- Name:

- Torbjörn Isaksson

- Title:

- Nordea Chief Analyst

Rate hikes and high inflation are putting a damper on the Swedish economy, and unemployment will rise. A stabilisation is expected during 2024, but the recovery will be slow as the economy gradually adjusts to higher interest rates. After swift tightening this year and early next year, the Riksbank will leave its monetary policy unchanged in the coming years. The situation is uncertain with many dark clouds on the horizon.

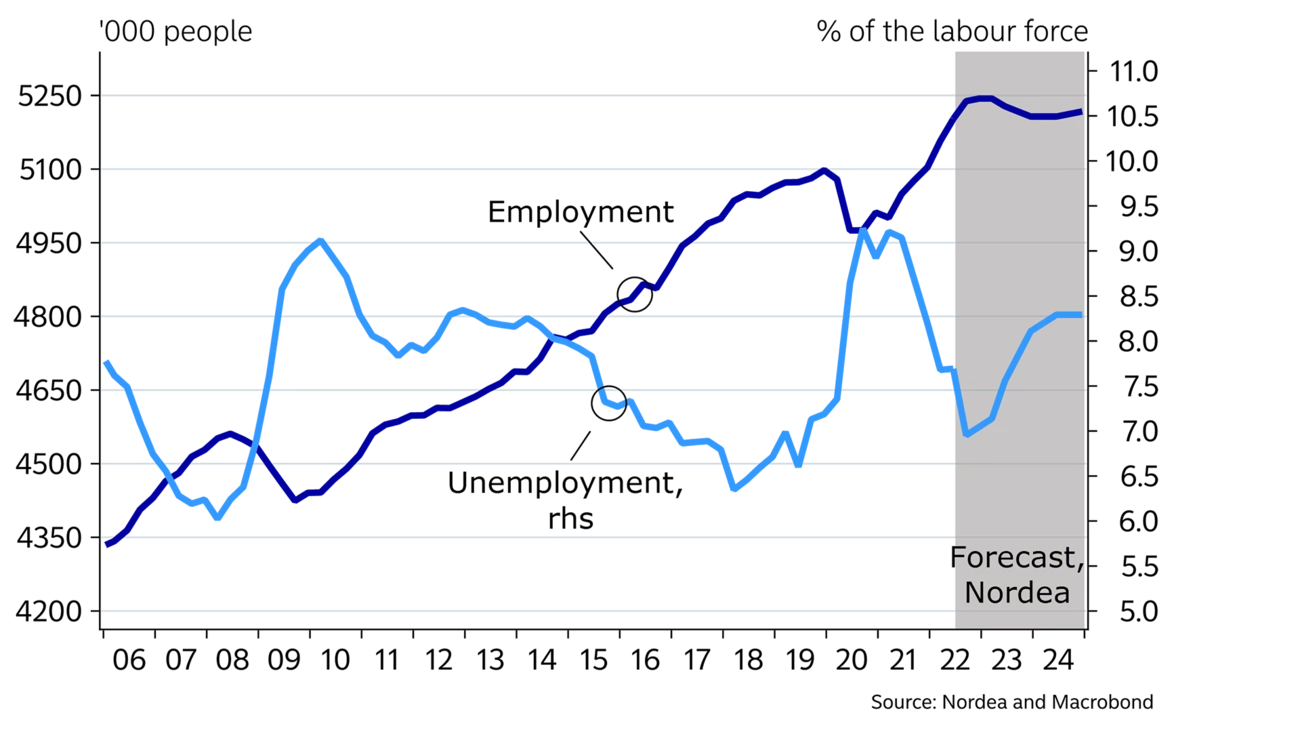

The Swedish economy is stronger than it has been for decades. In particular the labour market is overheated. The employment-to-population ratio is at a high since the early 1990s, with all regions and sectors experiencing labour shortages.

The Swedish economy will enter a new and significantly weaker phase next year. GDP will stagnate and the demand for labour will fall due to the dramatic change in financial conditions and the high inflation. The upswing in rates is both unexpected and rapid, and after a shaky 2023, the economy is expected to stabilise during 2024.

The very strong position makes it difficult to estimate when the downturn will become more pronounced and how resilient the economy is. Risks are tilted to the downside as growth prospects have changed in several ways, which could trigger negative dynamics and worsen the situation. The main risks are related to the rising interest rates and the housing market. Rising energy prices, the war in Ukraine and the tense security policy situation in Taiwan all contribute to the grim outlook as well.

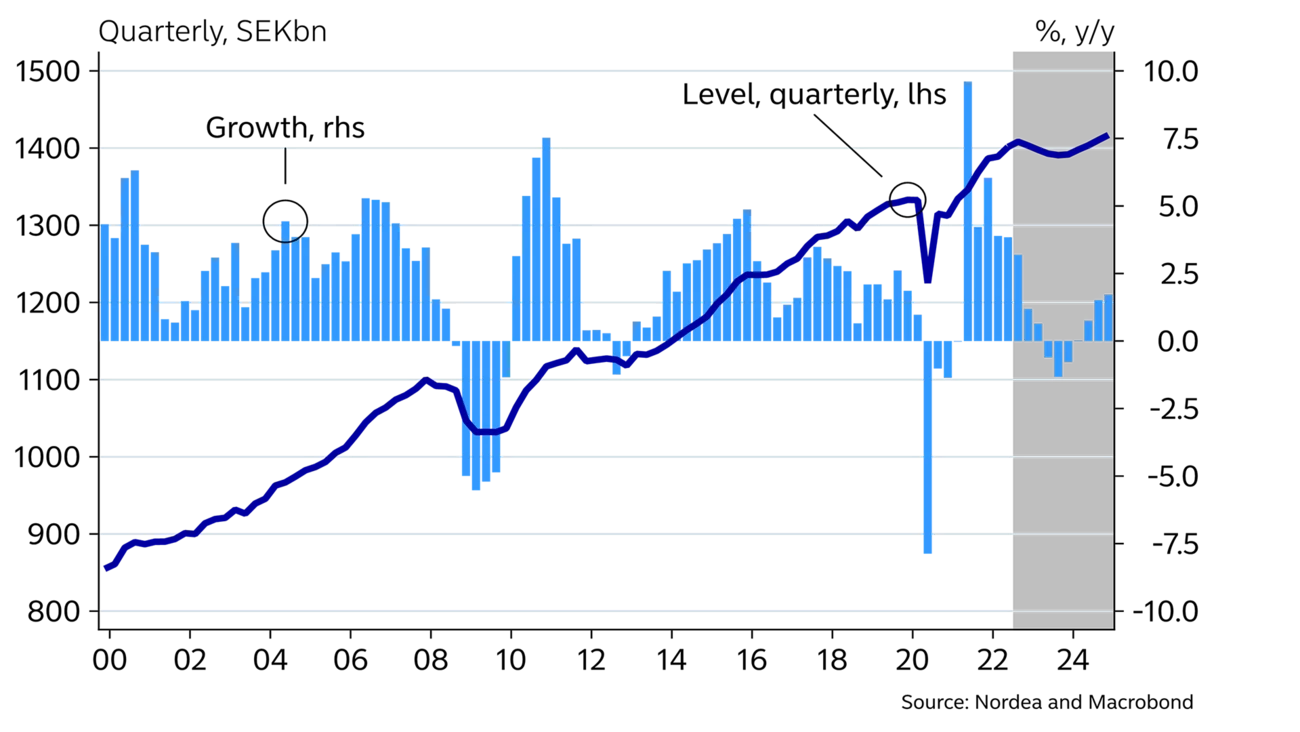

Households, the core factor of domestic demand, are under pressure. Ahead of 2022, household finances were very strong thanks to rising asset prices, good income growth and high savings. Households used their financial power during the first half of this year and consumption grew rapidly despite the gloomy sentiment. During the second quarter, household consumption was 6% higher than the year before. Measured at current prices, the increase was a hefty 12%. The fact that 2022 is the first year after the pandemic with almost normal conditions has likely also boosted household spending.

It is difficult to estimate how long households can and will maintain a high spending level. Households will face many challenges this year: high inflation is eroding purchasing power, interest costs are rising fast, home prices are dropping and stock market declines are reducing wealth. Moreover, the personal financial savings ratio fell below zero already during the first half of this year.

A simple calculation shows that a family with children with an adjustable-rate home loan of around SEK 3m will see expenses go up by around 20% during the course of 2022. This is equally due to high inflation and rising interest rates and clearly shows that many households will face drastic changes to their finances.

SWEDEN: MACROECONOMIC INDICATORS

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP (calendar adjusted), % y/y |

-2.4 |

4.9 |

3.0 |

-05 |

1.0 |

|

Underlying prices (CPIF), % y/y |

0.5 |

2.4 |

7.7 |

4.2 |

1.3 |

|

Unemployment (SPES), % |

8.5 |

8.8 |

7.3 |

7.7 |

8.3 |

|

Current account balance, % of GDP |

5.9 |

5.3 |

3.3 |

3.6 |

4.0 |

|

General gov. budget balance, % of GDP |

-2.7 |

-0.3 |

0.7 |

-0.2 |

0.4 |

|

General gov. gross debt, % of GDP |

39.2 |

36.2 |

31.0 |

29.8 |

29.5 |

|

Monetary policy rate (end of period) |

0.00 |

0.00 |

2.25 |

2.50 |

2.50 |

|

EUR/SEK (end of period) |

10.04 |

10.30 |

10.90 |

10.50 |

10.40 |

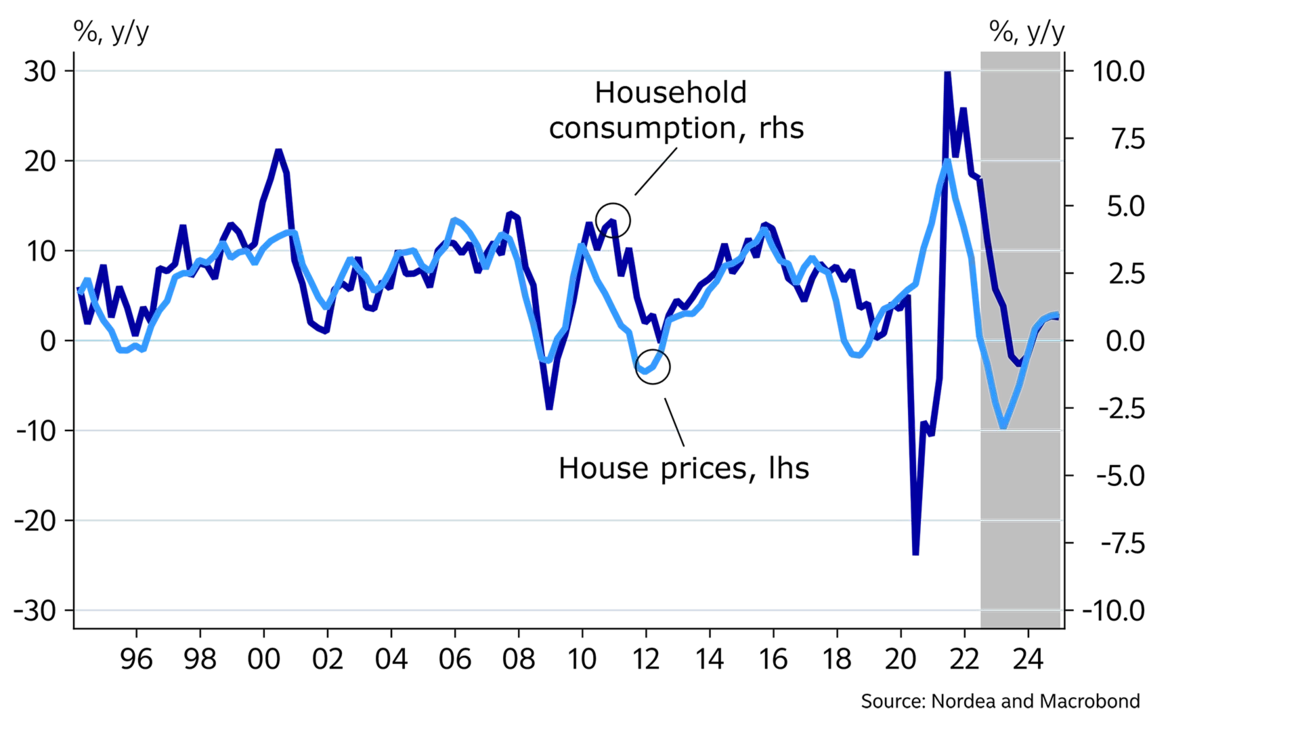

The trend in home prices often has a large effect on households’ spending and savings behaviour. The decline in home prices is thus worrying for several reasons.

So far this year, mainly long mortgage rates have risen while adjustable mortgage rates will start to increase more in the second half of the year. Nearly half of household mortgages have maturities of less than one year. In other words, households and the housing market are under severe pressure. Home prices have fallen by 6% this year through July and we expect this trend to continue. Home prices will fall by 15% in total, according to our forecast. Central banks will not come to the rescue; thus home prices will recover only slowly in 2024. Find out more in this article on the stormy Swedish housing market.

The dramatic trend in energy prices in Europe also creates uncertainty for Swedish households. Fiscal policy is expected to compensate households – but it remains to be seen exactly how. That will reduce risks, but for Sweden, this is seen as a buffer against soaring energy prices rather than extra stimulus.

Overall, household consumption developed at a decent pace during Q3 this year according to our forecast, but will drop next year. When the interest shock eases and inflation drops, households will recover somewhat and consumption should pick up slightly in 2024.

The large supply is another factor that weighs on home prices. During 2021, the construction of 68,000 new homes began and most of them will be completed this year. Construction activity was also high during the first half of the year and exceeded the population growth rate, assuming two persons per home on average.

But housing construction is expected to fall sharply from and including H2 2022. In 2021, new housing construction lifted GDP growth by around 0.5 percentage point, but will be an even larger drag on growth in both 2023 and 2024. Industrial investment surged last year and remains high this year, but will fall next year. Also, the services sector grew significantly in 2021 and 2022 but the investment trend is expected to be more subdued, especially in 2023. Thus, total fixed investment will increase slightly this year, but decrease next year and in 2024.

Fiscal policy is loose in the election year 2022, equal to SEK 130bn. It is a large sum but only around half the amount for 2021. In 2023 and 2024, fiscal policy is slightly expansionary. Public sector financial savings are around zero and Maastricht debt will be around 30% of GDP.

Households see a dramatic change in their financial situation.

Exports of goods have been largely unchanged this year and seemingly somewhat weaker compared to world trade. This is probably because the shortage of input goods has hampered mainly car- and truck manufacturers. Swedish exporters have full order books and shortage problems are easing, indicating continued good activity in the industry for the near term.

Signs are emerging that the inflow of new orders is slowing and at the same time global demand will fall next year. Goods exports are thus stable near term, but will decrease next year. Exports of services are increasing at a faster pace this year, but will level out in 2023.

Employment has continued to accelerate this year. In the second quarter, the employment-to-population ratio was 69% (age group 15-74). That is the highest reading since the early 1990s. Unemployment has fallen to the lowest level since 2009, according to the Swedish Public Employment Service. Excluding persons in labour market policy programmes, unemployment is at a three-decade low. Demand for labour was also very high during the summer. New vacancies remain at the record levels seen in the spring, with the lowest number of redundancies since 1989. Labour shortages in the corporate sector are at the highest level since at least 1996. Against this backdrop, much suggests a healthy trend also in the second half of the year.

During 2023, weaker economic trends will impact the labour market. Employment will fall in 2023 and then stabilise in 2024. Unemployment will increase by around 1 percentage point during the forecast period.

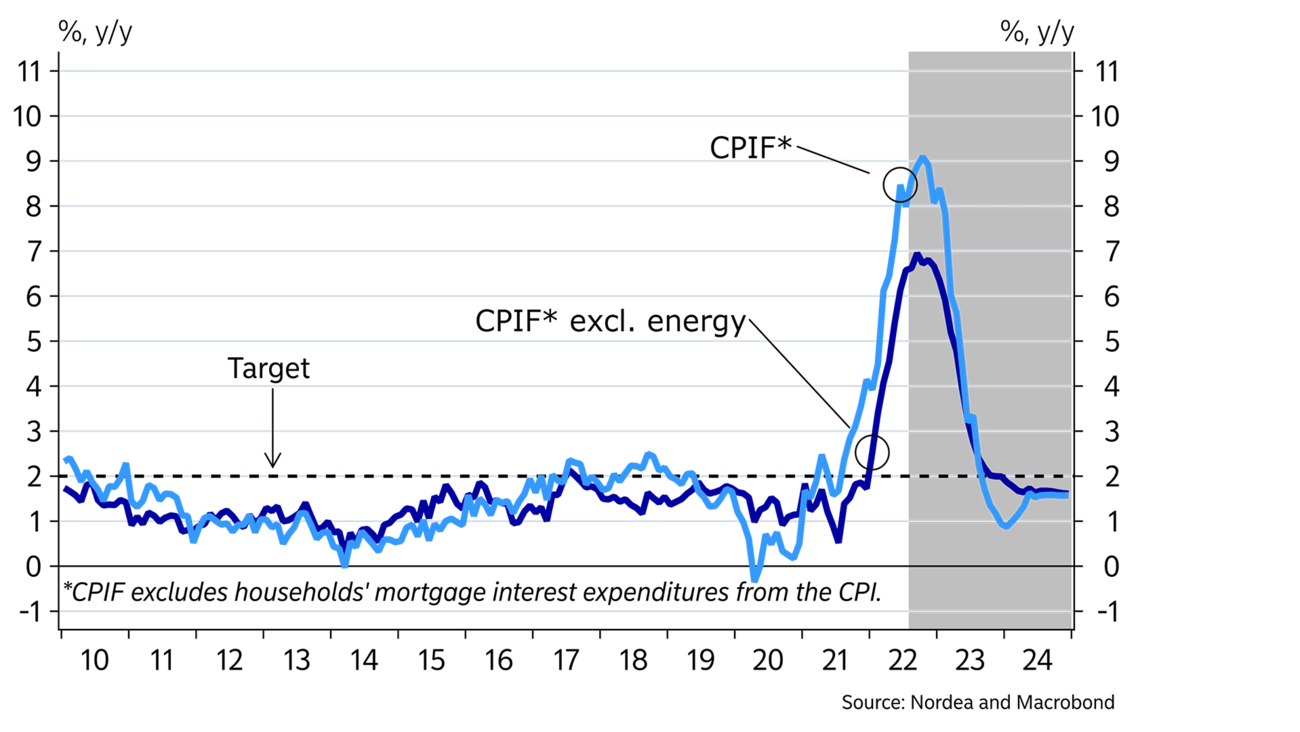

Domestic demand is set to lose momentum, reducing the price pressure on services.

Wage growth has so far been moderate, although a small uptick has been noted recently. During the spring of 2023, more than two million wage earners will get new pay deals. The setting is special with a strong labour market and very high inflation. In Germany, wage increases have gone up, which may impact Swedish pay talks. On the other hand, poorer economic trends may lead to some restraints. Our main scenario is a one-year deal of 3.5%. In addition to pay deals, wages will increase by nearly 4% in 2023 and 3.5% in 2024.

Wage growth of around 4% is a concern for the Riksbank and the bank will aim to ensure that wage increases do not accelerate further. The uptick in inflation has been broad-based this year. Increases in energy and food prices have been particularly high but prices of other goods and services have also risen rapidly. To curb price expectations and wage claims and ensure that inflation does not remain at an excessive level, the Riksbank will raise its policy rate quickly during the second half of the year and early next year.

The inflation outlook is uncertain, especially due to energy prices. The expected compensation for households and businesses is assumed to limit the effect of energy prices on inflation. Global transport costs and commodity prices have fallen this year. Domestic demand is expected to lose steam, which will also ease the price pressure on services. Inflation will thus fall next year and the Riksbank is expected to keep its policy rate unchanged.

Several central banks have raised interest rates unusually fast this year. The Riksbank is tightening monetary policy faster than the ECB, but interest rate differentials do not seem to be a main driver of currencies this year. Instead, market risk sentiment seems to be the key driver. With weak global growth, risk appetite may deteriorate and weigh on the SEK exchange rate. Concern about the Swedish growth outlook may also arise due to the relatively high interest rate sensitivity, and this could dampen market appetite for the SEK. In other words, times are tough for the SEK and the exchange rate is trading at relatively weak levels during most of the forecast period.

This article first appeared in the Nordea Economic Outlook: Feeling the Squeeze, published on 7 September 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more