The slower macro environment has, in many instances, reduced economies of scale, resulting in a higher environmental impact per economic unit. Furthermore, some countries and companies faced their first year of CSRD adoption. Paradoxically, we observed a slight decline in environmental disclosure rates for the first time in our records, dropping from 73% to 72% of our collected metrics.

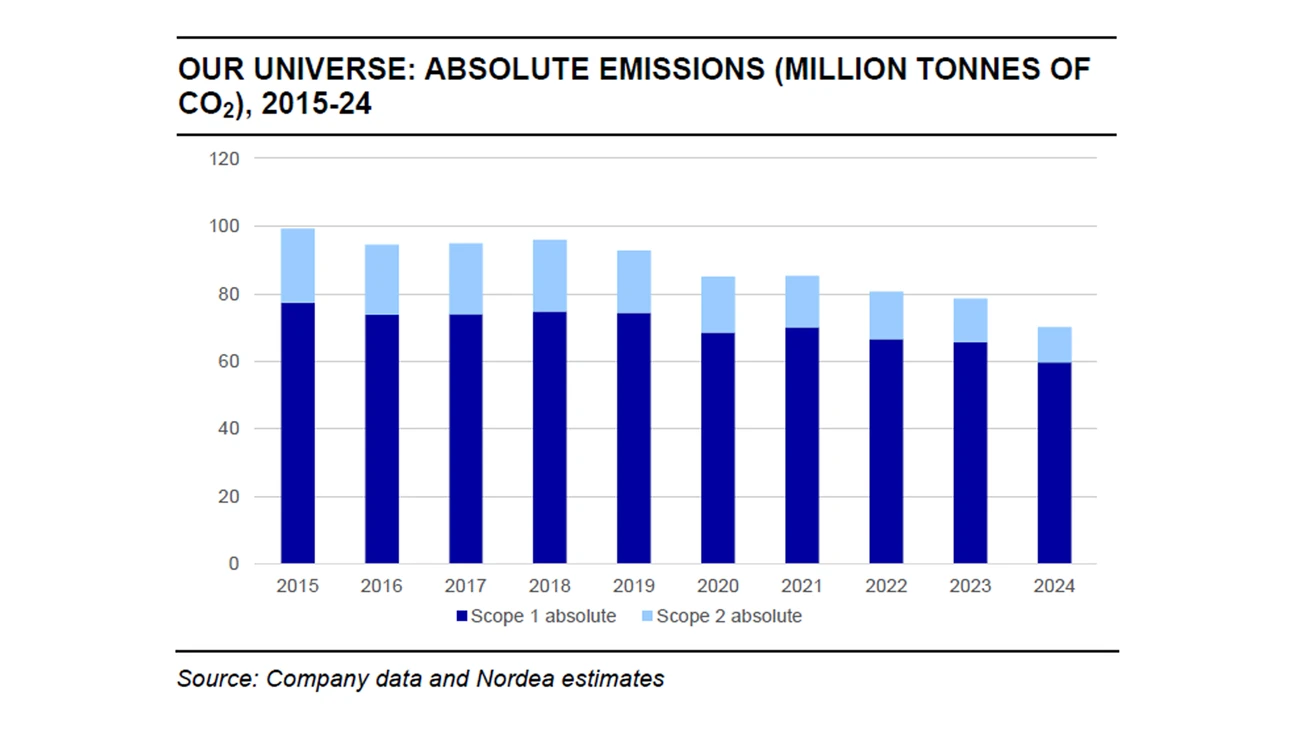

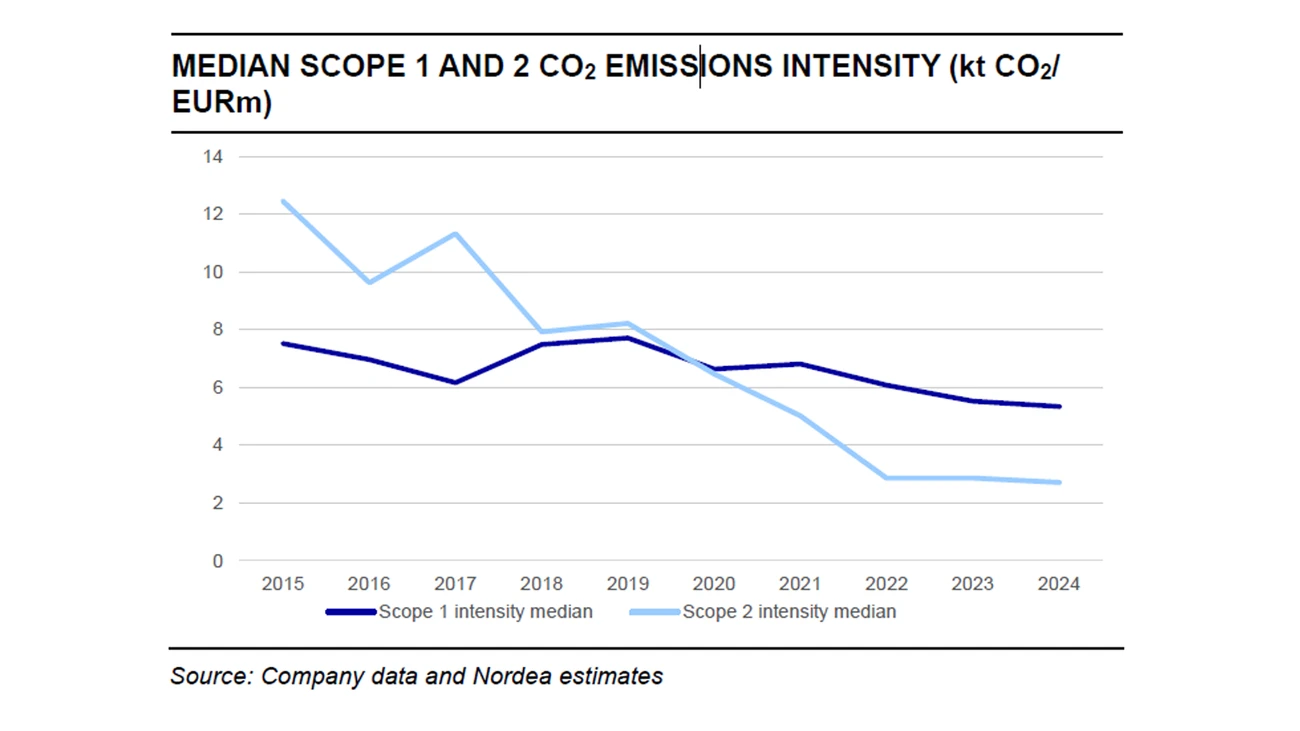

Greenhouse gas emissions across the company universe continued to decline, with absolute emissions in Scope 1 and 2 down 11% year-on-year. However, this reduction partly reflects an overall slowdown in activity. Emission intensity decreased by only 4% year-on-year, a slower rate than in previous years, mainly due to flat Scope 2 emissions. Water and waste intensity increased for the first time, although this could be partially attributed to the lower disclosure rate, potentially distorting the snapshot.

Gender diversity remained relatively stable year-on-year for staff (34%) and boards (40%) but improved for management (now at 30%). The median CEO compensation increased by 12% year-on-year, and more companies are linking their CEO compensation to ESG (64%, up from 44% last year).

Disclosure rates in our universe were affected for the first time by the introduction of CSRD in some countries, especially Finland and Norway. On the one hand, small companies continue to improve their reporting standards, sometimes from very low levels, which improves the overall average reporting rate. On the other hand, 2024 marked the first year when some companies began to report in line with the CSRD. Often, this has translated to lower disclosure rates, as companies stopped reporting on metrics not considered material. Environmental disclosure came down slightly year-on-year, from 73% to 72%, for the first time in over a decade of tracking ESG metrics.

CSRD adoption was highest in Finland and Denmark and lowest in Sweden among the Nordic countries. Paradoxically, this reduced the comparability within our universe, particularly affecting the environmental and social metrics, including water, waste and sickness absence rates.

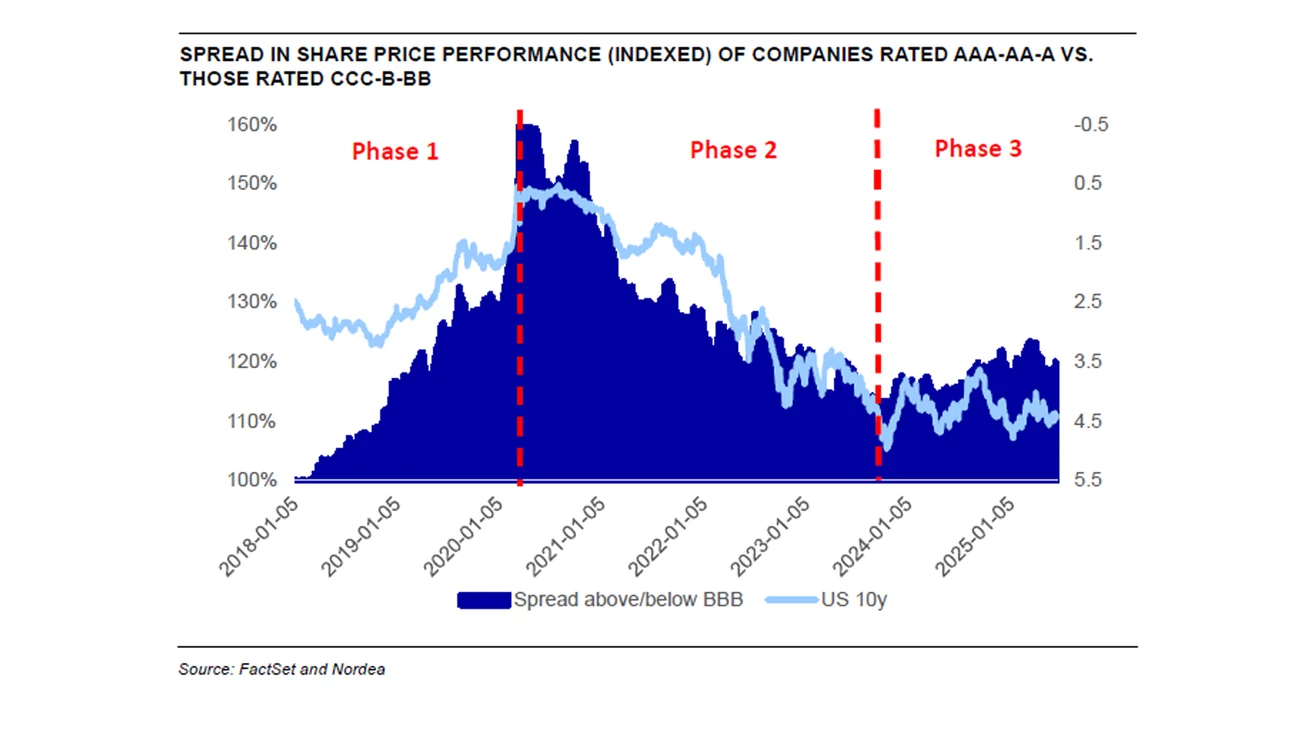

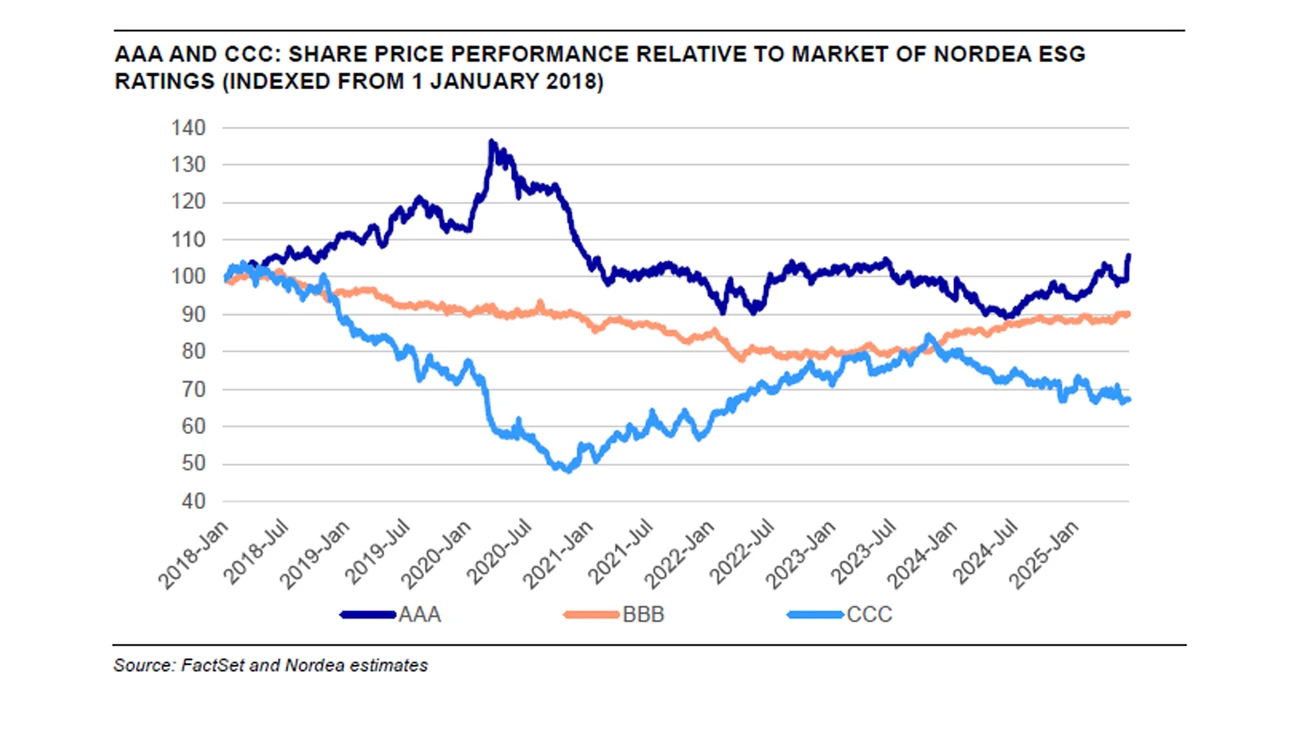

Our back-testing of ESG ratings against share price performance suggests that we are in a new phase of moderate outperformance for companies with better ESG ratings.

After several years during which interest rate trends dominated ESG performance (+21% per year in 2018-20 and -12% per year in 2021-23), our 2025 assessment appears to confirm what we had anticipated last year – that a more stable interest rate environment is supporting moderate ESG outperformance.

In 2024-25 year-to-date, companies with better ESG ratings outperformed those with worse ratings by 6% on an annualised basis. This outperformance is especially driven by spread between AAA vs. CCC-rated companies (+15% year-to-date), with our upgrades and downgrades also contributing to the performance differential.

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read more

Sustainable banking

Morningstar Sustainalytics has recently published a new report identifying companies that are taking steps to reduce emissions, set actionable targets and implement good governance practices. Nordea is highlighted for its significant progress in reducing emissions and its comprehensive climate targets.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more