What is ESG?

ESG is used as a model for investing and screening. ESG stands for Environmental, Social and Governance. This is also called sustainability in many cases.

Read moreESG stands for environmental, social and governance, and refers to the three key factors widely used to evaluate how companies, countries and other actors contribute to sustainable development

ESG is used as a model for investing and screening. ESG stands for Environmental, Social and Governance. This is also called sustainability in many cases.

Read more

Insights

Sustainable debt continues to grow, and the first quarter of 2022 showed that it can be a source of stability in a turbulent market environment.

Read more

ESG

Nordic real estate companies are helping to fuel the boom in sustainable debt issuance in the region. Ebba Ramel from Nordea Sustainable Finance Advisory shares the latest ESG and sustainable finance trends in the sector.

Read more

Insights

The Platform on Sustainable Finance has released the EU Taxonomy's Technical Screening Criteria for the remaining four environmental objectives and the Extended Environmental Taxonomy for transitional activities.

Read more

Insights

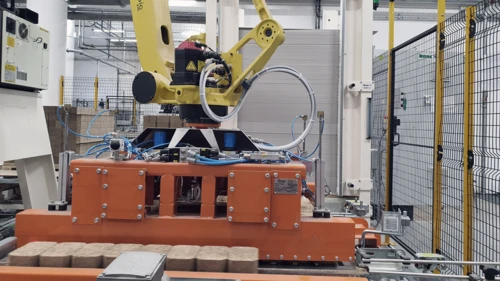

Recycling champion IceBear has big ambitions for its Dutch operation that produces composite pallet blocks out of recycled waste wood and green energy. After securing financing via a green bond issuance with Nordea’s help, the company recently hit its first major production milestone.

Read more

Insights

The sustainability reporting landscape is rapidly changing. Cutting through the noise, Nordea’s Sustainable Finance Advisory team has conducted a deep dive to highlight what’s essential. Find the key takeaways and market developments summarised below.

Read more

Insights

After some delays, the EU expert group consisting of individuals from the public sector, industry and academia, released their final report on the proposed Social Taxonomy. The group took into account feedback received last year and aligned the proposal with new and existing legislation in order to facilitate adherence for companies. This proposal consists of structural suggestions for the design of a social taxonomy, as opposed to specific technical screening criteria, and is expected to form the basis for the future legislative proposal.

Read more

Insights

In just a few years, sustainability-linked bonds (SLBs) have carved out their place in the sustainable bond market, now representing 10% of total issuance for the year to date. As SLBs gain popularity, potential challenges with the format are beginning to emerge. In this article, we examine some of the difficulties relating to the application of the concepts of materiality and ambitiousness within SLBs and highlight some early research into SLB pricing.

Read more

Meet our talents

"In my experience, it’s a bank that truly cares about its employees, and values diversity and teamwork. It is a place where you can thrive," says Elias who attended a 11 weeks' internship with us in Equity Research. Read Elias' blog and learn about his tasks, the culture, opportunities, and what surprised him the most!

Read more

Insights

Biodiversity is rapidly climbing investor and corporate agendas. Leaning on years of important but often underutilised work on the importance of biodiversity, recognition is growing, and actors are beginning to align on the issue. In this article, we outline the initiatives likely to shape the conversation and drive more targeted action over the coming years.

Read more

Insights

The pandemic catalysed an explosion in issuance of social debt, most prominently by sovereign issuers. While the share of social bonds issued has now decreased as pandemic bonds are phased out, investor appetite for the new format remains. We explore how social issues can be integrated into existing debt formats and how they can differ in their application.

Read more

Insights

In a controversial move, the European Commission has decided to include specific gas and nuclear activities in the list of sustainable investments covered by the EU taxonomy. Nordea's Head of ESG Research Marco Kisic explains what to expect.

Read more

Insights

Nordea’s Sustainable Finance Advisory team has compiled a list of key issues set to shape the sustainable finance markets in 2022.

Read more