- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaThe economy has surprised positively in the first months of the year, but the outlook for the rest of the year is clearly weaker. The rise in prices and interest rates will continue to put pressure on consumers, and lower housing demand will decrease the volume of construction. However, the increase in electricity output and the strong employment situation will support the economy.

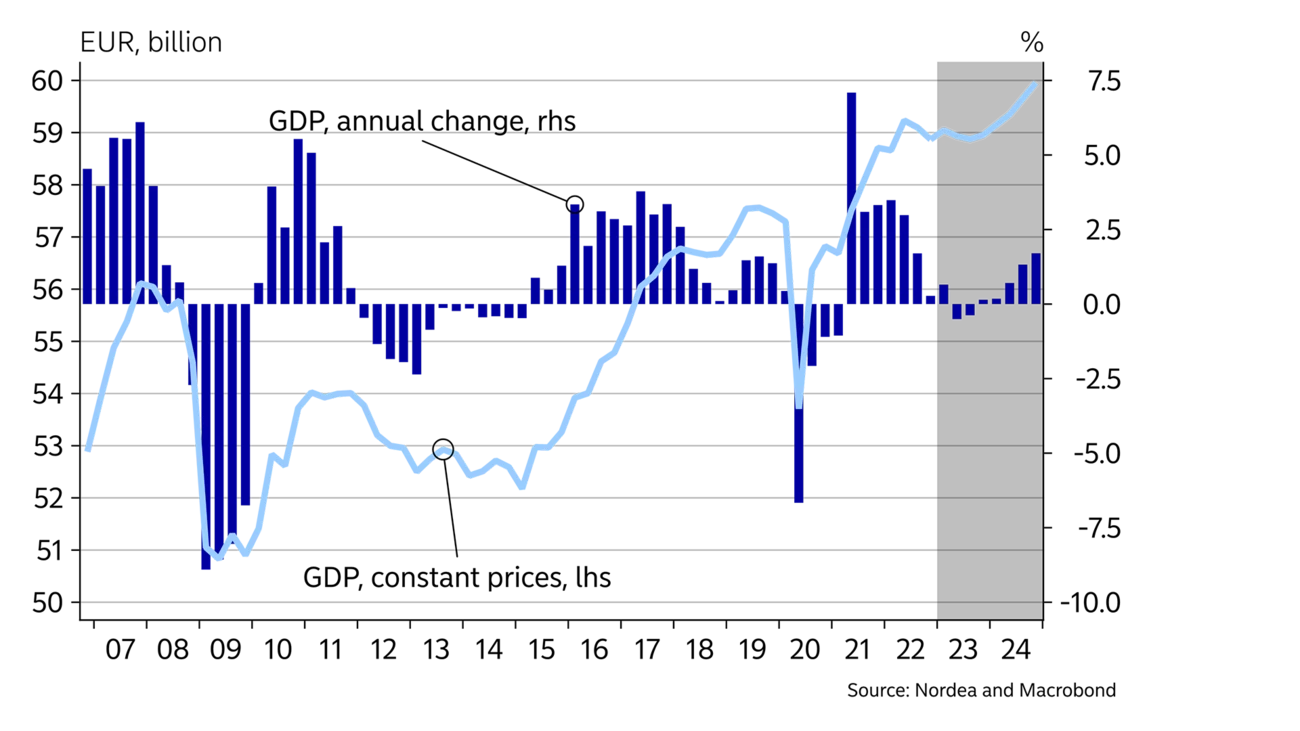

The Finnish economy began to sputter at the end of last year, when global economic growth slowed down and, simultaneously, inflation and higher interest rates began sapping household purchasing power. Finland’s GDP shrank slightly in the second half of 2022, as consumption, exports and investment began to decline.

In the first months of this year, economic performance has been somewhat more positive due to energy prices reaching a peak and worries about a recession in Europe abating. In addition, with the level of employment remaining strong and households spending their savings, demand for services has held up despite the drop in purchasing power.

The economic outlook for 2023 is still challenging, despite the good start to the year. Household purchasing power is expected to continue to decline this year. The slump in the housing market will result in a clear slowdown in residential construction. Similarly, order backlogs in the manufacturing sector have begun to dwindle due to sluggish global demand.

While the growth in domestic electricity generation and the new investment opportunities offered by clean energy will improve the long-term economic outlook, they are not sufficient to propel the economy to positive growth this year yet.

We are maintaining our forecast of zero growth for this year. Next year, we expect the economy to grow moderately by 1%.

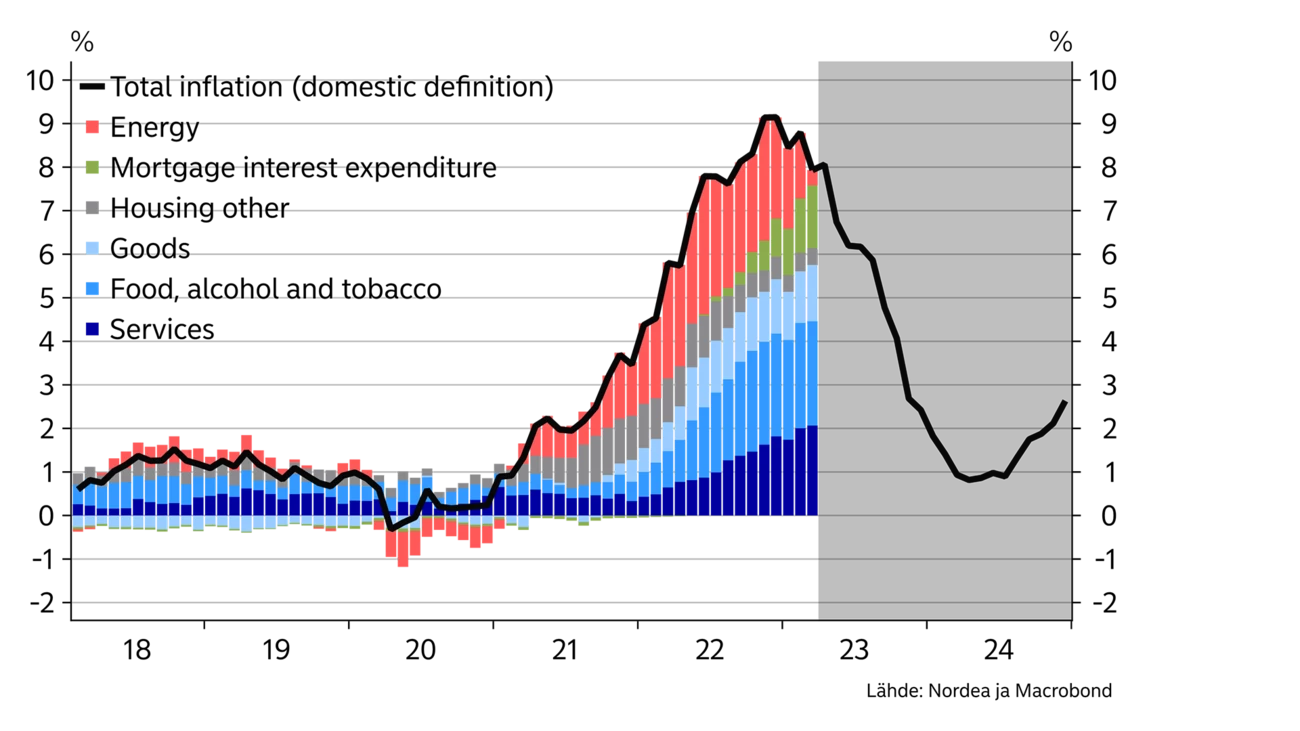

The rise in consumer prices has abated since the start of the year as energy prices have fallen clearly. In March, fuel prices were already lower than a year ago, and electricity has become much cheaper.

Nearly all other prices, however, have continued to rise during the early year. Food prices were up to 16.2% higher than a year ago in March. The cost of many services is also rising rapidly, including restaurants, where prices have risen by 8.3% year-on-year.

However, the decrease in transportation costs, the global prices of commodities and energy costs, coupled with deteriorating demand, is expected to slow down inflation during this year. Despite all this, inflation has decreased less than expected since the start of the year, which is why we have raised our full-year inflation forecast to 6.0%. Next year, we expect inflation to fall to 1.5%.

Interest rates have continued to rise in 2023, with the most widespread reference rate for mortgages, the 12-month Euribor, increasing to 3.9%. The increase in the average interest rate on mortgages is already beginning to show in Finland’s domestic inflation indicators, with higher interest rates raising inflation by nearly three percentage points this year. The EU’s Harmonised Index of Consumer Prices (HICP) does not account for interest rates, which is why it indicates that inflation has already fallen below 7%. The gap between the Finnish index and the HICP will be exceptionally large this year.

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP, % y/y |

-2,4 |

3,0 |

2,1 |

0,0 |

1,0 |

|

Consumer prices, % y/y |

0,3 |

2,2 |

7,1 |

6,0 |

1,5 |

|

Unemployment rate, % |

7,8 |

7,6 |

6,8 |

7,0 |

7,5 |

|

Wages, % y/y |

2,0 |

2,4 |

2,4 |

4,0 |

3,4 |

|

Public sector surplus, % of GDP |

-5,6 |

-2,8 |

-0,9 |

-1,1 |

-2,0 |

|

Public sector debt, % of GDP |

74,7 |

72,6 |

73,0 |

71,9 |

72,8 |

|

ECB deposit interest rate (at year-end) |

-0,50 |

-0,50 |

2,00 |

3,75 |

3,00 |

Private consumption has been sluggish since the autumn, as demand for goods, in particular, has declined as consumer purchasing power has contracted. Nordea’s latest card transaction data indicate that demand for services, too, has fallen in the early year.

Wage increases this year will mostly kick in in June. Wages will increase by about 3% on average, in addition to which workers will be paid a one-off bonus of around 1%, depending on the sector, which will improve wage earners’ purchasing power somewhat. We expect the decline in real wages to end in the second half the year as inflation slows down.

The large inflation adjustments made to social benefits at the beginning of this year as well as the persistently strong employment situation are bolstering purchasing power, although households’ disposable income in real terms will continue to decrease year-on-year. As a result, consumers will have to tap into their savings to maintain their spending.

Finnish mortgage holders will feel the rise in interest rates quickly, as most mortgages are tied to short-term reference rates. In our theme article, we provide a closer analysis of mortgage costs and changes in the savings ratio in a higher interest rate environment.

The employment situation has remained strong despite the clear slowdown in economic growth. The unemployment rate has remained at around 7% for more than a year, and the number of job vacancies continues to be large.

However, we expect unemployment to start rising slowly towards the end of this year. The slowdown in activity in the construction sector is bound to be felt in the labour market. The weaker outlook in the manufacturing sector and dwindling private consumption will naturally decrease demand for labour. The uptick in unemployment is expected to be moderate, however, and the unemployment rate is forecast to rise to 7.5% by the end of the year.

The biggest drop in house prices has already occurred.

House sales have been subdued since the end of last year. Higher interest rates, the drop in house prices and the increase in other living costs have made home buyers consider their purchasing decisions for longer than before.

The slump in house sales has lengthened selling times especially in growth centres, where dwellings have typically been sold quickly previously. The increase in selling times can be attributed to weaker demand as well as an increase in supply, as plenty of new apartments are still being completed. The decreased interest of property investors is particularly evident for small apartments, which are suffering from weak demand and a bigger drop in prices than large dwellings.

House prices have decreased across Finland by more than 5% year-on-year. We expect the price slide to stop during the current quarter, with prices settling at around 7% lower than a year ago. In the Greater Helsinki Area, we expect prices to fall to around 10% below last year’s peak figures.

House sales are expected to pick up in the second half of this year as the rise in interest rates slows down and house prices stop declining. However, the oversupply in the housing market is expected to continue until next year when the stock of unsold new homes will be off the market.

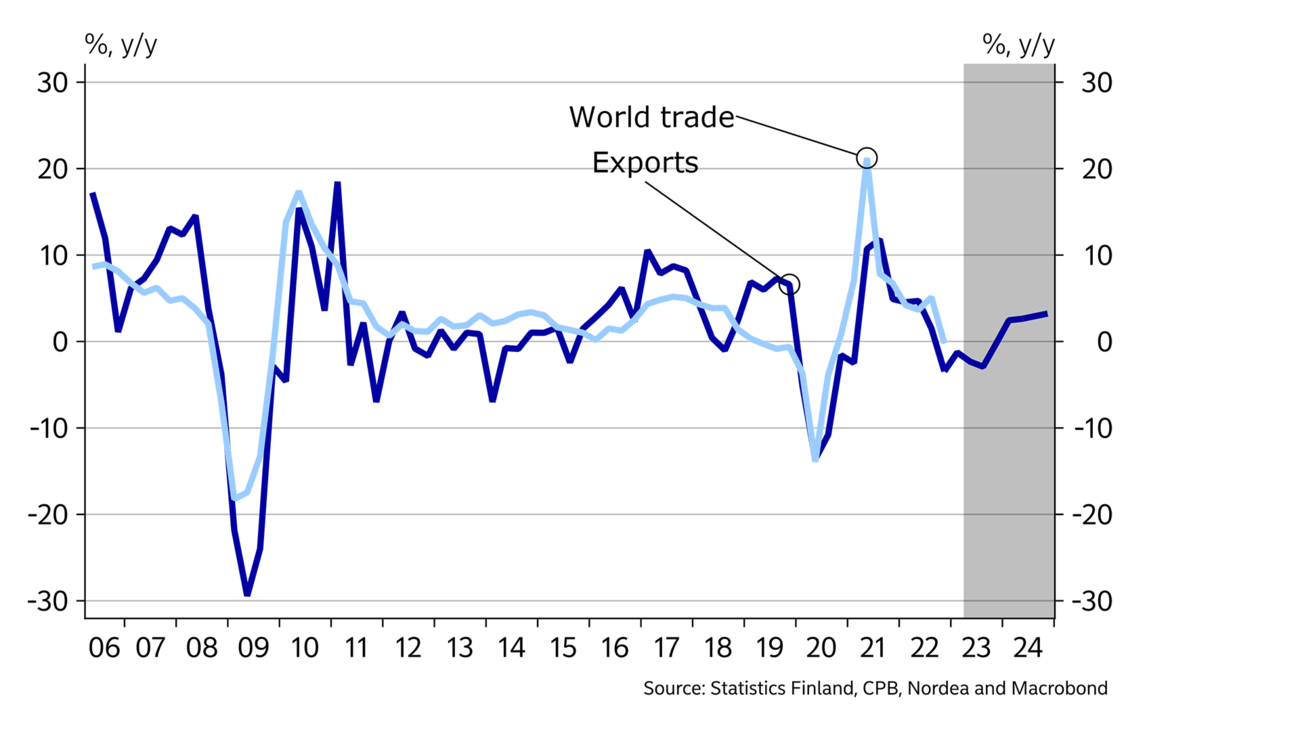

Finland’s export sector continued to fare relatively well last year, despite the sudden collapse in trade with Russia. Abundant order backlogs fuelled growth in exports despite weaker demand. Exports are increasingly shifting to the West, as the US surpassed Sweden last year as Finland’s largest export partner when goods and service exports are combined.

The flow of new orders in the manufacturing sector has begun to dry up and the order backlog has shrunk, presaging a contraction in goods exports and, consequently, manufacturing output. Export prices have also begun to fall, which will be reflected in the profitability of export companies.

The significant increase in Finland’s electricity generation after the new reactor at the Olkiluoto nuclear power plant began regular output, combined with the construction of additional wind power, will boost domestic industrial production, reduce the need to import power and keep the price of electricity at a clearly more moderate level than in the past year. This, along with declining import prices, will help manufacturers control their costs. In fact, imports will decrease even more than exports this year, and the contribution of net exports to economic growth will be positive.

The moderate wage increases in Finland compared to many competitor countries, coupled with the drop in the price of electricity, will maintain the competitiveness of manufacturing. Exports are expected to begin growing again next year, provided that global demand picks up.

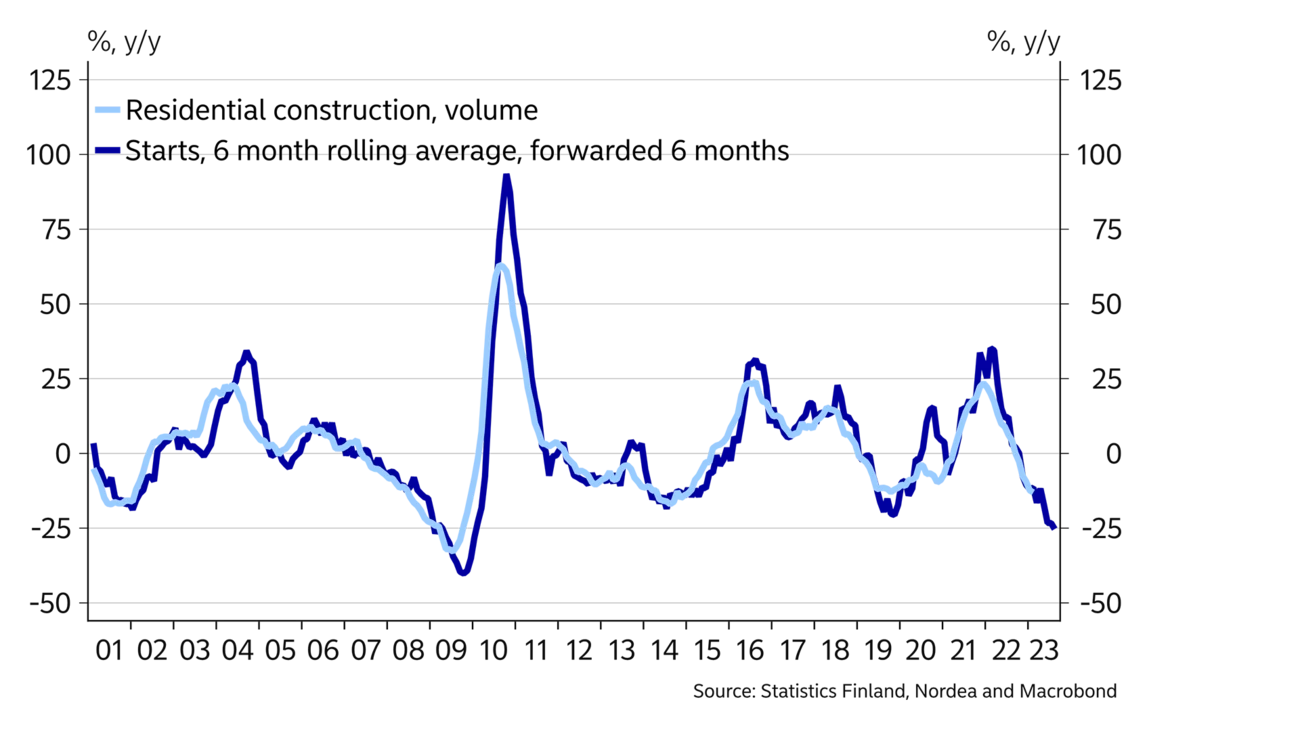

Investments grew by 5% last year, but towards the end of the year, construction investments in particular began to decrease.

With house sales still very sluggish, the number of new residential construction starts has also fallen by up to 25% year-on-year, signalling that construction will contract sharply this year as ongoing projects are completed.

The stock of unsold new homes has grown considerably, and new construction starts are not expected to begin growing again until next year.

Investments in machinery and equipment have held up better than construction but dwindling manufacturing demand will most probably decrease these investments, too. Over the longer term, the investment environment in Finland has become more attractive due to clean power being readily available, which will provide opportunities for many green investments ranging from battery technology to hydrogen production.

Public debt will continue to increase next year if no cost-cutting measures are undertaken.

Finland’s public sector deficit was only 0.8% of GDP last year. The rapid increase in tax revenue has continued in the first months of this year, but at the same time, rising costs have begun to increase spending.

Index-linked increases to pensions and other benefits, wage raises, the sharp increase in interest rates and the costs of the wellbeing services counties will result in a rapid growth in expenses this year.

As a consequence, the public sector deficit is expected to increase to 1.1% this year. The deficit next year will largely depend on economic development and the new government’s budget decisions. However, without any cost-cutting measures, the deficit is expected to grow next year as well.

Public debt increased to 73% of GDP last year. The debt-to-GDP ratio is expected to decrease slightly this year, but to increase again in 2024 as deficits grow and nominal GDP growth slows down due to falling inflation.

This article first appeared in the Nordea Economic Outlook: The Inflation Standoff, published on 9 May 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more