- Name:

- Susanne Spector

- Title:

- Nordea Chief Analyst

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskThe tight labour market, record-high demand for workers and recent inflation spike suggest that wage growth will be higher going forward. We revise up our wage forecast, and the Riksbank faces new challenges.

Labour demand is at an all-time high and labour shortages are rising. Many workers are changing jobs – for higher wages. The number of unemployed per job opening is the lowest in at least 30 years. In addition, the open unemployment rate is at its lowest level since 2008, underscoring how tight the labour market is.

Looking back at the 2010s, the labour market situation had little impact on wages. Wage growth remained at 2.5% throughout the business cycle and did not gear up in any marked way even at the end of that cycle. However, the labour market is already tighter than it was during the peak in 2018–2019, and high inflation creates a new situation for wage growth as well. The Riksbank’s business survey shows that expectations for wage drift are at the highest level recorded in the survey which started in 2009. There are also signals that current local wage negotiations have reached agreements higher than the benchmark of around 2.4%.

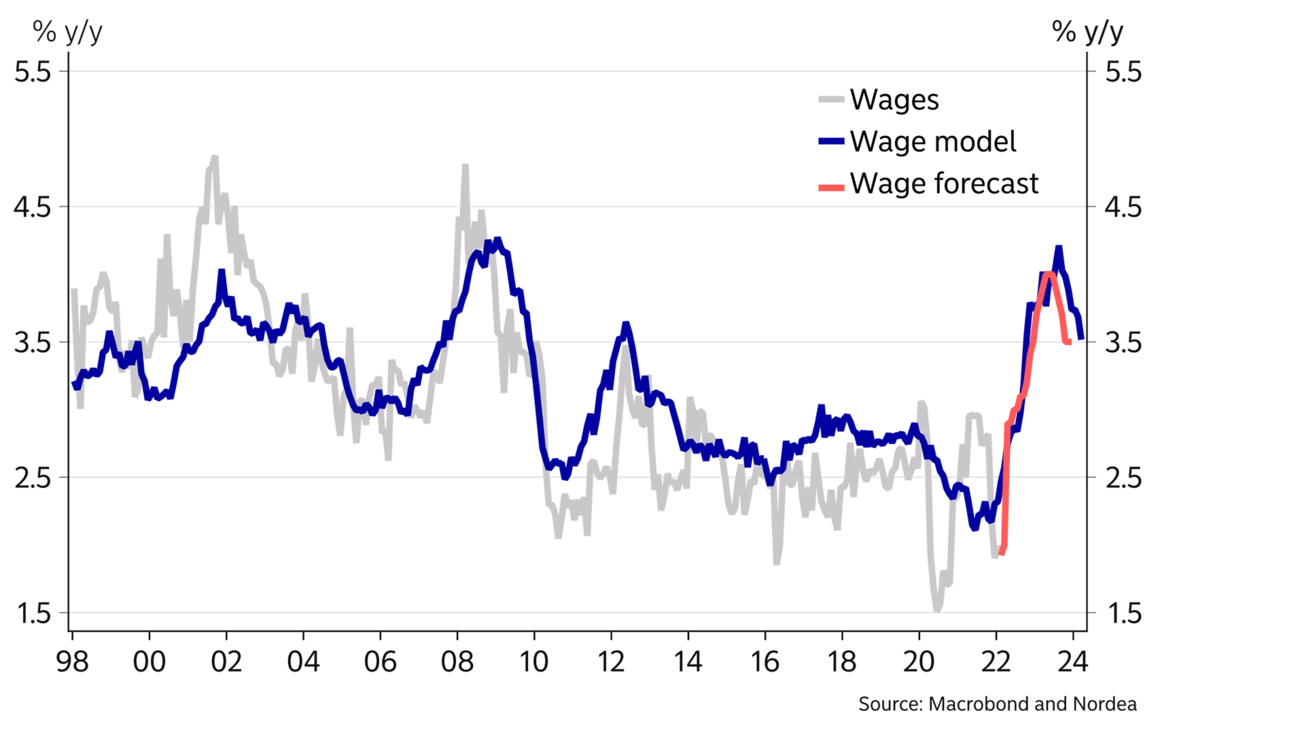

The best indicator for wage growth has been the Prospera wage expectations. These increased to 2.8% in March from around 2.3% before the pandemic. Assuming that wage expectations peak slightly above 3% this year and that new vacancies will fall back from the current all-time highs, our preferred wage model suggests wage growth of 4% later this year.

Wage growth is difficult to interpret at the moment due to the current agreement covering 17 months, until the next scheduled wage increase this April. Looking ahead, we expect wages to pick up markedly from April and onwards. On average, we expect wage growth of 2.8% in 2022 and 3.8% in 2023. Wages are thus set to break out of their 2.5% decade-long average.

The risks to our forecast are balanced. On the one hand, if inflation stays higher for longer, there are upside risks to wages. In addition, if labour demand continues to surprise on the upside, wages will likely rise more. There are also other factors that speak for even higher wage growth, the most prominent one being companies’ high inflation expectations.

On the other hand, there are also downside risks. The norm around the industry benchmark is strong. Wage agreements are set at 2.4% from this April. Also, global demand will likely cool throughout 2022. The manufacturing parties, which set the wage benchmark, will follow the German wage agreements closely, and the German outlook is uncertain. In addition, workers might be hesitant to push for higher wages amid increased uncertainty.

Wages are set to break out of their 2.5% decade-long average.

So far, the labour market parties’ wage expectations remain anchored. The unions have stressed that they do not want to start a price-wage spiral. The 25-year period with the Industrial Agreement has been successful for both parties, and there is little appetite to rock the boat. However, there is a limit to what employees can accept in terms of real wage losses. According to our forecast, real wage growth will still be negative when the next big wage round in early 2023 is set to finish.

And if inflation continues to surprise on the upside, unions will have a very difficult task selling wage agreements in the range of 2-3% to workers. Tensions are also increasing between blue-collar workers who get little wage drift and white-collar workers who are in a better position to get higher wages from the tight labour market.

Therefore, the Riksbank is facing a new kind of challenge where they need to safeguard the nominal anchor of 2% from the upside. Our main scenario is a one-year wage agreement at 3% in 2023, but the risks for a messy wage round and clearly higher wage growth are the biggest in decades.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more