4.3%

Food inflation in 2025, annual average.

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskTorbjörn Isaksson

Households have regained confidence, and conditions are in place for consumption to substantially increase. The export industry has weathered several global challenges, and the outlook is healthy. The unemployment rate is set to fall to 5%, according to the new BAS measure. Inflation will likely stay low in 2026 – partly due to temporary factors – before normalising in 2027. Stronger economic conditions will reduce the need for monetary policy stimulus. The global security and trade policy situation poses a risk to the forecast.

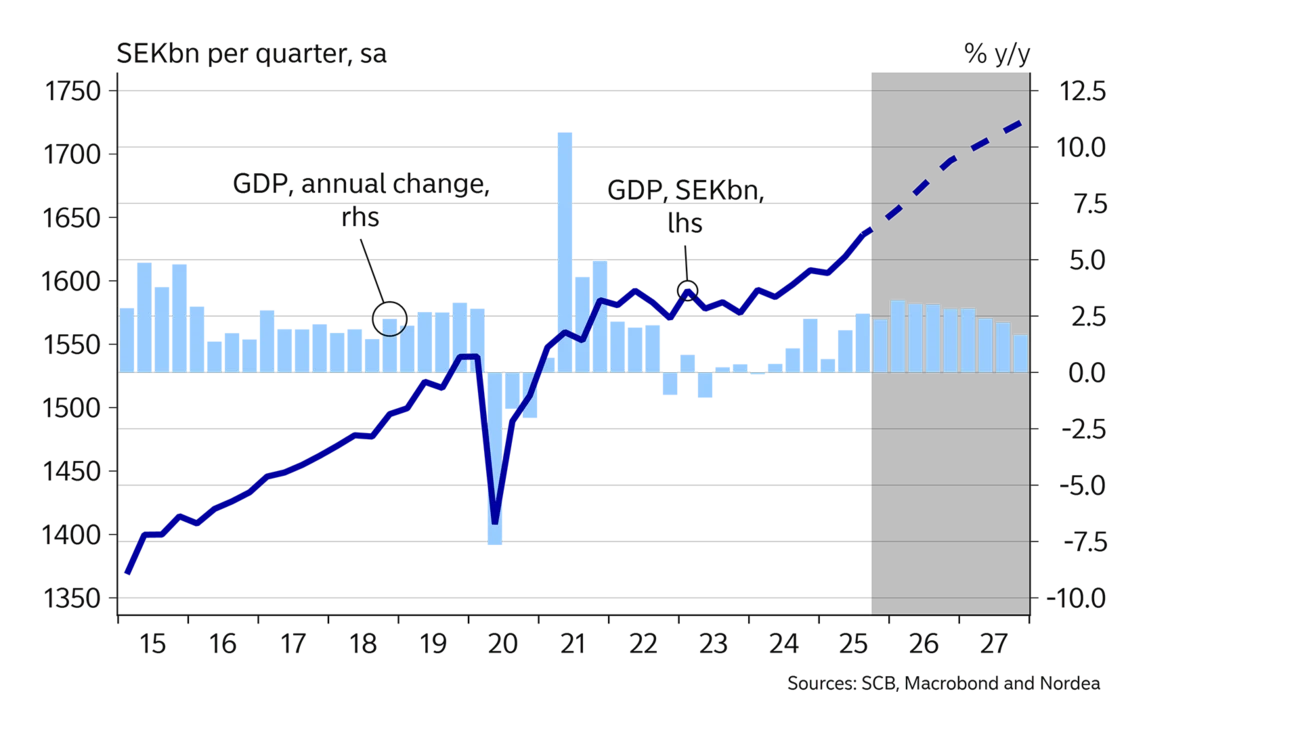

After several years of stagnation, the Swedish economy began to recover in 2025. Domestic demand started to rise following the inflation and interest rate shock that primarily hit households in the post-pandemic years. Exports also increased. The recovery will likely continue in the coming years, increasingly driven by the domestic economy.

Low population growth has reduced Sweden's long-term growth potential. Consequently, the projected GDP growth of ~3% this year will increase resource utilisation faster than before the pandemic.

Despite significantly improved economic conditions, inflation will stay low in 2026 – partly due to temporary factors – before normalising in 2027. Stronger economic conditions will keep the Riksbank from cutting rates in 2026. Increasing resource utilisation is likely to drive rate hikes during 2027, dampening GDP growth.

4.3%

Food inflation in 2025, annual average.

-25

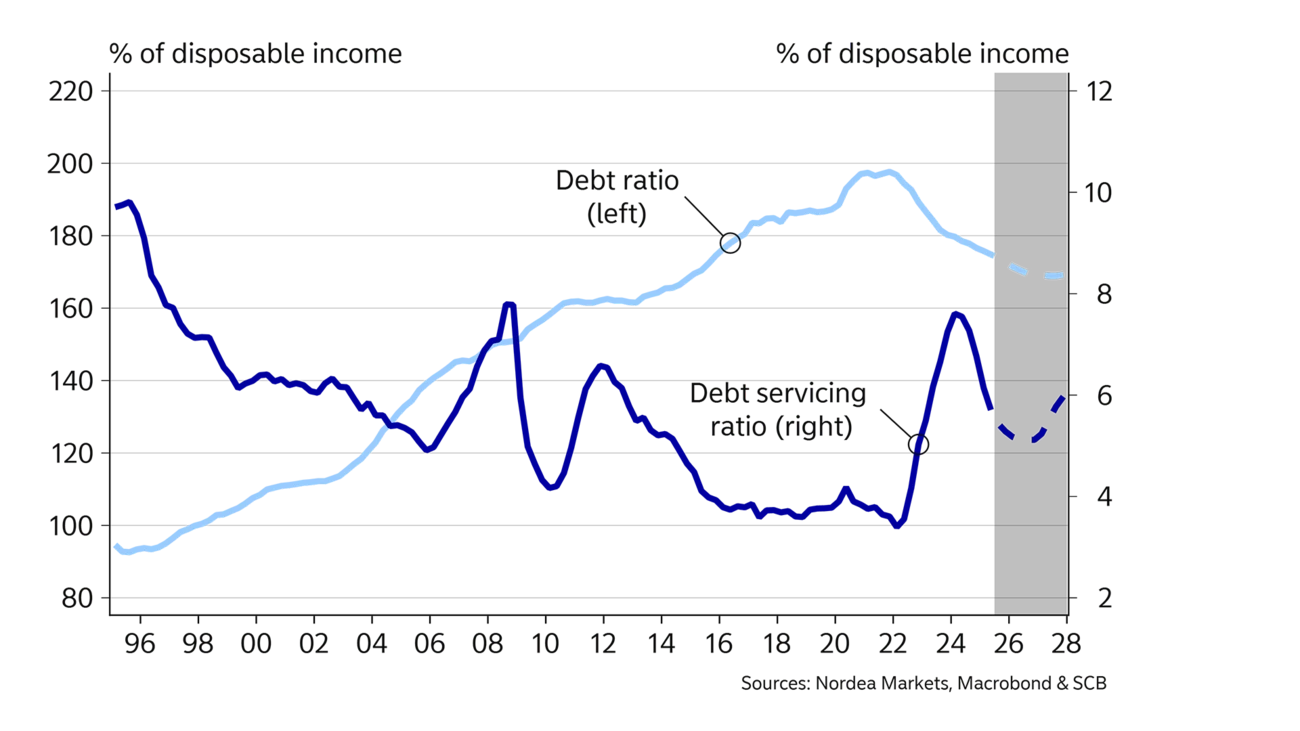

Percentage point, decline in the household debt-to-income ratio from end-2021 to Q3 2025.

5.6%

Unemployment in October 2025, according to BAS.

In recent years, households have improved their financial position and adapted to the higher interest rate level. This occurred when credit growth stalled, while income continued to rise at a solid pace. As a result, the balance in households' finances improved, with the debt-to-income ratio – i.e. debt relative to income – falling sharply.

Furthermore, interest rates have fallen and savings have remained at a high level, which is typical in times of uncertainty. Surging inflation and high interest rates have in particular created uncertainty and led to high buffer savings. In addition, turbulence in early 2025 linked to the global trade policy appeared to contribute to heightened uncertainty and an increased need for savings.

We believe households have reached a stage in their adjustment process in which consumption can begin to rise. Savings will likely not need to increase further beyond the current levels. Meanwhile, income growth is unusually strong – both nominally and in real purchasing power as inflation falls.

Forecasts are always associated with uncertainty. There is potential for even stronger consumption growth. According to our forecast, savings will remain high, but in a more stable environment with higher employment, steady interest rates and low inflation, savings could decline – freeing up more room for spending. The risk of weaker consumption growth is mainly tied to external factors, including the security policies of leading powers. Households have regained confidence after a shaky start to 2025. Yet dark clouds remain on the horizon, potentially creating renewed uncertainty and making households tighten their purse strings.

| ‘24 | ‘25E | ‘26E | ‘27E | |

|---|---|---|---|---|

| Real GDP (calendar adjusted), % y/y | 1.0 | 1.9 | 3.0 | 2.3 |

| Underlying prices (CPIF), % y/y | 1.9 | 2.6 | 0.9 | 1.7 |

| Unemployment rate (LFS), % | 8.4 | 8.8 | 8.5 | 7.9 |

| Unemployment rate (BAS), % | 5.4 | 5.7 | 5.5 | 5.0 |

| General gov. budget balance, % of GDP | -1.6 | -0.8 | -2.0 | -2.1 |

| General gov. gross debt, % of GDP | 34.0 | 34.2 | 35.4 | 36.3 |

| Monetary policy rate (end of period) | 2.50 | 1.75 | 1.75 | 2.50 |

| EUR/SEK (end of period) | 11.48 | 10.83 | 10.50 | 10.40 |

Housing construction has levelled off. In 2025, housing starts rose to less than 30,000 dwellings, according to our calculations. This is a sharp decline from the peak in 2021, when the construction of 67,000 new homes began, but slightly above what we consider a long-term level. Thus, we do not expect any increase going forward. The stabilisation of housing construction means it no longer weighs on investment or GDP growth. For example, the drop in housing construction reduced GDP growth by as much as 1pp in 2023.

Non-residential construction, however, seems to be picking up again. In addition, the services sector is expanding, while industrial investment growth looks set to be low, as investment levels are already relatively high. Consumption and investments in the public sector are also increasing, not least driven by government defence spending.

These public investments and household tax cuts are weighing on public finances. The discretionary fiscal policy measures correspond to 1.2% of GDP in 2026. Consequently, the budget deficit will increase from 1% of GDP in 2025 to around 2.0% in 2026 and 2027, respectively. Public debt will thus grow but only to somewhat above 35% of GDP.

The trade conflict caused significant fluctuations in world trade in 2025, which surged early in the year but then experienced an almost equally steep decline. The temporary upswing was likely driven by orders placed in anticipation of the implementation of US tariffs.

However, Swedish exports have continued to rise steadily despite global turbulence. Exports of goods and services increased during 2025. Moreover, indicators for Sweden's export industry have improved, suggesting continued resilience and near-term growth.

There are several risks to the forecast, linked to global trade and security policy. Global demand for Swedish export products and services are expected to rise going forward, despite the turmoil related to US’ trade policy. US’s share of Swedish exports of goods has fallen and is now 7.5% and less than 3% of GDP. Swedish exporters are competitive and should find ned markets. Moreover, interest rates have come down and fiscal policy is expansionary in many parts of the world, including across Europe, boosting global demand. Thus, the main scenario is that exports will grow at a healthy pace during the forecast period.

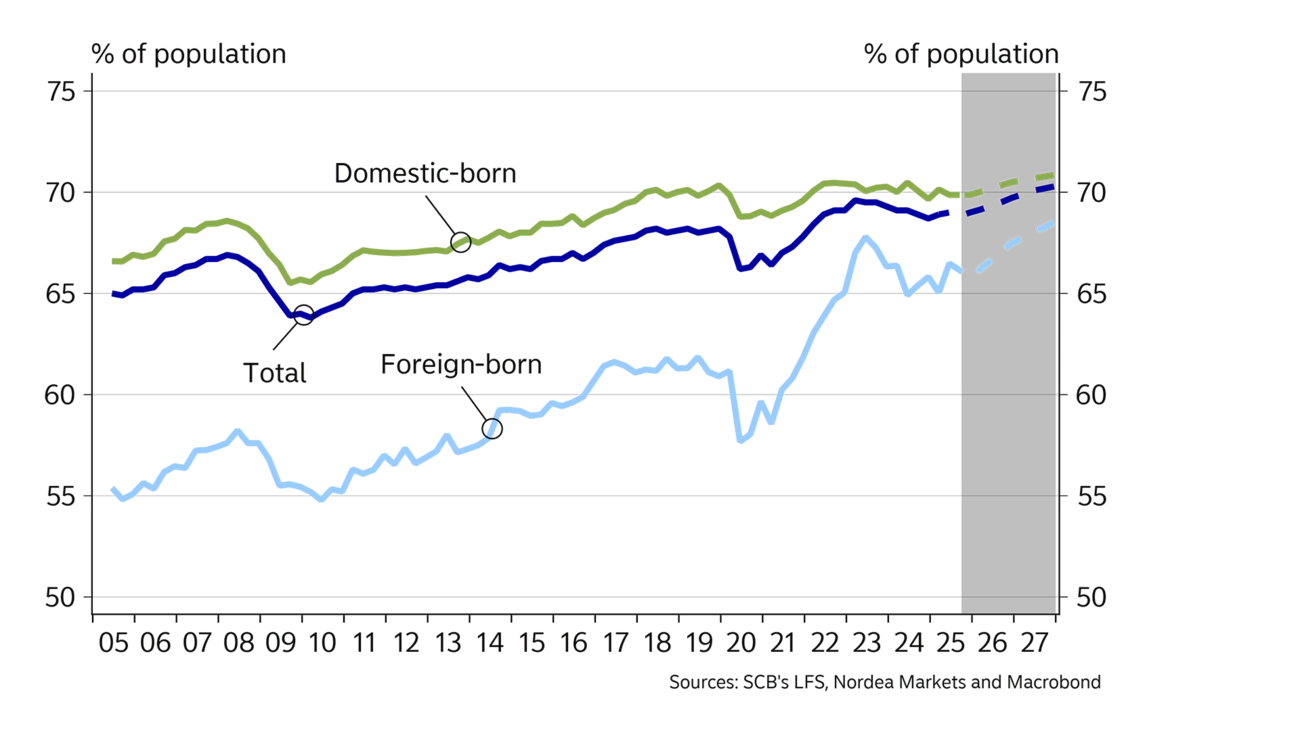

The employment rate will rise to new record levels in the forecast period.

In 2025, labour demand was subdued. Employment went up, but labour supply grew faster, driving unemployment higher.

The labour market indicators improved towards the end of 2025. Companies' hiring plans rose, and the Swedish Public Employment Service began to register an increase in new job vacancies, albeit from subdued levels. Together with accelerating GDP growth, this supports the picture of increasing labour demand. At the same time, the labour force is growing at a slower pace, owing to lower population growth.

As a result, unemployment will fall to just below 8% by end-2027, according to Statistics Sweden's Labour Force Survey. According to Statistics Sweden's Population by Labour market status (BAS), which is a new alternative measure, unemployment will fall to ~5% by end-2027 from the current level of just below 6%. We believe BAS provides a more accurate picture of the labour market resource situation (see theme article).

Thanks to the recovery, the employment rate – the number of people employed relative to the population – will rise in 2026 and 2027. The positive trend among foreign-born people will especially help drive a higher employment rate.

High labour force participation and better integration of foreign-born people into the labour market will help the rate reach ~70% in 2027 – clearly above the pre-pandemic levels and higher than that of many other countries.

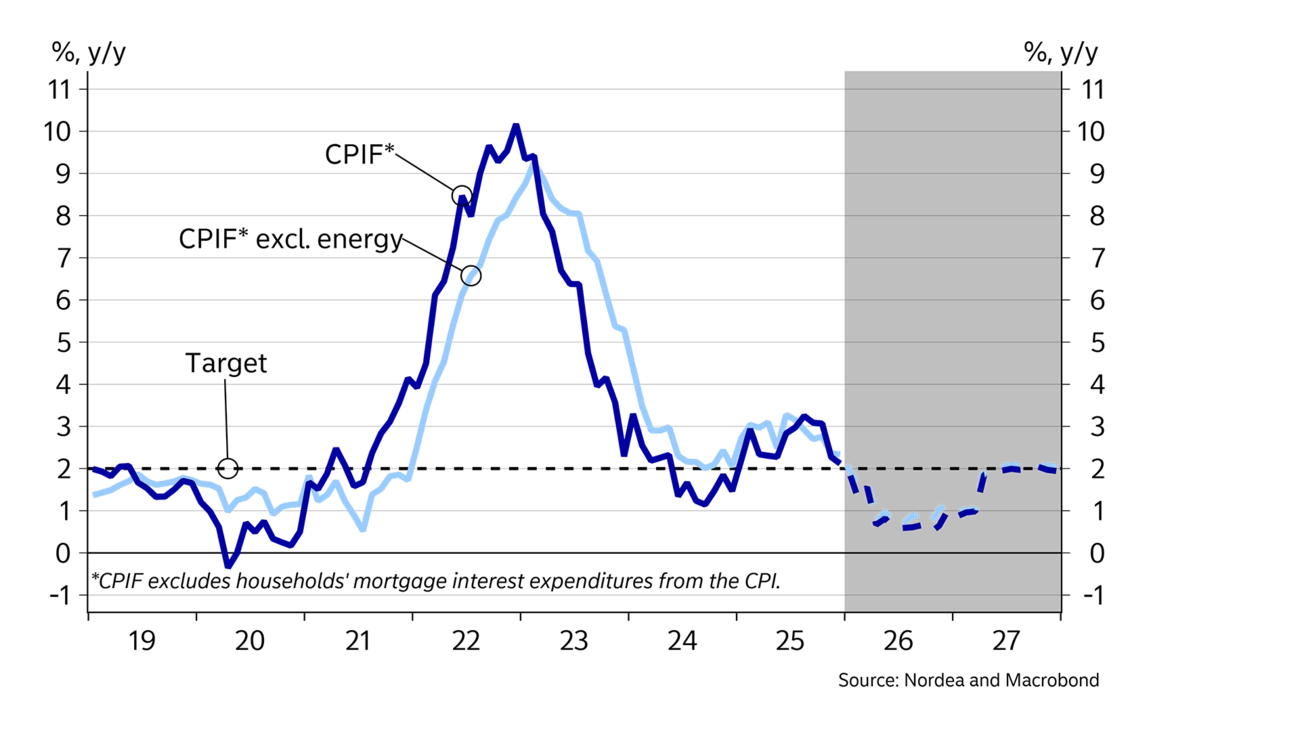

The correlation between the economic cycle and inflation is often limited. An exception occurred in 2021 and 2022, when demand in Sweden and among our trading partners was exceptionally strong, leading to clear inflationary consequences. The economy is not expected to be that strong during the forecast period, even though conditions in Sweden will improve. The recovery in the domestic economy will likely lead to higher price increases for some goods and services than would otherwise have occurred, but the effects are expected to be fairly small.

More often, the global price pressure plays a more important role for Swedish inflation, which is currently low. Global inflation is expected to remain modest going forward, at least in the absence of drastic shifts in trade policy.

Furthermore, the SEK trade-weighted exchange rate has strengthened, with a 9% appreciation in the past year, dampening prices of mainly goods but also of some services.

The domestic price pressure is also moderate. Wage growth will slow in the forecast period and will not drive inflation to any significant extent. Moreover, VAT on food will be halved as from 1 April, which is expected to have only a temporary effect on inflation. Excluding food and energy, price increases are expected just below 2% during 2026, according to our forecast, with risks skewed towards lower-than-forecast inflation.

Although it is uncertain how a better economic climate will affect inflation, the recovery still matters for the Riksbank. Low inflation is increasingly tolerated as long as the economy is growing and unemployment is falling. We thus expect the Riksbank to keep its policy rate on hold in 2026, with the first rate hike anticipated in early 2027.

In recent years, the SEK has strengthened from very weak levels. Today the SEK is considered to be closer to its long-term level, and we expect only a cautious appreciation against the EUR going forward.

A competitive business sector, strong public finances and a recovery in domestic demand will support the SEK. However, low inflation this year and the possibility of near-term monetary policy easing will reduce the appreciation pressure.

This article first appeared in the Nordea Economic Outlook: Northern Lights, published on 21 January 2026.

Read more from the latest report

Economic Outlook

The increase in household saving has kept private consumption subdued in recent years. We examine how alternative assumptions about the savings ratio in the forecast years will affect consumption, employment and economic growth.

Read more

Economic Outlook

The global economy was characterised by a high degree of resilience in a tumultuous 2025, with the prospect of renewed growth in 2026. However, there are significant risks are associated with the unpredictable geopolitical situation.

Read more

Economic Outlook

In a world of political uncertainty, the Danish economy is well positioned to handle future challenges. The foundation lies in the labour market, where record-high employment helps ensure robust public finances.

Read more